I’ve been playing the miles game for over a decade now, and for that entire time, I was perfectly happy getting by without any Maybank cards in my portfolio. The way I saw it, their cards just weren’t attractive enough to bother with- even though I personally relish writing about the Maybank Manchester United Card each year!

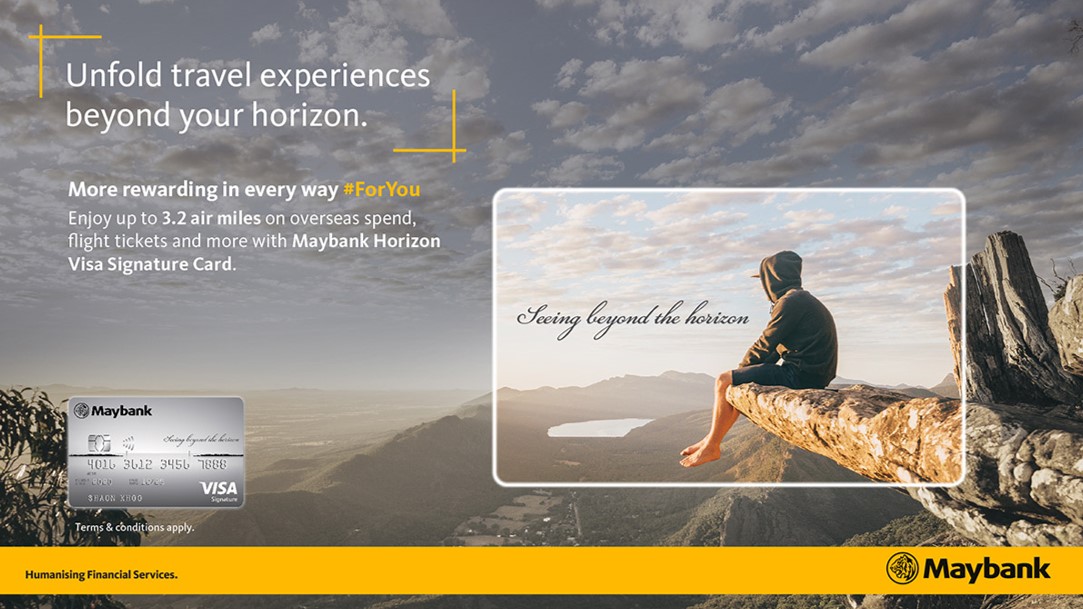

But then the Maybank Horizon Visa Signature got a makeover in November 2023, adding 2.8 mpd on all foreign currency (FCY) transactions (uncapped) and air tickets (capped at S$10,000 per month) as an evergreen benefit, further upsized to 3.2 mpd for a limited time.

And now it’s become a fixture in my wallet. On the whole I love this card because it gives me something no other card can: an uncapped 2.8 mpd on all FCY spending, even on commonly-excluded categories like donations and education.

But of course it’s not perfect, so in that spirit, here’s what I love and hate about the Maybank Horizon Visa Signature.

Things I love

2.8 mpd on FCY spend and air tickets

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

||

| Min. Spend | S$800 per calendar month* | |

| FCY Spend (no cap) |

2.8 mpd | |

| Air Tickets (capped at S$10K per calendar month) |

2.8 mpd | |

| *The min. spend can be on any retail transactions, whether SGD or FCY | ||

Maybank Horizon Visa Signature Cardholders earn an uncapped 2.8 mpd on all FCY spending, provided they spend at least S$800 per calendar month.

Sure, there are higher-earning 4 mpd options out there, such as the UOB Visa Signature or other specialised spending cards, but all of these come with caps, and/or are only valid for spending on certain MCCs.

My first choice is still to use Amaze for its lower FCY fees, but once the caps on my specialised spending cards are exhausted, it’s useful to have the Maybank Horizon as a fallback option.

| 💳 Maybank FCY fee |

| Maybank does have a 3.25% FCY fee, so you’re looking at paying about 1.16 cents per mile, but that’s acceptable to me- especially when the earn rate is upsized further to 3.2 mpd (1.02 cents per mile). |

Cardholders also earn 2.8 mpd on all air tickets, subject to the same S$800 minimum spend and capped at S$10,000 per calendar month (if you have air ticket transactions in FCY, they aren’t subject to the cap).

