Milestone bonuses are a common feature of airline or hotel loyalty programmes, providing an incentive for continued patronage even after requalifying for elite status.

For example, Singapore Airlines has PPS Rewards and KrisFlyer Milestone Rewards, which offer upgrade vouchers or bonus miles upon accumulating a certain number of status credits. Likewise, IHG offers Milestone Rewards like confirmable suite upgrades and an annual lounge membership at various elite night tiers.

But what about credit cards? Are there any cards on the market which recognise spending milestones with bonuses beyond the usual rewards?

Which credit cards offer milestone bonuses?

While not so common in Singapore, milestone bonuses are offered by a handful of credit cards.

| 💳 Credit Card Milestone Bonuses |

||

| Card | Spend Req. (in 12 months) |

Reward |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

S$15K on SIA or Scoot tickets First Year Only |

KrisFlyer Elite Gold |

| S$10K in FCY Recurring |

18,000 miles voucher | |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

S$12K Recurring |

S$150 SIA credit |

AMEX HighFlyer Card AMEX HighFlyer Card |

S$15K on SIA, Scoot or KrisShop First Year Only |

KrisFlyer Elite Gold |

AMEX PPS Card AMEX PPS Card |

S$15K on SIA tickets Recurring |

Double KrisFlyer miles accrual voucher |

| S$75K Recurring |

50% off KrisFlyer miles redemption | |

AMEX Solitaire PPS Card AMEX Solitaire PPS Card |

S$50K on SIA tickets Recurring |

Business to First upgrade |

| S$75K Recurring |

50% off KrisFlyer miles redemption | |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

S$5K on SIA or Scoot tickets First Year Only |

KrisFlyer Elite Silver |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

S$50K Recurring |

20,000 miles |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

S$100K Recurring |

15,000 miles |

UOB Reserve Card UOB Reserve Card |

S$250K Recurring |

100,000 miles |

| S$1M Recurring |

Upgrade to Diamond Card | |

AMEX KrisFlyer Ascend: KrisFlyer Elite Gold & KrisFlyer Miles Redemption Voucher

AMEX KrisFlyer Ascend Cardholders who spend at least S$15,000 on Singapore Airlines or Scoot tickets within the first 12 months of approval will receive an upgrade to KrisFlyer Elite Gold.

If you miss that window, you won’t get another chance to try in the following membership year, unless there’s a special promotion.

Tickets must be:

- Purchased on Singapore Airlines or Scoot website or mobile app

- Originating from Singapore

- Charged in Singapore Dollars

This one-time offer is only available to a cardholder who is currently KrisFlyer Elite Silver or lower; you can’t use this to extend an existing KrisFlyer Elite Gold membership.

KrisFlyer Elite Gold is certainly useful, but if you’re spending S$15,000 on air tickets, you might be able to qualify through flying anyway- unless perhaps you were flying on Scoot exclusively, or buying tickets for someone else (since you can only earn Elite miles on tickets with your name on it, regardless of who paid).

AMEX KrisFlyer Ascend Cardholders who spend at least S$10,000 in foreign currency from 1 November to 31 October of the following year will receive an 18,000 KrisFlyer Miles Redemption Voucher (MRV).

This benefit is available each year of card membership, but is rather underwhelming due to the many restrictions on its use, and the opportunity cost involved in earning it (the Ascend earns just 1.2 mpd on overseas spend, so you might as well have used another higher-earning card from the start).

I’ve explained these in more detail in the article below.

How do the AMEX KrisFlyer Ascend Miles Redemption Vouchers work?

AMEX KrisFlyer Credit Card: S$150 SIA credits

AMEX KrisFlyer Credit Cardholders who spend at least S$12,000 (on any miles-earning transaction) between 1 July and 30 June of the following year will receive S$150 cashback, valid on their next purchase of Singapore Airlines air tickets via singaporeair.com or the Singapore Airlines mobile app.

To utilise the cashback, you must charge your air tickets to your AMEX KrisFlyer Credit Card. This only applies to flights originating from Singapore, and purchased in Singapore dollars.

