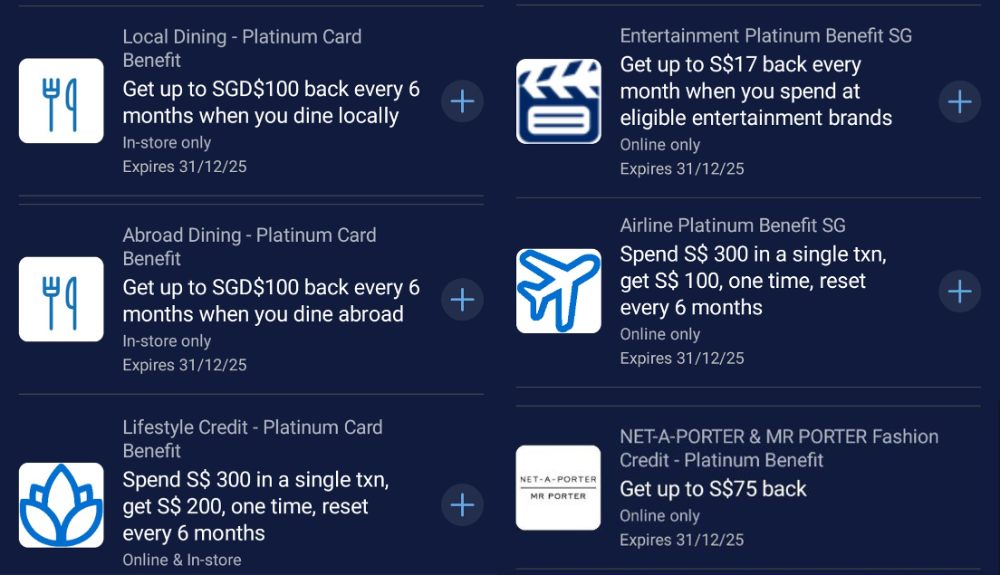

American Express kicked off 2025 by announcing some highly unpopular changes to the AMEX Platinum Charge’s annual statement credits. From this year onwards, the local dining, overseas dining, lifestyle and airline credits will be issued on a half-yearly basis, adding further complexity to a card that already requires a good deal of micromanagement.

There’s a lot of unhappiness about this switch, and while I do intend to cover that in a separate post, what I want to talk about here is the messy and haphazard manner in which American Express is rolling out the credits.

Enrolment for 2025’s credits was supposed to open on 15 January 2025, but instead, it’s gone live more than a week ahead of schedule. That might sound like a good thing, but it’s actually causing a lot of confusion, and likely to result in a lot of (completely avoidable) customer dissatisfaction.

| ⚠️ Story update: Reports are coming in that customers who enrolled their cards and spent ahead of 15 January are receiving their statement credits. |

2025 Platinum Statement Credits now live (or are they?)

On 7 January 2025, the AMEX Offers portal was updated with 2025’s Platinum Statement Credits. Cardmembers can enrol their cards without any issues, but if you’re thinking about rushing out and spending those credits now, you might want to wait.

