In June 2023, the UOB Visa Infinite Metal Card received a significant enhancement, which buffed the overseas earn rate to 2.4 mpd and added an unlimited-visit DragonPass lounge membership for the cardholder and one guest.

On top of this, a welcome offer of up to 80,000 miles & S$200 Grab vouchers was launched. The welcome offer was originally set to lapse on 31 December 2023, but UOB has now extended it till 31 March 2024.

Unfortunately, the S$200 Grab vouchers have been removed, which makes the offer less attractive than before.

New UOB Visa Infinite Metal Card welcome offer

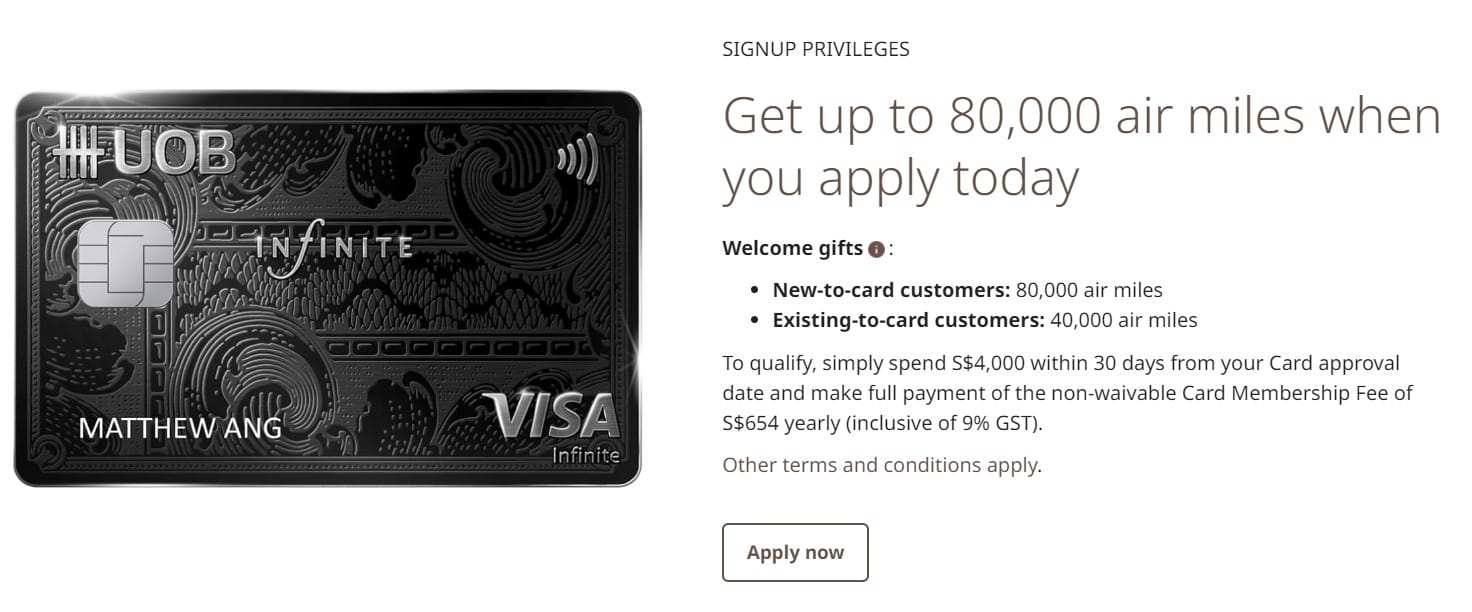

From 1 January to 31 March 2024, new UOB Visa Infinite Metal Cardholders who pay the S$654 annual fee and spend at least S$4,000 within 30 days of approval will receive:

| New customers | Existing customers | |

| Pay S$654 annual fee | 25,000 miles | 25,000 miles |

| Spend S$4,000 within 30 days of approval | 55,000 miles | 15,000 miles |

| Total | 80,000 miles | 40,000 miles |

|

A new customer is defined as someone who:

|

||

Unlike most UOB sign-up offers, there is no cap on the number of eligible applicants.

Given the S$654 annual fee, you’re basically paying 0.82 cents (new) or 1.64 cents (existing) per mile. Back when S$200 Grab vouchers were thrown into the mix, this was a very attractive offer indeed, but now I’d only consider it if I met the new customer definition.

What counts as qualifying spend?

Eligible transactions include all retail transactions in local or foreign currency, and a full list of exclusions can be found at point 1.5 of the T&Cs.

The key exclusions to highlight are:

- Charitable donations

- Government payments

- Insurance

- ipaymy

- Prepaid account top-ups (e.g. GrabPay or YouTrip)

- Utilities

- UOB Payment Facility

For avoidance of doubt, CardUp, education and hospital transactions are eligible to earn miles, and will count towards minimum spend. Moreover, the UOB Visa Infinite Metal Card is one of the rare cards to still earn rewards on education (schools, enrichment centres and higher education fees), so enjoy it while it lasts.

Supplementary cardholder spending will be pooled with the principal cardholder’s in determining if the minimum spend has been met. And before you say “isn’t that obvious?”, remember that UOB is not above such shenanigans.

When will the bonus be credited?

The 25,000 miles for paying the annual fee will be credited (in the form of UNI$) when the annual fee is posted.

The additional 55,000/15,000 miles for new/existing customers will be credited (in the form of UNI$) two months after the annual fee is posted.

Terms and Conditions

The full T&Cs for this offer can be found here.

What can you do with UNI$?

UNI$ transfer to frequent flyer programs at a 1:2 ratio, with a minimum transfer block of 5,000 UNI$ (let’s ignore AirAsia, because converting points there is like throwing them away):

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 2,500: 4,500 |

UOB Visa Infinite Metal Cardholders enjoy a waiver of the usual S$25 conversion fee. And since UNI$ pool, you can use the Visa Infinite Metal Card as a conduit to convert UNI$ earned on other UOB cards for free too.

Overview: UOB Visa Infinite Metal Card

|

|||

| Apply | |||

| Income Req. |

S$120,000 p.a. |

Points Validity |

2 years |

| Annual Fee |

$654 | Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | Waived |

| Local Earn | 1.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The UOB Visa Infinite Metal Card has a minimum income requirement of S$120,000 and a non-waivable annual fee of S$654.

Cardholders receive 25,000 miles each year the annual fee is paid, and enjoy perks such as:

- Unlimited DragonPass lounge visits for cardholder + 1 guest

- S$10 Grab vouchers every month

- 50% off weekday lunch bill at selected restaurants in Pan Pacific and PARKROYAL hotels in Singapore, plus Si Chuan Dou Hua (UOB Plaza)

- 4th night free with 3 nights booked at selected COMO Hotels and Resorts

- Up to US$1 million travel accident insurance

- Complimentary Pan Pacific DISCOVERY Platinum status

- Complimentary golf games at Sentosa Golf Club, and 50% off green fees at clubs across SEA

- A waiver of the usual S$25 admin fee for miles conversions

Key drawbacks to note include S$5 earning blocks and the lack of an airport limo benefit.

For the full analysis of the card’s perks and drawbacks, refer to the post below.

Conclusion

The UOB Visa Infinite Metal Card has extended its 80,000 miles sign-up offer till 31 March 2024, but the deal is less lucrative than before due to the nerfing of the S$200 Grab vouchers.

That said, you could hit the minimum spend for the sign-up bonus with commonly-excluded transactions like hospitals and education expenses, so it could still be worth considering for new-to-bank customers.

The best time to act was 2023 though!