CardUp and OCBC have a long-standing partnership that offers cardholders a discounted admin fee for various payments made through the platform, such as rent, tuition fees, income tax and insurance premiums.

This promotion was originally set to expire on 31 December 2024, but has now been extended till 31 March 2025.

New CardUp users will enjoy a 1.5% admin fee, while existing users will benefit from a rate of 1.8% or 2%, depending on card. This works out to a cost of 0.92 to 1.51 cents per mile, depending on the card used.

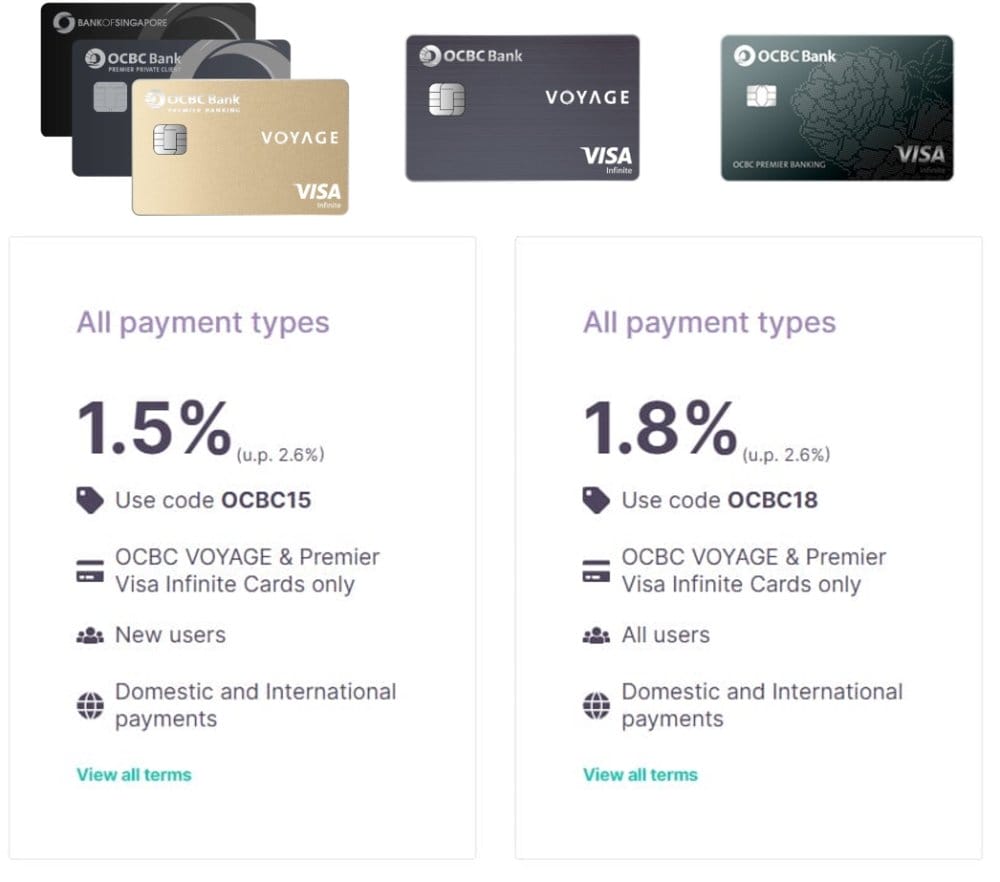

OCBC VOYAGE & OCBC Premier Visa Infinite: 1.5% or 1.8% fee

New CardUp users (1.5%)

| Code | OCBC15 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.5% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 March 2025, 6 p.m SGT |

| Due Date By | 3 April 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC15 to enjoy a 1.5% admin fee on their first payment of any kind.

The payment must be scheduled on CardUp by 31 March 2025, 6 p.m (SGT), with a due date on or before 3 April 2025. No minimum payment is required, nor is there any maximum.

The code can be used either on a one-off payment, or the first payment of a recurring series.

Existing CardUp Users (1.8%)

| Code | OCBC18 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No limit on redemptions |

| Admin Fee | 1.8% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 March 2025, 6 p.m SGT |

| Due Date By | 3 April 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

Existing CardUp users can use the code OCBC18 to enjoy a 1.8% admin fee on any CardUp payment.