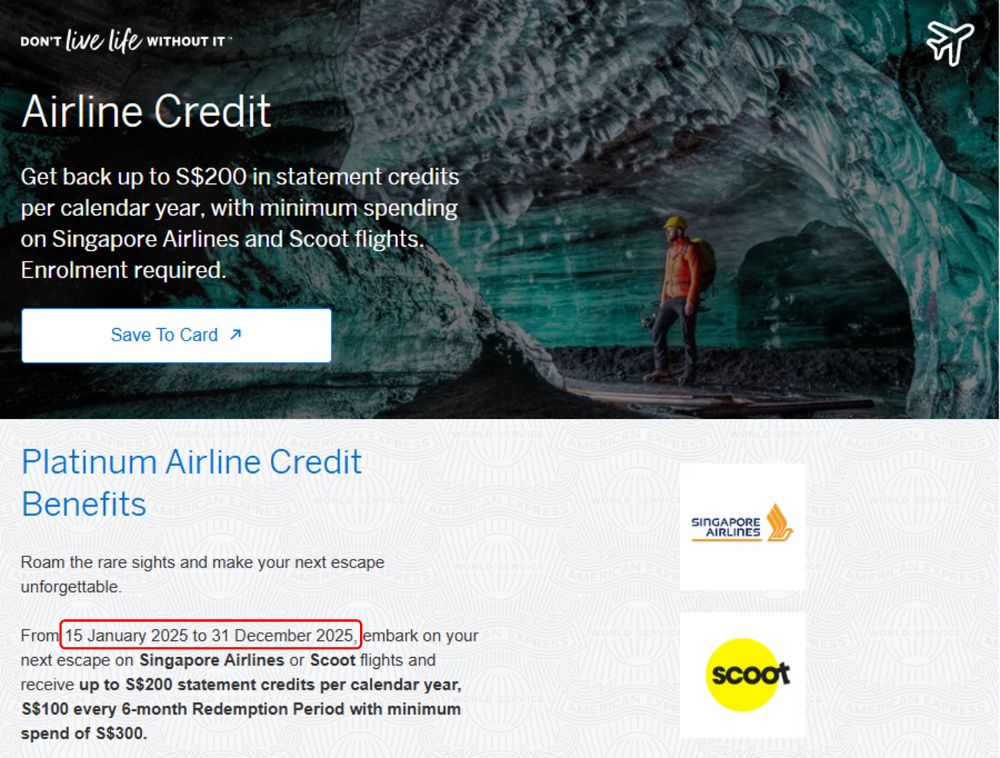

Why? Because according to American Express, the credits are for use from 15 January 2025 onwards.

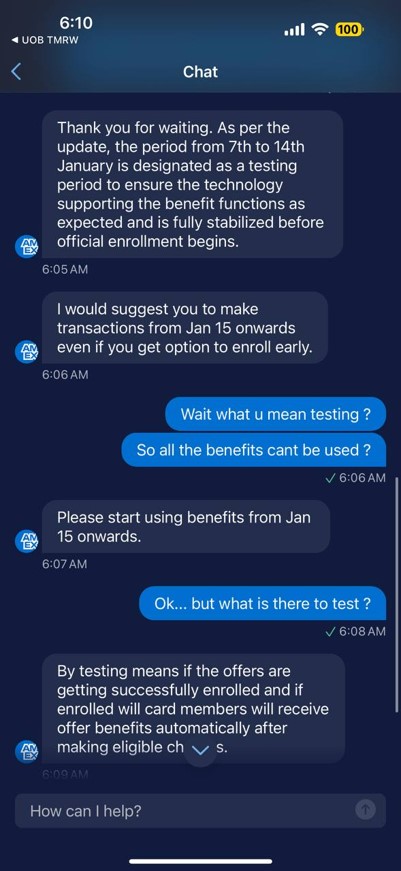

Huh? Then why release them now? Well, per the CSOs:

“The period from 7th to 14th January is designated as a testing period to ensure the technology supporting the benefit functions as expected and is fully stabilised before official enrollment begins.”

I’m no tech whiz, but isn’t that the kind of thing you’re supposed to do in a closed environment, instead of releasing it into the wild?

I mean, if cardholders see something listed in the AMEX Offers section, it’s not unreasonable for them to assume they can enrol and start using it right away. But no. According to the CSOs, the offer is live but not live, and if you spend right now, you won’t receive any statement credits.

Of course, we know better than to take what the CSOs say at face value. So I also reached out to AMEX for clarification, and was told that “officially”, you have to wait till 15 January 2025 to start spending.

Now, if this is true, then it’s very poor form indeed, because the offer terms make no mention of the start date. For example, here’s the T&Cs for the Local Dining credit.

