With physical card usage on the decline as consumers turn to online shopping and mobile payments, more and more banks are offering so-called “instant digital cards”, which remove some of the friction involved in traditional physical card issuance.

There’s numerous scenarios where digital cards can come in handy:

- You’ve already been approved for a credit card, but the physical card has yet to arrive and there’s an upcoming transaction you’re relying on to meet the minimum spend for a welcome offer

- Your physical card is not with you at the moment and you want to buy something online

- You’re out at a restaurant and realise there’s a discount for Bank X cardholders, but you left your physical card at home

- Your physical card needs to be replaced because it’s been compromised or lost, but you don’t want to miss out on the points while waiting for a new one to arrive in the mail

In this post, we’ll look at which banks offer the convenience of instant digital cards.

Which banks offer instant digital cards?

There’s two main ways that banks can implement digital cards: offer in-app card details, or an add-to-wallet feature.

| Bank | In-App Card Details? | Add to Wallet Feature? |

| ✕ |

✓ AMEX Pay |

|

| ✕ |

✕ | |

| ✓ |

N/A* | |

| ✕ |

✓ Apple Pay |

|

| ✓ | N/A* | |

| ✕ | ✕ | |

| ✕ | ✓ Apple Pay |

|

| ✕ | ✓ Apple Pay |

|

|

✕ | ✓ Google Pay |

| *If you already have the full card details in-app, then an “add to wallet” function is redundant because you can manually add it to your mobile wallet anyway. At most it offers some extra convenience. | ||

The underlying idea behind both is the same — enabling transactions without the physical card — but the implementation is slightly different.

Citi and HSBC provide in-app card details, with the full card number, expiry date and CVV viewable in the respective banking apps.

Once your card is approved, you can use these details to make online transactions, or add the card to your mobile wallet and make in-person transactions wherever contactless payments are accepted.

AMEX, DBS, OCBC, StanChart and UOB do not provide full card details within their apps. Instead, they have an “add to wallet” feature, which allows you to add your card to Amex/Apple/Google Pay with a few taps, without needing the physical card handy. Once this is done, you can then make transactions at online merchants which accept Apple/Google Pay, or offline merchants which support contactless payments.

However, you won’t be able to transact at an online merchant which does not accept Apple or Google Pay, as you won’t have the full card number, expiry date and/or CVV number needed to do so.

