Earlier this week, UOB unveiled a new design for the UOB Lady’s Cards, as well as “The Unstoppable Pairing”, a bonus UNI$ scheme for UOB Lady’s Cardholders who opened a UOB Lady’s Savings Account.

Now, I’m not really a fan of the new-look card. If you ask me, the current ones are much nicer. But then again, I’m not exactly a doyenne of style — a date once told me “I think it’s so cool you don’t care about fashion trends” — so make of that assessment what you will.

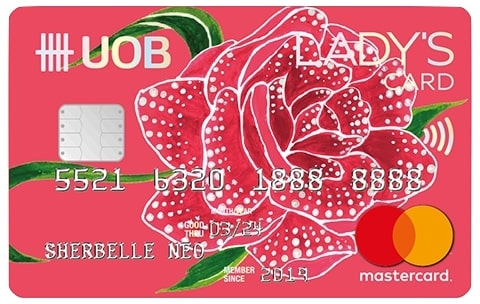

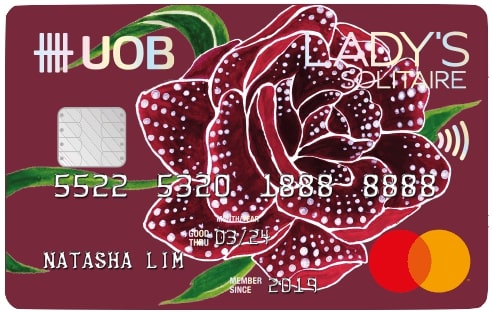

| Current design | New design |

UOB Lady’s Card UOB Lady’s Card |

UOB Lady’s Card UOB Lady’s Card |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

As for The Unstoppable Pairing (am I the only one who cracks up every time I say it aloud?), I wrote that I didn’t really see the point given how miserly the interest rates on the UOB Lady’s Savings Account were (just 0.05% p.a.), but then someone asked:

What if I just deposit the bare minimum of S$10,000 and use it to keep earning 6 mpd on the UOB Lady’s Cards after 1 April?

That got me thinking: maybe I’m being too hasty in dismissing the idea altogether. So I decided to run some scenarios, and you know what? There might actually be something to this.

Recap: Bonus UNI$ with the UOB Lady’s Savings Account

|

| ❓ Key Facts: UOB Lady’s Savings Account |

|

From 1 April 2024, UOB Lady’s Cardholders will be able to earn bonus miles with the UOB Lady’s Savings Account as summarised in the table below.

| Monthly Average Balance | UNI$ from Lady’s Savings Account | UNI$ from Lady’s or Lady’s Solitaire Card | Total |

| <S$10K | N/A | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| S$10,000 to S$49,999 | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| S$50,000 to S$99,999 | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| S$100K and more | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

The maximum bonus UNI$ you can earn from the Lady’s Savings Account is capped at:

- UOB Lady’s Card: S$1,000 per calendar month

- UOB Lady’s Solitaire Card/Lady’s Solitaire Metal Card: S$2,000 per calendar month

I find this mechanism strange for two reasons.

First, the bonus cap has no relation to your MAB. Whether you keep S$10,000 or S$100,000 in the Lady’s Savings Account, what determines your bonus cap is the type of Lady’s Card you hold.

Second, even though the bonus rate is related to your MAB, it does not scale linearly. Whether I put S$10,000 or S$49,999 in the account, I still earn an extra 2 mpd on my spending. Why on earth would I put anything more than S$10,000 then?

Yes, the extra funds may qualify me for some additional cancer coverage, but the value of that is debatable- not to mention that S$10,001-S$25,000 and S$25,001-S$49,999 would be in the same coverage band, so there’s literally no incremental benefit there.

| Monthly average balance (Rolling average of the past 3 months) |

Coverage (Female cancer benefit sum assured) |

| S$1 – S$10,000 | S$1,000 |

| S$10,001 – S$25,000 | S$10,000 |

| S$25,001 – S$50,000 | S$25,000 |

| S$50,001 – S$75,000 | S$75,000 |

| S$75,001 – S$100,000 | S$100,000 |

| More than S$100,000 | S$200,000 |

But strange or not, those are the rules that UOB has set for this game, so the question then becomes: should we bother playing it?

