Citi PayAll has launched a new promotion that offers a flat 1.75 mpd on all payments scheduled by 28 February 2025.

Given the 2.6% service fee, this works out to 1.49 cents per mile, which is lower than the last promotion (1.63 cents per mile for non-tax payments), but obviously not as good as the past few years.

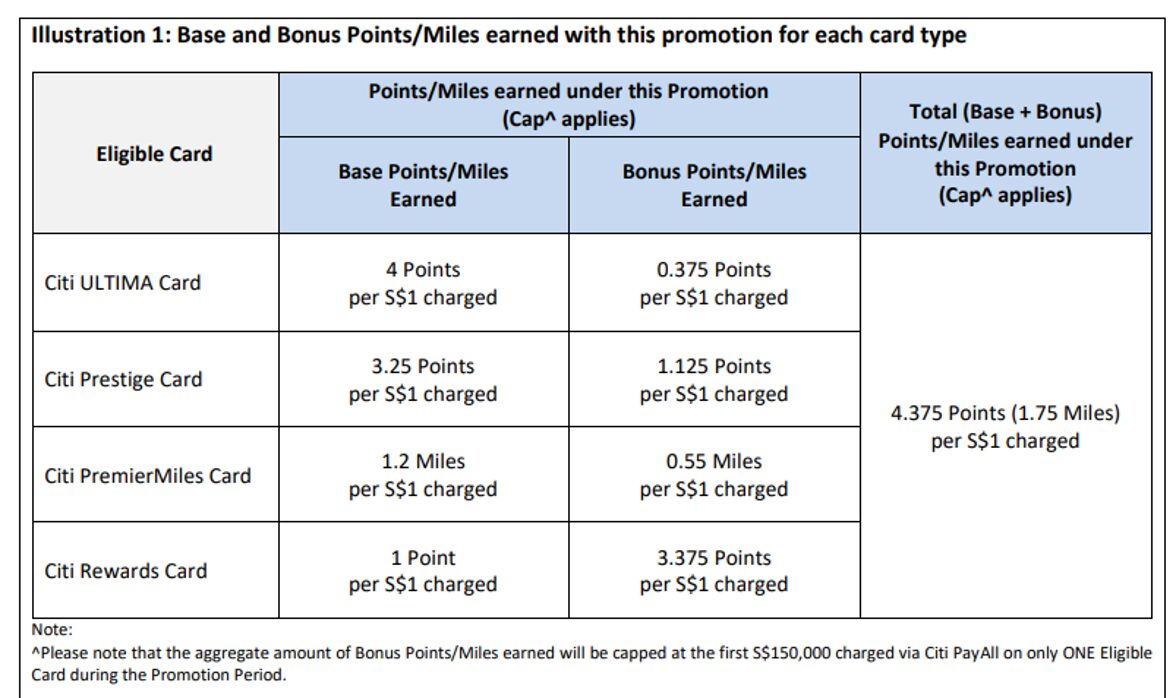

A minimum spend of S$5,000 on Citi PayAll transactions on a single card is required, and an overall cap of S$150,000 applies.

If you’re new to Citi PayAll, or just need a refresher, be sure to refer to my comprehensive guide for everything you need to know.

Earn 1.75 mpd on Citi PayAll transactions

|

| Citi PayAll Promo |

From 7 October 2024 to 28 February 2025, Citi cardholders will earn 1.75 mpd on all Citi PayAll transactions.

This is subject to a minimum spend of S$5,000 in Citi PayAll transactions on a single card, and capped at S$150,000 across all Citi PayAll categories.

The offer is valid for principal cardholders of the following cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

For avoidance of doubt, any spend by supplementary cardholders will not be considered.

Given the service fee of 2.6%, you’re looking at a cost of 1.49 cents per mile across all cards.

| Card | Base | Bonus | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.15 mpd |

1.49¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 0.45 mpd | 1.49¢ |

Citi Premier Miles Citi Premier Miles |

1.2 mpd | 0.55 mpd | 1.49¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 1.35 mpd | 1.49¢ |

To illustrate how this works, suppose you spend S$5,000 on Citi PayAll during the promotion period:

- You will earn 8,750 miles (S$5,000 x 1.75 mpd)

- You will pay an admin fee of S$130 (S$5,000 x 2.6%)

