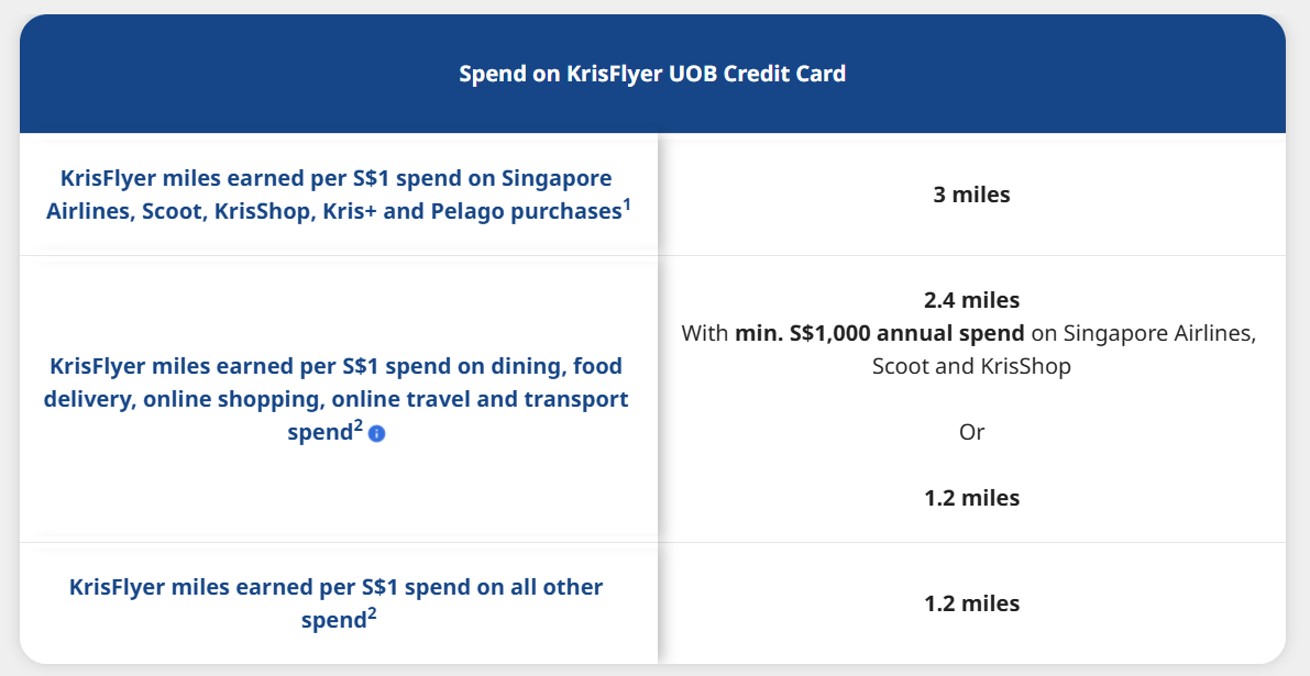

The KrisFlyer UOB Credit Card usually earns a mediocre 1.2 mpd on all transactions, but its Accelerated Miles feature boosts the earn rate on dining, food delivery, online shopping, online travel and transport spend.

The bonus used to be an uncapped 3 mpd, but unfortunately, on 1 June 2025 the earn rate was cut to 2.4 mpd. While a 20% reduction isn’t the worst devaluation ever, it’s still painful!

On the bright side, there continues to be no cap on the Accelerated Miles you can earn, making this a useful option for big-spending cardholders who have exhausted the bonus caps on higher-earning cards.

In this post, I’ll walk you through how the Accelerated Miles feature works, what categories are covered, and a few important things to know.

What are Accelerated Miles?

|

||

| Earn Rate | Remarks | |

| Base Miles | 1.2 mpd | Earned on all SGD/FCY spend |

| Accelerated Miles | 1.2 mpd | Earned on selected categories of SGD/FCY spend |

| Total | 2.4 mpd | |

KrisFlyer UOB Credit Cardholders normally earn 6 KrisFlyer miles per S$5 (1.2 mpd) spent on all transactions, with no minimum spend and no cap.

