Here’s The MileLion’s review of the HSBC TravelOne Card, which shook up the miles game when it launched back in May this year with 12 transfer partners, instant, free conversions, a generous lounge benefit and a competitive sign-up bonus. Feature-wise, it’s as strong a general spending card as you could hope for.

And there’s more still to come. That transfer partner list, already the longest in Singapore, is set to grow to more than 20 by the end of 2023. Points pooling is in the pipeline. The TravelOne Card is not the finished article yet, but it’s moving in the right direction.

If nothing else, it’s at least worth hopping onboard for the first year.

HSBC TravelOne Card HSBC TravelOne Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The HSBC TravelOne Card is a great general spending card that’s missing one crucial piece: points pooling | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: HSBC TravelOne Card

Let’s start this review by looking at the key features of the HSBC TravelOne Card.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee (Including GST) |

S$194.40 |

Min. Transfer |

25,000 points (10,000 miles)^ |

| Miles with Annual Fee | N/A | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | Free (till 31 Dec 23) |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes: 4x Dragon Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| ^Subsequently 2 miles | |||

Fun fact: the HBSC TravelOne Card continues the trend towards “portrait-style” credit cards, designed vertically instead of horizontally. This supposedly allows for a smoother user experience, as it mimics how customers typically handle their cards when they tap to pay or dip the card into a chip reader. It’s even got a notch at the bottom, a thoughtful touch that’s designed as an accessibility feature for the visually-impaired (so they know which end they insert into the card reader).

But Apple and Google Pay wallets don’t support vertical card faces, so if you add it to your phone you’ll see the secondary design that HSBC created, in landscape.

Despite its silver Mastercard logo, do note that the HSBC TravelOne Card is a World Mastercard and not a World Elite Mastercard.

How much must I earn to qualify for a HSBC TravelOne Card

The HSBC TravelOne Card has an income requirement of S$30,000 p.a., the MAS-mandated minimum to hold a credit card.

If you do not meet the minimum income requirement, you may apply for a secured version of this card by depositing at least S$10,000 in a fixed deposit account. The application form can be found here.

How much is the HSBC TravelOne Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$194.40 | Free |

| Subsequent | S$194.40 | Free |

The HSBC TravelOne Card has an annual fee of S$194.40 for principal cardholders. At the moment, HSBC is not offering a first year fee waiver; you must pay the annual fee (which also lets you enjoy the 20,000 miles sign-up bonus).

In subsequent years, the annual fee can be waived with a minimum spend of S$25,000 in a membership year. As this is a new credit card, I can’t say at the moment whether HSBC will strictly enforce this- though I think it’d be very hard for them to do so, given that most other competitors offer fee waivers fairly easily.

All supplementary cards are free for life.

What sign-up bonus or gifts are available?

HSBC

From 1 September to 31 December 2023, customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$1,000 by the end of the month following approval

- Opt-in for marketing communications during the sign-up (don’t forget this step- it’s just as important as the first two)

This offer is valid for both new and existing HSBC cardholders.

The qualifying spending period is as follows:

| Card Account Opening Date | Qualifying Spend Period |

| 1-30 Sep 2023 | 1 Sep to 31 Oct 2023 |

| 1-31 Oct 2023 | 1 Oct to 30 Nov 2023 |

| 1-30 Nov 2023 | 1 Nov to 31 Dec 2023 |

| 1-31 Dec 2023 | 1 Dec to 31 Jan 2024 |

| 1-15 Jan 2024 | 1 Jan to 29 Feb 2024 |

20,000 miles for S$1,000 spend and a S$194.40 annual fee is a tidy return; put it another way, you’re paying about 0.97 cents per mile (S$194.40/20,000 miles), which is a great price especially when you factor in transfer partner variety.

The terms and conditions for the HSBC offer can be found here.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 2.4 mpd | N/A |

SGD/FCY Spend

HSBC TravelOne Card cardholders will earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

These are among the highest earn rates for any general spending card in Singapore, especially when you consider HSBC’s relatively favourable rounding policy (more on that below).

