CardUp has announced its 2025 income tax promotion, which features a discounted 1.75% admin fee for recurring payments made with a Visa or UnionPay card.

This allows cardholders to buy miles from as little as 0.86 cents each, depending on what card they hold. It’s a very competitive price already, but those who can afford to wait may wish to see what offer Citi PayAll has lined up for this year.

CardUp offering 1.75% fee for income tax

Recurring payments

|

|

| Code | MLTAX25R |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 25 March 2026 |

| Eligible Cards | Visa, UnionPay |

| MLTAX25R T&Cs | |

CardUp customers can use the promo code MLTAX25R to enjoy a 1.75% fee for recurring income tax payments, instead of the usual 2.25% (technically 2.6%, but for CardUp’s year-round OFF225 offer).

The code is valid for up to 11 monthly recurring personal income tax payments, and the earliest due date you can select will be from 7 May 2025 onwards.

| ❓ Why 11 months and not 12? |

|

“CardUp pays in advance. You can only set up 11 months of payments on CardUp, not 12. The reason for this is that the first payment of each new tax cycle should be deducted through GIRO, as mandated by IRAS. This ensures that your GIRO remains active and valid.” |

Here’s the key details of this promotion:

- All payments must be scheduled by 31 August 2025, 6 p.m Singapore time

- Payment due dates must be on or before 25 March 2026

- Only valid for Singapore-issued Visa or UnionPay cards

- Valid for up to two redemptions per user

- Valid for both new and existing CardUp users

One-off payments

|

|

| Code | VTAX25ONE |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 23 May 2025, 6 p.m |

| Due Date By | 26 May 2025 |

| Eligible Cards | Visa, UnionPay |

| VTAX25ONE T&Cs | |

CardUp customers can use the promo code VTAX25ONE to enjoy a 1.75% fee for one-off income tax payments, instead of the usual 2.6%.

Here’s the key details of this promotion:

- All payments must be scheduled by 23 May 2025, 6 p.m Singapore time

- Payment due dates must be on or before 26 May 2025

- Only valid for Singapore-issued Visa or UnionPay cards

- Valid for up to two redemptions per user

- Valid for both new and existing CardUp users

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given their earn rates and a 1.75% admin fee.

| Card | Earn Rate | Cost Per Mile (1.75% fee) |

Chocolate Visa Card Chocolate Visa CardApply |

2 mpd* | 0.86¢ |

DBS Insignia Card DBS Insignia CardApply |

1.6 mpd | 1.07¢ |

UOB Reserve Card UOB Reserve CardApply |

1.6 mpd | 1.07¢ |

OCBC VOYAGE Card OCBC VOYAGE Card(Premier, PPC, BOS) Apply |

1.6 mpd | 1.07¢ |

Citi ULTIMA Card Citi ULTIMA CardApply |

1.6 mpd | 1.07¢ |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd | 1.15¢ |

StanChart Visa Infinite Card StanChart Visa Infinite CardApply |

1.4 mpd^ | 1.23¢ |

UOB PRVI Miles Visa Card UOB PRVI Miles Visa CardApply |

1.4 mpd | 1.23¢ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

1.4 mpd | 1.23¢ |

OCBC VOYAGE Card OCBC VOYAGE CardApply |

1.3 mpd |

1.32¢ |

OCBC 90°N Visa Card OCBC 90°N Visa CardApply |

1.3 mpd | 1.32¢ |

DBS Altitude Visa Card DBS Altitude Visa CardApply |

1.3 mpd | 1.32¢ |

OCBC Premier Visa Infinite Card OCBC Premier Visa Infinite CardApply |

1.28 mpd | 1.34¢ |

Citi PremierMiles Visa Card Citi PremierMiles Visa Card |

1.2 mpd | 1.43¢ |

Maybank Visa Infinite Card Maybank Visa Infinite CardApply |

1.2 mpd | 1.43¢ |

StanChart Journey Card StanChart Journey CardApply |

1.2 mpd | 1.43¢ |

| *Capped at S$1,000 per calendar month, after which 0.4 mpd ^With a minimum spend of S$2,000 per statement month, otherwise 1 mpd (1.72 cpm). CardUp spending counts towards the minimum spend |

||

| 💳 OCBC customer? |

|

OCBC cardholders can take advantage of a lower fee:

|

To illustrate how this works, suppose you have a S$1,000 tax bill and make a one-off payment with CardUp:

- S$1,017.50 will be charged to your credit card (S$1,000 bill + 1.75% fee)

- Assuming a 1.4 mpd card, you will earn 1,425 miles (S$1,017.50 x 1.4 mpd; ignoring rounding)

- Given a S$17.50 fee, the cost per mile is 1.23 cents each (S$17.50/1,425 miles)

Remember, both the tax payment amount and the CardUp fee are eligible to earn miles.