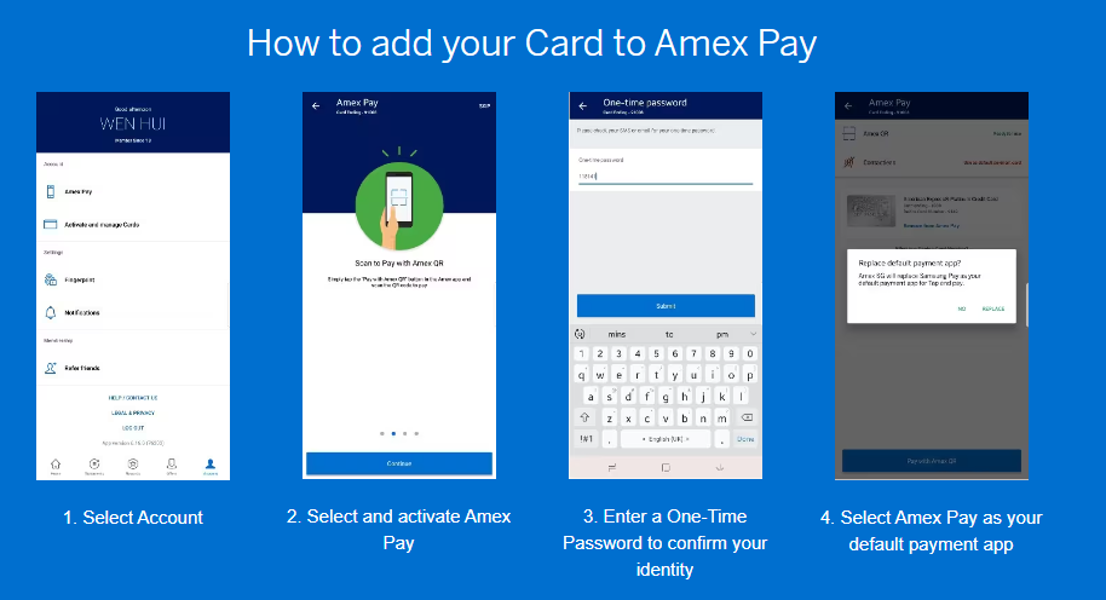

American Express

|

| Details |

The AMEX app does not display full card details.

However, there is an option to add your card to Amex Pay, which allows you to make contactless (Android only) or QR code based payments (Android or iOS) via the AMEX app, without the physical card present.

Bank of China

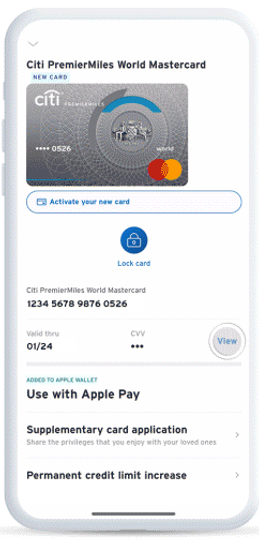

Citibank

|

| Details |

The Citi Mobile app allows cardholders to view their full card details, expiry date and CVV upon approval.

To view your card details:

- Log in to your Citi Mobile App or download the “Citibank SG” mobile app from App Store or Google Play

- Select the Credit Card you wish to view

- Tap on the “Manage” button on the top right

- You will be able to view your card details and expiry date on the screen

- Tap on “View” to see your CVV

Upon activation of the physical card, the CVV will change and be updated in the Citi Mobile app so you’ll always have the most up-to-date details necessary.