The cashback is valid for 12 months, and will appear on your billing statement within 90 days of purchase. Ticket purchases via AMEX Pay Small do not qualify.

A S$150 rebate for S$12,000 spend works out to 1.25%, so it’s not exactly Christmas.

AMEX HighFlyer Card: KrisFlyer Elite Gold

AMEX KrisFlyer HighFlyer Cardholders who spend at least S$15,000 on Singapore Airlines, Scoot or KrisShop within the first 12 months of approval will receive an upgrade to KrisFlyer Elite Gold.

If you miss that window, you won’t get another chance to try in the following membership year.

This may sound very similar to what the AMEX KrisFlyer Ascend has to offer, but there are some key differences.

Apply Apply |

Apply Apply |

|

| AMEX KrisFlyer Ascend | AMEX HighFlyer Card | |

| Min. Spend | S$15,000 in first 12 months of approval | |

| Eligible Spending |

Flights must originate from Singapore and be charged in SGD |

|

| Status Validity | 12 months from date of upgrade | |

In short, the AMEX HighFlyer Card offers the easier path, because it includes KrisShop spending, and does not require flights to originate from Singapore or be charged in SGD.

AMEX PPS Card: Double KrisFlyer miles voucher & KrisFlyer redemption discount

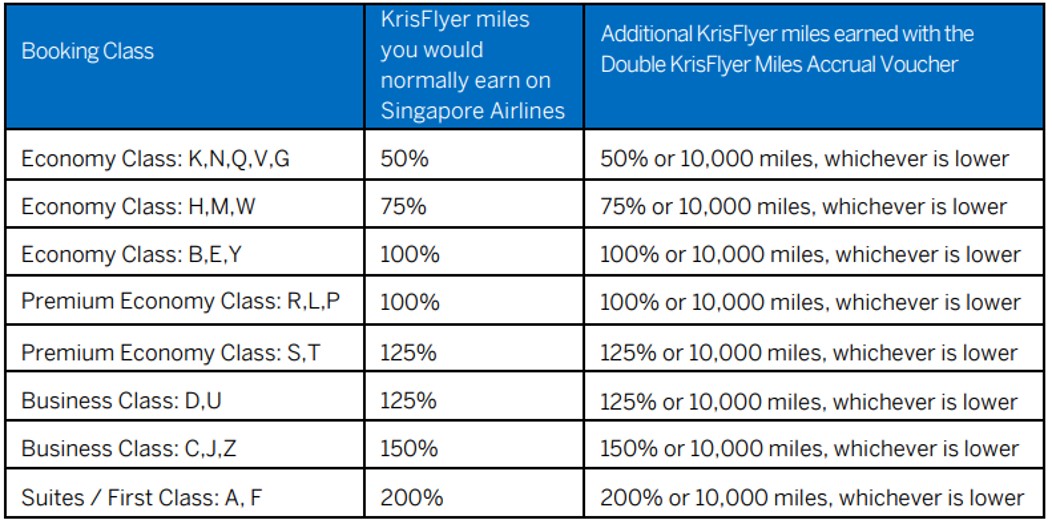

AMEX PPS Cardholders who spend S$15,000 on Singapore Airlines tickets from 1 July to 30 June of the following year will receive a double KrisFlyer miles accrual voucher.

This voucher allows members to double the KrisFlyer miles they earn on eligible flights, capped at 10,000 miles. For example, if a K class ticket normally allows you to earn 50% of the miles, you’ll earn a further 50%.

Here’s an illustration of how the voucher works:

The following conditions apply:

- All tickets must originate in Singapore, and be purchased in Singapore dollars to count towards the S$15,000 minimum spend

- Voucher can only be used by the principal cardholder, for the principal cardholder’s own travel

- An eligible booking includes a maximum of two flight segments in one booking, where the first and/or last flight must include Singapore

- Flights must be operated by Singapore Airlines

- Bookings which include Singapore as a transit point are excluded

- Codeshare flights marketed by Singapore Airlines and operated by partners are excluded, as are codeshare flights marketed by partners and operated by Singapore Airlines

- Only KrisFlyer miles are doubled; Elite miles and PPS Value stay the same.

