Here’s The MileLion’s review of the Standard Chartered Smart Card, launched in October 2021 and proudly trumpeted as the bank’s first carbon-neutral card. Yes, the carbon footprint involved in the card’s production had been calculated and offset to zero, so cardholders can feel virtuous every time they buy more stuff they don’t need!

Gratuitous corporate greenwashing aside, the card itself wasn’t half bad. Cardholders could enjoy a permanent annual fee waiver, plus up to 7.7 mpd on fast food, streaming subscriptions, and public transport. And since Standard Chartered pooled points, it didn’t really matter how much you spent on these categories- those who already had a StanChart X Card or Visa Infinite might as well add this to their stable.

But the picture’s changed since then. Standard Chartered ended points pooling in early 2023, which reduced the Smart Card’s earn rate to 5.6 mpd (since you couldn’t take advantage of the superior Visa Infinite conversion rates anymore). They also axed their more exotic transfer partners, leaving just KrisFlyer and Asia Miles.

So is the StanChart Smart Card still worth a spot in your wallet? Perhaps, but maybe not as a miles solution.

Standard Chartered Smart Card Standard Chartered Smart Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| While 5.6 mpd on fast food, streaming and SimplyGo sounds good on paper, the likelihood of orphan miles means the Smart Card might be a better cashback card. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Standard Chartered Smart Card

Let’s start this review by looking at the key features of the StanChart Smart Card.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | Up to 3 years |

| Annual Fee | None |

Min. Transfer |

34,500 points (10,000 miles) |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | 0.46 mpd | Points Pool? | No |

| FCY Earn | 0.46 mpd |

Lounge Access? | No |

| Special Earn | 5.6 mpd on fast food, streaming, SimplyGo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

How much must I earn to qualify for a Standard Chartered Smart Card?

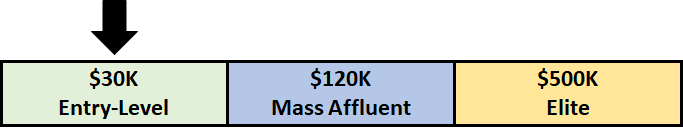

The StanChart Smart Card has a S$30,000 p.a. income requirement, the MAS-mandated minimum for a credit card.

What welcome gifts are available?

|

|||

| Apply |

New-to-bank customers who apply for a StanChart Smart Card through the links in this post can enjoy welcome gifts from SingSaver, including:

- Dyson AM07

- Hinomi H1 Classic V3

- Apple AirPods 3rd Gen

- S$250 cash

A minimum spend of S$500 within 30 days of approval is required. Gifts are often rotated, so be sure to refer to the T&Cs for the latest selection.

New-to-bank customers are defined as those who do not currently hold a principal StanChart credit card, and have not cancelled one in the past 12 months. Do note that holding a Trust Bank card has absolutely no impact on your new-to-bank status for Standard Chartered, as the two are completely separate entities.

How much is the Standard Chartered Smart Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | Free | Free |

The StanChart Smart Card has no annual fee for principal or supplementary cardholders, period.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.46 mpd | 0.46 mpd | 5.6 mpd on fast food, streaming and SimplyGo |

SGD/FCY Spend

StanChart Smart Cardholders normally earn:

- 1.6 points for every S$1 spent in Singapore Dollars

- 1.6 points for every S$1 spent in foreign currency (FCY)

That’s an equivalent earn rate of 0.46 mpd for local and overseas spend.

Overseas transactions come with a hefty 3.5% FCY fee, the highest in the market. Needless to say, this isn’t a card you should be using for general spending!

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Bonus Spend

StanChart Smart Cardholders who spend in SGD on fast food, streaming subscriptions or public transportation will earn:

- the regular base rate of 1.6 points per S$1 (0.46 mpd), and

- a bonus of 17.6 points per S$1 (5.10 mpd)

This means a combined earn rate of 19.2 points per S$1 (5.6 mpd), capped at 14,400 bonus points per statement month (S$818 spend). This feature, previously positioned as a limited-time bonus, was made permanent late in 2023.

| ❓ Wasn’t the earn rate up to 7.7 mpd? |

|

There was a period where the StanChart Smart Card would earn up to 7.7 mpd on bonus categories, provided you had a StanChart X Card or StanChart Visa Infinite Card. That’s because these cardholders could convert points to KrisFlyer miles at a 2,500 to 1,000 rate, instead of the regular 3,500 to 1,015 rate. And since all StanChart points pooled, you could leverage the better rate even for points earned on the StanChart Smart Card. Unfortunately, this ended in February 2023, when StanChart axed points pooling for KrisFlyer transfers. Now, it doesn’t matter what other Standard Chartered cards you have; you’ll earn 5.6 mpd with the Smart Card, period. |

However, the bonus isn’t awarded by MCC. Instead, fast food, streaming entertainment and public transportation are limited to the following merchants.

| Category | Merchants |

| 🍔 Fast Food |

|

| 📺 Streaming |

|

| 🚆 Bus/MRT |

|

Once again, a reminder that the bonuses only apply if the transaction is charged in SGD. This means that overseas Burger King, Subway etc. transactions will not earn bonuses.

