CardUp has introduced a new promotion to encourage customers to make payments in categories they haven’t used before. With an admin fee of just 1.78%, the cost per mile can be reduced to as low as 1.09 cents.

| ❓ What is CardUp? |

|

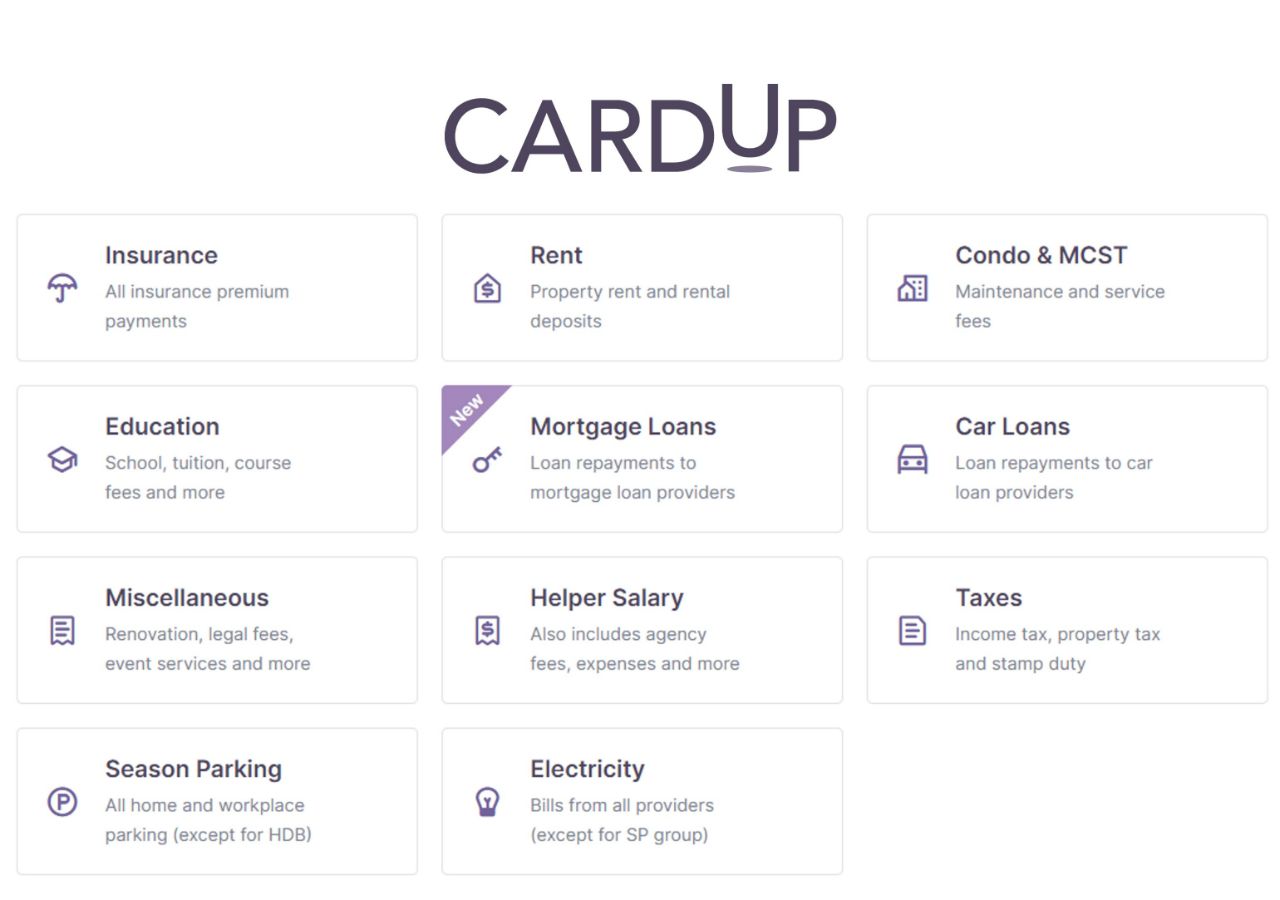

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. |

The offer is valid for up to three new payment categories scheduled by 30 November 2024, and each payment can be up to S$10,000. You will need to use a Visa card, but there’s plenty of options that will earn you up to 1.6 mpd.

Details: CardUp 3MORE offer

|

|

| Code | 3MORE |

| Limit | 3x redemptions per user |

| Admin Fee | 1.78% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 30 November 2024, 6 p.m (SGT) |

| Due Date By | 30 September 2024 (loan repayments) 4 December 2024 (all others) |

| Validity | Visa cards only |

| 3MORE T&Cs | |

Both new and existing CardUp users can use the code 3MORE to enjoy a 1.78% admin fee on three personal domestic payments with a Singapore-issued Visa card.

