Back in November 2023, the OCBC Rewards (then known as the Titanium Rewards) was on the receiving end of a massive nerf which saw the bonuses for electronics stores, IKEA and Courts removed, and the 4 mpd cap switched from S$13,335 annually to S$1,110 per month.

Following these changes, there was very little this card could do that others couldn’t do better, and therefore very little reason to keep it. I certainly didn’t shed many tears when cancelling.

But there’s new wind in the sails of the OCBC Rewards Card these days, which is down to two main factors:

- OCBC’s quarterly 6 mpd promotion

- The rise of HeyMax and its gift card selection

In fact, there’s now a very strong argument for having the OCBC Rewards Card- at least for the rest of 2024.

OCBC Rewards Card offering 6 mpd on department store transactions

In January 2024, the OCBC Rewards Card launched a quarterly 6 mpd promotion, offering upsized rewards for selected merchants or categories:

- Q1: TANGS & SHEIN

- Q2: Duty-free shopping, department stores and Watsons

- Q3/4: Department stores and Watsons

The 6 mpd earn rate is capped at S$1,000 per calendar month. Any spending above this threshold will earn the usual 4 mpd up till S$1,110, and 0.4 mpd after that.

| Component | Monthly Cap (OCBC$) |

Monthly Cap (S$) |

| Base: 5 OCBC$ per S$5 (0.4 mpd) |

N/A | N/A |

| Regular Bonus: 45 OCBC$ per S$5 (3.6 mpd) |

10,000 OCBC$ | S$1,110* |

| Special Bonus: 25 OCBC$ per S$5 (2 mpd) |

5,000 OCBC$ | S$1,000 |

| *Really S$1,111, but remember that OCBC only awards points in blocks of S$5 |

||

What this means is that ever since the start of April and all the way till the end of December, OCBC Rewards Cardholders can earn 6 mpd on up to S$1,000 per month at department stores under MCC 5311.

Now, you’re probably thinking: why should I care? Who still shops at department stores anyway, where everything is marked up to high heaven?

Well, it doesn’t matter if you don’t know your Takashimaya from your TANGS. 6 mpd on MCC 5311 is a very, very good thing indeed.

HeyMax vouchers code as department stores

|

| 👍 700 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 700 Max Miles as a welcome bonus after adding a card, purchasing a voucher and viewing the redemption page |

| 700 bonus Max Miles |

HeyMax, the website better known for its MCC lookup tool, also sells vouchers for a staggering array of merchants.

|

|

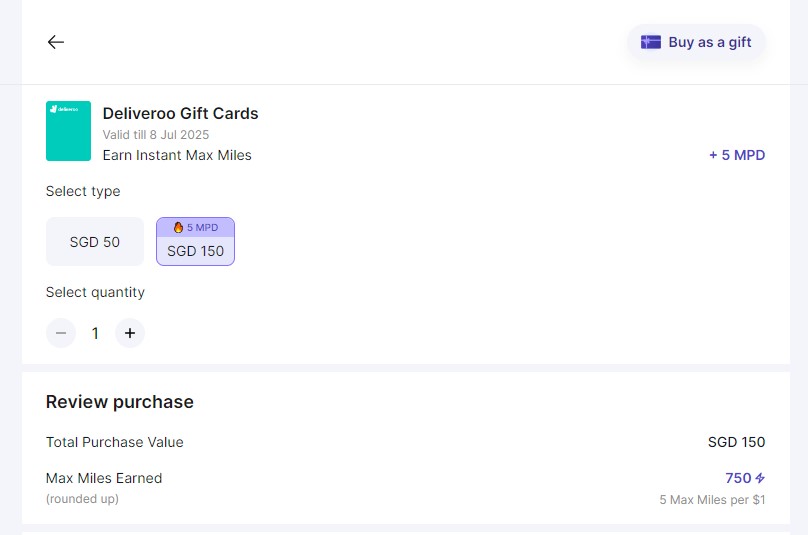

There’s some big names on that list, including Amazon, Best Denki, Courts, Deliveroo, IKEA, Klook, Lazada, NTUC FairPrice Online, and Qoo10.

These would normally code under a wide range of MCCs, but when purchased as vouchers through HeyMax, will universally code as MCC 5311.

I hope you see where I’m going here. Whether you’re buying electronics or furniture, booking activities, taking a Grab or gojek, ordering food delivery, buying eSIMs or shopping online, you can use HeyMax to turn that into a 6 mpd opportunity for the OCBC Rewards Card.

