While banks dangle tantalising welcome gifts for new customers, perhaps the greatest gift of all is the lesson that patience is a virtue. It usually takes at least three months for gifts to be fulfilled, sometimes even four or five, plus some chasing over the phone.

But Maybank is a surprising outlier.

Like many readers, I recently applied for a Maybank Horizon Visa Signature to take advantage of its uncapped 3.2 mpd on foreign currency spending (even on donations, insurance and education), S$60 cash from SingSaver, and Maybank gifts worth up to S$336.

Maybank’s T&Cs did not mention a fulfilment timeline, but I subsequently clarified that gifts would be fulfilled five business days after meeting the minimum spend requirement. I did a double take when I heard that, because it sounded too fast to be true.

To my surprise, however, Maybank has made good on that promise.

My lightning fast Maybank gift fulfilment

|

||

| Apply Here |

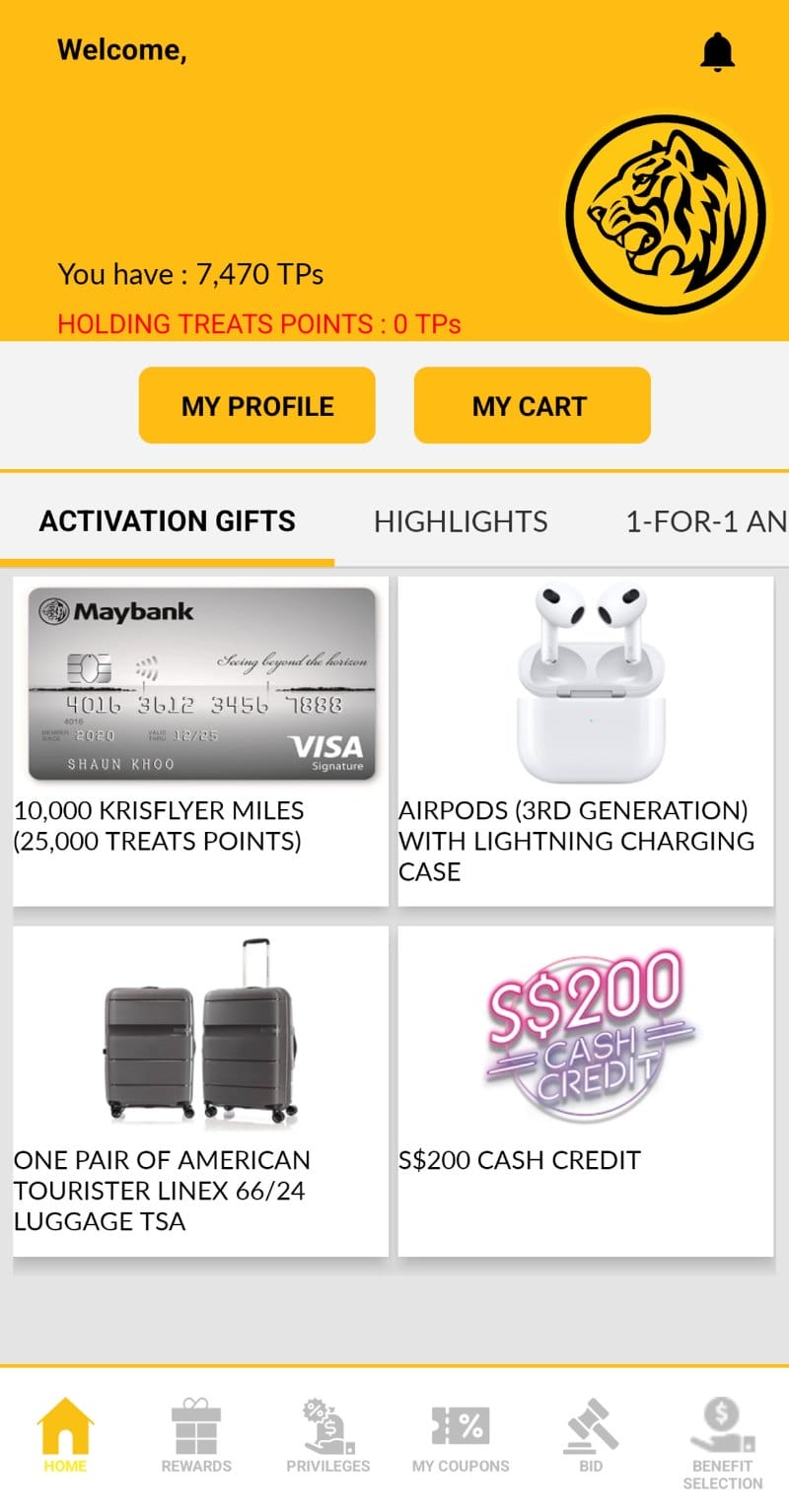

Maybank is currently offering the following welcome gifts for new-to-bank customers who apply for a Maybank Horizon Visa Signature and other selected Maybank cards:

- 2x American Tourister Linex 66/24 Luggage (worth S$336)

- Apple AirPods (3rd Gen) with Lightning Charging Case (worth S$261.40)

- S$200 cash credit

- 10,000 KrisFlyer miles (in the form of 25,000 TREATS points)

Cardholders who apply for a Maybank credit card and CreditAble account are required to spend at least S$600 per month for the first two consecutive months after approval (there’s no need to charge anything to the CreditAble account).

