In February 2024, the DBS Altitude Card launched a new welcome offer of 43,400 bonus miles for cardholders who spend S$3,000 within 60 days of approval.

|

| DBS Altitude Offers |

Assuming they paid the first year’s S$196.20 annual fee (10,000 miles) and met the entire minimum spend in foreign currency (6,600 miles), they’d receive up to 60,000 miles in total- hence the marketing tagline in the banner above.

Adjusted for spending, this is a better offer than the one which ended on 31 January 2024, which awarded up to 22,600 bonus miles for S$2,000 spend. The catch is that this time round, there’s nothing here for existing customers; only new-to-bank customers are eligible to participate.

This offer was originally set to lapse on 31 May 2024, but has now been extended till 15 July 2024.

DBS Altitude Card welcome offers

The following welcome offers are only valid for new-to-bank customers, defined as those who do not:

- currently hold a principal DBS or POSB credit card, and

- have not cancelled a principal DBS or POSB credit card in the past 12 months

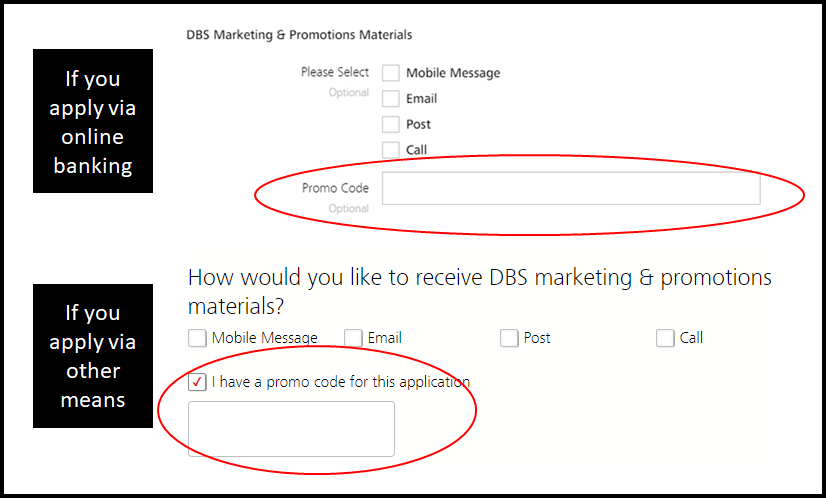

Customers must enter a certain promo code at the point of application (see below for details). Make sure to do this; no code, no bonus!

There’s nothing stopping you from signing up for both the DBS Altitude AMEX and DBS Altitude Visa cards. However, you will only enjoy the new-to-bank bonus on the first card that’s approved.

DBS Altitude AMEX

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTA60 | ALTAW50 |

| Bonus Miles | 43,400 miles | |

| Base Miles From S$3K Spend (1.3 mpd local, 2.2 mpd FCY) |

3,900-6,600 miles | |

| Miles From S$196.20 Annual Fee | 10,000 miles | Fee waived |

| Total Miles | 57,300 – 60,000 miles | 47,300 – 50,000 miles |

From now till 15 July 2024, new DBS Altitude AMEX cardholders who spend at least S$3,000 within 60 days of card approval will earn:

- 43,400 bonus miles

- 3,900 to 6,600 base miles, depending on the breakdown of the S$3,000 spend (1.3 mpd for SGD spend; 2.2 mpd for FCY spend)

If they pay the first year’s S$196.20 annual fee, they will earn an extra 10,000 miles.

Customers who wish to pay the annual fee should apply with the code ALTA60. Customers who want a fee waiver should apply with the code ALTAW50.

DBS Altitude Visa

DBS Altitude Visa DBS Altitude VisaApply |

||

| Promo Code | ALTV53 | ALTVW43 |

| Bonus Miles | 36,400 miles | |

| Base Miles From S$3K Spend (1.3 mpd local, 2.2 mpd FCY) |

3,900-6,600 miles | |

| Miles From S$196.20 Annual Fee | 10,000 miles | Fee waived |

| Total Miles | 50,300 – 53,000 miles | 40,300 – 43,000 miles |

From now till 15 July 2024, new DBS Altitude Visa cardholders who spend at least S$3,000 within 60 days of card approval will earn:

- 36,400 bonus miles

- 3,900 to 6,600 base miles, depending on the breakdown of the S$3,000 spend (1.3 mpd for SGD spend; 2.2 mpd for FCY spend)

If they pay the first year’s S$196.20 annual fee, they will earn an extra 10,000 miles.