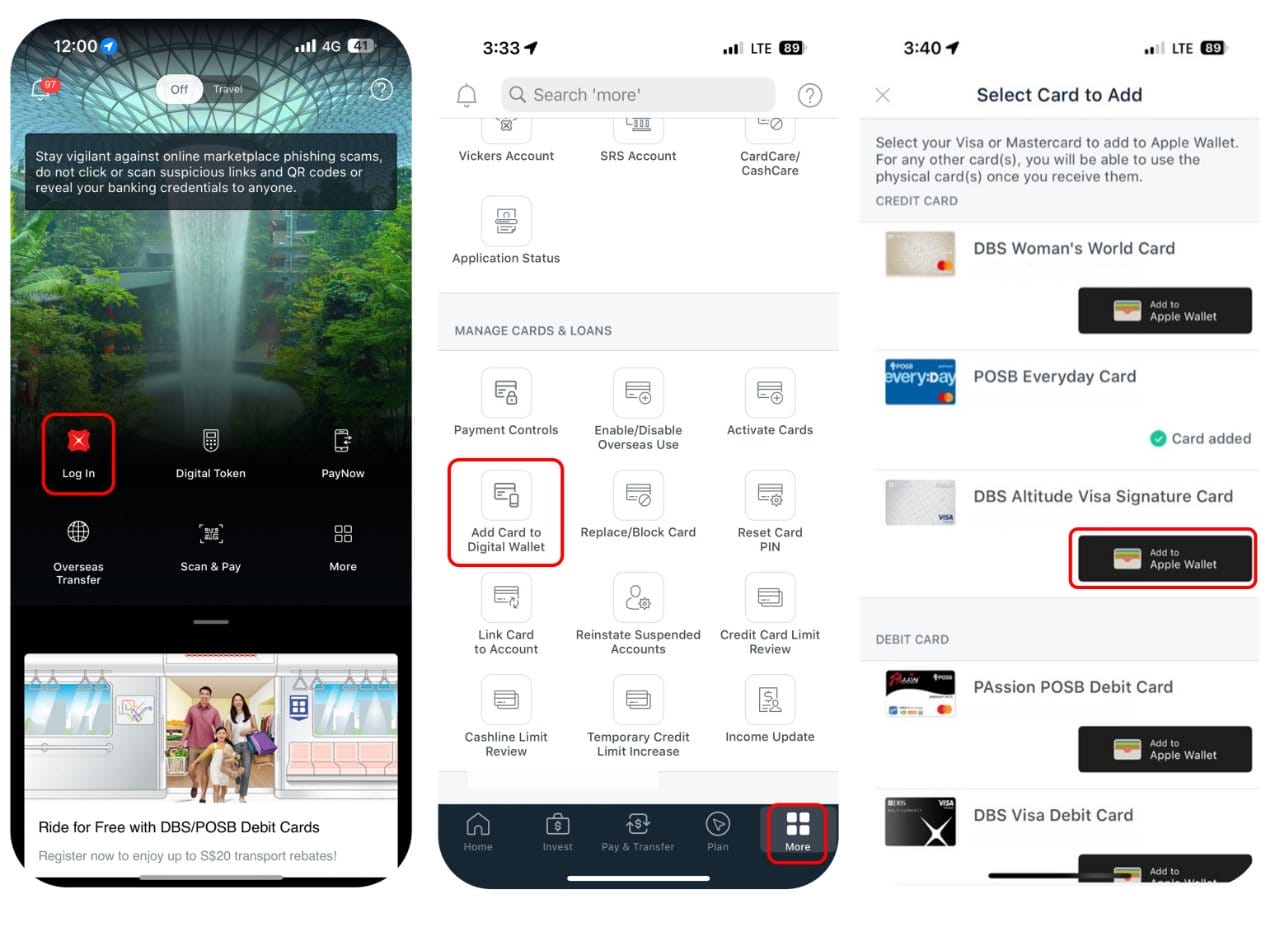

DBS Bank

|

| Details |

The DBS digibank app does not display full card details.

However, if you own an iPhone, you will be able to add any DBS card (except American Express cards) to your Apple Wallet immediately upon approval via the digibank app.

- Login to your digibank app with your User ID and PIN.

- Select “More” on the menu bar.

- Under “Manage Cards & Loans”, select “Add Card to Digital Wallet” option.

- Follow instructions on screen to add card(s) to Apple Wallet.

Details are provided below.

HSBC

|

| Details |

HSBC cardholders can access their full card number, expiry date and CVV via the HSBC Singapore app, immediately upon approval.

To view your card details:

- Login to the HSBC app

- Select the credit card account you want to see details for

- Tap View More > Card Details

- Tap the eye icon to see the CVV

Maybank

Like Bank of China, Maybank is behind on digital card adoption (quite ridiculously, you need to download two similar-sounding banking apps — M2U SG and M2U SG (Lite) — to get the same functionality that other banks provide in a single app)

While you can add Maybank cards to your Apple Wallet, you’ll need the physical card on hand, because the Maybank app doesn’t provide anything beyond the 16-digit card number.

OCBC

|

| Details |

OCBC does things a little differently from other banks.

Upon approval, customers will receive an SMS or email with a reference code they can enter on the OCBC website to retrieve their digital card details. These details can be used to add the card to your mobile wallet, or to make payment online.

However, once you receive and activate your physical card, the CVV will change, and you won’t be able to obtain the full card details from the OCBC Mobile Banking app.

But if you’re an iPhone user, you can add any OCBC Visa card to your Apple Wallet by:

- Login to your OCBC Mobile Banking app with your User ID and PIN.

- Select your OCBC Visa card

- Tap on “Add to Apple Wallet”

- Verify details and enter OTP when prompted

Standard Chartered

|

| Details |

Like OCBC, StanChart will provide newly approved cardholders with an instant digital card, which they can use to make transactions while waiting for the physical card to arrive.

However, once the physical card is activated, the digital card will no longer be available for use, and you won’t be able to look up the physical card details in the app (it has the full card number and expiry date, but not the CVV).

