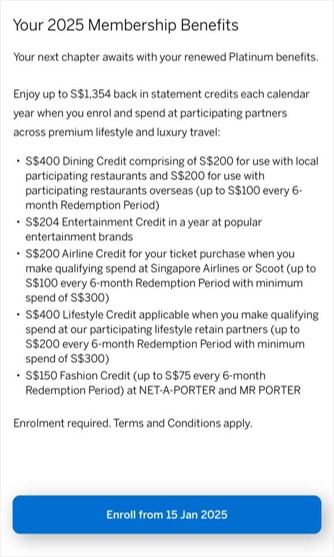

One of the biggest perks of the AMEX Platinum Charge are the Platinum Statement Credits, which cover up to S$1,354 of dining, shopping, entertainment, and travel.

These credits put a significant dent in the non-waivable S$1,744 annual fee, and since they’re awarded based on calendar year, new cardholders get to enjoy two sets of credits in their first membership year.

However, American Express has kicked off 2025 with new restrictions on these credits, by dividing their use into six-month periods. This change not only reduces the appeal of the first membership year, it’s likely to cause increased breakage due to the added effort required to fully utilise the credits— a move that’s no doubt intentional.

Moreover, the new Platinum Statement Credits will only open for registration from 15 January 2025, so you’ll need to hold off on any spending for now.

Platinum Statement Credits: What’s changed?

For 2025, American Express will be making the following changes to the Platinum Statement Credits.

| 💳 Platinum Statement Credits | ||

| 2024 | 2025 | |

| Local Dining | S$200 per yr. | S$100 per 6 mo. |

| Overseas Dining | S$200 per yr. | S$100 per 6 mo. |

| Lifestyle | S$400 per yr. (Min. S$600 spend) |

S$200 per 6 mo. (Min. S$300 spend) |

| Airline | S$200 per yr. (Min. S$600 spend) |

S$100 per 6 mo. (Min. S$300 spend) |

| Entertainment | S$17 per mo. | |

| Fashion | S$75 per 6 mo. | |

There is no change to the Entertainment credit, which will continue to be awarded as S$17 each calendar month, or the Fashion credit, which will continue to be awarded as S$75 half-yearly.

However, the Local Dining, Overseas Dining, Lifestyle and Airline credits will now be awarded half-yearly:

- The 1st credit will be awarded on 15 January 2025, and must be used by 30 June 2025

- The 2nd credit will be awarded on 1 July 2025, and must be used by 31 December 2025

The rest of the terms remain the same, with the minimum spend for Lifestyle and Airline credits cut in half to reflect the half-yearly periods.

| Min. Spend | No. of Trxns | |

| Local Dining | N/A | Single or multiple |

| Overseas Dining | N/A | Single or multiple |

| Lifestyle | S$300 | Single |

| Entertainment | N/A | Single or multiple |

| Airline | S$300 | Single or multiple |

| Fashion | N/A | Single or multiple |

As before, registration will be required, and can be done via the AMEX Offers portal on the desktop website or AMEX SG mobile app from 15 January 2025.

There is no need to enrol supplementary cardholders, and indeed, supplementary cardholder spend will not trigger the credits.

Why is American Express doing this?

Based on customer feedback and in order to enhance the cardholder experience.

American Express has two obvious goals here:

- Downsizing the “first year sweet spot” for new cardmembers

- Increasing breakage among existing cardmembers

Downsizing the “first year sweet spot”

Prior to this change, the first membership year was especially lucrative for new AMEX Platinum Charge cardholders, because in addition to the welcome bonus, they would also enjoy 2x sets of Platinum Statement Credits.

For example, if a cardholder was approved in May 2024, he would receive:

- on approval, one set of credits* to be used by 31 December 2024

- on 1 January 2025, one set of credits* to be used by 31 December 2025

*Entertainment credits are issued on a monthly basis, and the Fashion credit half-yearly

He would be perfectly at liberty to use both sets of Platinum Statement Credits and cancel his card when renewal came around in May 2025.

With the revised system, the most he can utilise is 1.5x sets, because his renewal decision will come before the second set of the second calendar year’s credits is awarded. Even if he were to apply in the second half of the year, he would still be capped at 1.5x sets, because he would miss out on the credits awarded for the first half of the year.

Increasing breakage

At the risk of stating the obvious, further subdividing annual credits into half-yearly credits means double the work to do.

Some credits (e.g. Entertainment) are relatively simple “fire and forget”, but others, like Overseas Dining and Airline, require more planning. In fact, if you don’t travel at least twice a year, once in the first half and again in the second half, you won’t be able to fully utilise the Overseas Dining credit.

| ❓ Japan exception |

|

If you plan to use the Overseas Dining credit in Japan, you’ll need to make a prepaid reservation via Pocket Concierge. So even if you’re not travelling in that particular half-year period, you could utilise the credit by making a booking for a future date. For example, I could use July-December 2025’s Overseas Dining credit for a booking that takes place in early 2026 (assuming the restaurant allows bookings that far in advance) |

American Express will no doubt argue that little has changed, because the quantum of credits has remained the same. But that says nothing about the cognitive load on the cardmember, and while it’s not rocket science, it’s hard not to feel that the screw is being turned on min-maxers.