Let’s look at some different scenarios.

Scenarios

If you deposit S$10,000 in the UOB Lady’s Savings Account, you’ll earn an extra 2 mpd on spending, which means:

- UOB Lady’s Card: An extra 24,000 miles per year

- UOB Lady’s Solitaire Card/Lady’s Solitaire Metal Card: An extra 48,000 miles per year

Here’s the interest rate at which the extra miles and foregone interest on the S$10,000 are in equilibrium (let’s use simple interest to avoid confusing things).

| 💰 Deposit: S$10,000 | ||

| Value of a Mile | Yearly Interest (UOB Lady’s Card) |

Yearly Interest (UOB Lady’s Solitaire) |

| 2 cents | 4.8% | 9.6% |

| 1.9 cents | 4.6% | 9.1% |

| 1.8 cents | 4.3% | 8.6% |

| 1.7 cents | 4.1% | 8.2% |

| 1.6 cents | 3.8% | 7.7% |

| 1.5 cents | 3.6% | 7.2% |

| 1.4 cents | 3.4% | 6.7% |

| 1.3 cents | 3.1% | 6.2% |

| 1.2 cents | 2.9% | 5.8% |

| 1.1 cents | 2.6% | 5.3% |

| 1 cent | 2.4% | 4.8% |

| Highlighted in yellow = my personal value of a mile | ||

If you can earn a return greater than the rates in this table, then the miles are the inferior choice. If you can’t earn a return greater than the interest rates in this table, then the miles are the superior choice.

For example, if you’re a UOB Lady’s Cardholder who values a mile at 2 cents each, then the miles are the superior choice unless you can earn a return of more than 4.8% p.a. on the S$10,000.

If you’re a UOB Lady’s Cardholder who values a mile at 1.5 cents each, then the miles are the superior choice unless you can earn a return of more than 3.6% p.a. on the S$10,000.

Of course the higher you value miles, the higher the interest needs to be, and UOB Lady’s Solitaire Cardholders need higher interest rates because they enjoy 2x the miles cap of Lady’s Cardholders (so to put it another way, the UOB Lady’s Savings Account makes more sense if you’re a Solitaire Cardholder).

If you deposit S$50,000 in the UOB Lady’s Savings Account, you’ll earn an extra 4 mpd on spending, which means:

- UOB Lady’s Card: An extra 48,000 miles per year

- UOB Lady’s Solitaire Card/Lady’s Solitaire Metal Card: An extra 96,000 miles per year

Here’s the same analysis repeated:

| 💰 Deposit: S$50,000 | ||

| Value of a Mile | Yearly Interest (UOB Lady’s Card) |

Yearly Interest (UOB Lady’s Solitaire) |

| 2 cents | 1.9% | 3.8% |

| 1.9 cents | 1.8% | 3.6% |

| 1.8 cents | 1.7% | 3.5% |

| 1.7 cents | 1.6% | 3.3% |

| 1.6 cents | 1.5% | 3.1% |

| 1.5 cents | 1.4% | 2.9% |

| 1.4 cents | 1.3% | 2.7% |

| 1.3 cents | 1.2% | 2.5% |

| 1.2 cents | 1.2% | 2.3% |

| 1.1 cents | 1.1% | 2.1% |

| 1 cent | 1.0% | 1.9% |

| Highlighted in yellow = my personal value of a mile |

||

If you deposit S$100,000 in the UOB Lady’s Savings Account, you’ll earn an extra 6 mpd on spending, which means:

- UOB Lady’s Card: An extra 72,000 miles per year

- UOB Lady’s Solitaire Card/Lady’s Solitaire Metal Card: An extra 144,000 miles per year

