Maybank has been making a concerted effort to improve its miles cards of late, with the Maybank Horizon Visa Signature and Maybank Visa Infinite both getting buffs to their foreign currency (FCY) earn rates.

Now it’s the Maybank World Mastercard’s turn to get a refresh, giving cardholders an uncapped 3.2 mpd on FCY spending, alongside existing benefits like an uncapped 4 mpd on petrol, and selected dining & retail merchants.

While there are cards with higher earn rates on FCY spending, there’s always a bonus cap to consider. The fact that Maybank has not imposed a cap on this — and continues to reward even education, donations, utilities and hospital spend — is a strong reason to consider adding this card to your line-up.

Details: Maybank World Mastercard revamp

Maybank World Mastercard Maybank World Mastercard |

|||

| Apply | |||

| T&Cs | |||

| Income Req. | S$80,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$261.60 (FYF) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | Up to 3.2 mpd |

Lounge Access? | No |

| Special Earn | 4 mpd on petrol and selected dining & retail | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and Malaysia Airlines, 2,000 points for Air Asia |

|||

By way of recap, the Maybank World Mastercard has a minimum income requirement of S$80,000 p.a., and an annual fee of S$261.60. The annual fee is waived for the first year, and will be waived in subsequent years if you spend at least S$24,000 in a membership year.

I don’t have any personal experience with the card, so I can’t say how strict Maybank is with the income requirement or annual fee waivers in situations where the minimum is not met.

General spending

The Maybank World Mastercard now earns 0.4 mpd on local general spending, and up to 3.2 mpd on FCY general spending, per the table shown below. The rates apply to both online and offline spending.

| Spend (per calendar month) |

SGD* | FCY* |

| <S$800 | 0.4 mpd | 0.4 mpd |

| S$800 to S$3,999 | 0.4 mpd | 2.8 mpd |

| ≥S$4,000 | 0.4 mpd | 3.2 mpd |

| *Certain categories of spend are eligible to earn 4 mpd; see below | ||

The upsized earn rates apply from the very first S$1 of spend (well, technically S$5 since Maybank has S$5 earning blocks), and not just the incremental spending above. For example:

- A cardholder who spends S$1,000 in FCY would earn 2,800 miles (S$1,000 @2.8 mpd)

- A cardholder who spends S$5,000 in FCY would earn 16,000 miles (S$5,000 @ 3.2 mpd)

While you will need to spend at least S$800/S$4,000 per calendar month to unlock the 2.8 mpd/3.2 mpd rates, there is no cap on the maximum miles you can earn. And if the uncapped feature is what attracts you to this card, then it’s safe to say the minimum spend won’t be an issue.

While the Maybank Visa Infinite and Maybank Horizon Visa Signature have offered an uncapped 3.2 mpd on FCY spend on a promotional basis, the Maybank World Mastercard is adding this as a permanent feature. This makes it one of the best FCY general spending cards on the market, as shown in the table below.

| 💳 FCY Earn Rates by Card (For general spending cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

Maybank World MC Maybank World MCApply |

3.2 mpd | Min. S$4K spend per c. month |

| 2.8 mpd | Min. S$800 spend per c. month | |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month Review |

Maybank Horizon Maybank HorizonApply |

2.8 mpd | Min. S$800 spend per c. month Review |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | Review |

HSBC TravelOne HSBC TravelOneApply |

2.4 mpd | Review |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) Apply |

2.3 mpd | Review |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

2.24 mpd | |

Citi PremierMiles Card Citi PremierMiles CardApply |

2.2 mpd | Review |

DBS Vantage DBS VantageApply |

2.2 mpd | Review |

OCBC VOYAGE OCBC VOYAGEApply |

2.2 mpd | Review |

OCBC 90°N Card OCBC 90°N CardApply |

2.1 mpd | Review |

| All other options earn 2 mpd or less | ||

The Maybank World Mastercard has an FCY fee of 3.25%, so using it overseas represents buying miles at around 1.02 cents (3.2 mpd) or 1.16 cents (2.8 mpd) apiece, which is very decent in my book.

Obviously, my first choices for FCY general spending will still be:

| Card | FCY Earn | FCY Fee | CPM |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd* | 3.25% | 0.81¢ |

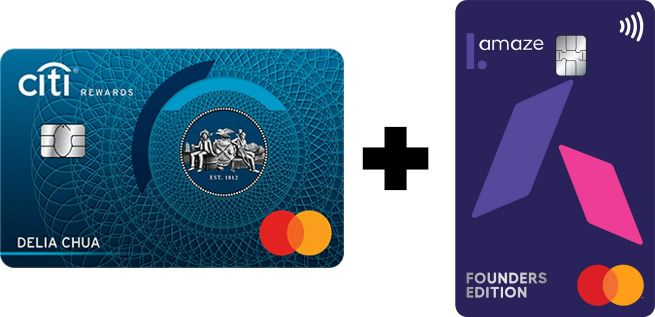

Amaze + Citi Rewards Amaze + Citi RewardsApply |

4 mpd^ |

2%# | 0.50¢ |

| *Min. spend S$1,000 per statement month, capped at S$2,000 per statement month ^Capped at S$1,000 per statement month, excludes travel #Amaze has no explicit FCY fee, but its rates are ~2% over Mastercard |

|||

But these have their caps and limitations (e.g. no bonuses for travel spend with the Citi Rewards), and if these are exhausted, or if I’m spending on a category they exclude, then the Maybank World Mastercard fits in perfectly.