Provided they meet a certain minimum spend on SIA Group transactions (see next section), they will be eligible to earn an extra 6 KrisFlyer miles per S$5 (1.2 mpd) on selected categories of spending for that membership year, with no cap.

The extra 1.2 mpd component is referred to as Accelerated Miles.

| ❓ What about my spending prior to 1 June 2025? |

| Prior to 1 June 2025, the Accelerated Miles bonus was 1.8 mpd. Transactions made prior to this date will still be rewarded with 3 mpd overall (1.2 mpd base, 1.8 mpd bonus). |

How do you qualify for Accelerated Miles?

To qualify for Accelerated Miles, KrisFlyer UOB Credit Cardholders must spend at least S$800 per membership year on SIA Group transactions, defined as:

- Singapore Airlines

- Scoot

- KrisShop

For the avoidance of doubt, this includes using your card to pay for taxes and surcharges on a KrisFlyer award ticket (for both Singapore Airlines and partner flights).

Kris+ and Pelago are not considered part of the SIA Group, and transactions on these platforms will not count towards the minimum spend requirement.

If your card membership year ends from November 2025 onwards, however, the minimum spend on SIA Group transactions will be S$1,000 per membership year.

Or to put it another way, the higher minimum spend applies to anyone who was approved for, or renews their KrisFlyer UOB Credit Card from December 2024 onwards.

If you’re not sure when your membership year ends, simply look at the expiry month on your card. For example, if your expiry month is April, then your membership year runs from 1 April to 31 March each year.

In case you were wondering, here’s how the SIA Group minimum spend has evolved over the years. This criteria was initially set at S$500, but was lowered to S$300 during the COVID period. Since then, it’s been increased to S$800, and now S$1,000.

| Card Membership Year End | SIA Group Min. Spend |

| Prior to April 2021 | S$500 |

| April 2021 to August 2022 | S$300 |

| September 2022 to March 2023 | S$500 |

| April 2023 to October 2025 | S$800 |

| November 2025 onwards | S$1,000 |

What transactions can you earn Accelerated Miles on?

Cardholders who meet the minimum SIA Group spend will earn Accelerated Miles on the following transactions, whether in SGD or FCY.

| Category | MCCs |

| Dining & Food Delivery | 5812, 5813, 5814 |

| Online Shopping | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5661, 5691, 5699, 5732, 5733, 5735, 5912, 5942, 5944-5949, 5999, 7278 (only for Shopee, Lazada and Qoo10) |

| Online Travel | Agoda, Airbnb, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel |

| Transport | BUS/MRT, 4121 |

| Bonuses apply to both SGD and FCY spending | |

This includes popular merchants such as Atome, Amazon, Deliveroo, Foodpanda, GrabFood, Grab rides, gojek, Lazada, and Shopee. Do keep in mind that shopping and travel transactions must be charged online, and in the case of the latter, only specific merchants are included.

While you can’t explicitly earn bonus miles with competing airlines (this is a Singapore Airlines cobrand card after all!), you can still do so if you book them through one of the OTAs.

Will Accelerated Miles be awarded for the entire year?

Accelerated Miles will be awarded on eligible transactions for the entire membership year, not just from the time the SIA Group minimum spend was met.

For example, if my membership year runs from June 2024 to May 2025, and I achieve the SIA Group minimum spend in September 2024, I will earn Accelerated Miles for all eligible transactions from June 2024 to May 2025.

