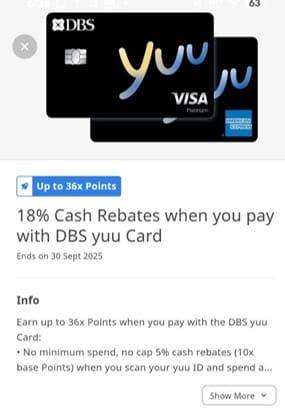

The DBS yuu Card offers simply unbeatable value for spending within the yuu ecosystem, with a staggering 18% rebate or 10 mpd.

However, it’s admittedly not the simplest card to use, and cardholders need to be mindful of the various conditions involved, including the minimum spend and minimum merchant requirement, bonus cap, and more.

In this article, I’m going to provide quick answers to many commonly-asked questions about the DBS yuu Card. I highly recommend you read this post in conjunction with my full review of the DBS yuu Card.

DBS yuu Card DBS yuu Card |

||

| Apply (AMEX) | ||

| Apply (Visa) | ||

| Link your card to the yuu app with code TMCYRWM5 for 2,000 bonus yuu Points |

| 💳 DBS yuu Card FAQs |

Applying for the DBS yuu Cards

What welcome offers are available?

The DBS yuu Card is currently offering the following welcome offers.

| Card | New | Existing |

DBS yuu AMEX DBS yuu AMEXApply |

S$300 + S$80 Esso vouchers Code: DBSYUU |

S$80 Esso vouchers No code |

DBS yuu Visa DBS yuu VisaApply |

S$300 + S$80 Esso vouchers Code: DBSYUU |

S$80 Esso vouchers No code |

| Esso vouchers are awarded in the form of 20 x S$4 off min. S$60 petrol purchase |

||

New customers are defined as those who do not:

- currently hold a principal DBS or POSB credit card, and

- have not cancelled a principal DBS or POSB credit card in the past 12 months

All other applicants are considered existing customers.

New customers who spend at least S$800 within the first 60 days of card approval will receive S$300 cashback.

Both new and existing customers will receive S$80 worth of Esso fuel discount vouchers, comprised of 20 x S$4 off with a minimum spend of S$60 on petrol. You do not need to spend anything on the DBS yuu Card to receive this gift.

These offers are valid for applications submitted by 31 December 2025. The T&Cs can be found here.

Should I get the AMEX or Visa?

Here are the main differences between the DBS yuu AMEX and Visa:

- AMEX has a lower FCY fee of 3% versus 3.25% for Visa (not that you should be using either card for overseas spending, mind you)

- AMEX occasionally gets to participate in AMEX Offers such as Shop Small

- AMEX does not earn 18% rebates/10 mpd at Charge+ or Mandai Wildlife Group

- AMEX is not accepted at 7-Eleven

- Some Singtel Kiosks do not accept AMEX cards

- The Cold Storage app does not accept AMEX cards

In general, I’d say the Visa is the better choice.

Can I get both the AMEX and Visa?

Yes. There is nothing stopping you from applying for both the AMEX and Visa. This allows you to double your monthly bonus cap (see below), and yuu Points will be automatically pooled into the same yuu account.

How do I link my DBS yuu Card to the yuu app?

When you receive your first DBS yuu Card, you can link it to the yuu app by opening the app > tap on the DBS icon > Link DBS card > Continue > Login to ibanking to finish

This is a one-time exercise, and there is no need to link any subsequent yuu cards. For example, if you first apply for the DBS yuu AMEX, link it, and then apply for a DBS yuu Visa, there is no need to link the Visa separately.

You can get 2,000 bonus yuu Points (S$10) by using the code TMCYRWM5 during the linking process.

10 mpd earn rate

How is the 10 mpd rate derived?

| Reward | Min. Spend | Cap |

| Base Reward 1x point per S$1* 0.5% rebate 0.28 mpd |

N/A | N/A |

| Bonus Reward 1 9x points per S$1* 4.5% rebate 2.5 mpd |

N/A | 28,800 points (S$822.86) |

| Bonus Reward 2 26x points per S$1 13% rebate 7.22 mpd |

S$800 Spend at 4x merchants |

|

| Note: For SimplyGo, Base Reward = 0.5x points per S$1, Bonus Reward 1= 9.5x points per S$1 |

||

The DBS yuu Card earns a total of 36 yuu Points per S$1 on transactions with yuu merchants and SimplyGo, broken down into:

- Base Reward: 1x point per S$1 (0.5x points per S$1 for SimplyGo)

- Bonus Reward 1: 9x points per S$1 (9.5x points per S$1 for SimplyGo)

- Bonus Reward 2: 26x points per S$1

The conversion rate between yuu Points and KrisFlyer miles is 3.6:1, from which we derive the 10 mpd rate.