Here’s the same analysis repeated:

| 💰 Deposit: S$100,000 | ||

| Value of a Mile | Yearly Interest (UOB Lady’s Card) |

Yearly Interest (UOB Lady’s Solitaire) |

| 2 cents | 1.4% | 2.9% |

| 1.9 cents | 1.4% | 2.7% |

| 1.8 cents | 1.3% | 2.6% |

| 1.7 cents | 1.2% | 2.4% |

| 1.6 cents | 1.2% | 2.3% |

| 1.5 cents | 1.1% | 2.2% |

| 1.4 cents | 1.0% | 2.0% |

| 1.3 cents | 0.9% | 1.9% |

| 1.2 cents | 0.9% | 1.7% |

| 1.1 cents | 0.8% | 1.6% |

| 1 cent | 0.7% | 1.4% |

| Highlighted in yellow = my personal value of a mile | ||

What you’ll notice is that the value proposition of the Lady’s Savings Account progressively breaks down as we go to S$50,000 and S$100,000.

For example, for a UOB Lady’s Solitaire Cardholder with a S$50,000 deposit and a 1.5 cents per mile valuation, the extra miles aren’t worth it if I can earn more than 2.9% p.a. on my money, which is possible via something like Stashaway Simple Guaranteed, which at the time of writing is offering 3.3% p.a. for a 12-month tenure.

The case is even worse for S$100,000, where given a 1.5 cents per mile valuation, any alternative that earns above 1.1% p.a. (Lady’s Card) or 2.2% p.a. (Lady’s Solitaire Card) makes the miles not worth it.

And so we circle back to S$10,000, which could be the sweet spot. Based on my personal valuation of 1.5 cents per mile, a UOB Lady’s Solitaire Cardholder who maxes out the S$2,000 bonus cap each month should pick the UOB Lady’s Savings Account unless they can generate more than 7.2% p.a. on their funds. Since I doubt I can do that (dogecoin?), I’m leaning towards this option- unless someone can find a flaw in my thought process?

Caveat: You must max out your bonus each month!

The main caveat I want to add here is that all of the above calculations assume you max out your bonus cap each month, i.e. S$1,000 for the UOB Lady’s Card, and S$2,000 for the UOB Lady’s Solitaire Card/Lady’s Solitaire Metal Card.

If you don’t, then the whole picture changes. Let’s go back to our S$10,000 deposit example, and suppose this time, the UOB Lady’s Solitaire Cardholder only spends an average of S$800 on her card per month.

| 💰 Deposit: S$10,000 | ||

| Value of a Mile | Yearly Interest (UOB Lady’s Solitaire) @ S$2K spend |

Yearly Interest (UOB Lady’s Solitaire) @ $800 spend |

| 2 cents | 9.6% | 3.8% |

| 1.9 cents | 9.1% | 3.6% |

| 1.8 cents | 8.6% | 3.5% |

| 1.7 cents | 8.2% | 3.3% |

| 1.6 cents | 7.7% | 3.1% |

| 1.5 cents | 7.2% | 2.9% |

| 1.4 cents | 6.7% | 2.7% |

| 1.3 cents | 6.2% | 2.5% |

| 1.2 cents | 5.8% | 2.3% |

| 1.1 cents | 5.3% | 2.1% |

| 1 cent | 4.8% | 1.9% |

| Highlighted in yellow = my personal value of a mile | ||

In that case, the yearly interest rate to beat drops from 7.2% to 2.9% p.a, because the cardholder is leaving miles on the table. The opportunity cost of foregone interest is incurred on the full S$10,000, but she is only earning 40% (S$800/S$2,000) of the miles she could be getting.

So if you want to proceed, be sure to max out your bonus cap every month.

Conclusion

From 1 April 2024, UOB Lady’s Cardholders will be able to earn bonus miles via the UOB Lady’s Savings Account.

While you could earn the most miles by depositing S$100,000, my take is that the sweet spot is a token deposit of S$10,000, for someone with the UOB Lady’s Solitaire who is confident about maxing out the S$2,000 bonus cap each month.

This gives an extra 2 mpd, which together with the revised 4 mpd from the Lady’s Cards allows you to keep earning 6 mpd even after the ongoing miles buff expires on 31 March 2024.

