Back in January 2024, OCBC launched the first of what it said would be a quarterly 6 mpd promotion, with upsized rewards for customers who used their OCBC Rewards Card (formerly known as the OCBC Titanium Rewards) at TANGS and SHEIN.

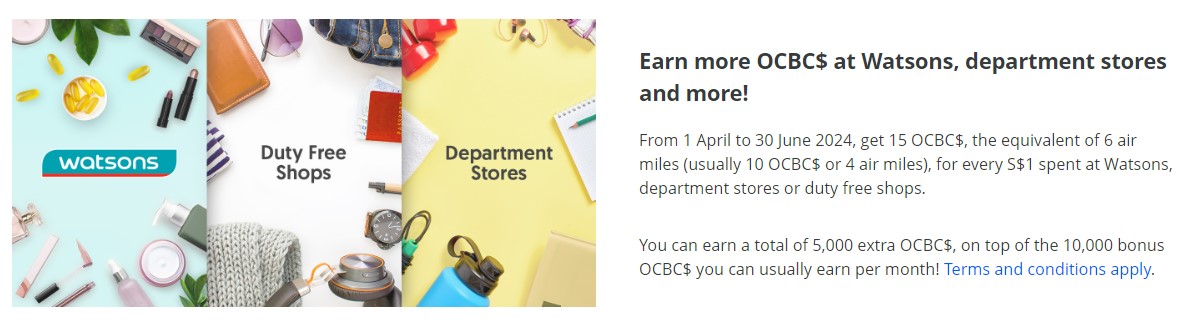

With Q2 now here, OCBC has unveiled the next set of bonus merchants, and I’m pleased to see it’s a wider range this time. Cardholders can now earn 6 mpd for spending at duty-free stores, departmental stores and Watsons, both in Singapore and overseas.

Also, while the previous campaign had a sneaky retention clause (later removed), which allowed the bank to clawback the bonus miles if cardholders subsequently cancelled their cards, OCBC has done away with that, and there’s no such shenanigans to fear this time round.

OCBC Rewards 6 mpd promo

From 1 April to 30 June 2024, OCBC Rewards Cardholders will earn 6 mpd for transactions at duty-free stores, departmental stores and Watsons, both in Singapore and overseas.

| MCC | Examples (non-exhaustive) |

| MCC 5309 Duty-Free Shops |

DFS, KrisShop, Lotte, The Shilla |

| MCC 5311 Departmental Stores |

BHG, Metro, Takashimaya, Tangs |

The MCC list may seem restrictive at first glance, but don’t forget that you can buy vouchers at HeyMax for merchants like Deliveroo, Grab, Lazada, Food Panda, NTUC FairPrice, Klook, Best Denki, Qoo10 and more.

|

| 👍 1,000 Max Miles joining bonus |

| If you don’t have a HeyMax account yet, sign up here and get up to 1,000 Max Miles as a welcome bonus (1:1 conversion ratio with most airlines and hotels) |

All voucher purchases on HeyMax code as MCC 5311, which will trigger the bonuses with the OCBC Rewards Card.

If you’re shopping overseas, you can also use Amaze to enjoy better FCY conversion rates than what OCBC would offer, but this will only work for MCC-based bonuses (i.e. MCC 5309 and 5311) since Amaze doesn’t modify MCCs.

Using Amaze at an overseas Watsons would not work, because the Watsons bonus is merchant-based, and Amaze modifies the transaction description in a way such that OCBC doesn’t see it as Watsons anymore.

The 6 mpd earn rate is split into the following components:

| Component | Monthly Cap (OCBC$) |

Monthly Cap (S$) |

| Base: 5 OCBC$ per S$5 (0.4 mpd) |

N/A | N/A |

| Regular Bonus: 45 OCBC$ per S$5 (3.6 mpd) |

10,000 OCBC$ | S$1,110* |

| Special Bonus: 25 OCBC$ per S$5 (2 mpd) |

5,000 OCBC$ | S$1,000 |

| *Really S$1,111, but remember that OCBC only awards points in blocks of S$5 |

||

The maximum bonus you can earn is capped at S$1,000 per calendar month; any spend above this will earn the usual 4 mpd (up till S$1,110).

Both principal and supplementary cardholder spend will be aggregated when awarding the bonus OCBC$, but supplementary cards do not have their own cap.

If you have a legacy OCBC Titanium Rewards Blue and Pink Card, each is treated as a separate product, so each principal card will have its own bonus cap.

When will bonus miles be credited?

The additional 25 OCBC$ per S$5 will be credited by the end of the next calendar month, following the relevant transaction posting date.