While bonus miles are nice, I certainly wouldn’t consider this benefit to be attractive. In fact, I’d view it as “compensation” for missing out on 4 mpd opportunities when using the PPS Credit Card to buy Singapore Airlines tickets.

S$15,000 of spending means an opportunity cost of up to 30,000 miles (based on a 2 mpd differential), so 10,000 miles doesn’t even begin to make up for it!

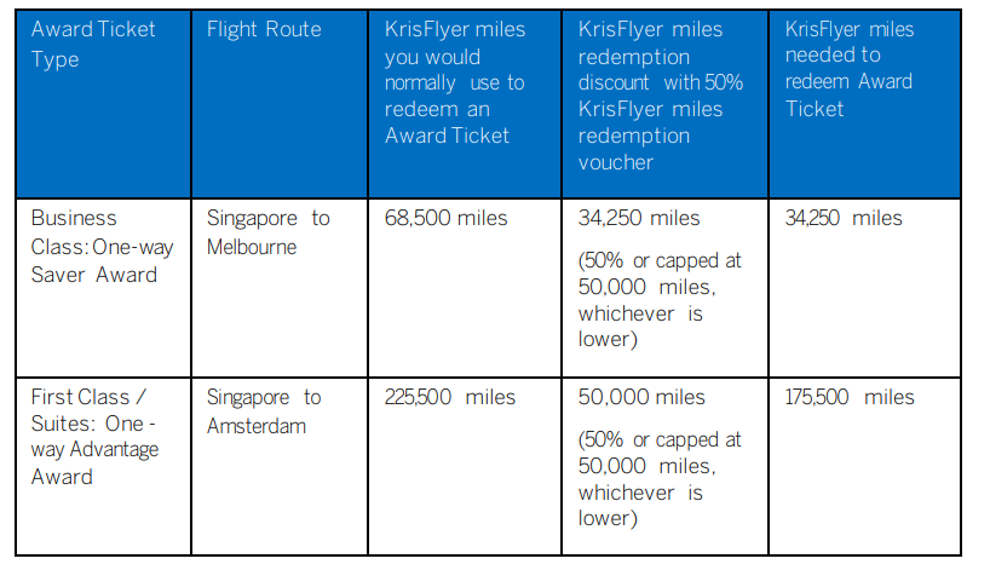

AMEX PPS Cardholders who charge at least S$75,000 (on any miles-earning transaction) from 1 July to 30 June of the following year will receive a 50% discount on a KrisFlyer miles redemption.

This voucher reduces the cost of an award booking by 50%, capped at 50,000 miles. For example, if an award flight normally costs 80,000 miles, you’ll pay 40,000 miles instead.

Here’s an illustration of how the voucher works:

The voucher can be used for a cardholder or a redemption nominee, but here’s the catch: it’s only valid for a single passenger. For example, if you’re booking 2x round-trip Business Class Saver awards from Singapore to Hong Kong (68,000 miles each, 136,000 miles total), you’ll only get a 34,000 miles discount.

The following conditions apply:

- Vouchers are only valid for flights operated by Singapore Airlines; it’s not valid for Star Alliance or other partner redemptions.

- Voucher cannot be combined with any other discount or promotion, so you can’t use it on a Spontaneous Escapes award, for example

- Bookings must be made through KrisFlyer membership services; you can’t book it by yourself online

- An eligible booking includes a maximum of two flight segments in one booking, where the first and/or last flight must include Singapore

- Bookings which include Singapore as a transit point are excluded

- Bookings made with this voucher cannot be changed

- Voucher is valid for 12 months from issuance; all bookings and travel must be within this period

These are some serious restrictions, and it does feel petty to only apply the discount to the first passenger in the booking. That’s not to mention the fact that S$75,000 is a lot of spend that could have been put on higher-earning cards. I’d much rather do that and earn more miles upfront, rather than having to deal with this highly-restricted voucher.