The Chocolate Visa Card gives the lowest cost per mile (at least for payments up to S$1,000 per month), but I’m more inclined to conserve its 2 mpd cap for transactions that are normally ineligible for rewards, such as charitable donations, government services, education, insurance premiums and utilities. Alternatively, I might consider using it for foreign currency spending, as it does not have any foreign currency transaction fees.

Assuming you don’t qualify for ultra-premium cards like the Citi ULTIMA, DBS Insignia or UOB Reserve (all 1.6 mpd), then the next best alternatives would be the DBS Vantage (1.5 mpd) or UOB PRVI Miles Visa (1.4 mpd).

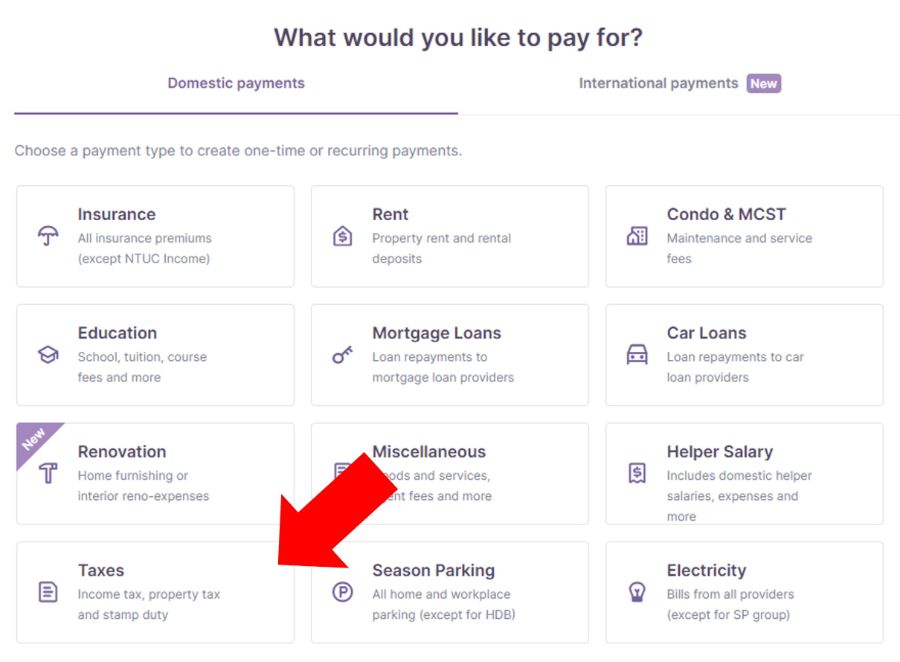

How to set up income tax payments

To schedule an income tax payment, login to your CardUp account and click on Create Payment > Taxes > IRAS-Income Tax

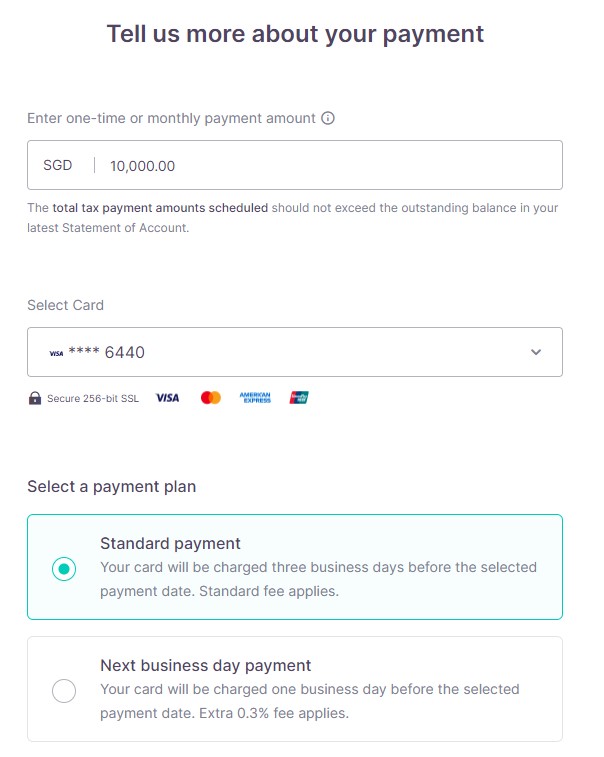

On the next screen, you’ll be prompted to enter the payment amount, choose a card (remember: Visa only), and a payment plan (the code is only valid for Standard payments).