This is the same timeframe for the posting of the additional 45 OCBC$ per S$5 that is part of the card’s evergreen features.

Terms and Conditions

The T&Cs of this promotion can be found here.

A nice little booster

2023 was not a good year for the OCBC Rewards Card, so it’s good to see 2024 starting off differently.

If OCBC makes good on their promise to run this campaign throughout the year, then you’re looking at an extra 60,000 bonus OCBC$ (24,000 miles). That means the OCBC Rewards Card would earn up to a total of 180,000 bonus OCBC$ (72,000 miles) for 2024.

It’s impressive, but the catch is that the cap is only relevant if you can regularly max out the bonus cap at participating merchants each quarter.

Overview: OCBC Rewards Card

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$196.20 (2 Years Free) |

Min. Transfer (KF) |

25,000 OCBC$ (10,000 miles) |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on online and offline shopping | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The OCBC Rewards Card has a minimum income requirement of S$30,000 p.a. and offers a two-year waiver of its S$196.20 annual fee.

Cardholders can earn 4 mpd on selected online and offline shopping, capped at S$1,110 per calendar month (both the Blue and Pink versions of the card have their own cap).

| 💳 OCBC Rewards Bonus Whitelist | |

| MCC | Examples (non-exhaustive) |

| MCC 5309 Duty-Free Shops |

Lotte Duty Free, King Power Duty Free, The Shilla Duty Free |

| MCC 5311 Departmental Stores |

Takashimaya, TANGS, Isetan, OG, Metro, BHG, Marks & Spencer |

| MCC 5611 Men’s and Boys’ Clothing and Accessories Stores |

Benjamin Barker, Timberland, Edit Suits, Berluti |

| MCC 5621 Women’s Ready to Wear Stores |

Zara, H&M, Mothercare |

| MCC 5631 Women’s Accessory and Speciality Stores |

Tory Burch, Love Bonito, Pandora |

| MCC 5641 Children’s and Infants’ Wear Stores |

Kiddy Palace, Mummys Market, Pupsik, Motherswork |

| MCC 5651 Family Clothing Stores |

Uniqlo, ASOS, Club 21, Burberry, Yoox |

| MCC 5655 Sports and Riding Apparel |

Nike, Lululemon, Adidas |

| MCC 5661 Shoe Stores |

Skechers, Charles & Keith, Bata, Foot Locker, Pazzion |

| MCC 5691 Men’s and Women’s Clothing Stores |

Ezbuy, Zalora, Fartech |

| MCC 5699 Miscellaneous Apparel and Accessory Shops |

Qoo10, Cotton On, Reebonz |

| MCC 5941 Sporting Goods Stores |

Decathlon, Fila, New Balance |

| MCC 5948 Luggage or Leather Goods Stores |

Louis Vuitton, Coach, Rimowa |

| 🛒 Specified Merchants | |

|

|

| ^Amazon and Mustafa Centre transactions under MCC 5411 are not eligible to earn any OCBC$ *Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$ |

|

That said, it’s hard to think of something it does that other rewards cards, such as the Citi Rewards, HSBC Revolution or UOB Lady’s Card, can’t do better. Therefore, I’d only advise you to get the OCBC Rewards if you regularly max out the bonuses on those other cards.

Conclusion

OCBC Rewards Cardholders can now enjoy 6 mpd on duty-free stores, departmental stores and Watsons till 30 June 2024, capped at S$1,000 per month.

Even if you don’t intend to shop at any of these merchants, you can easily max out the bonus simply by buying gift cards on HeyMax, which cover many categories like dining, food delivery, online shopping and groceries, all under MCC 5311.

Do you think if e commerce shops like Lazada and Taobao with MCC 5311 will trigger the bonus 6 mpd or just the normal 4 mpd?

If it’s MC5311, why would there be a different treatment?

Lazada randomly codes as 5311 (Dept stores) or 5399 (Misc. General Merchandise and other similar services)..

Does the Watsons 6MPD also apply to Watsons store on amazon.sg?

Hmm.. the MCC code I got from Amazon was 5399 so I’m not sure if it’s in the white list or not. Any ideas?

I bought clothes at Desigual, which is a fashion clothing store similar to Zara. OCBC replied to my inquiry about the bonus issue, stating that the MCC is 5942, which is designated for bookstores.

I checked the MCC using the Instarem app, and it shows 5621, which is the same as Zara.

So, be aware when dealing with OCBC, it’s at your own risk

Any idea if it works through garmin pay? Or does it change the MCC?