AMEX Solitaire PPS Card: First Class upgrade & KrisFlyer redemption discount

AMEX Solitaire PPS Cardholders who spend S$50,000 on Singapore Airlines tickets from 1 July to 30 June of the following year will receive an upgrade voucher from Business Class to Suites or First Class.

The voucher can be used for a cardholder or a redemption nominee, and the following conditions apply:

- Voucher only applies to commercial bookings (i.e. not redemption tickets) in the J, C, U or Z booking classes, operated by Singapore Airlines

- Voucher is valid for a one-sector upgrade only (e.g. if you have a round-trip SIN-LHR-SIN itinerary, only the outbound or inbound leg can be upgraded)

- Voucher must be used to book an upgrade at least 48 hours before travel commences

I love an upgrade as much as the next guy, but having to spend S$50,000 on Singapore Airlines tickets to unlock it? Again, it’s a question of opportunity cost, which could be up to 100,000 miles in an idealised scenario where you optimise the spend perfectly with 4 mpd options. That’s enough to redeem a First Class flight to Sydney outright!

AMEX Solitaire PPS Cardholders who spend at least S$75,000 (on any miles-earning transaction) from 1 July to 30 June of the following year will receive a 50% discount on a KrisFlyer miles redemption. The same terms apply as for the AMEX PPS Card.

KrisFlyer UOB Credit Card: KrisFlyer Elite Silver

KrisFlyer UOB Credit Cardholders who spend at least S$5,000 on Singapore Airlines, Scoot and/or KrisShop within the first 12 months of approval will be upgraded to KrisFlyer Elite Silver.

If you miss that window, you won’t get another chance to try in the following membership year.

Unfortunately, the KrisFlyer Elite Silver benefits are rather mediocre, with extra baggage and priority boarding the only two real perks of note.

What’s more, the status upgrade only takes place six weeks after the end of the membership year, so you’ll be waiting a while to enjoy the perks.

This one-time benefit is only available to base KrisFlyer members; you can’t use this to extend an existing KrisFlyer Elite Silver membership.

UOB PRVI Miles AMEX: 20,000 bonus miles

UOB PRVI Miles AMEX Cardholders who spend at least S$50,000 in a membership year (on any points-eligible transactions) will receive 20,000 bonus miles (in the form of 10,000 UNI$) and a waiver of the S$261.60 annual fee.

While it’s true that you might be able to get a fee waiver without having to meet the minimum spend, the 20,000 bonus miles are a nice touch.

Of course, spending S$50,000 on a general spending card like the UOB PRVI Miles will incur a fair amount of opportunity cost, and the incremental earn rate of up to 0.4 mpd (20,000 miles/S$50,000) is unlikely to make up for it!

UOB Visa Infinite Metal Card

UOB Visa Infinite Metal Cardholders who spend at least S$100,000 in a membership year (on any points-eligible transactions) will receive 15,000 bonus miles (in the form of 7,500 UNI$), provided they renew their card for the following year by paying the S$654 annual fee.

I hope you realise how miserly this “benefit” is, especially compared to the UOB PRVI Miles AMEX in the previous section. Not only do you have to spend more (S$100,000 vs S$50,000) for a smaller bonus (15,000 miles vs 20,000 miles), you also have to pay the annual fee!

Furthermore, spending S$100,000 on a general spending card like the UOB Visa Infinite Metal Card will have a lot of opportunity cost too (unless you’re spending on a category that can’t earn miles with other cards, like education), and the incremental 0.15 mpd (15,000 miles/S$100,000) isn’t going to help much!

UOB Reserve Card

UOB Reserve Cardholders who spend at least S$250,000 in a membership year (on any points-eligible transactions) will receive 100,000 bonus miles (in the form of 50,000 UNI$), provided they renew their card for the following year by paying the S$3,924 annual fee.

On a miles to spend ratio, this is at least better than what the UOB Visa Infinite Metal Card has to offer, though it’s not on the same level as the UOB PRVI Miles Card.