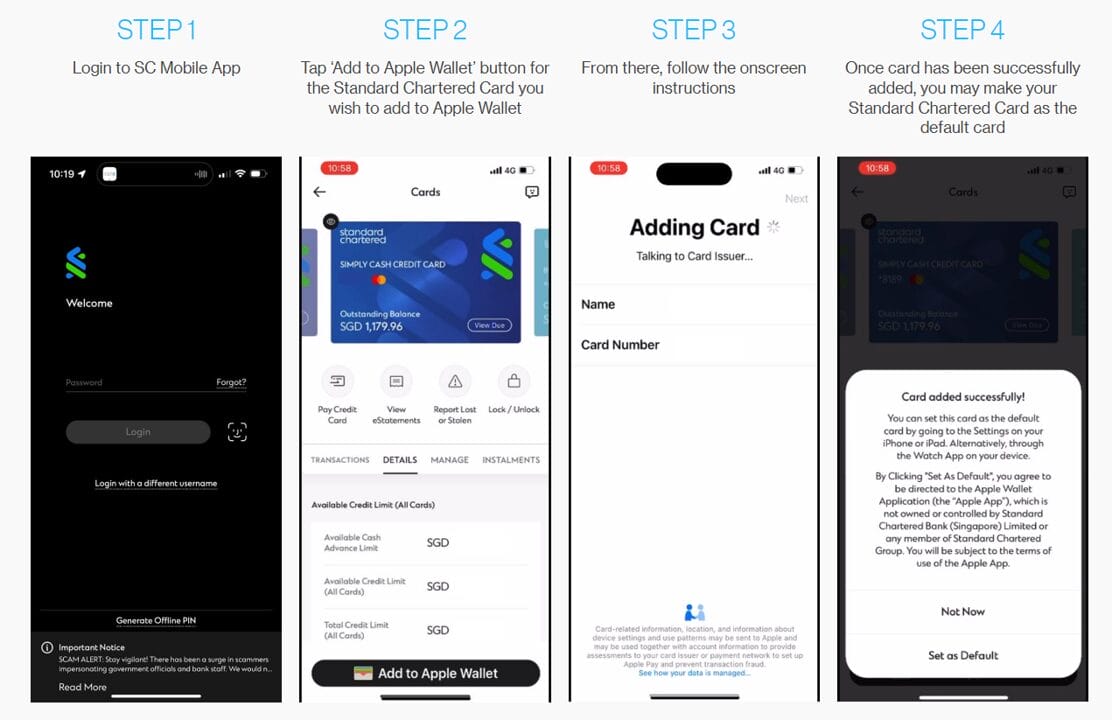

But if you’re an iPhone user, you can add your StanChart card to your Apple Wallet via the SC Mobile app.

- Login to the SC Mobile app

- Select the StanChart card you wish to add

- Tap “Add to Apple Wallet” button

- Follow onscreen instructions

Details are provided below.

UOB

|

| Details |

UOB does not display full card details on its UOB TMRW app.

However, if you own an Android phone, you will be able to add any UOB card to your Google Pay Wallet via the UOB TMRW app.

- Login to the UOB TMRW app

- Tap “Accounts”

- Tap on the card you wish to add to Google Pay

- Tap “Add to Google Pay”

- Follow the instructions to add your card

Conclusion

If you don’t have your physical card handy, you’ll appreciate the ability to get your full card details from the banking app or add the card to your mobile wallet instantly.

I personally prefer the flexibility that Citi and HSBC provide, which is conceptually similar to taking a photo of the front and back of my card- albeit with a lot better security. I do wish there’d be more parity between Apple and Google Pay for the rest of the banks though, because Apple has the upper hand where “add to wallet” functionality is concerned.

Haha. Gold. BOCed.

Convenience comes at a risk also.

if your mobile banking app is compromised, fraudster can add your card to their apple pay use happily up to your credit limits.