The sheer variety of HeyMax voucher coverage means you should be easily maxing out the S$1,000 cap each month, earning up to 54,000 miles from the April to December period. To sweeten the deal even further, you can earn Max Miles from voucher purchases on top of your credit card miles, convertible to 25 different airline and hotel programmes at a 1:1 ratio.

So in a way, HeyMax is hard carrying OCBC here. OCBC’s offering the 6 mpd, but HeyMax is providing the bridge to everyday life. 6 mpd on S$1,000 each month is like the good old days of the UOB Lady’s Card, only that you don’t need to pick a bonus category!

What’s my plan?

|

| Apply Here |

I no longer have an OCBC Rewards Card, having cancelled mine back in November to reset my new-to-bank status. There’s still five months to go (at the time I cancelled, OCBC’s new-to-bank timeout was six months, but they subsequently raised it to 12), but given how useful the Rewards Card is with HeyMax, it’s tempting to hop back onboard early.

Fortunately, I have The MileLioness to help here. She’s now cleared the new-to-bank hurdle for OCBC, and by getting her to apply for a Rewards Card, I can enjoy a fairly simple 36,000 miles (S$1,000 @ 6 mpd for six months) which I could cash out to a programme like Flying Blue, with no orphan balance (after the first block of 10,000 OCBC$, subsequent conversion blocks can be as small as 1,000 OCBC$).

The current SingSaver welcome offer for new-to-bank customers features Samsonite luggage, Apple AirPods Gen 3, S$220 eCapitaVouchers or S$200 cash. I’m leaning towards the eCapitaVouchers.

Conclusion

OCBC Rewards Cardholders can now earn 6 mpd on department stores till the end of 2024, capped at S$1,000 per month. Thanks to HeyMax, this can be extended to every manner of everyday spend via voucher purchases.

It’s quite a reversal of fortunes for this card, which at the end of 2023 looked like it was down and out. Someone at OCBC should really be sending a nice Christmas card over to HeyMax!

Not sure if this was what ocbc intended. They could have just included the other mcc codes. What if they nerfed HeyMax?

Hi, Joe cofounder of Heymax.ai here. Heymax.ai has a very healthy and productive relationship with each of the banks here helping them drive more card acquisition and usages based on our ability to generate interests for them. We stick to the guideline of best practices in payment and does not intend to “game”. Helping customers optimize and automate their finance will help convince more customers be open to more personal finance products – great for all parties involved.

What is the HeyMax business model? It’d be a shame to be a bag holder if they are just another startup burning through investor funds and suddenly Max Miles and HeyMax vouchers become worthless.

once you buy the vouchers, your credit risk is not heymax, it’s the party whose name is on the voucher.

Hi, thanks for the question! Joe cofounder of Heymax.ai here. Those who’s been following the journey along in our very active telegram group knows that we are making a sustainable business. This day and age in fact – no investors are interested to fund a “burn money and pray” business models. To be more specific how it works – when you “Shop with Heymax” or “Buy Vouchers” – we receive a commission from the merchants. The commission varies that’s why Miles per dollar varies. The commission is what’s funding your Max Miles. We are super lean, with just over 10… Read more »

Hi Aaron, Could i clarify something. I am trying to make sense of the above campaign wrt it’s regular campaign

If I managed to confirm lazada with their customer support mcc as 5311

Does it mean to max the campaign

1. I can spend $2110 at lazada ? Or

2. I can spend $1110 at lazada in which $1k is 6mpd and the remaining $110 is 4mpd ?

Thank you

lazada does not always code as 5311. you need to be very careful.

“after the first block of 10,000 OCBC$, subsequent conversion blocks can be as small as 1,000 OCBC$“

Where can I find more information on this? I don’t see it mentioned in your article on cards offering the smallest conversion blocks

that article was written in the context of krisflyer miles, for which different rules apply.

for this- you can try yourself with the slider bar on the ocbc stack portal.

How does that referral code work? I clicked it, then signed up and got 0 miles.

Would this also work with hsbc revolution given that it’s going to be an online only card

sure, but that’s “only” 4 mpd

Wow inflation is real! :0 thanks for the reply.

The vouchers for quite some merchants are out of stock 🙁

Can I confirm that this works if I use the ‘old’ OCBC Titanium card too?