But hey, S$250,000 is small change for this segment, right? The real party starts when you spend at least S$1,000,000 in a membership year, because then you get an upgrade to the UOB Reserve Diamond Card, which comes with additional privileges.

|

|

|

| UOB Reserve | UOB Reserve Diamond | |

| Earn Rate |

|

|

| Points Expiry | 2 years | None |

| Lounge Access | Principal: Unlimited Priority Pass (+1 guest) Supplementary: Unlimited Priority Pass |

|

| Limo Transfers | 4 per year | |

| Meet & Assist | 2 per year | 8 per year |

| Golf Games | 4 per year | 6 per year |

| Free 2nd Hotel Night | N/A | Once per quarter |

| Meal On Us | N/A | Once per quarter |

| The physical Diamond Card has a validity of five years, but Diamond-tier privileges will be rescinded if the customer does not meet the qualifying spend in the subsequent 12-month membership period. In other words, you might have a physical UOB Reserve Diamond Card, but the features of a regular UOB Reserve Card. | ||

UOB Reserve Diamond Cardholders enjoy non-expiring points (why that’s a perk reserved only for those who spend a million dollars a year, I do not know), extra meet & assist usages, and extra golf games.

They also enjoy the 2nd hotel night free (nowhere as good as it sounds, since it’s capped at one user per quarter and S$400) and a complimentary meal for two each quarter.

What about annual fee waivers?

While many credit cards offer an annual fee waiver upon spending a certain amount in a membership year, I generally don’t consider that a “true” milestone bonus given how you can often — at least in the case of entry-level cards — get a fee waiver even without meeting that threshold.

However, it’s a different story when it comes to $120K cards. In this segment, annual fees are strictly non-waivable, though there are a few cards which will waive the annual fee if a minimum spend is met.

| 💳 Credit Card Milestone Bonuses |

||

| Card | Spend Req. (in 12 months) |

Reward |

DBS Vantage Card DBS Vantage Card |

S$60K Recurring |

Fee waiver |

Maybank Visa Infinite Maybank Visa Infinite |

S$60K Recurring |

Fee waiver |

OCBC VOYAGE OCBC VOYAGE |

S$60K Recurring |

Fee waiver |

OCBC Premier VOYAGE OCBC Premier VOYAGE |

S$30K Recurring |

Fee waiver |

| Note: Fee waivers are only available from the second membership year onwards, based on the spend in the previous membership year. The Maybank Visa Infinite waives the first year annual fee for all customers |

||

In all these cases, you will receive the same benefits as a fee-paying customer, with the exception of renewal miles (if any).

DBS Vantage Card: Accor Plus Explorer, 10 lounge visits

DBS Vantage Cardholders who spend at least S$60,000 in a membership year (on any points-eligible transactions) will receive a waiver of the S$599.50 annual fee, which is strictly non-waivable otherwise.

Cardholders who get a fee waiver will not receive the 25,000 renewal miles, but they will receive an Accor Plus Explorer membership and 10 more Priority Pass lounge visits. So the question here is whether 25,000 fewer miles is worth saving S$599.50, and unless your value of a mile is extremely high, the answer will always be yes.

| With Fee Waiver | No Fee Waiver | |

| Cost | S$0 | S$599.50 |

| Renewal Miles | 0 | 25,000 |

| Accor Plus Explorer Membership | Yes | Yes |

| 10X Priority Pass Visits | Yes | Yes |

Maybank Visa Infinite: 4x lounge visits

Maybank Visa Infinite Cardholders who spend at least S$60,000 in a membership year (on any points-eligible transactions) will receive a waiver of the S$654 annual fee.

Cardholders who get a fee waiver will still receive the same 4x lounge visits that fee-paying customers enjoy, but let’s be honest: it’s not exactly Christmas. This is an underwhelming card on the whole, and it’s hard to see why anyone would clock S$60,000 spend with it in the first place (even if you were paying insurance premiums, you can only earn rewards on S$3,000 spend per month, adding up to S$36,000 per year and far short of the threshold for a waiver).