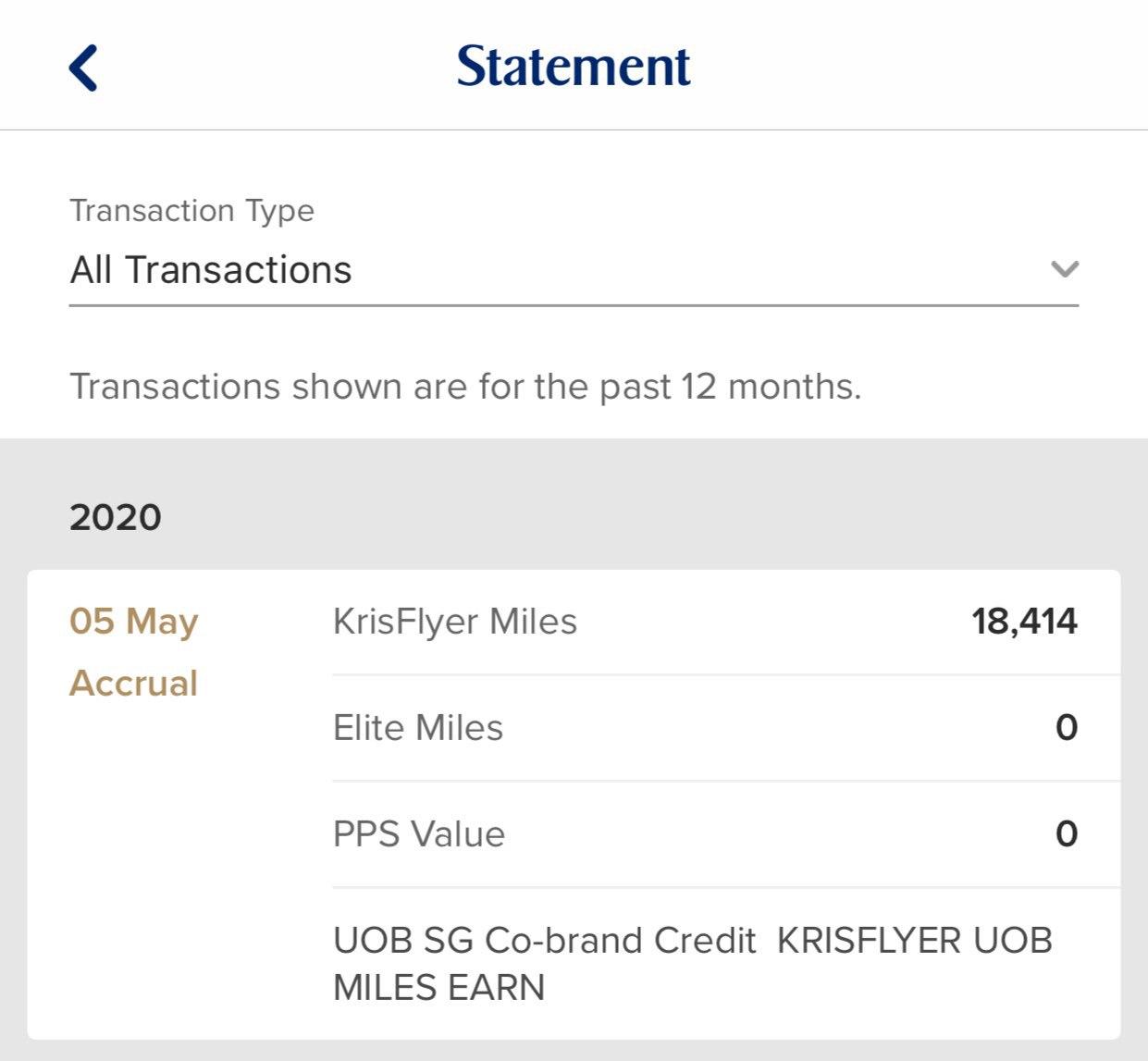

When are Accelerated Miles credited?

Unlike base miles, Accelerated Miles are not credited when the transaction posts. Instead, they are credited two months after the end of the membership year.