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.2 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 2 mpd |

DBS Altitude DBS Altitude |

1.2 mpd | 2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2 mpd* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2 mpd* |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

| *In June and Dec only, otherwise 1.1 mpd | ||

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network | ||

| Issuer | ↓ Visa & Mastercard | AMEX |

| Standard Chartered | 3.5% | N/A |

| Citibank | 3.25% | 3.3% |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

| American Express | N/A | 2.95% |

With a 2.4 mpd earn rate and a 3.25% FCY fee, using the HSBC TravelOne Card overseas represents buying miles at 1.35 cents apiece.

There is also the option of pairing the HSBC TravelOne Card with Amaze in order to enjoy better conversion rates, but you’ll earn 1.2 mpd instead of 2.4 mpd in that case since transactions will be converted into SGD.

Bonus Spend

Unfortunately, the HSBC TravelOne Card does not have a bonus earn category. To be fair, not all general spending cards offer one, but it’s a particular problem for the TravelOne because points don’t pool.

This means that you can’t take advantage of the HSBC Revolution’s excellent 4 mpd earn rate, nor can the HSBC Revolution’s points be used for the TravelOne’s new transfer partners.

HSBC says they’re working on adding points pooling, but until they do, your earn rates will be relatively underpowered compared to other 4-6 mpd earning specialised spending cards.

When are HSBC Rewards Points credited?

HSBC Rewards Points are credited when the transactions posts, usually in 1-3 days.

How are HSBC Rewards Points calculated?

Here’s how you can work out the HSBC Rewards Points earned on your HSBC TravelOne Card.

| Local Spend (3x) | Multiply by 1, round to the nearest whole number. Multiply by 2, round to the nearest whole number. Add both figures |

| FCY Spend (6x) |

Multiply by 1, round to the nearest whole number. Multiply by 5, round to the nearest whole number. Add both figures |

The minimum spend required to earn points is S$0.25 (SGD) and S$0.10 (FCY) respectively.

This means that the HSBC TravelOne Card (1.2 mpd) can outperform the ostensibly higher earning UOB PRVI Miles Card (1.4 mpd) in certain circumstances, depending on transaction size.

HSBC TravelOne Card HSBC TravelOne CardEarn Rate: 1.2 mpd |

UOB PRVI Miles Card UOB PRVI Miles CardEarn Rate: 1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 12 miles | 6 miles |

| S$15 | 18 miles | 20 miles |

| S$19.99 | 24 miles | 20 miles |

| S$25 | 30 miles | 34 miles |

| S$29.99 | 36 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND(X*1,0) + ROUND(X*2,0) |

| FCY Spend |

=ROUND(X*1,0) + ROUND(X*5,0) |

| Where X= Amount Spent |

|

HSBC previously only displayed total points balances, but with the launch of the TravelOne Card they’re now providing transaction-level points breakdowns.