Those who were rejected for CreditAble, or who simply forgot to tick the box during application (like me) can still enjoy the welcome gifts with a slightly higher minimum spend of S$650 per month for the first two consecutive months after approval.

My card was approved on 10 November 2023, so my two spend periods would be:

- Spend Period 1: 10 November 2023 to 9 December 2023

- Spend Period 2: 10 December 2023 to 9 January 2024

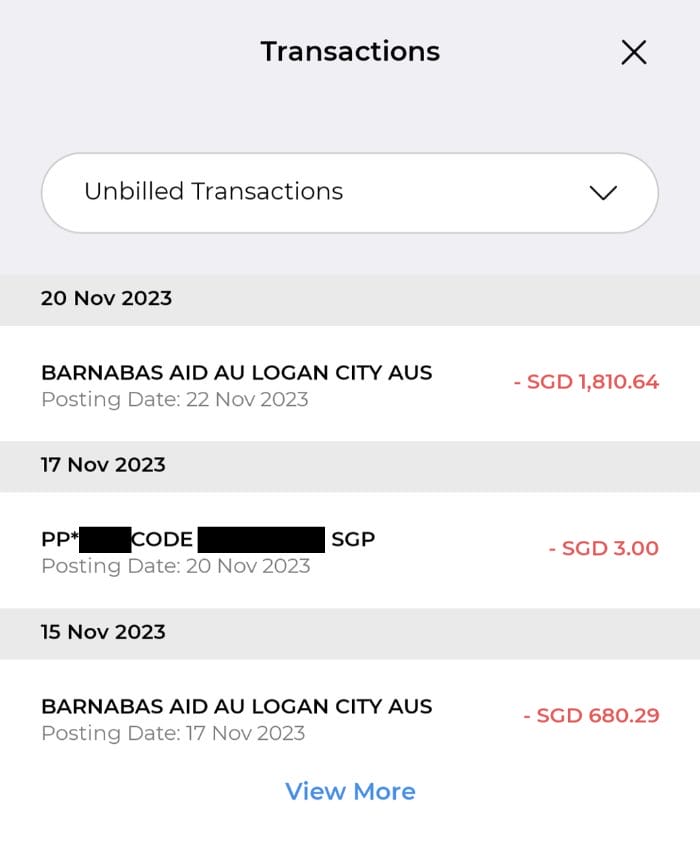

On 15 November 2023, I charged my first transaction of S$680.29, a foreign currency donation to a charitable organisation. On 20 November 2023, I charged a second transaction of S$1,810.64, also to the same organisation. These transactions would normally be ineligible to earn points with most cards, but with the Maybank Horizon Visa Signature I’d be earning 3.2 mpd.

I was expecting that I’d have to wait till at least 10 December 2023 to make the next tranche of S$650 spend (or S$600, as your case may be), so imagine my surprise when I received an SMS five days later, informing me that my welcome gift was now available for redemption!

It appears that despite what Maybank says in its T&Cs about spending S$600/650 per month over two months, all you need to do is spend at least S$1,200/1,300 within two months to trigger the gift.

Maybank gift redemption process

Gift redemptions are done through the Maybank TREATS SG app, and once you login you should see the options listed on the home screen.

After selecting an option, you’ll get a coupon to redeem your choice of gift.

The luggage and AirPods gifts require you to visit Short-Q at Centrepoint, while the S$200 cash credit and TREATS Points gifts will be automatically credited to your account within 2-5 business days.

| Gift | Remarks |

| 2x American Tourister Linex 66/24 Luggage | Redeem at Short-Q |

| Apple AirPods (3rd Gen) with Lightning Charging Case | Redeem at Short-Q |

| S$200 cash credit | Credited within five business days |

| 25,000 TREATS Points | Credited within two business days |

Do note that the additional S$60 cash gift for those who applied via SingSaver is fulfilled separately, by SingSaver. The stated fulfilment time is four months.

Clock your minimum spend with transactions excluded by other cards!

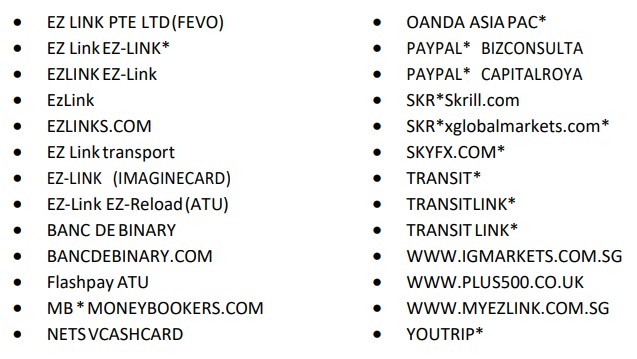

The best thing about Maybank is that its exclusions list is very forgiving.