Here’s an example of how it works for someone with a card membership year running from 1 June 2024 to 31 May 2025, and who spends S$1,000 on Accelerated Miles categories per month.

| Month | Spend on Acc. Miles Categories | Base Miles (1.2 mpd) | Acc. Miles (1.8 mpd) |

| Jun 2024 | S$1,000 | 1,200 | – |

| Jul 2024 | S$1,000 | 1,200 | – |

| Aug 2024 | S$1,000 | 1,200 | – |

| Sep 2024 | S$1,000 | 1,200 | – |

| Sep 2024: Meets minimum spend on SIA Group transactions* |

|||

| Oct 2024 | S$1,000 | 1,200 | – |

| Nov 2024 | S$1,000 | 1,200 | – |

| Dec 2024 | S$1,000 | 1,200 | – |

| Jan 2025 | S$1,000 | 1,200 | – |

| Feb 2025 | S$1,000 | 1,200 | – |

| Mar 2025 | S$1,000 | 1,200 | – |

| Apr 2025 | S$1,000 | 1,200 | – |

| May 2025 | S$1,000 | 1,200 | – |

| Jun 2025 | – | – | – |

| Jul 2025 | – | – | 21,600 |

| *I’ve shown this as Sep 2024, but it really doesn’t matter- so long as he meets this minimum spend by May 2025, he will be eligible for Accelerated Miles on transactions from 1 June 2024 to 31 May 2025 | |||

Each month, he earns 1,200 base miles (S$1,000 x 1.2 mpd). It’s only in July 2025 that the remaining 21,600 Accelerated Miles (S$1,000 x 1.8 mpd x 12) are credited.

Yes, you don’t need to tell me the irony, but Accelerated Miles are in fact delayed!

What are the implications of delayed crediting?

The delayed crediting mechanism gives rise to several important issues.

First, any pending Accelerated Miles will be forfeited if you cancel the KrisFlyer UOB Credit Card before they post. This effectively locks you into the card, which I’m quite certain is deliberate.

Second, because Accelerated Miles are credited as one lump sum, it will be very tricky to reconcile your points. I mean, it’s hard enough doing this on a month to month basis; imagine doing it for 12 months’ worth of transactions.

Third, you will be more exposed to devaluation risk. If SIA announces an award chart devaluation in, say, two months, other cardholders can rush out to convert their points and burn their miles before it happens. You can’t, because your Accelerated Miles are in limbo.

Fourth, your miles will all be of different vintages. The Base Miles will be credited each month, and start their 3-year expiry period immediately. The Accelerated Miles will follow 2-14 months later.

What happens in reality?

While the official position is that Accelerated Miles are only credited two months after the end of the membership year, in practice it seems like cardholders receive them one month before the card’s renewal date.

For example, I received a screenshot from a cardmember who received his card in June 2019. By the letter of the T&Cs, he should receive his bonus miles in August 2020, but instead they were credited in May 2020.

There are a few more reports of similar cases.

If you do receive your Accelerated Miles before the card renewal date, then yes, you can proceed to cancel the card if you wish for the upcoming membership year.

However, keep in mind that this “advance crediting” is not official UOB policy, and therefore you can’t hold UOB to it. It’s also not clear whether this happens for every cardmember, or whether some are just lucky. And even if they’ve done it in the past, there’s no guarantee it’ll happen again in the future.

Is it still worth earning Accelerated Miles?

Given the recent cut to the Accelerated Miles bonus and the increase to minimum spend, is it still worth the trouble?

It really boils down to how big a spender you are. If you don’t max out the 4 mpd caps on other cards, then there’s really no reason why you should be settling for 2.4 mpd, on a delayed timeline no less.