Local Dining credit T&Cs

The terms never specify that the benefit is restricted to use from 15 January 2025. They only state that you must save the benefit to your card before making a payment. And if cardholders have done that, it’s rather devious to turn around and say “Gotcha! You should have been checking the website!”

| 🎭 Entertainment credit terms |

| In fact, if you read the offer terms for the Entertainment credit, it specifically says “The Platinum Entertainment Card Benefit will start on the date you save it to your Card and will expire on 31 December 2025″ (emphasis mine). |

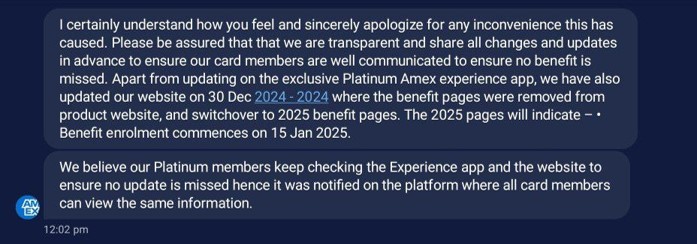

But that’s exactly what a cardmember was told, when he asked a CSO why the 15 January 2025 start date was not mentioned in the T&Cs.

I did a double take when I read this:

“We believe our Platinum members keep checking the Experience app and the website to ensure no update is missed hence it was notified on the platform where all card members can view the same information.”

Um, no. I don’t know how to tell you this, but they really don’t. At best they’ll read the T&Cs, and if it’s not mentioned there, how do you expect them to know about the restriction?

What’s frustrating is how unnecessary this problem is. Would it have been that hard to insert a line in the T&Cs which clearly states that credits can’t be used before the 15th? Isn’t that better than dealing with a bunch of angry customers clogging up your chat lines, or having to manually process appeals after the fact?

Of course, I suppose you could read between the lines of AMEX’s response, in that even though “officially” you can only start spending from 15 January 2025, “unofficially” you can start from the time of enrolment and everything will be fine.

I guess those who pulled the trigger early will find out soon enough, and for what it’s worth, I personally plan to use the Overseas Dining credit in Bangkok on the 12th. The way I see it, if I’m right I’ll have settled the credit for H1 2025, and if I’m wrong, I’ll just incur some opportunity cost in terms of the miles I could have earned with a better card.

Messy, messy, messy

American Express is normally one of the better card issuers when it comes to customer service and user experience, but they’ve dropped the ball here in a big way.