The three categories must be ones which the CardUp users has never made a payment before. As a reminder, CardUp offers a total of 12 different categories of payment.

- Car Loans

- Condo & MCST

- Education

- Electricity

- Helper Salary

- Insurance

- Miscellaneous

- Mortgage Loans

- Renovation

- Rent

- Season Parking

- Taxes

The payment must be scheduled on CardUp between 5 September to 30 November 2024 before 6 p..m (SGT) with a due date by 4 December 2024 (30 September 2024, if you intend to do a loan repayment like a mortgage or car loan).

No minimum payment is required, but there is a cap of S$10,000. Any amount exceeding S$10,000 will be subject to the prevailing 2.6% fee. For example, if you have a payment of S$12,000, S$10,000 will be charged 1.78%, and S$2,000 will be charged 2.6%.

Terms & Conditions

The T&Cs for this promotion can be found here.

What’s the cost per mile?

This particular promotion is only valid for Visa cards, and here’s the cost per mile for the various options.

| Card | Earn Rate | Cost Per Mile (1.78% fee) |

DBS Insignia DBS Insignia |

1.6 mpd | 1.09¢ |

UOB Reserve UOB Reserve |

1.6 mpd | 1.09¢ |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 mpd | 1.09¢ |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 1.09¢ |

DBS Vantage DBS Vantage |

1.5 mpd | 1.17¢ |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd* | 1.25¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 mpd | 1.25¢ |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 mpd | 1.25¢ |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

1.35¢ |

OCBC 90°N Visa OCBC 90°N Visa |

1.3 mpd | 1.35¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 mpd | 1.35¢ |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 mpd | 1.37¢ |

SCB Journey SCB Journey |

1.2 mpd | 1.46¢ |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd (1.75 cpm). CardUp spending counts towards the minimum spend. |

||

Don’t forget that new-to-CardUp customers with OCBC cards have the option of a slightly-lower 1.5% admin fee, which you can read about in this post.

Other CardUp offers

CardUp also continues to offer discounted fees for rental, recurring payments, overseas payments and more, the details of which can be found below.

Rental (1.79%)

|

|

| Code | SAVERENT179 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.79% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa, Mastercard, UnionPay |

| SAVERENT179 T&Cs | |

CardUp users paying rent can use the promo code SAVERENT179 to enjoy a 1.79% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

Recurring Payments (1.85%)

|

|

| Code | RECURRING185 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.85% |

| Min. Spend | None |

| Cap | S$20,000 per month |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa |

| RECURRING185 T&Cs | |

CardUp users making recurring payments can use the promo code RECURRING185 to enjoy a 1.85% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

The code is only valid for locally-issued Visa cards, and applies to the first S$20,000 of payments per calendar month. CardUp’s regular fee of 2.6% will apply to the portion of the payment that exceeds S$20,000.

Payments can be set up with weekly, monthly or quarterly frequencies. Remember, CardUp supports mortgage payments for both bank and HDB loans, so this could be useful for anyone looking to repay a housing loan.

International Payments (1.85%)

|

|

| Code | GLOBE185 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.85% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa |

| GLOBE185 T&Cs | |

CardUp users making international payments can use the promo code GLOBE185 to enjoy a 1.85% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

The code is only valid for locally-issued Visa cards.

Given that this is an international transfer, you should also check whether the rate CardUp is offering is competitive compared to the alternatives, because otherwise that implicitly increases your cost per mile.

All other payments (2.25%)

|

|

| Code | GET225 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 2.25% |

| Min. Spend | S$130 |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa, Mastercard, UnionPay |

| GET225 T&Cs | |

For all other payments, CardUp users can use the promo code GET225 to enjoy a 2.25% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

Conclusion

|

| First Payment Promo |

| Save S$30 off your first-ever CardUp transaction with code MILELION, no minimum spend required. This code is valid for Visa and Mastercard payments only |

CardUp is offering a 1.78% admin fee for new and existing customers to make payments in up to three new categories, providing a great opportunity to earn miles at a low cost.

This offer is only valid for Visa cards, but you can buy miles from as little as 1.09 cents each which is an excellent price either way. Remember to schedule your payments by 30 November 2024 , and pick the highest-earning general spending card you have.

Do these cards all still allow points earning via cardup? A lot of cards now exclude it. And how can we check if the T&Cs are not explicit.

it is certainly not true that “a lot of cards now exclude it”. the only bank which excludes cardup is hsbc. dbs has exclusions for sign-up bonus spending, but still rewards regular points.