Come to think of it though, a true min-maxer would plan their trip to straddle the June/July changeover so that they could utilise two sets of credits on a single trip…

Conclusion

AMEX Platinum Charge cardholders will face an additional hurdle to utilising their 2025 Platinum Statement Credits, with the allocation now half-yearly.

It would be one thing if AMEX softened the blow by bumping up the value of the credits slightly, or expanding the list of merchants where they could be used. Unfortunately, this is an all take, no give kind of situation.

This, together with Comoclub’s nerfing of birthday treats (which isn’t AMEX’s fault, obviously, but still), makes for an inauspicious start to the year. Maybe it’s time to start making eyes at the StanChart Beyond Card?

“Come to think of it though, a true min-maxer would plan their trip to straddle the June/July changeover so that they could utilise two sets of credits on a single trip…”

Previously, min-maxer would plan trip to straddle Dec/Jan to enjoy 2X credits, but now he will need to straddle Jun/Jul & Dec/Jan to enjoy 1.5X credits. 🤷♂️

That is the way

Seems like it is getting harder and harder to manage and maintain and track. May have just broke the camels back with this one.

So glad I cancelled a few days ago. So long Amex Charge

Amex’s bet on the existence of enough status chasers in SG that will pay almost 3X the US version, with watered down benefits to boot, is holding true. Nobody pays this annual fee to deal with UOB / BOC level of cheapo Ts&Cs, unless as a bridge to a Centurion run. This is the most overrated <$500K card in the market.

I find that the whole attitude is a little insincere. Have felt this way since we were asked to call in to get the annual renewal 20K-50K points (not miles). Seems a little demeaning (in the sense that Amex obviously has no regard for the value of our time) to have to call in to’beg’ for points (must be done soon after AF deduction, they will not award any points if you call a few months later even on 100K annual spend!!! some pretense about system rules from the CSO) after paying >$1500 AF and spending on airfare/hotels/merchants etc throughout… Read more »

HAHA. corporate entities, esp financial institutions, and sincerity in the same sentence. HAHA.

You’re right. None of them are sincere. Perhaps a better word to use is ‘respect’. As in respect for our time. Give the benefits or not at all. None of this additional registration every 6 months (what’s next, every 3 months?). Most cards only require holders to call in once a year for annual fee waivers (which I don’t, I don’t get those cards; don’t enjoy going hat in hand just for this). Those with non-waiveable annual fees at least have the decency to provide most of the benefits like renewal miles or merchant/restaurant discounts without additional steps. (Yes I… Read more »

Agree with many of the comments here…have had this card for over 25 years but been thinking about cancelling for the past couple of years cos the benefits keep getting worse and worse…but this one is probably the last straw

Perhaps if enough of us cancel and cite the reasons they will do a U-turn and offer something to get us to rejoin

Will be cancelling, join me?

Honestly, i had trouble managing the past 2+ years of continuous thinking how to use the amex credits etc – and i think i saw less value being realised than the few years back iteration of just spend and forget.

This new 6 month changeover is going to make it doubly hard on the brain!

Cancelled the card back in mid-2024, I am finally free from doing all the homework of using the coupon book and all the T&C attached. Do not miss the card at all except for unlimited lounge usage but then again don’t travel that much to fully-utilise and/or fly business class that comes with lounge access.

This will be the deal breaker for me. Actually quite happy that I would not need to think of ways to use and track their statement credit anymore.

I agree. Trying to use the local dining credit had us going out of our way to eat at Basilico this year (nice staff but the ala carte food was not up to standard except for the risotto). We used to do Yi but it’s not what it once was (maybe just us). Wooloomooloo and Una were not good for us either. We liked Odette but the $200 is insignificant for that level of spend. The only easy credits are for Entertainment (Netflix) and Airline (airport taxes). Overseas Dining Credits required some planned serendipity (oxymoron?) that took time away from… Read more »

I just renewed early Dec but was not told of these changes…….well done. Called to cancel but they said they cannot reverse membership fee and would take down my concerns and unhappiness (so maybe more of us should call in cos apparently I’m not the only one who called in). Wow. Well, they have me for another year but that’s it.

Perhaps you should file an MAS complaint and see what happens.

Not MAS, just complain to firdec. They will take action.

Unfortunately for us, they are doing something right. Singaporeans are wussies who keep complaining but continue to pay 1700+ (GST increase coming after election). They know it and there are too many poor people who pay this fee to pretend to be rich. I think my biggest gripe of all, is the amex CS. That’s the basic for a “premium” card and that has gone major downhill over the years. They’re basically the same as the bank’s outsourced concierge. My advice to the Amex SG country manager for Plat card; please bring back the income restriction; and hell increase the… Read more »

GWC weekend parking has been removed too

Only for Centurion now. Have to go from 1700 to 7500 AF if you want this

Only centurion still has it. I confirmed it earlier today at the service counter on level 2

Already not much benefit and now this nerf.. what a waste of AF