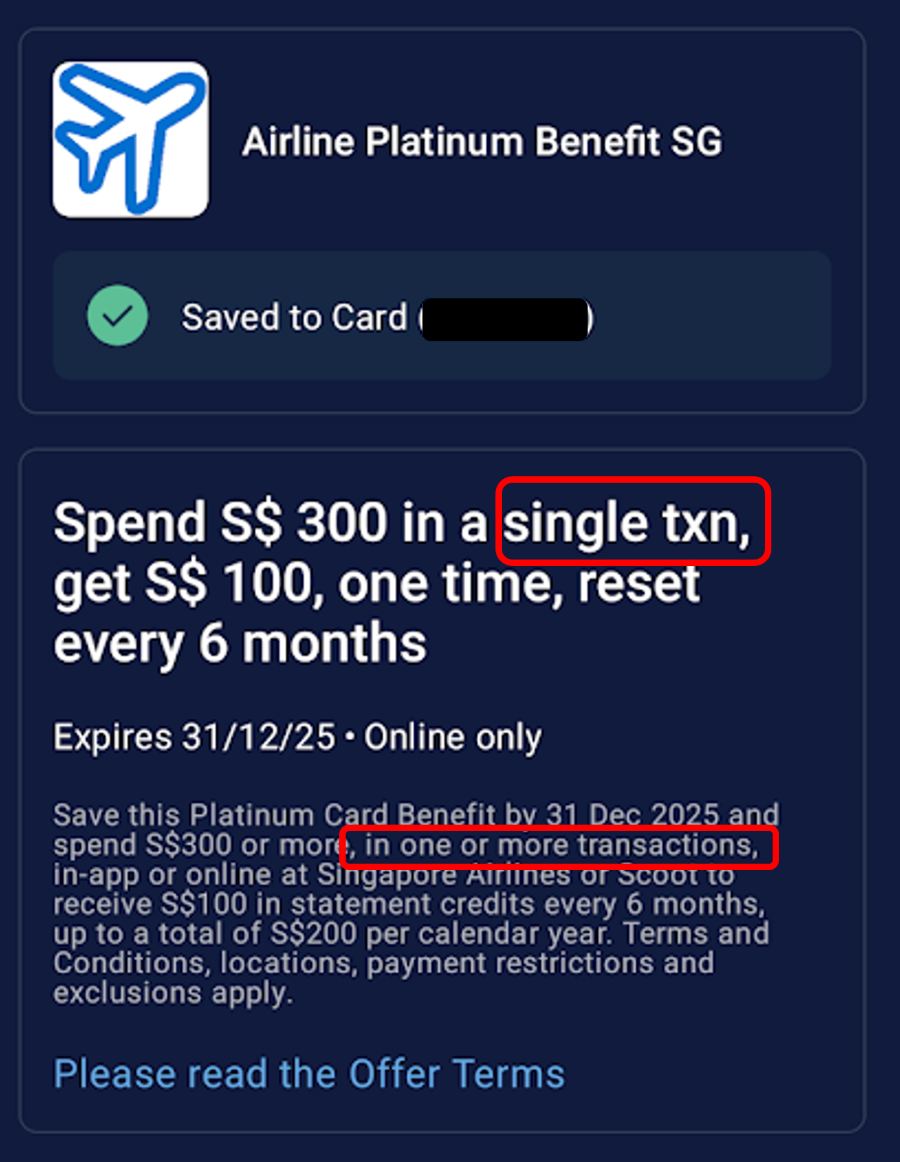

Leaving aside the can of worms they’ve opened by posting the offers ahead of schedule, there’s minor typos that can cause major headaches. For instance, the Airline credit’s headline specifies a minimum spend of S$300 in a single transaction, but the offer terms suggest the amount can be accumulated across multiple transactions.

I’ve clarified with AMEX that “single” is the correct version — which means another nerf compared to last year where the credits could be spent over multiple transactions — but how hard would it be to proofread these things?

The error has been corrected as of this morning, but there’s at least one person out there who relied on the T&Cs (and a CSO’s mistaken assurances) and made an airline spend of less than S$300. I certainly hope they do right by him, because whenever something conflicts with the T&Cs, the T&Cs should take precedence.

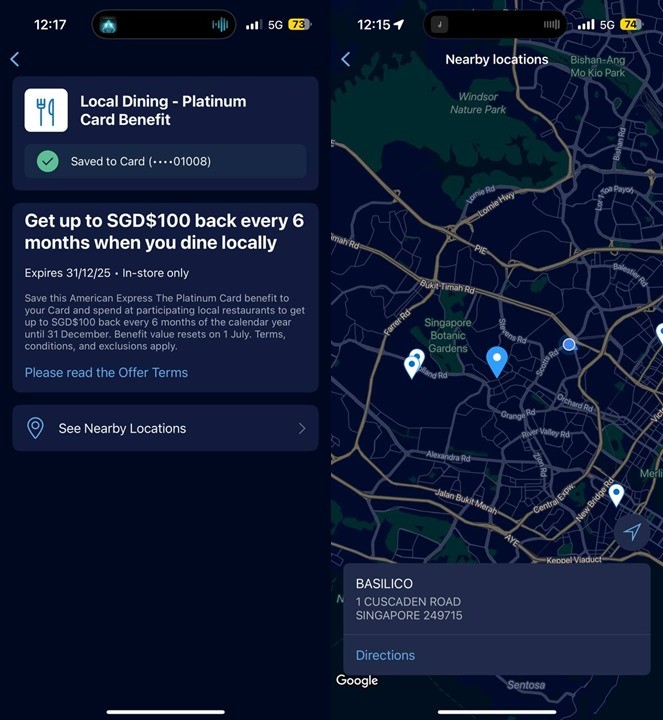

Another example of a glitch that shouldn’t have made its way into the wild can be found with the Local Dining credit. Tapping “See Nearby Locations” should bring up a list of eligible restaurants, but it mentions Basilico, which is not participating for 2025.