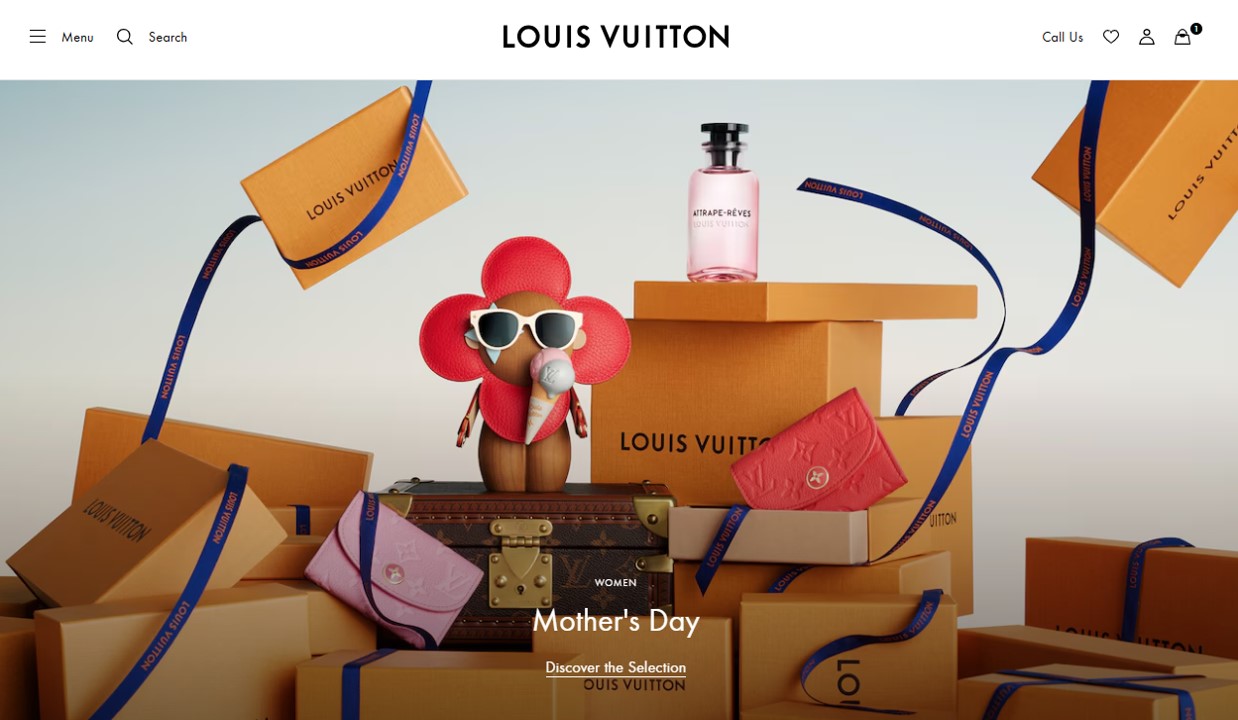

But if you do, then I’d argue there’s definitely something of interest here— especially for those who buy luxury goods. Take a look at the qualifying transactions for Accelerated Miles, and you’ll notice the following inclusions:

- MCC 5944: Clock, Jewelry, Watch and Silverware Stores

- MCC 5948: Leather Goods and Luggage Stores

Those happen to be the MCCs for luxury merchants like Cartier and Louis Vuitton, and if you can buy those online (LV has an online store!), you could earn an uncapped 2.4 mpd on your purchases.

However, if your Accelerated Miles transactions are in foreign currency, there are alternative cards which offer an uncapped 2.4 to 4 mpd. These would be preferable, since the miles will all be awarded upfront (or by the very next month at the latest), and there’s no minimum SIA Group spend to hit.

| 💳 Cards with Uncapped FCY Earn Rates |

||

| Card |

FCY Earn Rate | Remarks |

StanChart Beyond Card StanChart Beyond CardApply |

PP: 4 mpd PB: 3.5 mpd Regular: 3 mpd |

|

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd |

Min. S$4K spend per c. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd |

Min. S$4K spend per c. month |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd |

Min. S$2K spend per s. month |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd |

Min. S$800 spend per c. month |

DBS Treasures Black Elite DBS Treasures Black Elite |

2.4 mpd |

No longer available for applications |

HSBC TravelOne Card HSBC TravelOne CardApply |

2.4 mpd |

|

UOB PRVI Miles UOB PRVI MilesApply |

3 mpd (IDR, MYR, THB, VND) 2.4 mpd |

|

UOB VI Metal Card UOB VI Metal CardApply |

2.4 mpd |

|

Bonuses for SIA Group, Pelago and Kris+

The KrisFlyer UOB Credit Card earns 15 KrisFlyer miles per S$5 spent (3 mpd) on:

- Singapore Airlines

- Scoot

- KrisShop

- Kris+

- Pelago

Don’t confuse this with Accelerated Miles! There is no minimum spend necessary to trigger this earn rate, and the full 3 mpd is awarded at the time the transaction posts (and credited to your KrisFlyer account the following month).