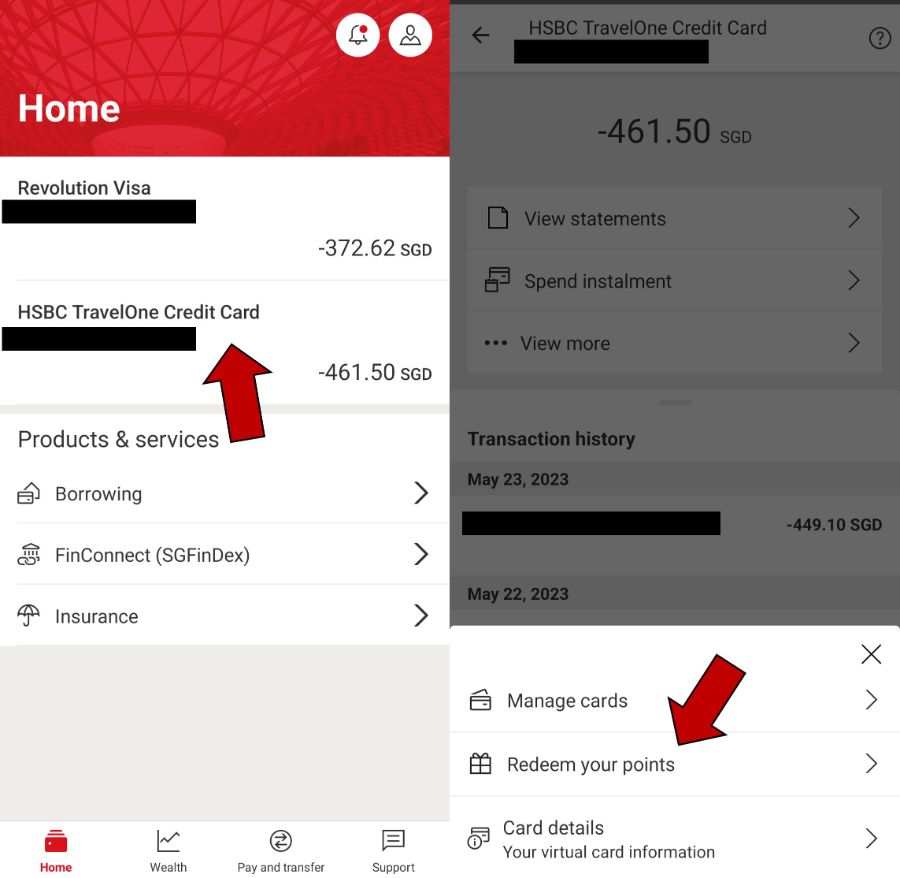

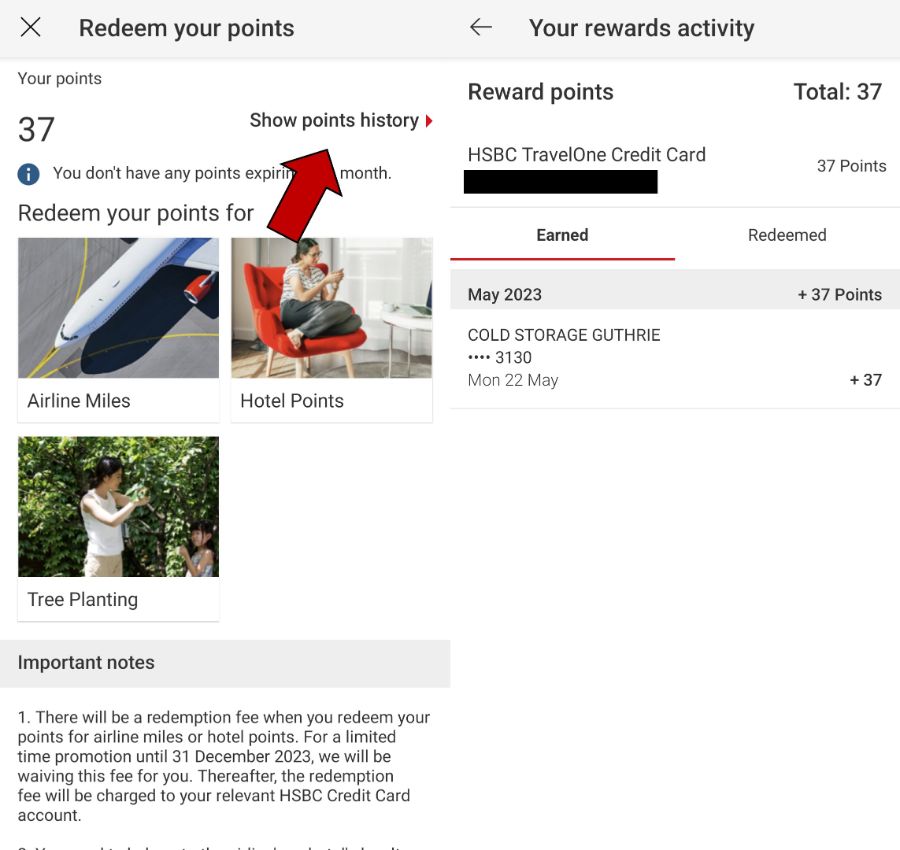

To view this, login to the HSBC mobile app and tap on your HSBC TravelOne Credit Card > View More > Redeem Your Points

On the next screen, tap ‘Show points history’, and you’ll see a breakdown of points earned per transaction.

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HSBC Rewards Points?

A full list of transactions that do not earn HSBC Points can be found in the T&Cs (at Point 3).

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay top-ups

- Insurance

- Professional services provides (e.g. Google & Facebook Ads, AWS)

- Real Estate Agents & Managers

- Utilities

HSBC also excludes CardUp, ipaymy and RentHero transactions from earning points. In a way, this does compound the lack of a bonus category problem, since you can’t even buy additional TravelOne points via these payments services if you were so inclined.