Your payment reference number will be automatically filled based on the NRIC number registered to your CardUp account. This means you can’t use your CardUp account to pay someone else’s taxes, though someone else can use your credit card to pay taxes from their personal CardUp account.

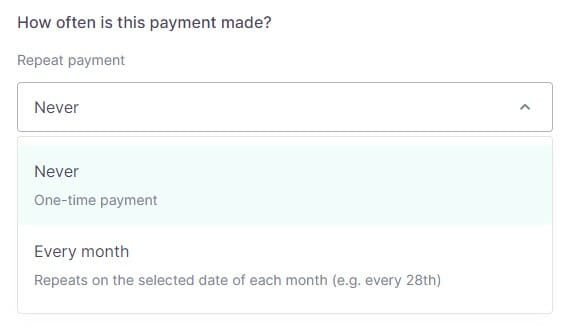

You’ll also be prompted to choose whether you want this to be a one-time payment, or recurring payment.

One-time payment

Under this option, you can pay any amount up to the total tax due on your NOA.

In other words, if your tax bill is S$10,000, you can pay any amount up to S$10,000.

Recurring payment

Under this option, you can use CardUp to pay your monthly instalment under a GIRO plan with IRAS.

This can be set up via the following methods:

- Instant

- myTax portal (DBS/POSB, OCBC, UOB, Bank of China, HSBC, Maybank)

- 3 working days

- Bank portal (DBS/POSB, OCBC, UOB)

- AXS stations (DBS/POSB)

- 3 weeks processing

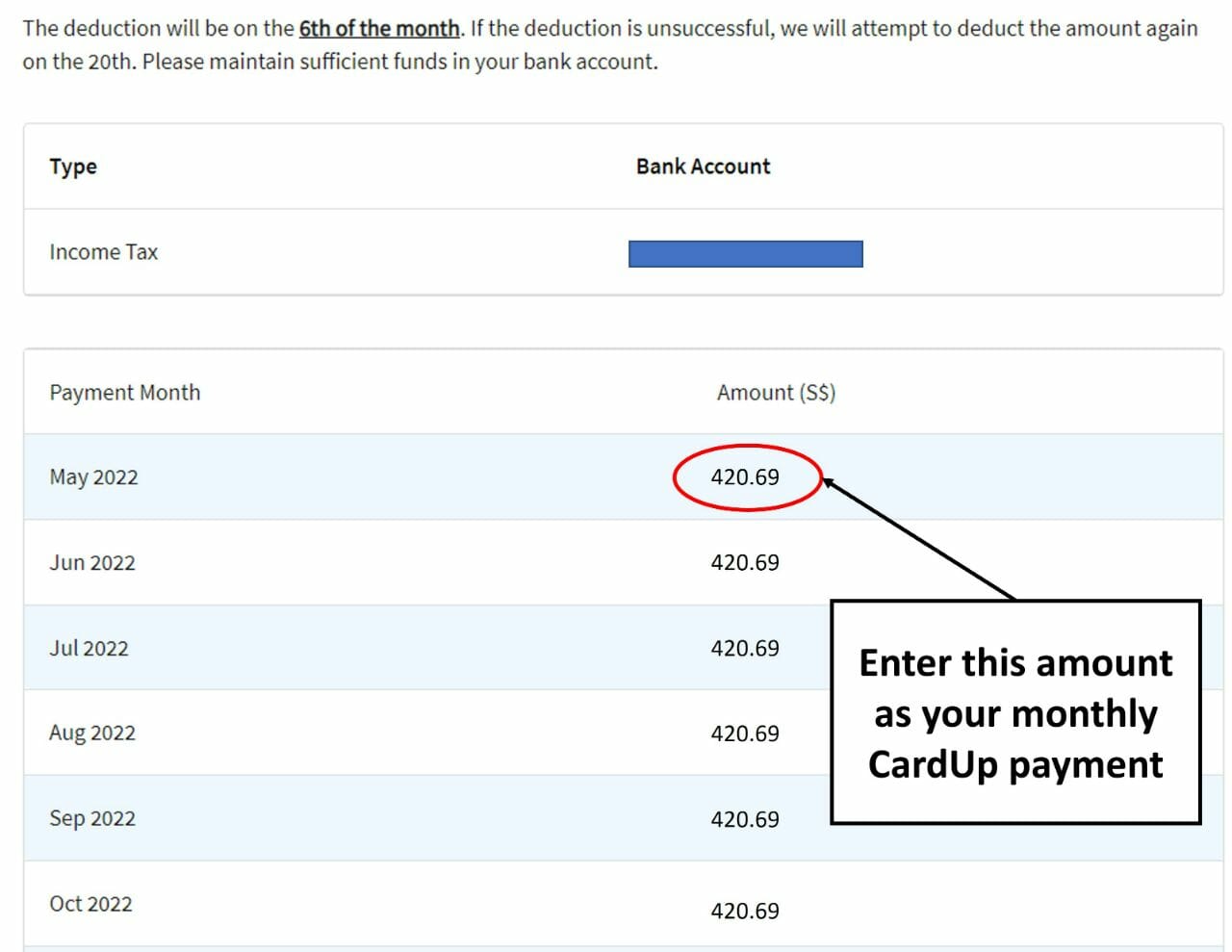

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal.