5.6 mpd is an attractive earn rate, but the bigger question is: how much can you realistically spend on these merchants each month anyway? Unless you’re compulsively eating fast food multiple times a week and subscribing to multiple streaming services, it’s quite unlikely you’ll max out the S$818 cap. And given that the minimum conversion block is 34,500 points (10,000 miles), pursuing a miles strategy with this card could very well result in a lot of orphan points.

But there’s an alternative. The StanChart Smart Card allows cardholders to convert 3,200 points into a S$10 statement credit. At this value, 19.2 points per S$1 is equivalent to a 6% cash rebate. This might be a better approach for those whose spend on these categories is more modest.

When are 360° Rewards Points credited?

The base 1.6 points per S$1 are credited when the transaction posts, which generally takes 1-3 working days.

The bonus 17.6 points are aggregated and credited in the following statement cycle.

How are 360° Rewards Points calculated?

Here’s how you can work out the 360° Rewards Points earned on your StanChart Smart Card:

General spend

| Local Spend (1.6x) | Multiply transaction by 1.6, then round to nearest whole number |

| FCY Spend (1.6x) |

Multiply transaction by 1.6, then round to nearest whole number |

The minimum spend to earn points would be S$0.32 (local & FCY).

Bonus transactions (SGD only)

| Bonus Spend (19.2x) | Multiply transaction by 1.6, then round to nearest whole number. Multiply transaction by 17.6, then round to nearest whole number. Add both numbers |

The minimum spend to earn points would be S$0.03.

If you’re an Excel geek, here’s the formulas you need to calculate points:

General spend

| Local Spend | =ROUND(X*1.6,0) |

| FCY Spend |

=ROUND(X*1.6,0) |

| Where X= Amount Spent |

|

Bonus transactions

| Bonus Spend | =ROUND(X*1.6,0) + ROUND(X*17.6,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for 360° Rewards Points?

A full list of transactions that do not earn points can be found in the T&Cs at point 15.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay and YouTrip top-ups

- Insurance Premiums

What do I need to know about 360° Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| Up to 3 years | No | S$27.25 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 2 | 5 working days (for KF) |

Expiry

360° Rewards Points earned on the StanChart Smart Card are valid for up to three years.

Note how that’s “up to three years” and not “three years”. Like Citibank, Standard Chartered points have a fixed expiry date, based on when you opened your card.

As the T&Cs put it:

11.7 360° Rewards Points awarded are valid for 3 years from the date of opening of the credit card account to which the points are credited to (“Initial Period”). 360° Rewards Points awarded after the Initial Period will be valid for a further period of 3 years from the date the Initial Period ends (“Further Period”).

Thereafter, subject to Clause 4.2.3 and Clause 7, any 360° Rewards Points that remain in the 360° Rewards Points balance after the Initial Period or Further Period will expire automatically. All 360° Rewards Points that have expired cannot be reinstated.

In other words, when you open an SCB card account, a three year countdown timer starts. All the points you earn during that initial three year period will expire on the same date, regardless of when they were actually earned. In an extreme example, your points can be valid for as little as one day!

Pooling

Standard Chartered no longer pools points among cards.

Therefore, you’ll need to transfer out all your points before cancelling the StanChart Smart Card, or else forfeit them.

Transfer Partners & Fees

Standard Chartered used to have 10 airline and hotel transfer partners, but in March 2024 it axed nine of them, leaving only Singapore Airlines KrisFlyer.

Cathay Pacific Asia Miles was subsequently added, but the upshot is that there’s only two partners to choose from now- quite the fall from grace!

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Visa Infinite & Journey | All others | |

|

25,000 : 10,000 | 34,500 : 10,000 |

|

25,000 : 10,000 | 34,500 : 10,000 |

Transfers cost S$27.25 each, regardless of the number of points transferred.

Transfer Time

Conversions to KrisFlyer miles are generally completed within five working days.