Exclusion List

- NETS and eNETS transactions;

- Payments made to government or government‐related institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra‐government purchases and any other government services not classified here);

- Betting or gambling transactions;

- Brokerage/securities transactions;

- Transactions classified under the following Merchant Category Codes (“MCC”):

- MCC 6012 – Financial Institutions – Merchandise, Services and Debt Repayment

- MCC 6051 – Non‐Financial Institutions – Foreign Currency, Non‐ Fiat Currency (including but not limited to Cryptocurrency), Money Orders, Account Funding, Travelers Cheques, and Debt Repayment

- MCC 6540 – Non‐Financial Institutions – Stored Value Card Purchase/Load (including by not limited to Grab mobile wallet top‐ups)

- Transactions made via AXS or SAM;

- FlexiCash, FlexiPay, 0% Interest Instalment Plans, funds transfers, cash advances, finance charges, late payment charges, annual fees, reversals, interest charges, or any other miscellaneous charges charged to the Applicant;

- Payment of funds to prepaid accounts such as those listed below (such list is not exhaustive and Maybank reserves the right to amend the list from time to time without giving prior notice or reason to any party)

- Any transaction deemed by Maybank at its sole discretion to be of a business and/or corporate nature; and

- Any other transaction which Maybank may reasonably determine to be unsuitable to, or

should not, be counted towards the Minimum Spend

Note the absence of charitable donations, education, insurance premiums, hospitals, and utilities. These are usually excluded by other banks, but will count towards the minimum spend for this offer (a fact I’ve confirmed with a Maybank spokesperson).

So, you could clock the minimum spend entirely on these categories, incurring very little opportunity cost in the process.

| SGD | FCY* | |

| Charitable Donations | 0.4 mpd | 3.2 mpd |

| Education | 0.24 mpd | 3.2 mpd |

| Insurance Premiums | 0.24 mpd | 3.2 mpd |

| Private Hospitals | 0.24 mpd | 3.2 mpd |

| Utilities | 0.24 mpd | 3.2 mpd |

| *With min. S$800 spend per calendar month |

||

If these are charged in SGD, you’ll earn a rather underwhelming rate of 0.24 mpd on insurance, medical, education and utilities (0.4 mpd on donations), but:

(1) that’s still better than most other options, and

(2) the miles aren’t really the point here (you’re getting welcome gifts!)

And if you can charge these in FCY, you’ll earn 3.2 mpd, subject to meeting a minimum spend of S$800 per month. I can’t think of any other card on the market that offers that.

Conclusion

|

||

| Apply Here |

Despite the stated requirement to spend S$600/650 per month for two consecutive months, it seems that the Maybank Horizon Visa Signature will award its welcome gift to customers once they hit a cumulative amount of S$1,200/1,300, even if the first month isn’t over yet.

Moreover, gift fulfilment takes place within five business days of meeting the minimum spend, which is hands down the fastest I’ve ever see a bank fulfill its welcome offer.

Who has the patience to wait months, anyway?

Wanted to chime in and say I quite like how maybank is using the treats app with gift delivery and friends and family card spend tracker. Just wish they could have fingerprint login and integrate it into a single app (that last one is a dream – I have 2 maybank banking apps and I don’t understand what’s the difference) But I also wanted to say, what’s with all the luggages…. I am expecting to get about 6 suitcases, 1 from HSBC spin and win, 1 from maybank FX/travel spend a couple of months ago, 2 (set) from DCS sign… Read more »

Hey Aaron, so which reward did you go for in the end?

haven’t decided yet. definitely not the miles, probably not the cashback, so that leaves the luggage and airpods…

i signed up via singsaver and oddly the redemption form only shows 60sgd paynow. any idea why?

because $60 is what’s fulfilled by singsaver. the other gifts are fulfilled by maybank.

thank you

How does Singsaver give the $60? PayNow or credit into Maybank credit card as an credit item? Also, if I received the $200 from Maybank but not the $60 from Singsaver yet, can I cancel the card and still expect Singsaver to pay me the $60 reward?

Hi Aaron, awesome content as always!

Suggest you can update the “What card do I use for… FCY” and put this terrific card at its rightful position near the top 🙂

yup that’s going in the next update, thanks!

Take note to keep the cards/accounts for at least 9 months.

“Maybank reserves the right to claim the full cost or retail value of the Activation Gift from a

Successful Applicant in the following events: (a) any of such Applicant’s Eligible Card account or

CreditAble account is closed/terminated for whatever reason (whether by the Applicant, Maybank

or otherwise) within nine months from the opening date of the Eligible Card account or CreditAble

account”

Aaron, can check with Maybank which account does Maybank credit the $200 cash into? I don’t have a savings account with them … Only horizon cc and creditable

I have a question about the $200 cash too. I added that option to my coupons, but no idea what 6 digit code to enter to use it

no need a code. just leave blank

Thanks, but leaving it blank will just give an error message E107 – You have entered an invalid code. Looks like I’ll have to call Maybank unless someone else has redeemed and can chime in

Update for anyone else with the same issue. Once you add to your coupons, you don’t need to “use it”, just leave it unused in your coupons and Maybank will pick it up.