The payment must be scheduled on CardUp by 31 March 2025, 6 p.m (SGT), with a due date on or before 3 April 2025. No minimum payment is required, nor is there any maximum.

The code can be used either on a one-off payment, or the first payment of a recurring series. There is no limit on the number of times each account can use this code.

What’s the cost per mile?

Here’s the cost per mile for the OCBC VOYAGE and OCBC Premier Visa Infinite Cards, given their earn rates and a 1.5%/1.8% admin fee.

| Card | Earn Rate |

Cost Per Mile (1.5% fee) |

Cost Per Mile (1.8% fee) |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

1.6 mpd | 0.92¢ | 1.11¢ |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 1.14¢ | 1.36¢ |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 mpd | 1.15¢ | 1.38¢ |

| Both the amount due and the CardUp fee are eligible to earn miles | |||

The cost per mile starts from 0.92 cents, which is certainly worth considering especially since there’s no maximum cap on the payment you can make.

Terms & Conditions

The T&Cs for both the OCBC15 and OCBC18 codes can be found here.

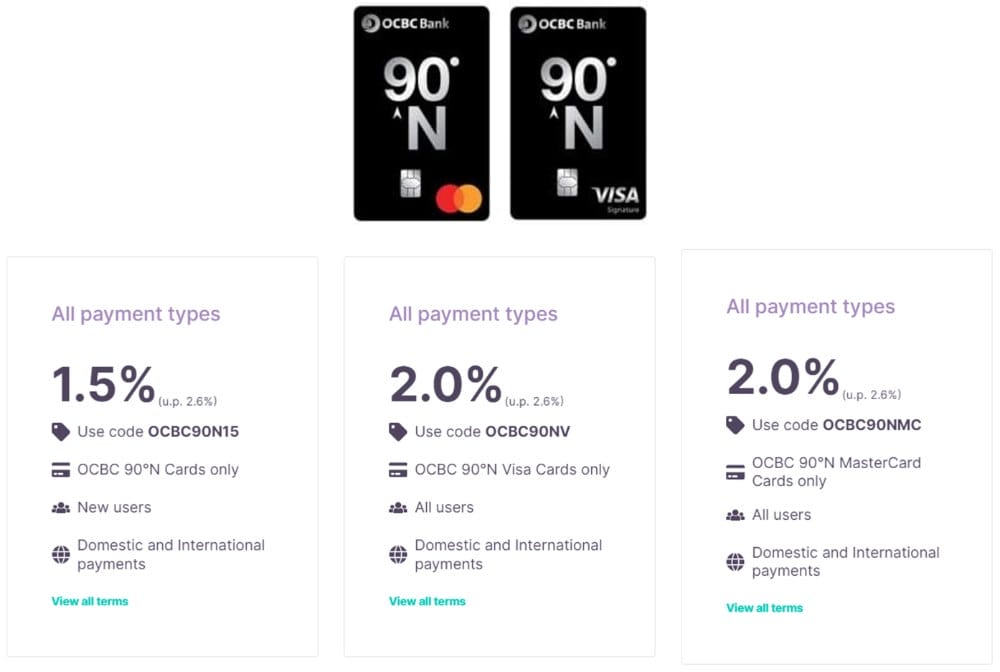

OCBC 90°N Card: 1.5% or 2% fee

New CardUp users (1.5%)

| Code | OCBC90N15 |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.5% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 March 2025, 6 p.m SGT |

| Due Date By | 3 April 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC90N15 to enjoy a 1.5% admin fee on their first payment of any kind.

The payment must be scheduled on CardUp by 31 March 2025, 6 p.m (SGT), with a due date on or before 3 April 2025. No minimum payment is required, but the maximum payment you can make is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series.

Existing CardUp Users (2%)

| Code | OCBC90NV OCBC90NMC |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No limit on redemptions |

| Admin Fee | 2% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 March 2025, 6 p.m SGT |

| Due Date By | 3 April 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

Existing CardUp users can use the code OCBC90NV (for 90°N Visa) or OCBC90NMC (for 90°N Mastercard) to enjoy a 2% admin fee on any CardUp payment.