Other card perks

Complimentary travel insurance

| Accidental Death | S$500,000 |

| Medical Expenses | Excluded |

| Others | Emergency Medical Evacuation: S$25,000 |

| Policy Wording | |

StanChart Smart Cardholders enjoy complimentary travel insurance when they purchase air tickets using their credit card.

However, this is far from comprehensive, covering only accidental death and emergency medical evacuation. There is no coverage for overseas medical expenses, trip cancellation, trip delays, lost luggage, rental car excess, or any of the other things that travel insurance should really cover.

Moreover, there’s no reason why you should be using the Standard Chartered Smart Card to purchase air tickets in the first place.

Terms & Conditions

Summary Review: Standard Chartered Smart Card

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

Back when Standard Chartered pooled points, it was a no-brainer for those with the X Card or Visa Infinite Card to add a Smart Card to their collection. There was no annual fee, pooling reduced the chances of orphan points, and you could tap the superior conversion ratio.

But now, it’s a different story. The end of points pooling means the Smart Card can’t ride on the coattails of the X/Visa Infinite anymore, which forces you to confront the question: do I really spend on fast food, streaming subscriptions and bus/MRT rides enough that it warrants a stand-alone card?

If so, you could conceivably earn up to ~55,000 miles with the Smart Card each year, though your dietician might have some concerns.

If not, there could still be a case for the Smart Card, provided you don’t mind converting your points into cashback. A 6% rebate is still very respectable, and you only need to spend in blocks of S$167 (3,200 points / 19.2 points per S$1) to achieve it.

And hey, it’s carbon neutral- so long as you don’t breathe while swiping.

If you want to be good and cut down on fastfood (and if you need to put streaming under Amex Platinum Charge, like any Milelion reader who can), this leaves you with a MRT card. If you take one round trip per day, realistically, you redeem the cashback every 2-3 months. And the Smart card is so flimsy it’s not hard for it to fall out of a shallower pocket. Was anyone that disciplined to use Smart just as a MRT card as this article outlines? I tried it and said it’s just a hassle, even for a die hard… Read more »

If that’s the case, then might as well use Lady’s card for public transport to reduce the risk of orphan miles.

Problem with this strategy is that unless you own a Solitaire, you’ll be forgoing important categories like dining, which will undoubtedly incur a much higher monthly spend

if you pick the transport category for lady’s card, it should really be because you drive or take grab instead of taking bus/mrt. petrol spending + grab will certainly be higher than bus/mrt fares.

Yeah, can’t imagine the math working for someone who does not own a car to give up dining, travel (airline + hotel) or family (groceries) for bus/MRT cashback.

I do, and occasionally on McD, Toastbox n yakun

I would argue this card is essential for non-car users. 6% back is nothing to scoff at especially when specialised spending cards like Citi Rewards, WWMC and Revolution barely gives anything back in this category.

6% is great and only the UOB Evol and DBS Yuu beat that in percent cashback terms.

But in absolute (not percent) terms, what is this, $6/month cashback reward to carry an extra card just for MRT and the occasional fastfood?

But those specialised spending cards do award 4mpd for most of those categories. These are online (4mpd for CR and WWMC) Disney+ Netflix Spotify YouTube And for the fast food you have some options: CR+Amaze 4mpd Mobile Orders (e.g. McD app) for WWMC 4mpd HSBC Revolution covers 5814 Fast Food 4mpd So, it’s real trick essentially just BUS/MRT. If you are spending that much per month, you might want to consider taking up the Adult Hybrid Concession instead (which caps your losses at $128). Not to mention even if you chose the 6% rebate instead of miles, there will be… Read more »

Eh, might want to double check on the 5814 for HSBC Revolution 🙂

Oops, my bad, i forgot about the nerfs 5411/5499/5814.

Aaron,

Actually points from Smart card still pool with other SCB cards like SCB rewards+, prudential card etc, except for SCB journey and infinite.

will this card still reward 5.6mpd if I buy from McD/KFC app?

I use this card as my simply go card via googlepay and I have given the physical card to my daughter to use on simplygo. I have already raked up close to 10k points. This combined with the 25K points I got for applying for the journey card is enough for me to redeem $100 worth Capita vouchers. After that I intend to just close the SCB cards and wait for 1 yr for the new user signup bonus.

What happens if you and your daughter are travelling together?

Actually it doesn’t matter. Transitlink treats mobile wallet card and physical card as separate card numbers when tapping on bus/MRT card readers (hence the advice to tap in and out with the same medium). Although it could just be easier (and safer) to give the daughter a supp card.