What is the minimum spend required?

Base Reward & Bonus Reward 1

There is no minimum spend required for the Base Reward, and Bonus Reward 1.

Bonus Reward 2

Bonus Reward 2 requires that cardholders meet a minimum spend of S$800 per calendar month, and transact with 4x participating merchants each calendar month (more on this requirement below).

What counts towards the minimum spend?

The S$800 minimum spend for Bonus Reward 2 does not include any spending that is on DBS’s general exclusions list, such as charitable donations, education, government services and utilities.

All other spending will count, including spending at non-yuu merchants, but a better question is: why would you even want to spend at non-yuu merchants in the first place?

Non-yuu transactions only earn 0.5 yuu Point per S$1, which would drag your weighted average down like a stone. Even if you’re short of the minimum spend, it would be preferable to buy grocery vouchers and spend them the following month rather than making transactions outside the yuu ecosystem.

Is the minimum spend based on transaction date or posting date?

The minimum spend is based on transaction date, not posting date.

For example, if you spend S$100 at Cold Storage on 31 October 2025, but the transaction posts on 1 November 2025, that S$100 will count towards October 2025’s minimum spend.

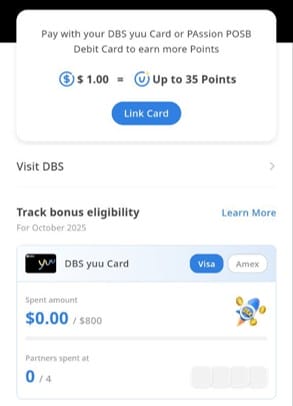

How can I track the minimum spend?

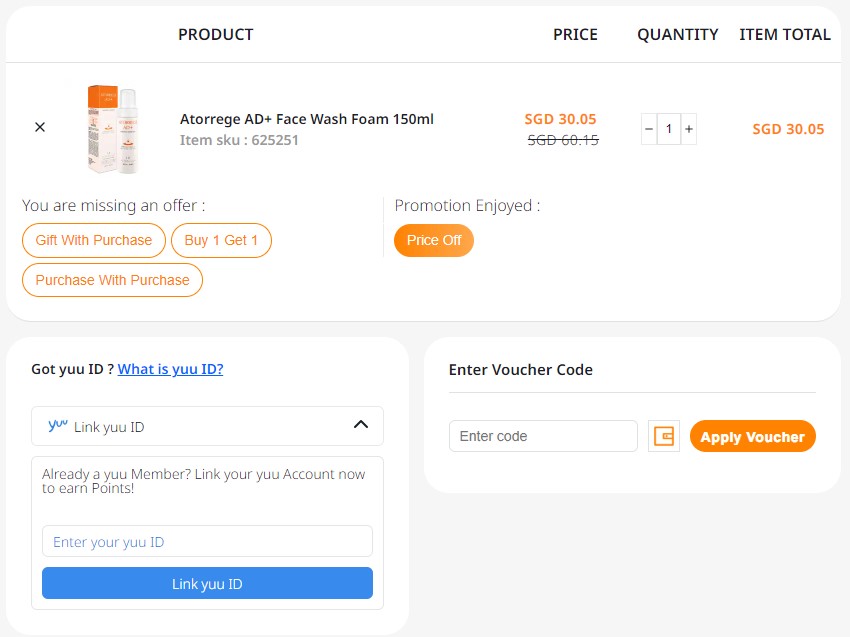

The yuu app provides an easy way of tracking your progress towards the minimum spend (and 4x merchant requirement; see below).

Tap on Brands > DBS, and you’ll see the tracker. You can toggle between the AMEX and Visa if you have both cards.

How long is the bonus reward valid for?

Bonus Reward 2 has always been positioned as a limited-time offer, and if you visit the yuu app, you might see that it’s scheduled to finish at the end of the current month.

Don’t worry. This is a placeholder date that is consistently extended by another month once the deadline comes. At the moment, the promotion is evergreen until further notice.

My guess is that they want to create a sense of urgency, or to avoid overcommitting while retaining the ability to review the promotion each month.

When are yuu Points credited?