- The cost per mile is therefore S$130/8,750 miles = 1.49 cents

| ⚠️ Citi app shows base rates! |

| The Citi Mobile App (where Citi PayAll payments are set up) shows the base earn rates by default. The bonus rates are not reflected. This has always been the case even for past promotions, and Citi has shown no interest in fixing the UX, so you’ll have to take it on faith that the bonus miles will follow. |

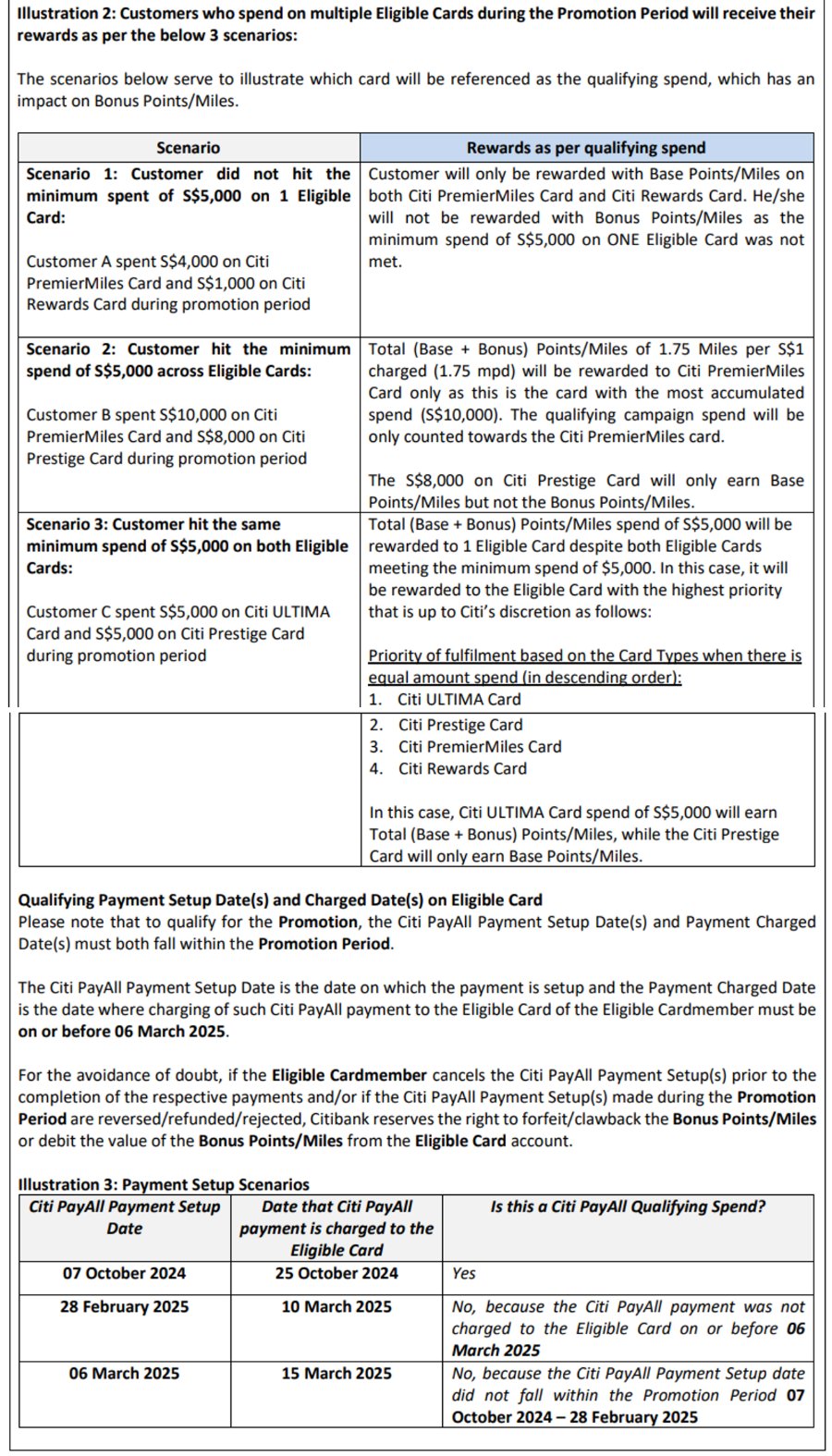

A few important points to note:

- the payment setup date must be on or before 28 February 2025, 11.59 p.m

- the payment charge date must be on or before 6 March 2025, 11.59 p.m

- the S$5,000 spending need not be in a single transaction; it can be combined across multiple payments that fall within the promotion period, so long as its on a single card

- the aggregate bonus points or miles earned is capped at S$150,000 on only one eligible card

Since the base earn rate differs for each card, the maximum bonus you can earn per card differs. Don’t get confused though, as the overall earn rate for all cards is the same at 1.75 mpd.