What do I need to know about HSBC Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 3 years | No | Free (till 31 Dec 23) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles (2 miles after) |

12 | Instant |

Expiry

HSBC Points expire at the end of 37 months following the time they were earned.

For example, any points awarded in August 2022 will expire on 30 September 2025.

Pooling

HSBC Points do not pool across cards. If you have 10,000 HSBC Points on the HSBC TravelOne Card, and 15,000 HSBC Points on the HSBC Revolution Card, for example, you won’t be able to combine the two when redeeming.

However, HSBC tells me that points pooling is on the roadmap, so hopefully this will no longer be the case soon.

In the meantime, since points do not pool, you will have to transfer all your HSBC Points before cancelling the HSBC TravelOne Card, or else forfeit them.

Transfer Partners & Fees

The HSBC TravelOne Card stole a march on Citibank when it launched with 12 airline and hotel partners, replacing them as the bank with the most transfer partners in Singapore.

In addition to KrisFlyer and Asia Miles, there’s also opportunities to leverage sweet spots with British Airways Executive Club (and Qatar Privilege Club by extension, since the two programmes are linked), and EVA Air Infinity MileageLand’s sometimes-better Singapore Airlines award space.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

HSBC says they plan to scale up the number of partners to 20 by the end of 2023, and based on the partners the Malaysia and Hong Kong versions have, I’d expect to see Air Canada Aeroplan, JAL Mileage Bank and Turkish Airlines Miles&Smiles added to the mix.

Do note that only HSBC TravelOne Cardholders can access the abovementioned transfer partners; if you have a HSBC Revolution or HSBC Visa Infinite Card, you are still limited to KrisFlyer and Asia Miles for the moment.

Regarding minimum conversion blocks, cardholders will need to convert a minimum of 25,000 points (10,000 miles). However, the subsequent conversion block drops to just 5 points (2 miles), which means you could convert 10,002 miles, or 200,006 miles if you so desired. That’s great, because it helps avoid the problem of orphan miles. So long as you keep at least 10,000 miles in your account, you can cash out your entire balance with almost no miles left behind.

HSBC normally charges a S$43.20 annual fee for unlimited conversions, but as part of the TravelOne’s launch campaign, all transfers are free-of-charge till 31 December 2023. It remains to be seen what model HSBC adopts after that, but my sense is that we can expect a ~S$25 fee per conversion.

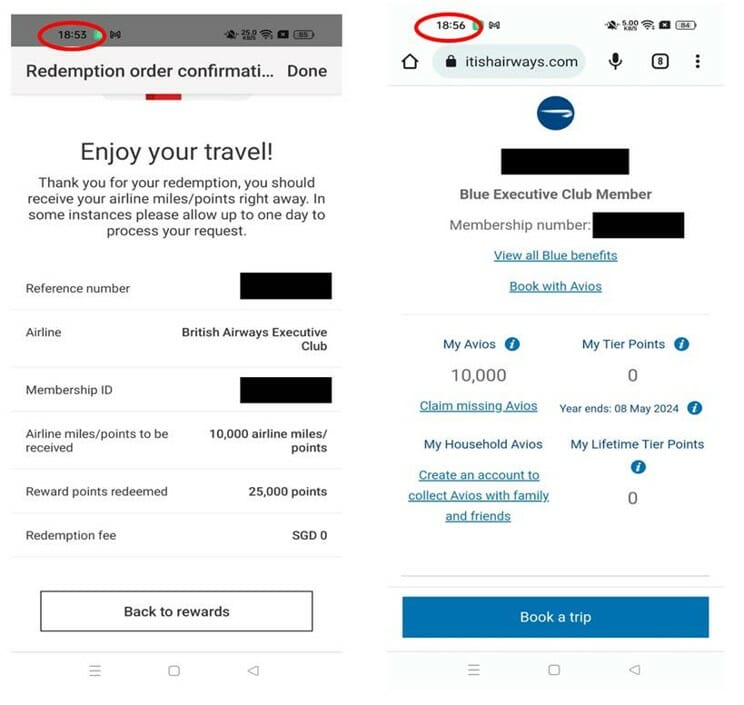

Transfer Time

HSBC says that with the exception of Accor Live Limitless, TravelOne points transfers are processed “instantly or within one business day”.

I’m pleased to report that all transfers actually process instantly. This is possible because HSBC uses Ascenda Loyalty’s platform, which has API integration with the airlines.