The Base Reward is credited as follows:

- yuu merchants (1x point per S$1): Same day

- SimplyGo and non-yuu merchants (0.5x points per S$1): 60 working days after the end of each calendar month

Bonus Reward 1 & 2 will be credited within 60 working days after the end of each calendar month.

Bonus Cap

What is the bonus cap?

Bonus Reward 1 and Bonus Reward 2 have a combined cap of 28,800 points per calendar month, equivalent to S$822.86 of spending.

In other words, you should be aiming to spend between S$800 and S$822.86 per calendar month!

Can I double the bonus cap by getting both the DBS yuu AMEX and Visa?

Yes. The bonus cap applies on a card-level basis, so you’ll be able to earn 10 mpd on up to S$1,645.72 (S$822.86 x 2) of combined spending with both the AMEX and Visa.

At the risk of stating the obvious, you’ll also need to meet the S$800 minimum spend on each of the AMEX and Visa in this case.

yuu Points will be automatically pooled into the same yuu account.

Can I double the bonus cap by getting a supplementary card?

No. Supplementary cards do not have their own bonus cap, and share the bonus cap of the principal cardholder.

Is the bonus cap based on transaction date or posting date?

The bonus cap is based on transaction date, not posting date.

For example, if you spend S$100 at Cold Storage on 31 October 2025, but the transaction posts on 1 November 2025, that S$100 will count towards October 2025’s bonus cap.

yuu Merchants

Which merchants are eligible for 10 mpd?

The DBS yuu Card will earn 10 mpd with the following merchants.

| Participating Merchant | Consists Of |

| 🏪 7-Eleven |

|

| 🍞 BreadTalk [❌ Leaving yuu on 1 Nov 25] |

|

| 🍵 CHAGEE |

|

| ⚡Charge+ Visa only |

|

| 🛒 Cold Storage |

|

| 🍽️ foodpanda |

|

| 🛒 Giant |

|

| 💊 Guardian |

|

| 🚕 Gojek |

|

| 🦁 Mandai Wildlife Group Visa only [❌ Leaving yuu on 1 Nov 25] |

|

| 📱 Singtel |

|

| 🚆 SimplyGo* |

|

| 🍞 Toast Box [❌ Leaving yuu on 1 Nov 25] |

|

| Thye Moh Chan [❌ Leaving yuu on 1 Nov 25] |

|

| *SimplyGo is not a yuu merchant per se, but is still eligible for the bonus earn rate |

