The HSBC TravelOne Card already boasts the most transfer partners of any card in Singapore, with 20 different airlines and hotels to choose from.

That’s now become 21, with the addition of United MileagePlus to the roster. HSBC becomes the third bank to offer this programme in Singapore, alongside OCBC and StanChart- though the latter will drop it from 24 March 2024.

HSBC TravelOne Card adds United MileagePlus

HSBC TravelOne Cardholders can now transfer points to United MileagePlus.

Unfortunately, the ratio comes pre-nerfed at a very underwhelming 3,500 points to 1,000 miles, though to be fair, this is on par with what OCBC and StanChart offer.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

To put it another way, the HSBC TravelOne Card earns 1.2 mpd on local spend and 2.4 mpd on foreign currency spend, but only if you choose a partner with a 25,000 points = 10,000 miles conversion ratio.

If you were to transfer miles to United MileagePlus, your effective earn rate is much lower at 0.86/1.71 mpd.

| If the transfer ratio is (Points : Miles) |

Local Spend | FCY Spend |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

A minimum transfer of 35,000 points (10,000 miles) is required, although subsequent blocks can be as small as 7 points (2 miles).

Do note that the HSBC TravelOne Card is waiving all conversion fees until 31 May 2024, after which it may or may not be introducing a 10,000 points conversion fee.

What can you do with United MileagePlus?

Even though the transfer ratio leaves something to be desired, the key advantage I see for United MileagePlus is that award redemptions are free from fuel surcharges. It doesn’t matter which airline you’re redeeming- you’ll only pay airport taxes, period.

United MileagePlus underwent a big devaluation in June 2023, but there’s still pockets of value here and there:

- Domestic US flights start from 5,000 miles

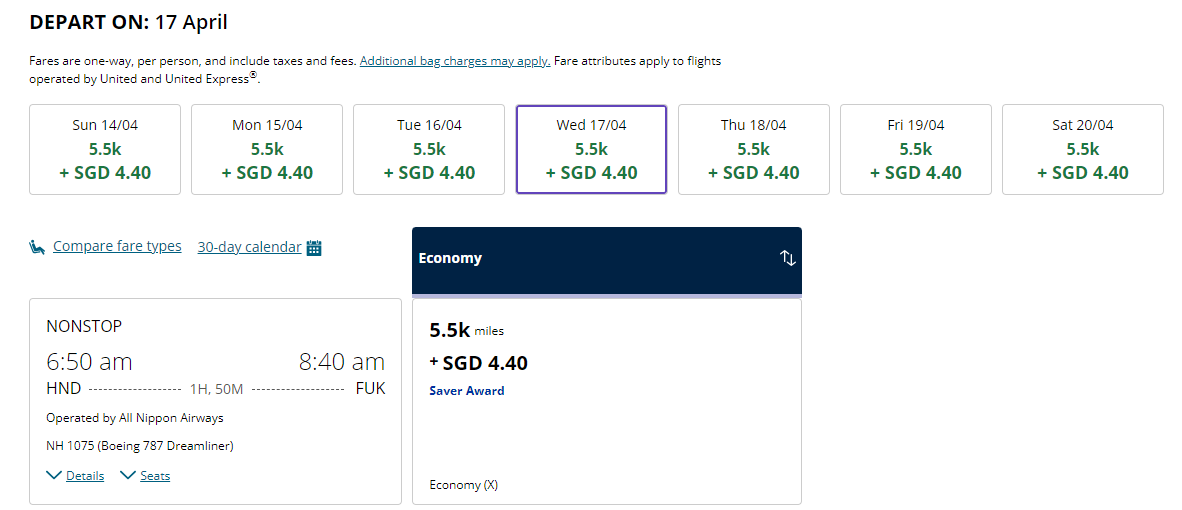

- Intra-Japan flights start from 5,500 miles

- Intra-Europe flights start from 6,000 miles

- Intra-Africa flights start from 8,000 miles

These can save you significant amounts of money when cash fares are unusually high.

United also posts “Featured Awards” each month, sort of like their version of Spontaneous Escapes. This lets you do a search for whether there’s any cheap award tickets for places you’d like to go. This month’s examples include San Francisco to Zurich in Economy for 30,000 miles, and Chicago to London in Economy for 35,100 miles.

Don’t forget the Excursionist Perk, which allows you to add a free one-way flight to a round-trip award ticket, without needing extra miles.

Transfers to Asia Miles still unavailable for non-TravelOne cardholders

While we’re talking about HSBC, I should mention that Asia Miles transfers are still unavailable for non-TravelOne Cardholders, and have been since November 2023.

No one but HSBC knows when this problem will be resolved, though there doesn’t seem to be any particular urgency on their side.

HSBC TravelOne Cardholders can still make transfers to Asia Miles, as these are powered by a different platform.

Who has the most transfer partners?

With the addition of United MileagePlus, here’s a summary of which banks have the most transfer partners.

HSBC continues to surge ahead (at least for TravelOne Cardholders), with AMEX and Citi jostling for second and third place.

Don’t forget that this chart will change significantly from end March, when StanChart drops nine of its airline and hotel partners.

Conclusion

HSBC TravelOne Cardholders now have 21 different airline and hotel loyalty programmes to choose from, with United MileagePlus the latest addition.

While the programme may be unfamiliar to most of us in Singapore, it can offer good value short-haul awards, and lets you avoid fuel surcharges on redemption tickets regardless of carrier.

The problem is that the transfer ratio is unfavorable, costing 40% more than other partners like KrisFlyer, Flying Blue, Asia Miles and British Airways Executive Club. This makes your sweet spots less sweet, barring any transfer bonuses.

Any other use cases for United MileagePlus for someone based in Singapore?

HSBC Travel One point still cant combine with HSBC Revo Point ?