Here’s an example showing an instant transfer from TravelOne to British Airways Executive Club. There are also successful data points of instant transfers to Singapore Airlines KrisFlyer.

Other card perks

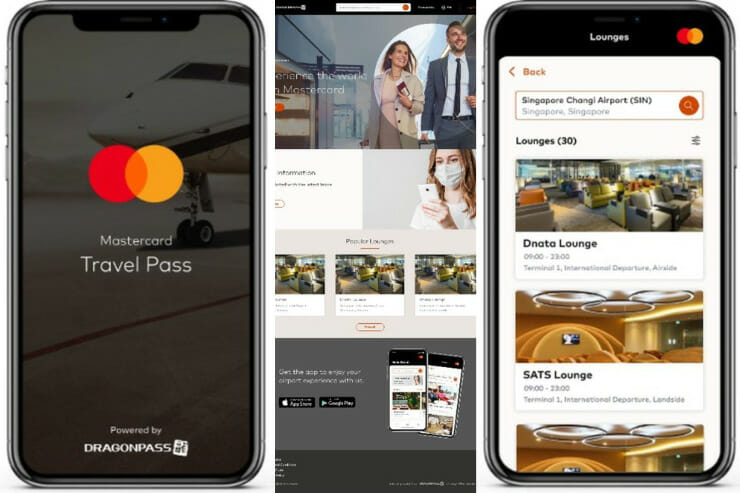

Four complimentary lounge visits

|

|

| Lounge Benefit T&Cs |

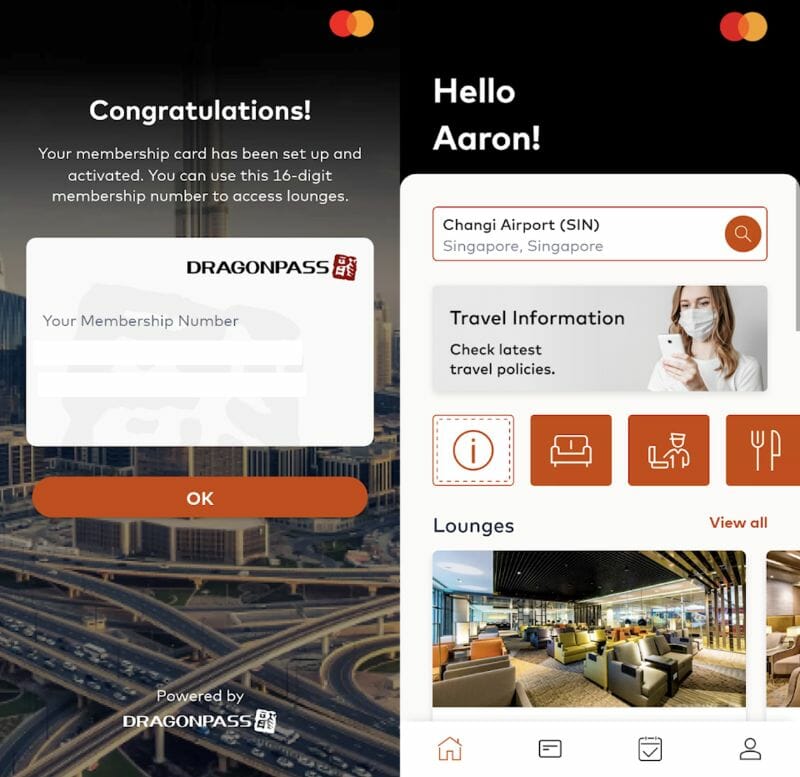

Principal HSBC TravelOne Cardholders enjoy four complimentary lounge visits per year, provided via DragonPass.