|

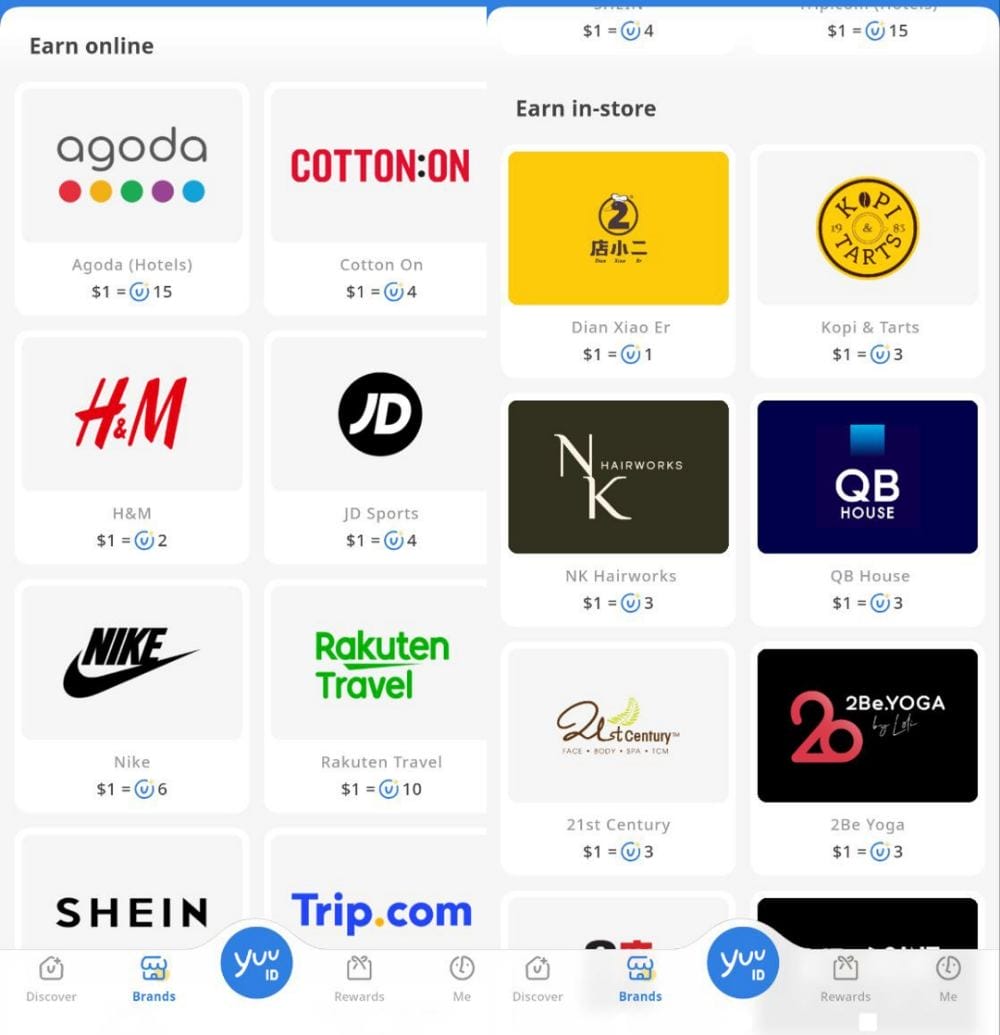

There tends to be some confusion because the yuu app also shows other merchants under Featured Brands, such as Agoda, Trip.com and QB House.

While you can earn yuu Points at these merchants by scanning the yuu app in-store, or shopping online via the link in the yuu app, they are not yuu merchants per se, and you will not earn further bonus points with the DBS yuu Card.

What about the 4x merchant minimum?

In addition to meeting the minimum spend, Bonus Reward 2 also requires that DBS yuu Cardholders spend at four different Participating Merchants per calendar month.

For example, you could meet the requirement by spending with SimplyGo, Cold Storage, Giant and Guardian. However, if you were to spend at Cold Storage, CS Fresh and Jasons Deli, it would only count as one merchant (since they’re collectively under the “Cold Storage” heading).

Having to spend at four different merchants each month will present some cognitive load, but one of them can be SimplyGo, and if you’re using the yuu Card, you’re almost certainly spending with at least one yuu merchant already.

There is no minimum spend required per merchant, so you could just as easily buy one plastic bag at Cold Storage and Giant’s self check-out stations.

Conversions to KrisFlyer

Are there any fees for transferring yuu Points to KrisFlyer?

All conversions are free of charge.

How fast are transfers processed?

All transfers from yuu Points to KrisFlyer are processed instantly.

What’s the minimum conversion block?

|

|

| yuu Points | KrisFlyer miles |

| 3.6 points | 1 mile |

| Min conversion block: 200 yuu Points | |

A minimum conversion block of 200 yuu Points (56 miles) applies, after which conversions are in blocks of 1 mile.

All conversion amounts are rounded up to the nearest mile, e.g. 200 yuu Points = 55.55 miles ≈ 56 miles.

What’s the opportunity cost of choosing miles over rebates?

With the DBS yuu Card, you’re basically choosing between 18% rebates or 10 mpd for yuu merchant spending.

On the surface, this appears to be simple maths: the cost per mile is 1.8 cents (18/10). That’s decent, though it might be on the high side for most people’s purchasing thresholds.

That’s not quite correct. It would be correct if you were dealing with a cashback card, where the rebate is offset against your monthly bill. But the yuu Card is not a cashback card. It’s a rewards card, where the points need to be offset against future spending.

Here’s a simple illustration. Suppose you spend S$600 on your yuu Card and earn 21,600 points. You now have a choice between:

- Using those points to offset S$108 of spend at a yuu merchant

- Converting those points to 6,000 KrisFlyer miles

Choose option 1 implicitly means you forgo the opportunity to earn 1,080 miles on your next transaction at a yuu merchant (because your bill is reduced by S$108, at 10 mpd). Therefore, by choosing the S$108 offset, you’re giving up not 6,000 miles, but 7,080 miles. Based on this, the opportunity cost is 1.53 cents per mile- something much more tolerable.

Other uses for yuu Points

What else can you do with yuu Points?

yuu Points can be used to offset purchases at yuu merchants at a rate of 1 point = 0.5 cents. A minimum of 200 yuu Points (S$1) is required for redemption.

