While no one wants to end up in a hospital, the silver lining is that these big ticket transactions will likely earn you a good number of miles and points (even better if it’s reimbursable via insurance!).

Unfortunately, it’s going to be even harder from 17 January 2024, when Citi becomes the latest bank to add this category to its exclusions list. Per an update on the Citi website:

|

|

|

We wish to inform you that, with effect from 17 January 2024, transactions made at hospitals classified under the Merchant Category Code (“MCC”) 8062 will not earn the cardmember ThankYou Points/ Citi Miles/ Cash Back/ SMRT$/ Citi M1 Rebate/ Rewards Points/ Cash Rebate. This change is applicable for all Citi Credit Cards except Citi ULTIMA Card and will be updated under point 2 in the Terms. Click here to view the revised Terms -Citi |

|

Citi adds hospitals to exclusion list

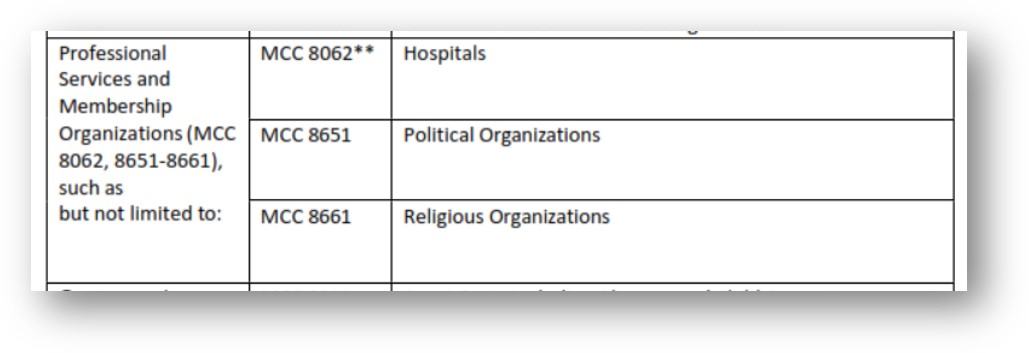

Citi’s new rewards exclusions list, dated December 2023, makes an addition under the Professional Services and Membership Organisations section:

As you can see, MCC 8062 Hospitals has been added, and will no longer earn rewards from 17 January 2024 on any Citi card except the Citi ULTIMA.

| 🤦 OMG AMAZE IS ON THE EXCLUSIONS LIST??? |

| No. To pre-empt the inevitable panic by some who scroll further down the list to Section 3, let me refer you to this post. |

This means you’ll no longer be able to pair the Amaze + Citi Rewards for 4 mpd, nor use the Citi Prestige or Citi PremierMiles Cards for 1.3 and 1.2 mpd respectively.

It’s unfortunate, but Citi is just the latest in a long line of banks to add hospitals to its exclusion list. DBS, OCBC and UOB have already excluded this category- with limited exceptions carved out for high-end cards like the UOB Reserve and OCBC VOYAGE.

This does not rule out all healthcare facilities

Sometimes people get paranoid when they see that hospitals are on the exclusions list, and assume it means anything vaguely healthcare-related will not earn points.

This is untrue. MCC 8062 is just one small subsegment of the overall healthcare range, and there are different MCCs used by private clinics, health screeners, dentists, opticians, nursing homes and the like.

| 👨⚕️ Healthcare-related MCCs | |

| MCC | Examples |

| 8011: Doctors-Not Elsewhere classified | Healthway Medical, Q&M Medical, Raffles Medical |

| 8021: Dentists and Orthodontists | Parkway Dental, Q&M Dental, Unity Denticare |

| 8031: Osteopathic Physicians | City Osteopathy Physiotherapy, The Osteopathic Centre |

| 8041: Chiropractors | Chiropractic First, Spinal Rehab Centre |

| 8042: Optometrists and Ophthalmologists | Asia Retina, Tsecc |

| 8043: Opticians, Optical Goods and Eyeglasses | KJ Optometrists, Northern Optician, New China Opticians |

| 8044: Optical Goods and Eyeglasses | Nanyang Optical, Paris Miki, W Optics, |

| 8049: Chiropodists, Podiatrists | Footworks Podiatry Clinic, East Coast Podiatry |

| 8050: Nursing and Personal Care Facilities | Charis Manor Nursing Home, LC Nursing Home, Orange Valley |

| 8071: Dental and Medical Laboratories | NewPath Diagnostics Lab |

| 8099: Health Practitioners, Medical services- Not Elsewhere Classified | Doctor Anywhere, Eu Yan Sang TCM Clinic, HealthHub |

These will continue to earn points as per normal, until explicitly excluded.

Note in particular that the HealthHub & Health Buddy app codes as MCC 8099. If you’re able to pay your bills through the app, you can use the Citi Rewards Card to earn 4 mpd.

If you’re uncertain about the MCC of a particular merchant, here’s three ways of looking it up prior to purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

What other cards can you use for hospital transactions?

From 17 January 2024, here’s the remaining credit cards that will still award miles for hospital transactions.

| 💳 Best Cards for MCC 8062 Hospitals | |

| Card | Earn Rate |

UOB Reserve UOB Reserve |

1.6 mpd |

Citi ULTIMA Citi ULTIMA |

1.6 mpd |

OCBC VOYAGE (BOS, PPC, Premier) OCBC VOYAGE (BOS, PPC, Premier) |

1.6 mpd^ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd* |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

1.3 mpd^ |

AMEX PPS Credit Card AMEX PPS Credit Card |

1.3 mpd^ |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd^ |

HSBC Visa Infinite HSBC Visa Infinite |

1.25 mpd# |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd^ |

SCB Journey Card SCB Journey Card |

1.2 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd^ |

AMEX Centurion AMEX Centurion |

0.98 mpd^ |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd^ |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd^ |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd^ |

| *With min. spend of S$2,000 per statement month, otherwise 1 mpd ^Private hospitals only #With min. spend of S$50,000 in the previous membership year, otherwise 1 mpd |

|

Do note that AMEX cards and OCBC cards only earn miles for private hospitals, defined as the following:

- Crawfurd Medical

- Farrer Park

- Gleneagles

- Mount Alvernia

- Mount Elizabeth

- Mount Elizabeth Novena

- Parkway East

- Raffles Hospital

- Thomson Medical Centre

Conclusion

From 17 January 2024, Citi cards will no longer earn rewards for hospital transactions, with the exception of the Citi ULTIMA.

Fortunately, this doesn’t rule out all healthcare-related transactions. So long as you avoid MCC 8062, you can still earn regular rewards as usual. Don’t forget the HealthHub/ Health Buddy workaround too, which will still be viable if MCC 8099 avoids the blacklist.

Oh bummer 🙁

Thanks Aaron for informing

For payment on apps like health buddy, do we have to use amaze + citi rewards or can we just use the citi rewards card directly?

Suggest to use it with amaze card so that you can view the mcc afterwards.

Amaze will charge 1% for local healthcare transactions.

will the hospital spend still be eligible for citi prestige limo ride?