Citi also provides several scenarios for how spending on multiple cards will work.

If you spend on multiple cards, only the card withthe highest accumulated spend will earn bonus points. In other words: stick to a single card! No matter how many Citi cards you have, the maximum bonus you can earn is capped at S$150,000 on a single card.

Finally, remember that if you already have an existing recurring payment in place before the start of the promotion period, you will need to cancel it and set it up again to benefit from this promotion.

When will the bonus miles be credited?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts. The bonus component will be credited within 12 weeks from the end of the promotion period, i.e. by 23 May 2025 (for comparison, the previous campaign was 16 weeks).

In other words, the higher your base earn rate, the more miles you get upfront. For example, a Citi ULTIMA Cardholder would enjoy 1.6 mpd upfront, while a Citi Rewards Cardholder would enjoy just 0.4 mpd upfront.

So if you have upcoming travel plans for which you plan to use these miles, try and use a card with a higher base earn rate.

Terms and Conditions

The T&Cs for this promotion can be found here.

Is it worth it?

Well, look. We all know that the days of Citi PayAll splashing the cash are gone. The writing was on the wall ever since the 2.6% fee hike and middling income tax promotion for 2024.

So this promotion is not bad, but clearly isn’t as fantastic as what we saw in previous years. Buying miles at 1.49 cents each is passable, but you might be able to get a lower cost via CardUp, depending on the type of payment you’re making and what promo codes are offered.

Citi Miles and ThankYou points can be converted to 11 frequent flyer programmes and one hotel programme, with a S$27.25 conversion fee.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

Citi PayAll transactions count as qualifying spend

Citi PayAll transactions will count towards the qualifying spend required for welcome offers and card-related benefits, provided the service fee is paid.

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige

- The minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige

Citi PayAll transactions also count towards the aggregate sum to which the Citi Prestige’s Relationship Bonus is applied.

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Conclusion

Citi PayAll’s latest promotion offers cardholders a flat 1.75 mpd for all payments, subject to a minimum spend of S$5,000. This works out to a cost of 1.49 cents per mile- a decent price, but keep in mind you might be able to do better with CardUp or other alternatives in certain situations.

Do remember that the bonus miles will only arrive in May 2025, so those planning a year-end getaway should take that into consideration.

What do you make of this Citi PayAll offer?

Once again throwing Ultima and Prestige holders under the bus, classic Citi.

CardUp rent payments indeed still cheaper unless you use Citi Rewards.

But hey! You get more of your miles upfront!

Why bother? Waiting until the end of May 2025 to get the bonus is ridiculous. If Citi doesn’t waive your annual fee then the miles will cost even more. If the miles were cheap ok but for miles which are already expensive no thanks.

I used cardup recently to pay my daughter’s bill for photography service. Had to provide documentary proof of relationship and non cancellable invoice. ..abit troublesome.

Can I use payall for bill under my daughter’s name? All my previous payalls are my own bills.

If they start this sort of nonsense just use Card-up. Or failing that use UOB Pay Anything where it is “no questions asked” OK, UOB Pay Anything costs a bit more, but not hugely more.

Does this apply to city reward’s original 3.6 bonus mpd?

If I clock $1000 per month City Payall for rental, do I get the bonus 3.6 mpd?

Finally, remember that if you already have an existing recurring payment in place before the start of the promotion period, you will need to cancel it and set it up again to benefit from this promotion.

Wow, I’m not aware about the above!

I always think that if the recurring payments fall within the promotion period, it will be entitled to the bonus miles! This is just a weird rule but in any case, I’ve cancelled the payments and re-submitted.

Hi, newbie to using Citi payall to pay tax. If I had set up a GIRO arrangement to deduct monthly from my bank account, can I still setup a payment via citi payall to take advantage of this promotion? what will happen to the auto deduction from my bank account?

As long as it arrives before the giro due date (6th of the month for me), the giro deduction just gets skipped that month.

ooooh thanks much!

Min spend of 5k on the Payall facility required by March… Unless your condo fees are sky-high and you are including tons of other stuff, it may be difficult to hit this 5k bar. And if you can’t then you don’t earn the 1.75mpd…