Again, you could earn up to 4 mpd on this category, but with much lower caps. And ever since the DBS Altitude ended its 3 mpd on air tickets (which was capped at S$5,000 per calendar month), there’s been a gap in the market that the Maybank Horizon fills incredibly well.

The 2.8 mpd earn rate was even upsized to 3.2 mpd during the launch period, and again in May and June 2024. I’m hoping we’ll see another similar promotion for the year-end holidays.

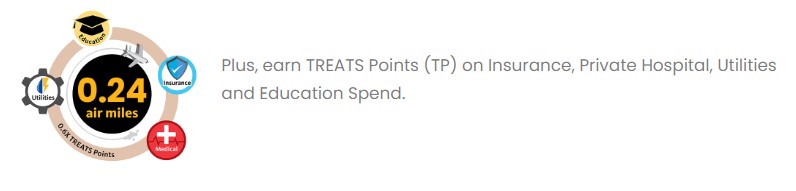

Earn points for commonly-excluded categories

Maybank’s rewards exclusion list is refreshingly sparse compared to other banks, with no exclusions for donations, education, hospitals (private), insurance premiums or utilities. And no, it’s not an oversight. The bank actively advertises this fact on its website.

These transactions earn 0.24 mpd, and I know what you’re thinking: that’s close to nothing. True, but it’s still better than the zero that you’d get elsewhere, and when you charge these in FCY, they earn 2.8 mpd!

Just picture the case of someone who goes overseas for medical treatment, or who has overseas tuition bills, or who gives regularly to an overseas charity- that’s a lot of miles you wouldn’t be able to earn with any other card.

Lightning fast sign-up gift fulfilment

With most banks, you usually need to wait at least three months for welcome gifts to be fulfilled, more commonly four or five (and perhaps some chasing over the phone).

Not so with Maybank.

Back when I applied for the Maybank Horizon Visa Signature in November 2023, I was shocked to receive an SMS just five days after hitting the minimum spend inviting me to claim my welcome gift!

It felt almost too good to be true, but sure enough, I went to the TREATS app, selected the S$200 cash credit, and received it after a further five business days. Incredible stuff. Why can’t all banks be this expedient?

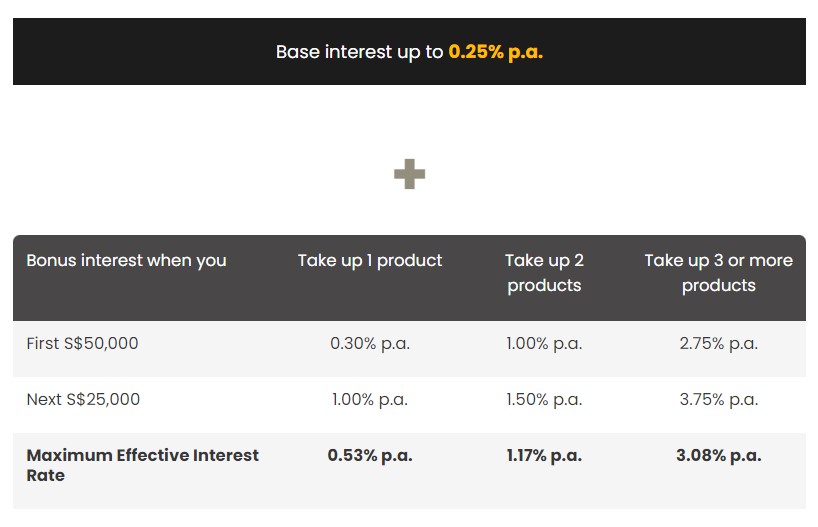

Bonus interest with SaveUp

This won’t be relevant to everyone, but since my home loan is already with Maybank, adding the Maybank Horizon Visa Signature to the picture helps me unlock even more bonus interest on my SaveUp account.