If a customer, relying on this information, were to go ahead and spend here (a reasonable assumption, as Basilico was a participating restaurant for the 2024 Local Dining credit), would AMEX still honour it? Errors like these feel self-inflicted, generating unnecessary work for both customers and AMEX.

Taking a step back, why is there even a blackout period from 1-14 January 2025? I understand that the rules governing the statement credits have changed, so there’s probably a need to update the backend systems, but 14 days? This seems like an issue that could have been flagged much earlier, especially for cardholders who planned post-New Year trips expecting to use their credits in early 2025.

Conclusion

AMEX Platinum Charge cardholders can now enrol for the 2025 Platinum Statement Credits, but should exercise caution with spending them ahead of 15 January 2025. Officially, you won’t get any rebates. Unofficially, well…who wants to test the waters?

American Express must surely have known that the switch to half-yearly credits would be widely loathed, so the least they could have done was make the changeover as smooth as possible. I’m willing to bet there’s a large number of cardholders who don’t use the AMEX Experiences app, who don’t read The MileLion, who simply see a new AMEX offer, enrol, and start spending. And if AMEX chooses to enforce the 15 January start date, this group is going to be frustrated (to put it mildly), especially since the offer terms fail to mention this restriction.

Not a great start to 2025, that’s for sure.

Pathetic bank. Cancelling my centurion nao!

Ya right…centurion…dream on…

What about nerd Great World complimentary parking

It’s removed in 2025, I confirmed with CSO but website not updated

I can confirm that only Centurion still has GWC parking perk. Get it at the service counter on level 2. Though I doubt many who will pay roughly 7500 AF will bother getting a queue number and wasting time for $3.60 overnight parking.

Only for Centurion. Won’t be paying 7500 for that privilege unless I park there whole day everyday (but then season parking for a year is still < 7500). Better spent on Ultima+Insignia

Also for the Entertainment rebate, my subscription is billed monthly on the 1st of each month, and this change caused me to lose out on one month’s rebate. It’s only $17 but it felt that they screwed those with billing dates before 15th of the month.

If anything, Entertainment credit is where you have the greatest grounds to raise a complaint because the T&Cs specifically say it’s valid from the time of registration.

edit: oh wait if yours was 1st of the month then no, it wouldn’t have been possible to register yet. still…

I faced the same situation and they refused to credit back to me $17. I told Amex I hope they made the right decision of losing a customer over $17! I shall not renew my card after this year.

Hey Aaron, I’m heading to bkk in early-mid Jan as well so your specific reference caught me a little off guard. Are there any participating restaurants in thailand?

plenty: https://www.americanexpress.com/en-sg/benefits/the-platinum-card/dining/global-dining-credit/

edit: oh wait thailand disappeared. odd, maybe it’ll come back

Talk about messy lol

Even the Singapore restaurants has reduced by a lot. I normally redeemed it in Wooloomooloo, but now it is also not included in as well.

Apparently, there is no overlap between the Love Dining restaurants and the dining credits fr 2025 so you can’t use both together

They didn’t give any heads up at all on these changes right? I certainty wasn’t notified via email or sms or anything on the changes nor these 15 day blackout date. Will ask for AF refund because this is too much.

Same thing happened to me. But they said annual fee will not be refunded. Even though the renewal was less than a month ago

I am cancelling it this year anyway

Agreed. All these hoops make it feel like collecting these fairprice coupon PWP or QR things that I never bother with.

Please do, and if you don’t get the credit in the stipulated period, you’ll have another article for Amex PR to comment on.

Amex: Don’t annoy your customers and most customers won’t be upset.

The way I see it, figures for 2024 were not good for SG Amex office and some big boss came in town to say “You better fix this or else…” and now we are assisting to some rushed containment plan (before bonus season ? :)). Likely we will never know. In any case, all these minor nerfs here and there have made the card painful to use, extra cognitive load for the coupon book that it truly is. There is no point getting sentimental about it, in the end it is just a mean of payment and one may not… Read more »

Amex culture and target audience changed. Look at the US Plat. And Amex’s Walmart partnerships.