Remember: one of the best things about Maybank cards is that they still award points for charitable donations, education, hospitals and utilities. And if you pay these in FCY, you get the upsized earn rate too!

Category spending

The Maybank World Mastercard continues to earn an uncapped 4 mpd on the following categories of spend and specific merchants. Do note that online transactions are ineligible for the bonus.

| Merchant | Branches |

| Petrol |

|

| Imperial Treasure |

|

| Les Amis Group |

|

| Valiram Group |

|

| Luxury Galleria at Resorts World Sentosa (capped at S$5,000 per c. month) |

|

| Leonian |

|

| The Par Club SG |

|

| Aparo Golf |

|

It’s good to see that these are not being sacrificed with the revamp, and while I didn’t see the point of getting a Maybank World Mastercard just for petrol, now I might as well use it. This would then free me to switch one of my UOB Lady’s Solitaire Card bonus categories out from Transport.

What can you do with TREATS Points?

TREATS Points can be transferred to four different airline partners at the following ratios:

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000 : 10,000* | |

| 12,500 : 5,000 | |

|

12,500 : 5,000 |

| 4,000 : 2,000 | |

| *You must convert KrisFlyer miles via the TREATS SG app (Android | iOS) to enjoy this rate. Manual conversion receive an inferior rate of 30,000 points = 10,000 miles | |

Malaysia Airlines Enrich and airasia rewards are close to worthless in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

Maybank World Mastercard cardholders are automatically enrolled into the Rewards Infinite (RI) programme, so their points never expire. All conversion fees are waived for Maybank World Mastercard (and Maybank Visa Infinite) cardholders.

The best part? Since TREATS Points pool, the no expiry policy and free conversion benefit also extends to other Maybank cards like the Maybank Horizon Visa Signature!

Welcome offers: Samsonite luggage or S$200 cashback

Maybank World Mastercard Maybank World Mastercard |

|||

| Apply |

Maybank is currently offering a welcome gift of either a Samsonite ENOW SPINNER 69/25 (worth S$570) or S$200 cashback for new-to-bank customers who apply for a Maybank credit card and spend at least S$1,300 within the first two months of approval.

New-to-bank customers are defined as those who:

- Do not currently hold a principal Maybank credit card or CreditAble account

- Have not cancelled a principal Maybank credit card or CreditAble account in the past 9 months

The T&Cs of this offer can be found here.

In my experience, Maybank is extremely fast with the gift fulfilment, and I received mine within days of meeting the minimum spend.

Conclusion

Maybank World Mastercard cardholders now enjoy an uncapped FCY earn rate of up to 3.2 mpd, which applies even to education, charitable donations, hospital bills and utilities.

While you will need to spend at least S$4,000 per month to unlock the 3.2 mpd rate, you’ll still earn a respectable 2.8 mpd so long as you spend at least S$800 per month, and really- if you’re looking for an uncapped FCY spending card, then a minimum spend should be the least of your worries.

Evergreen benefits like an uncapped 4 mpd on petrol continue to be offered, and with non-expiring points and free points conversions, this is a card I’d happily add to my wallet.

What do you make of the Maybank World Mastercard’s changes?

Can this card be paired with AMAZE?

sure- if you want to earn 0.4 mpd.

Is the 4k/month averaged out over a year or just something you can hit in a single month?

I was about to apply for Maybank Horizon VS. Seems like this may be a better option. Only downside seems to be the annual fee.

Yay finally something for big overseas purchases with uob kf dropping off

Would be great if it covered ev charging on top of fuel stations.

Don’t think any card has bonuses on EV charging?

if buy ticket SQ start from USA currency USD, will considered as FCY ?

Hi, just to confirm this card can earn 0.4mpd for donation, utilities, hospital regardless of the amount in SGD as long you intend to use for this card?

is this a take-ir or leave-it card?

Can anyone clarify how the bonus FCY points work? Is it calculated on the total monthly spend so even small transactions are included and the $5 block is pretty much irrelevant or is it per transaction? Also is there any specific date when the bonus is awarded like DBS or is it based on the statement date like UOB?

Do I earn 3.2/2.8 miles if I spend in foreign currency using online websites?