OCBC VOYAGE & Premier VOYAGE: Unlimited DragonPass visits

OCBC VOYAGE and Premier VOYAGE Cardholders who spend at least S$60,000 and S$30,000 respectively in a membership year (on any points-eligible transactions) will receive a waiver of the S$498 annual fee.

Cardholders who get a fee waiver will not receive the 15,000 renewal miles, but they will receive an unlimited-visit Dragon Pass membership. So, similar to the DBS Vantage, the question is whether 15,000 fewer miles is worth saving S$498, and unless you value a mile more than 3.3 cents, the answer is yes.

| With Fee Waiver | No Fee Waiver | |

| Cost | S$0 | S$498 |

| Renewal Miles | 0 | 15,000 |

| Unlimited Dragon Pass Visits | Yes | Yes |

What about airport limo rides?

Some credit cards offer airport limo transfers upon meeting a certain minimum spend within a month.

I suppose you could see these as a kind of milestone bonus too, but in any case I’ve already written a separate article about airport limo benefits.

What about milestone bonuses tied to tenure?

While there are credit card milestone bonuses tied to spend, one thing we haven’t seen yet are milestone bonuses tied to tenure; in other words, rewards for holding a card for a certain number of years.

Now, this would presumably be more suitable for $120K cards with mandatory annual fees. A cardholder might be more inclined to renew if they knew they were working towards something significant, or that they’d have to start from scratch if they cancelled and reapplied another year (sunk costs, after all, are a powerful motivator of decisions even if they shouldn’t).

I’m just throwing out ideas here, but some possible tenure-related bonuses might be:

- A higher earn rate unlocked after a certain number of years (come to think of it, the Citi Prestige Card already has such a feature via its relationship bonus)

- Increasing the number of renewal miles given each year for paying the annual fee (though how long can you continue doing that for?)

- Upgrading plastic cardholders to a metal version of the card (don’t underestimate the vanity factor!)

- Waiving points conversion fees for cardholders of a certain tenure (might be difficult to implement on the back end for less tech-forward banks)

- Complimentary one-time use lounge passes (even if the card offers a lounge benefit, guests may not be included so the passes could be used for them)

While I’m sure you can think of much more exciting features, economics could be the limiting factor. A product manager for a $120K card once told me that the annual fee is barely sufficient to break even, and that cards are viewed as loss leaders to sell wealth products. If that’s true, there might not be a whole lot of wriggle room, but we can always dream…

Conclusion

Milestone rewards are a relatively uncommon feature for credit cards in Singapore, but I do think they could help drive customer usage and retention. A combination of spend and tenure-related bonuses could be a good way of gamifying a credit card, provided the bonuses are actually worth earning!

What kind of credit card milestone rewards would you like to see?

Amex Krisflyer Blue. Spend $12K 1 July – 30 June to get $150 rebate for ex SIN SQ online flight bookings.

oh yes, forgot about this one. will get it added!

I think the DBS Vantage $60k spend to get annual fee waived is “meaningful” milestone. If pay AF, get 25k miles + Accor Plus, which broadly equals the AF paid. But if AF is waived, doesn’t get the 25k miles but still get Accor Plus for free. And the pleasure of metal card and other minor benefits.

good point, actually! i’d say the accor plus falls within the wheelhouse.

Question: does paying Amex cc using Vantage (through DBS online banking) counts towards the 60k spend to waive AF? Me trying and will only know later. For sure it counts towards the DBS Mulitplier amount thresholds. Thus Amex –> GPMC –> AXS = 1.5% on Amex + one more month cash in hand count towards Multiplier + possibly count towards AF waiver.

How do you pay Amex cc with vantage ?

Please let us know if the credit card bill payment it is counted

Maybank VI gonna have different FCY rewards starting 1 Jan 2025. It can be worthwhile for people that spend in FCY quite a fair bit. Works in tandem with cheaper limo

i dunno- I think the maybank world mc will still be superior because it offers you 2.8 mpd if you spend at least $800. with maybank vi there’s no intermediate tier, so if you spend $3,999 you earn 2 mpd.