Allowances are awarded by calendar year, which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2023, you will be awarded:

- On date of approval: 4 visits (expires 31 December 2023)

- On 1 January 2024: 4 visits (expires 31 December 2024)

Allowances cannot be rolled over, so be sure to fully utilise your visits by the end of the calendar year.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app (Android | iOS)

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

Four visits is relatively generous for an entry-level credit card, double what most of the competition is offering. The main catch is that these visits cannot be shared with a guest.

| Card | Network | Free Lounge Visits (per year) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

Plaza Premium | 4X |

HSBC TravelOne Card HSBC TravelOne Card |

DragonPass | 4X* |

Citi PremierMiles Citi PremierMiles |

Priority Pass | 2X* |

DBS Altitude DBS Altitude |

Priority Pass | 2X (Visa Version Only) |

StanChart Journey Card StanChart Journey Card |

Priority Pass | 2X |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

N/A | N/A |

BOC Elite Miles BOC Elite Miles |

N/A | N/A |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

N/A | N/A |

OCBC 90°N Card OCBC 90°N Card |

N/A | N/A |

UOB PRVI Miles UOB PRVI Miles |

N/A | N/A |

| *Awarded based on calendar year |

||

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

HSBC Everyday Global Account

|

| HSBC Everyday Global Account |

HSBC TravelOne Cardholders can earn an additional 1% cashback on all eligible transactions when they open an HSBC Everyday Global Account (EGA) and meet the qualifying criteria for the Everyday+ Rewards programme.

This involves:

- Depositing the following fresh funds into an EGA each calendar month:

- HSBC Personal Banking: S$2,000

- HSBC Premier: S$5,000

- Performing at least five eligible transactions of any amount each calendar month on their card

Eligible transactions simply refer to anything not on the exclusions list (Point 3 of T&Cs), such as GrabPay top-ups, government transactions, insurance premiums, utilities bills. All other retail spend (e.g. dining, groceries, clothing and apparel) is fair game.

Cardholders who meet the eligibility criteria will earn 1% cashback, capped at S$300 per month for HSBC Personal Banking and S$500 per month for HSBC Premier.

This means your effective return for spending will be:

- Local Spend: 1.2 mpd + 1 % cashback

- Overseas Spend: 2.4 mpd + 1% cashback

All this requires is a one-time setup of the EGA, plus a recurring instruction to transfer the minimum fresh funds every month.

Complimentary travel insurance

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This includes coverage of up to US$100,000 for both the cardholder and their family. COVID-19 related medical treatment and trip cancellation is also provided for.

| ☂️ Summary of Benefits |

|

| Please refer to the policy wording for the full details of coverage |

Summary Review: HSBC TravelOne Card

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☑Take It ☐ Take It Or Leave It ☐ Leave It |

The HSBC TravelOne Card has a lot going for it: the widest range of transfer partners in Singapore, with more soon to come. Instant conversions, with no fees till 31 December 2023. Double the lounge visits of its closest competitors. A minimum transfer block of 10,000 miles that reduces to just 2 miles subsequently, making it easier to avoid orphan miles in your account.

It feels like an exciting puzzle that’s missing one big piece: points don’t pool. Because of this, you can’t tap into the superior earning power of the HSBC Revolution, and even though the HSBC TravelOne Card’s earn rates are objectively good for a general spending card, 1.2/2.4 mpd is not going to challenge a 4 mpd card anytime soon.

There could be a silver lining though, because HSBC has points pooling on its roadmap. They’ve not committed to a specific timeframe, but when this happens, I get the sense that a lot of things will fall into place.

In the meantime, I certainly don’t see the harm of signing up for at least a year, in order to grab the sign-up bonus that’s open to both new and existing customers, as well as up to eight lounge visits.

What do you make of the HSBC TravelOne Card?

anyone know if AXS pay+earn also contributes to the $800 spend offer?

Hi Milelion! Thanks for the solid write-up.

By the way, in the above section “What sign-up bonus or gifts are available?”, the minimum qualifying spend seems to have increased to SGD1,000, from SGD800. As it is mentioned in HSBC’s “Terms and Conditions for the HSBC TravelOne Credit Card Sign up Promotion for 1 September 2023 to 31 December 2023”.

Raising this up to prevent confusion among readers.

Cheers~

thanks! will get that updated.

When will the TravelOne card annual fee for the bonus points be charged? I don’t see the annual fee showing on my statement yet after 2 months. If so how do I qualified for the bonus points? Any Idea?

hi Milelion, would u be in the know on whether the pooling would still happen by year end (aka 123123)?

i don’t have any info on this at the moment.

Hi Aaron,

this is a great article! Quick questions for the EGA cashback eligibility, referring to HSBC EGA T&C art 5a (i)

From above T&C, it seems only transactions in SGD are eligible for 1% cashback, not the FCY transactions. Kindly advise. Thank you!