Conclusion

|

| Apply |

The KrisFlyer UOB Credit Card’s Accelerated Miles feature is a useful way for big spenders to rack up miles, since there’s no cap on the maximum bonus you can earn.

Unfortunately, the recent cut in earn rates from 3 mpd to 2.4 mpd dulls its appeal somewhat, and if you’re spending overseas, there are alternative cards that offer higher, uncapped rates without any category restrictions or minimum SIA Group spend to bother with.

Also, the minimum SIA Group spend has been increased by 25% to S$1,000 for membership years ending from November 2025 onwards, and Accelerated Miles continue to be credited on a delayed timeline.

All that said, I can’t think of any other card that offers an uncapped 2.4 mpd for local spend (albeit selected categories), and in that sense, the Accelerated Miles perk still holds value— though perhaps not as much as before.

Yeah it really only is good for luxury goods

The card for Hermes.

Does it has to be online sales transaction?

Hi, to enjoy the benefit with scoot, it have to book through flyscoot.com/KrisFlyerUOB. Does it attract spike in ticket price ?

will there be accelerated miles for 5812, 5813, 5814 if i pair with Amaze + UOB KF ?

its a good 1 card strategy, i have recommended it to all my friends who are lazy to play the 6/4 MPD game

I think it is also worth mentioning that pairing this card with the Krisflyer UOB Account would earn you an additional 0.4mpd. AND bonus KrisFlyer miles up to 6mpd! Though the bonus miles depend on how much your Monthly Account Balance(MAB) is, as it is capped at 5% of your MAB. Some examples of yearly bonus miles from Krisflyer UOB Account: $500 monthly spend on UOB Krisflyer with $20,000 MAB = 12,400 bonus miles. (2.1mpd) $500 monthly spend on UOB Krisflyer with $50,000 MAB = 32,400 bonus miles. (5.4mpd) $1000 monthly spend on UOB Krisflyer with $20,000 MAB = 14,800… Read more »

with interest rates being as high as they are now, it’s a terrible deal. your cost per mile is way too high, and the 5% cap makes it even worse

hi! do you know if we need to pay the annual fee to get the accelerated miles? thank you!

not a requirement as such, but if in your subsequent year UOB refuses to waive and you refuse to pay, then you have to cancel the card and forfeit any pending miles.

okie thanks! but am I correct to say that if the miles are awarded one/two months after the membership year and they are not willing to waive the annual fee then you have to pay the annual fee to get those accelerated miles?

yup. ymmv. that’s your potential “hostage situation”

understood, thank you!

Would CardUp transactions by eligible for the 3% accelerated miles too?

If I use Atome to make payment in KrisShop, does it still count towards the $800 SIA Group spend?

Hi there, any idea how to check when the $800 anniversary is up? Ie when in Yr 2 must I must make that $800 spend again to unlock the 3mpd accelerator

Does supplementary card also need to spend $800 on SIA Group for those miles to get accelerated miles

No.

Is the accelerated miles earning subject to $5 earning block? Take an extreme example, if i were to spend $800 on SIA group and $4.99 every month for a year, will I be earning accelerated miles from my monthly $4.99 spending? Thanks

Hi Aaron, appreciate your consistent updates on new T&Cs. In the ‘How to Qualify’ section, it still refers to the $800 qualifying spend.

Does spending on SIA Tickets through 3rd party apps like trip.com count towards the annual $1000 minimum requirement spend for accelerated miles? Or must I buy the tickets directly from the SIA website?

I think it should be shared that for the 2nd year waiver onwards it is nearly impossible to get annual fee waiver. Got rejected twice on the app and speaking to customer service. Definitely cancelling the card once 2nd year annual fee comes in.

maybe for you, but i got my fee waived easily.

Just to confirm, the card calculates $1000 min spend based on amount charged on card and not travel date? My card year ends in Dec 25 and I am thinking whether spending within this membership year but traveling next year will contribute to min spend.