All I need to do is spend at least S$500 per calendar month on the Maybank Horizon Visa Signature Card, and credit a monthly salary of at least S$2,000. This brings my total “qualifying products” to three (mortgage + card + salary credit), and with it the highest bonus tier of 3.33% p.a. on up to S$75,000.

Obviously, that’s not as good as the UOB One (4% p.a. on up to S$150,000), but since I need to maintain a Maybank account anyway for instalment payments, it’s nice that I can earn a little extra too.

3-year fee waiver

The Maybank Horizon Visa Signature comes with a three year waiver of its S$196.20 annual fee, and subsequent annual fees are automatically waived with a minimum spend of S$18,000 per membership year.

You shouldn’t be paying an annual fee for an entry-level card in the first place, but it’s nice not to have to bother with fee waiver requests for at least three years.

Things I hate

Maybank’s three app ecosystem

Call it Maybank’s three body problem if you will, but because of my Maybank Horizon Visa Signature, I need to have three Maybank apps on my phone:

- M2U Lite

- M2U

- TREATS

Don’t ask me what the difference is between the M2U Lite and M2U, because I honestly don’t know (refer here if you want to know). In fact, it seems like the M2U Lite has more functionality than the M2U, because it’s where my secure token authentication prompts come from. And what genius decided that both apps should display exactly the same name on your phone anyway?

On top of that, you need to install the TREATS app too, in order to select your welcome gift and carry out conversions of TREATS points.

For what it’s worth, Maybank says they’re working on phasing out the M2U app, though they haven’t provided a timeline.

And while we’re at it, Maybank also has the stupidest password requirements out there:

- A combination of both letters and numbers

- A length of 8 to 12 characters

- No special characters (e.g. #!$%ˆ) and spaces are allowed, except underscore

Obviously you need a minimum number of characters, but a maximum? And no special characters? Aren’t those things that you should be encouraging?

S$5 rounding blocks

Ever since January 2023, Maybank has adopted S$5 earning blocks across all its cards. This means that all transactions are rounded down to the nearest S$5 before awarding points, which leads to lost points on every transaction (and no points for any transaction of S$5 or less).

The impact becomes less significant as your transaction size increases, but it’s still an incredibly annoying and customer-unfriendly policy.

Lack of transfer partner variety

Maybank TREATS points can be transferred to four different airline loyalty programmes (really just two, because conversions to Malaysia Airlines Enrich or AirAsia are as good as throwing them away).

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000: 10,000 | |

| 12,500: 5,000 | |

|

12,500: 5,000 |

|

4,000: 2,000 |

While it’s good that Maybank covers the basics with KrisFlyer and Asia Miles, I wish there were more variety on offer.

Of course, this isn’t a Maybank-exclusive criticism. The same could be said of BOC, DBS, StanChart and UOB for that matter. If you want to access “exotic” loyalty programmes, AMEX, Citi and HSBC should be your go-tos.

Which airline and hotel programmes can you transfer credit card points to?

Short points validity

TREATS Points earned on the Maybank Horizon Visa Signature have a relatively short validity period of just 12-15 months, depending on when they were earned.

| Points Earned | Expire On |

| 1 Jan to 31 Mar 2024 | 31 Mar 2025 |

| 1 Apr to 30 Jun 2024 | 30 Jun 2025 |

| 1 Jul to 30 Sep 2024 | 30 Sep 2025 |

| 1 Oct to 31 Dec 2024 | 31 Dec 2025 |

For what it’s worth, once you spend at least S$24,000 in a membership year, you’ll get a automatically enrolled in the Rewards Infinite (RI) programme where TREATS points become evergreen.

Maybank Visa Infinite, World Mastercard and Catholic High Alumni Platinum Associates cardholders are automatically granted an RI membership, so if you hold one of these cards then the TREATS Points earned on your Maybank Horizon Visa Signature Card will also never expire (since they pool).

No support for Google Pay

While Maybank cards support Apple Pay and Samsung Pay, there’s no support for Google Pay, which forces me to carry around my physical card (the horror).

There’s no indication if/when Google Pay support will be added, but since it’s happened across the causeway, maybe we can be hopeful?

