American Express has launched a new targeted promotion that offers cardholders 54% more value when redeeming Membership Rewards (MR) points for statement credits.

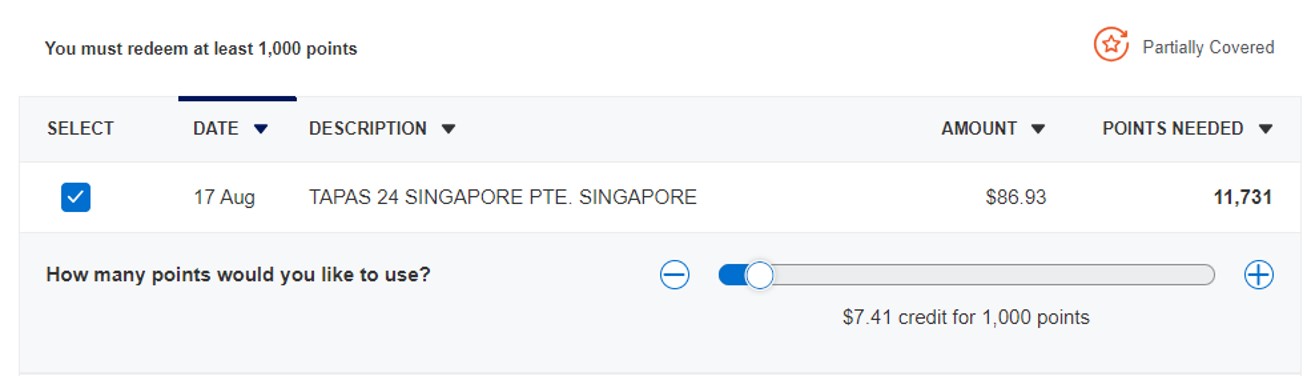

Cardholders will receive S$7.40 per 1,000 MR points, instead of the usual S$4.80.

This is slightly more generous than the 50% bonus (S$7.20 per 1,000 MR points) we saw offered in October 2023, though it’s still a far cry from April 2020, when a 100% bonus (S$9.60 per 1,000 MR points) was offered just as COVID was worsening!

Redeem Membership Rewards points with 54% more value

|

|

| MR Points | Statement Credit |

| 1,000 | S$7.40 |

From 19 August to 20 October 2024, American Express cardholders can redeem MR points for statement credit at an upsized rate of 1,000 MR points = S$7.40, instead of the usual S$4.80.

| ❓ What about Pay with Points+? |

| AMEX has a Pay with Points+ programme that offers a rate of 1,000 MR points = S$6 for selected merchants, such as InterContinental Singapore and Huggs coffee. The rate for these merchants will also be 1,000 MR points = S$7.40 during the promotion period. |

While cardholders must redeem a minimum of 1,000 MR points, there is no cap on the maximum number of MR points that can be converted under this campaign.

To convert MR points, login to the AMEX app or desktop portal and go to your card statement. Click on any transaction you wish to offset with points. A slider bar will appear, and if you’ve been targeted for this offer, it will reflect a rate of 1,000 MR points = S$7.40.

Once you’ve submitted the request, a credit will appear within three working days.

If you don’t have any transactions in your account to offset, you can call up AMEX customer service and they’ll manually process statement credit for you at the upsized rate.

Do note that you won’t be able to cash this credit balance out via cheque or bank transfer; you’ll only be able to spend it via your AMEX card.

Terms & Conditions

The T&Cs for this offer can be found below

T&Cs

- Promotion is valid from 19 August 2024 to 20 October 2024, both dates inclusive (“promotion period”)

- During the promotion period, Pay with Points redemption will be at a rate of 1,000 Membership Rewards points = S$7.40 credit (“Promotion”) for all Eligible Purchase, including purchase made with any participating partners of Pay with Points +. Thereafter, the regular rate of 1,000 Membership Rewards points = S$4.80 credit will apply. Please refer to go.amex/sgpwpplus for more information on Pay with Points +.

- The minimum points per redemption is 1,000 Membership Rewards points at any one time.

- Promotion is only valid for targeted Card Members who hold an Eligible Card and have received this email directly from American Express International Inc. (“Eligible Card” refers to a personal American Express Card issued in Singapore by American Express International Inc. that is enrolled in the Membership Rewards Programme, excluding American Express Corporate Cards and American Express Cards issued by DBS and UOB banks.)

- To use Pay with Points redemption, Card Member can login to the Amex App or online account, select transaction from an Eligible Purchase, and provide consent to offset points for credits.

- The credit will appear as a transaction on your Account Statement as “MR Points for Credit” within 3 working days upon redemption.

- Membership Rewards points redeemed through the Pay with Points feature will be awarded to you in the form of a credit to the Card Account to which the Eligible Purchase was originally charged, and that Card Account must be linked to the Membership Rewards account from which the Membership Rewards points are redeemed.

- An Eligible Purchase is a purchase made using an Eligible Card accepted by a merchant or otherwise recognized by our systems as a charge to the Eligible Card. Please note that these products, services, merchants and categories are subject to change from time to time, without prior notice to you. Only items displayed on the Pay with Points page are Eligible Purchases. Non-purchase related charges such as service fees, late payment fees and interest rates are not considered Eligible Purchases.

- Once purchase is confirmed, it is non-refundable and non-exchangeable.

- Basic Card Account must be in good standing, not cancelled for any reasons and enrolled in the American Express Membership Rewards Program.

- Promotion is not applicable in conjunction with other offers, promotions, loyalty programmes and discounts, unless otherwise stated.

- American Express International Inc. reserves the right, to make changes to the promotion due to unforeseen circumstances or matters beyond our control. We will use commercially reasonable efforts to notify you as soon as possible if we need to make such changes.

- In the event of any suspicion of illegal activities in connection with the Promotion, including without limitation fraud or an attempt at deception, American Express are entitled to disqualify the participation of Card Member and report such activity to the relevant authorities.

- Full Membership Rewards Pay with Points Terms and Conditions apply. Please refer to go.amex/sgpwp for the Terms and Conditions.

Is it worth it?

As a reminder, MR points can be transferred to 12 different airline and hotel partners at the following ratios.

If you choose to convert MR points to statement credits instead, it’s as if you’re implicitly accepting a value of:

- AMEX Platinum & Centurion: 1.18 cents per mile

- All other AMEX cards: 1.33 cents per mile

That’s probably not compelling enough for most people to bite, given how valuable MR points are.

Put it another way: you normally earn 2 MR points per S$1.60 spent on the AMEX Platinum Charge. If you cash out at the promotional rate, that’s an effective rebate of 0.92%. You might as well have used a 1.5-1.7% cashback card to spend in the first place!

Conclusion

From now till 20 October 2024, American Express cardholders can redeem Membership Rewards points for statement credit at a rate of 1,000 MR points = S$7.40, 54% more than the usual value.

If you have more MR points than you know how to spend, then I suppose you might not mind taking a value of 1.18 cents per mile. However, it’s certainly not the best use of them, and if you’re redeeming MR points for statement credit, you probably should have been using a cashback card in the first place.