Customers who wish to pay the annual fee should apply with the code ALTV53. Customers who want a fee waiver should apply with the code ALTVW43.

What counts as qualifying spend?

Cardholders are required to spend at least S$3,000 within 60 days of approval.

Qualifying spend includes both local and foreign retail sales and posted recurring bill payments, excluding the transactions mentioned in point 7 of the T&Cs.

CardUp rental transactions which code under MCC 6513 (Real Estate Agents and Managers) will count towards qualifying spend. However, all other CardUp transactions will not count towards qualifying spend, even though they will earn base miles. Refer to the article below for more information.

ipaymy transactions are explicitly excluded from counting towards qualifying spend.

For the avoidance of doubt, supplementary and principal cardholder spending will pool when calculating whether the minimum qualifying spend has been met.

When will the bonus miles be credited?

For cardmembers who have opted for the annual fee bonus, the 10,000 miles will be credited once the annual fee is charged.

The bonus miles for meeting the minimum spend will be credited within 2-4 months of meeting the minimum spend.

Terms & Conditions

The T&Cs of this offer can be found here.

Is it worth it?

Even if you have no interest in paying the annual fee, this is still an opportunity to generate up to 43,400 bonus miles for S$3,000 of spending. On a spend to miles ratio, it’s certainly better than last month’s offer (22,600 miles for S$2,000 spend).

The main catch is that you need to be a new-to-bank customer, which would be tricky for any serious miles collector (since you’d probably have the DBS Woman’s World Card already)!

What can you do with DBS Points?

DBS Points earned on the DBS Altitude Card do not expire, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$43.60 annual fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Overview: DBS Altitude Card

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$196.20 (FYF Option) |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | S$27 |

| Local Earn | 1.3 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes (Visa) |

| Special Earn | 6 mpd on Expedia, 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Altitude Card has an income requirement of S$30,000 and an annual fee of S$196.20, which can be waived in the first year (or paid to earn an extra 10,000 miles).

Cardholders earn:

- 1.3 mpd on SGD spend

- 2.2 mpd on foreign currency spend

Unfortunately, the 3 mpd for online flights and hotel bookings is no more, having been axed from 1 September 2023. Moreover, the 6 mpd with Expedia and 10 mpd with Kaligo lapsed earlier in 2024 and was not extended.

DBS Altitude Visa Cardholders enjoy a Priority Pass membership with two complimentary lounge visits.

For a full review of the DBS Altitude Card, refer to the article below.

Conclusion

DBS has launched a new set of welcome offers for the Altitude Card, with up to 43,600 bonus miles available to customers who apply by 15 July 2024 and spend S$3,000 within 60 days of approval. They can also opt to pay the S$196.20 annual fee for an extra 10,000 bonus miles.

Unfortunately, there’s no offer this time round for existing customers, so you’ll need to wait a little longer if you fall into this group.

Hey Aaron, will rent paid through RentHero count towards meeting minimum spend for DBS Altitude Visa card’s sign-up bonus?

past data points say yes.

Thanks for the quick response! Btw love the work you are doing 🙂 I moved to SG last year and have been an avid reader of your website to get myself into the miles game

Is the 3000 only in sgd or the equivalent of it in fcy?

Hey can I use this for local general spend? Since I am able to spend $5 or more each time..

Hi Aaron! I am just starting out in my miles journey. Just wondering, If I am new to DBS credit card, will it be worth to sign up for DBS Altitude just for the 36,400 miles (annual fee waiver)? Or am I better off signing up for the DBS Women’s World card (the 1 year points validity does sound pretty short)? I am looking to pay for my wedding banquet every month from May till Oct. I did consider signing up for both DBS Altitude & Women’s World but am not sure if its worth the trouble since I also… Read more »

Trash card. Applied and spent thousands on Taobao, ended up they say not eligible spend cause it is listed under professional service. Other banks would have counted it eligible spend MCC