Maybank Horizon Visa Signature welcome offers

|

| Apply (Maybank) |

| Apply (SingSaver) |

Applicants for the Maybank Horizon Visa Signature can enjoy a choice of two offers: one from Maybank, or one from SingSaver. For avoidance of doubt, you have to pick one or the other; they’re not stackable.

The offers below are only for new-to-bank customers, defined as those who:

- Do not currently hold a principal Maybank Credit Card or CreditAble account

- Have not cancelled a principal Maybank Credit Card or CreditAble account in the past 9 months

Maybank

Those who choose the Maybank offer can select from the following gifts:

- 10,000 air miles (awarded in the form of 25,000 TREATS points)

- S$200 cashback

- Apple AirPods 3rd Gen with Lightning Charging Case (worth S$263.80)

- Samsonite ENOW Spinner 69/25 (worth S$570)

A minimum spend of S$1,300 in the first two months of approval is required.

| ❓ Minimum Spend |

|

The Maybank website says you must spend S$1,300 within the first two months of approval, while the T&Cs say you must spend S$650 in the first month and S$650 in the second month. In practice, I’ve found that spending S$1,300 within the first two months (60 calendar days) will trigger the SMS for gift fulfilment |

There is currently no published end date for this offer, and the T&Cs can be found here.

SingSaver

Those who choose the SingSaver offer can select from the following gifts:

- 8,000 Max Miles

- S$180 eCapitaVouchers

- Apple AirPods 3rd Gen with MagSafe Charging Case (worth S$274)

- Xiaomi Smart Air Purifier 4 EU (worth S$275)

A minimum spend of S$500 must be made within 30 days of approval ,and be advised that SingSaver gift fulfillment will take longer than Maybank.

This offer is current valid for applications till 16 August 2024, but may be further extended. The T&Cs can be found here.

Conclusion

The Maybank Horizon Visa Signature Card has become a fixture in my wallet, in a big part due to its uncapped 2.8 mpd (sometimes upsized to 3.2 mpd) on FCY spending- even for donations, insurance, education, and other normally-excluded categories.

I also appreciate the rapid welcome gift fulfilment and the bonus interest it helps me earn on my SaveUp account, though there are annoyances like the three app ecosystem, lack of transfer partner variety, and short points validity.

Be sure to check out my full review of the Maybank Horizon Visa Signature Card below.

Fellow Maybank Horizon Visa Signature Cardholders: Love and hate?

can I check if you pay for education via AXS, will the MCC be coded as Education and be eligible to earn points for it?

axs is axs. no points.

Thank you

It makes sense for you since you already have a mortgage with Maybank. One option to make the Horizon more useful is that at the 11th month where your points are about to expire, just apply for a Visa Infinite. Use the Visa Infinite to pay your utilities and insurance for one year… then cancel your VI when they start to charge you annual fee. All your old accumulated points from Horizon starts with a one-year validity again

Also Maybank banking apps disallow running on an android phone with developer mode enabled, which may be the only bank in SG with such draconian requirements

oh yes. that annoyed me to no end too.

Citibank, too. And they won’t allow taking screenshots (or, rather, will display a pop-up every time) — not even on an iPhone, which (contrary to Aaron’s well-founded opinion) is actually LESS restrictive when it comes to SG banking apps!

I have no problem with Citibank app on developer mode. There are some specific settings in developer mode that contributes to them blocking app usage, which I agree because it theoretically compromises security on your phone. But Maybank app developers are just plain lazy and only checks for developer mode instead of specific problematic settings being toggled.

saw what you did there….mixing in Cat High and RI in the same paragraph😏

The TCs seem to say $650 per month for 2 months and not $1300 in 2 months in order to qualify for the welcome gift. Not sure if I’m reading it correctly.

added a note regarding this. in practice 1,300 works.

Thanks coz I actually missed the first month entirely was wondering if I could rescue it by doing $1300 in the 2nd month.

Have you tested if your paypal transactions at merchants will earn treats points? Please share if you have had a positive experience thus far.

Will be great to include a review on Privilege Horizon Visa Signature Card 🙂

it’ really the same product, just with 2 free grab rides a year to the airport i believe.