In Singapore, good things never last and there is always the possibility of unnecessary changes to make things worst than ever. It is in the culture of our country.

Well done, spoken like a true loser.

I’ve been thinking of cancelling but what is the alternative card that’s comparable in terms of benefits and annual fee? I’ve been a member since 2007.

I’m not 100% convinced by the stanchart beyond, but it would probably be the closest comparable alternative. More thoughts on that in the weeks to come.

Looking forward to your great article on Stanchart Beyond

The service and value have been deopping every year. I am already planning to not renew my card this year and the recent news really confirm my decision.

It’s time to cancel this card.

I was planning on getting this card this year but this is the final straw – now I won’t. For this annual fee I want a card that’s easy to use, not one I need a spreadsheet to work out what I can and can’t use.

Does this apply to amex platinum credit card credits?

Please don’t use the overseas dining credit in Bangkok. Amex cancelled the whole program in Bangkok. There is no restaurants that you can use in Thailand anymore. A lot of restaurants are nerfed in Singapore too.

To add mess to the mess, Aaron forgot to mention, if you click the “here” in the TnC to check participating restaurant, there’s no link. Just let him, I used the map function to check and he pointed out one restaurant is not participating…urgh

Thank you for that. I’m ready to sign up.

“say only”. We’re all typical Singaporeans complaining about the nerfs. Do something, call in, email and say it sucks and cancel your card. Enough cancellations will make someone in product at Amex takes notice.

I am now chatting with the AMEX App CSO, they are trying to check if the system clocked in the airline credit I tried to redeem. I registered the Airline credit 2 days ago before buying Scoot promo tickets, FYI both the Scoot promo and AMEX benefit testing roll out the same day.

ok here is the update: after some time spent on the CSO confirmation with the backend system team, the credit will be credited to the card in 2-3 working days. I will take that as good news, I hope they will treat every card member the same and not by ‘request to appeal’ basis.

Sharing my experience – registered for the benefit on Jan 11. Booked a flight on Scoot on Jan 13 and got the $100 credit next day

https://pocket-concierge.jp/en

dead

They removed gdc for japan as well?

Hi Aaron, thanks for the article! I had no idea about needing to wait until the 15th. I went ahead and booked my hotel and airline expenses on Jan 2. Both statement credits ($200 each) posted by Jan 4!

thanks for the data point! though your case sounds weird because the credits weren’t even open for registration then…

Hi Aaron,

Is there a $200 credit for airline in 6 months, or $100 in 6 months? Also is there a $200 hotel credit? Is Carolyn holding a Singapore Amex Platinum Charge card? Could it be the US version to me which is vastly superior $200 airline $200 hotel $240 Entertainment/Netflix/Spotify $155 Walmart $200 Uber $199 CLEAR in 12 months (not 6 months) No minimum spend to get credits. Saks $50 6 monthly. For a $695 annual fee, all in USD of course.

Today’s email says to collect the red packets ourselves from Raffles City level 3. Don’t remember receiving this email before in previous years. So now they are trying to save postage to our home address. Total cost to drive down to Raffles City, park, then go to level 3 to show them the email with our redemption number to collect red packets would be on us, just to save them about $1 per cardmember. These must be priceless red packets to be worth so much of our time. Truly a premium coupon clipping experience. I’ve already received red packets in… Read more »

This is a good move from AMEX, much as I don’t like the 2025 credits situation too.

Have you thought about how many red packets are wasted every year? And how many different financial institutions give a big stack of red packets to their customers?

And well, if you’re still complaining about this, either you have got a battalion of extended family kids to dole red packets to, or maybe it’s just a FOMO issue that you didn’t get the shiny nice red packets to keep in your storeroom this year.

Actually kind of like it mailed to us for convenience. Probably worse for the environment if we all make a trip to Raffles City. We give out close to 100 red packets every year. Most free angbaos are in packs of eight so we don’t usually have many left over. Maybe a few unused spares that we have on hand for when we bump into acquaintances or at our favorite chinese restaurants.

the angbao inside is tissue isit