Would you keep a UOB Lady’s Savings Account deposit to keep earning extra miles?

Thanks for this. Insightful as usual. Sounds like an overall downgrade. My view, not worth the effort given the low cap and $5 rounding. UOB shld step up on the incentives for higher MAB.

thanks for the info. it seems a downgrade. anyway any idea if the 6 mpd promotion ending on 31 Mar, is it based on posting date or transaction date?

posting date. it may already be too late to transact.

How about for Uob lady card maxed out with $10k deposit? Worth?

as a male, what options do I have since I can’t open a lady’s account? current user of uob solitaire (me and wife 1 each, separate)

i’m now hearing that from 1 april the uob lady’s savings account will accept male applicants. standby…

Please do let us know! I feel that with the savings account extra earn from just keeping 10k aside, it would be better compared to citi rewards.

I hope that is true… Crossing fingers….

1 april huh

😂You thinking April’s fool ah?

*Open to all genders from 1 May 2024 onwards. Check out the UOB website updated under account opening tnc

yup, so looks like the floodgates open next month!

Good catch!

According to UOB FAQs, monthly average balance is the rolling average of the past 3 month balances. If we put in $10,000 now, will our monthly average balance for April be (10000/3) = 3333.33? And May be (10000*2/3) = 6666.67

Saw this on the promotion website when mousing over the “i”. “Monthly Average Balance refers to the summation of each day-end balance in the UOB Lady’s Savings Account for each calendar month divided by the number of calendar days for that month.”

So given that today is the 3rd of April, I deposited 10,715.

https://www.uob.com.sg/personal/save/savings-accounts/ladys-savings-account.page?s_cid=pfs:sg:owned:off:vanity:na:vt:na:curla:0503-evergreen:ladysacctvan:na:na&vid=na&pid=msseacasa22

there is an FAQ that addresses this too: https://www.uob.com.sg/assets/pdfs/lsa-faq.pdf

I wonder if we would get a Male cancer coverage as well or at least able to nominate 1 female of our choosing for the coverage haha

Mr. MileLion, we get some added benefits of medical claims and dental visits.. Can please add those information to this post to give us a better idea of this new launch.

Just to point out, the new design of the UOB Lady’s Solitaire Metal Card in the article is the plastic version. The metal card has a thinner border. (Both the metal and plastic ones are almost the same but I’m just pointing out) Hopefully this can be updated in the article

The metal card looks like this:

that is a lot nicer actually! the silver border rather ruins it for me.

I kinda like the metal better, though I can agree with you on that.

FYI: The plastic card is actually the supplementary card

Useful but painful mechanic. Another way to think about it is you are putting $10,000 in Endowus and using the interest to pay UOB a membership fee to get the bonus miles.

It’s worth a few dollars a month to use with Lady Solitaire, but you add still another set of miles rules to follow.

You have to think about the net benefit, and it’s not pure 6 mpd because there is the cost of interest described in this article.

will endowus be able to consistently generate revenue enough to pay for the membership fees?

Should i get the lady’s cc first or open the lady savings account first? If i opened the savings account this month – must i also spend this month in order to get the added bonus?

Now that the bonus miles is 15X UNI$ for the UOB One Lady’s Saving Account, i think it makes more sense to maintain the 10K.

Lady’s Savings Account | UOB Singapore

Deposited 10k into savings acc since May but never gotten the additional bonus… UOB took 3-4months to “investigate” and informed me today that this promo is not applicable to private banking customers…..

I believe the sweet spot is 10,001. We’re leaving 9,000 worth of cancer coverage for $1 difference!

you might want to read this: https://milelion.com/2024/08/18/uob-ladys-savings-account-ending-female-cancer-coverage/

Is the 6mpd still available for $10k deposit then, or is it over already

If I have both lady’s and solitaire’s card with 10k deposit, do I get to earn 6 mpd for both credit cards?

don’t think so. The bonus cap is only $2000. not $1000 + $2000.