The payment must be scheduled on CardUp by 31 March 2025, 6 p.m (SGT), with a due date on or before 3 April 2025. No minimum payment is required, but the maximum payment you can make is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series. There is no limit on the number of times each account can use this code.

What’s the cost per mile?

Here’s the cost per mile for the OCBC 90°N Visa and Mastercards, given their earn rates and a 1.5/2% admin fee.

| Card | Earn Rate | Cost Per Mile (1.5% fee) |

Cost Per Mile (2% fee) |

OCBC 90°N Visa/MC OCBC 90°N Visa/MC |

1.3 mpd | 1.14¢ | 1.51¢ |

| Both the amount due and the CardUp fee are eligible to earn miles | |||

The cost per mile starts from 1.14 cents apiece, still a competitive price albeit capped at a S$10,000 transaction.

Terms & Conditions

The T&Cs for both the OCBC90N15, OCBC90NV and OCBC90NMC codes can be found here.

What can you do with OCBC points?

90°N Miles, VOYAGE Miles and OCBC$ can be converted to nine airline and hotel partners, with a S$25 conversion fee.

| Frequent Flyer Programme | Conversion Ratio (OCBC: Partner) |

|

| 90°N Miles & VOYAGE Miles | OCBC$ | |

| 1:1 (VOYAGE) |

25,000 : 10,000 |

|

| 1,000 : 1,000 (90°N) | ||

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 750 | 10,000 : 2,900 | |

| 1,000 : 700 | 10,000 : 2,800 | |

| 1,000 : 500 | 10,000 : 2,000 | |

| All ratios expressed as OCBC points : partner miles/points |

||

Unfortunately, not all conversions take place at the same ratio. Only Flying Blue shares parity with KrisFlyer; the other airlines all involve a haircut of 10-30%. It’s particularly poor that Asia Miles requires a 25% haircut, when every other bank in Singapore offers transfer parity between KrisFlyer and Asia Miles.

Citi PayAll alternative

|

| Citi PayAll Promo |

As a reminder, from now till 28 February 2025, Citi cardholders will earn 1.75 mpd on all Citi PayAll transactions. This is subject to a minimum spend of S$5,000 on Citi PayAll transactions on a single card, and capped at S$150,000 across all Citi PayAll categories.

Given the service fee of 2.6%, you’re looking at a cost of 1.49 cents per mile across participating cards.

CardUp’s offer will beat this if you have an OCBC VOYAGE or OCBC Premier Visa Infinite, but if you’re an OCBC 90°N Cardholder and don’t qualify for the new customer offer, Citi PayAll is cheaper.

For more on this offer, refer to the post below.

Citi PayAll launches 1.75 mpd promotion; buy miles at 1.49 cents

Conclusion

|

| Enjoy a 1.79% fee on your first CardUp transaction with code MILELION, no minimum spend required. This code is valid for Visa and Mastercard payments only |

OCBC cardholders can take advantage of a 1.5% (new) or 1.8/2% (existing) fee when paying bills with CardUp, depending on which card they hold.

There’s no cap on redemptions, and the existing customer codes can be used as many times as you wish during the promo period.

The new customer fee is particularly attractive, so do consider it if you have any upcoming bill payments to make.

Table for cost per mile for 90n should be 1.5 and 1.8% instead of 1.5 and 2%

actually it’s the section above it that’s wrong. have fixed, thanks!

what is best for recurring mortgage loan payment ?

If I have used the MILELION code that saves $30 on cardup, does that mean I can no longer use the OCBC15 code?

Is the MILELION code still active?

Yes, with a 1.79pc rate as mentioned at the bottom. They are no longer offering $30 off

Do you know if charging insurance premiums / taxes through CardUp with the OCBC card is subjected to the $5 rounding as with all OCBC cards? For example, for a $3000 tax payment

Instead of earning 3000 x 1.3 mpd …

the $3000 is divided by $5 blocks, hence 600 x 1.3 mpd 😱

Anyone have tried and knows? Thanks in advance!