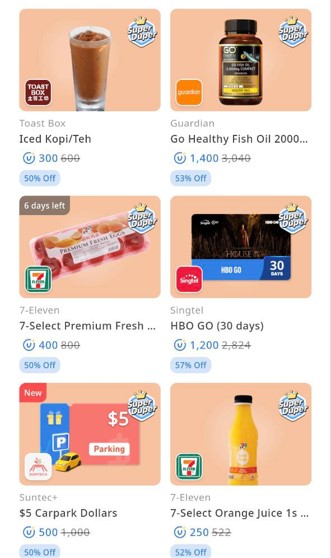

Alternatively, you can redeem yuu Points for items in the yuu app, some of which can offer higher-than-usual value. Some recent examples include:

- S$5 Gojek voucher for 500 points

- 7-day Sports Plus for 1,000 points

- 30-day HBO Max for 1,400 points

Some of these boost the value of a yuu Point significantly; for example, the S$5 gojek voucher represents 1 cent per point, or double the usual value. I personally find the 7-day Sports Plus packages to be great value, redeeming them during tennis tournaments I want to watch instead of buying a subscription.

Miscellaneous

Can I earn points for vouchers?

The DBS yuu Cards T&Cs (Appendix 1) exclude vouchers (and selected other items like Stage 1 infant milk powder, plastic bags and cigarettes) from earning the Base Reward.

However, it’s still possible to earn Bonus Reward 1 & 2 on these purchases. In other words, you will be earning 35 yuu Points per S$1 on these transactions (missing out on the base 1 yuu Point per S$1).

Can I earn points for my Singtel bill?

Yes, if you make payment in-person at one of Singtel’s self-serve kiosks, you can earn 35 yuu Points per S$1 on your Singtel bill (not the base 1 yuu Point per S$1).

Two points to note:

- You can overpay your Singtel bill by up to 2x the due amount

- While all kiosks accept Visa, not all accept AMEX. Take note if you have the yuu AMEX (Sethisfy maintains a list of which kiosks accept what payment methods)

Protip: your Singtel bill need not just be for your mobile subscription. Singtel lets you charge other expenses to your monthly postpaid bill such as Apple Music, Apple TV+, Google Play Store, Razer Gold and Spotify.

I shouldn’t have to say this, but because I’m sure it’ll be asked: no, you can’t pay a GOMO or other Singtel-using VMNO bill at a Singtel kiosk.

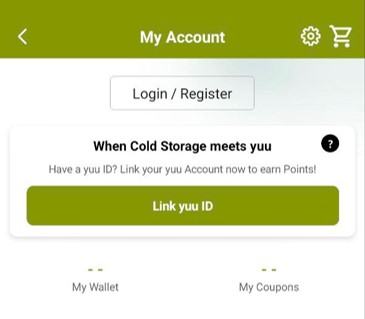

Can I shop at Cold Storage online?

Transactions made via the Cold Storage app are eligible to earn up to 36 yuu Points per S$1 with the DBS yuu Card, provided you link your yuu ID.

To do this, tap on My Account > Link yuu ID.

Can I shop at Guardian online?

Transactions made via the Guardian website are eligible to earn up to 36 yuu Points per S$1 with the DBS yuu Card, provided you link your yuu ID.

You’ll be given the option to do this at the check-out page.

Why didn’t I earn points on my foodpanda order?

Foodpanda is rather sneaky when it comes to awarding points. You will not earn points in the following situations:

- Dine-in orders

- pandago orders

- All orders on corporate accounts

- Top-ups on pandapay wallet

- pandapro subscriptions

- Any discounts and vouchers applied, delivery fee, platform fee and other fees, and rider tips

What if I cancel a yuu Card?

Cancelling a DBS yuu Card has no impact on the points already in your account. However, it will affect any pending bonuses not yet credited, so give yourself a 1-2 month period of no yuu Card spending before cancelling.

Conclusion

DBS yuu Card DBS yuu Card |

||

| Apply (AMEX) | ||

| Apply (Visa) | ||

| Link your card to the yuu app with code TMCYRWM5 for 2,000 bonus yuu Points |

The DBS yuu Card is one of the most rewarding cards on the market—if you play by its rules. With the potential to earn up to 10 mpd or 18% rebates, it’s unmatched for spending within the yuu ecosystem.

That said, the various conditions, such as the minimum spend, 4x merchant requirement, and bonus cap, mean it’s best suited for those who plan and track their spending diligently.

No one knows how long this kind of generosity can last, so make hay while you can!

Do you need to hit the$600 exactly just to maximise the mpd to 10mpd, or for some other reason?

For SingTel bill, online auto deduction not applicable ?

May I clarify if the Singtel bill payment at Singtel kiosk earns yuu points please? It is stated in the page 8 of the T&C that recurring bill payments and bill payments are excluded from the 36x yuu points.

Tried bill payment via Singtel Kiosk and it works, as in I did receive the 9x yuu points 1 week after bill payment using the yuu card.

However, for your data point or correction, but contrary to what was pointed above I wasn’t able to pay 2x my bill amount, but only rounded up to the nearest $10. For example my bill was $73.89, and I could only pay $80. Everytime I tried to input $90, it shows message “Enter a lower amount”

Yeah but I can’t hit 600 on these merchants alone. Guess this card isn’t for me.

You can consider doing foodpanda take outs to hit. If you have the subscription, extra 10% overall still a deal

So confirm if pay singtel bill using app won’t get bonus?

Finally a replacement for the “bottles and bottles” nerf

The illustration to demonstrate the cost of 1.53 cpm assumes that the spend for that calendar month is still below $492. If we use the cashback when we exceed $600 spend in a month, then the cost is 1.71 cpm. Unless I value miles >1.7 cpm, the 18% cashback would be preferable. The opportunity cost in this case is 5% not 18% (so 300 miles not earned per $108 offset) For us, this happens when there is some awesome infant formula offer at CS or some other offer at Guardian (I shop while looking at amazon/lazada/shopee/redmart/NTUC/Watsons on my mobile). Then… Read more »

The CS and Giant gift cards, can they be purchased online and counted to the $600 spent? The online gift cards are purchased from Giftano website, not directly from CS or Giant.

Think about it, if you buy McD via Grabfood or Foodpanda, is it possible to clock McD points in your McD app???

Can we use gpay with these cards, and will we get points?

BTw AMex is not accepted at Cold Storage online 🙁

Is the $600 for any transactions spend ? I keep hitting $600 but never got my bonus points for a few months.

Eg

$550 non Yuu merchants

$50 Seven Eleven

Is this ok for me to earn bonus points on the $50. Don’t judge me 🙂

Will I earn bonus points for the top-up of BTG rewards app?

I think Singtel kiosk nerfed already as per updated T&Cs? https://www.dbs.com.sg/iwov-resources/media/pdf/cards/promotions/dbs-yuu-cards/dbs-yuu-card-promotion-tncs.pdf

DP on points calculation: Gojek Toll fees, Foodpanda delivery fee, foodpanda platform fee do not earn 1x base points. But the whole transaction amount including these fees will earn the 9x points

Does subscribing to pandapro impact the bonus points earned from food delivery spend? (Not referring to the subscription fees).

What about online singtelshop?

Regarding “The minimum spend is based on transaction date, not posting date.” If anyone has insights / advice, it would be appreciated. I was just given a call by yuu Rewards Club today who clarified that according to the T&Cs: the min. spend is based on posting date (ref. Clause 13 below) and even more confusing, based on the transaction date, which is based on settlement date, which is the same as the posting date (ref. Clause 10 below)! Clause 10 of the T&Cs: “Eligible Spend must be charged to your DBS yuu Card within the calendar month, based on… Read more »

transaction date! clause 13 just means the transaction has to be posted but calculation still based on their txn date

“Eligible Spend must be charged to your DBS yuu Card within the calendar month, based on transaction date. The **transaction date is determined based on the merchant settlement date** between the merchant and their acquirer (subject to merchant or their acquirer’s timezone).”

I recently had a call with DBS to clarify their T&Cs, specifically clause 10, quoted previously, and with emphasis added above.

Their take is that the settlement date is the one that is to take precedence over the transaction date when computing eligible minimum spend.

Any thoughts / advice on this @Milelion / @Aaron / @Yiwei?

transaction date is the correct one to use.

Thanks for entertaining this topic, Aaron. So I’ve called both yuu (twice) and DBS to persuade them that the correct reading of the T&Cs should be that the following steps are performed (for 26X bonus points): 1. Retrieve all transactions with *transaction dates* within the calendar month 2. Check that the records retrieved in Step 1 have been posted (i.e. just a status check) 3. Check that the transactions were at yuu merchants 4. Sum the transactions amounts 5. Check that the sum in Step 4 meets the minimum spend required ($800 now) However, both sources have been consistent in… Read more »