You’ll need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

Regardless of whether you choose one-time or recurring, don’t forget to enter the relevant promo code. Don’t worry that the total fee doesn’t reflect the discount yet. That will appear on the final screen.

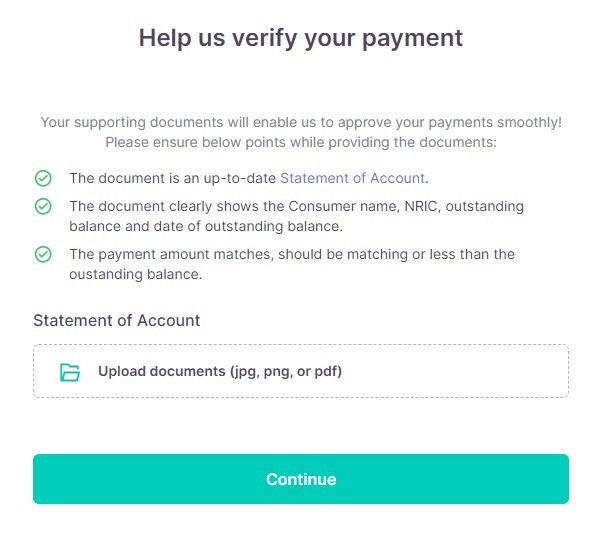

On the next screen, you’ll be prompted to upload a copy of your NOA for verification. This is to ensure you aren’t using CardUp to overpay your tax bill, which is a big no-no from an IRAS point of view.

Finally, you’ll be able to review the payment schedule before confirming it. Check that every payment in the recurring series enjoys the 1.75% rate (the last payment due date must be on or before 25 March 2026).

Conclusion

CardUp is now offering a 1.75% fee with the code MLTAX25R for income tax payments made with Visa or UnionPay cards, for payments set up by 31 August 2025. This allows the purchase of miles from as little as 0.86 cents each, depending on card.

It remains to be seen what other providers (especially Citi PayAll) come up with, but if your first instalment payment is due soon, it doesn’t hurt to use this code to cover it first.

Tried both codes. Neither work.

Try harder, MLTAX25R worked, just used it.

It works for Income Tax but not Property Tax. Which is weird. As last year the code worked for both Income and Property Tax.

No code for Mastercard this year? Ipm offering 1.99% hoping for lower from CU!

Do you think there will be a discount code for Master cards?

i understand it’s in the works, but may take a few more weeks.

I set up the GIRO plan with DBS last year (so it’s continuing this year as well). I’ve just set it up the payments using CardUp but I stil see my DBS account associated with the GIRO plan. Is this what I am supposed to see even when I set up the payments with CardUp?

Yes, the GIRO will still be in effect.

But will not go through if the cardup payment goes through

Great article! Do you know if the chocolate card will be a viable option for earning 2mpd for the first 1k per month of income tax payments with CardUp? And would it be possible to pay the first $1k of the bill using Cardup and then pay the remainder via bank transfer/giro? Not sure if multiple transactions for 1 tax bill would work.

Can, if you have giro

So for first month, there will be two deductions one on 6th and 13th for ex?

Hi Aaron, thanks for the article.

You have listed DBS Altitude Card but I noticed that under the DBS T&Cs, it excludes MCC 7399 in which Cardup uses.

Please advise and confirm whether it can be used and earned the miles for using CardUp for my recurring Income Tax payment.

Hope to receive your kind response, thanks again!

Ben

following this as I’m also intending to use the Altitude!

https://milelion.com/2024/04/04/clarified-using-cardup-rental-for-dbs-welcome-offers/

read this.

Thank you Aaron. Have been waiting for this article to come out to plan for my mileage strategy for the YA2025 income tax.

Is there a limit on the amount of income tax that can qualify for the promo rate and miles earned? I will be pairing with DBS insignia card

Based on my understanding, there’s no cap on the promo rate and miles earned if paired with DBS insignia card, would appreciate if @Aaron can help confirm this? Thanks!

Hi Aaron, Can i confirm the due date for VTAX25ONE is 26 May 2025 or is it May 2026 ?

What does “2x redemptions per user” mean? Does it mean it only works for 2 months for recurring payments?

no, it means you can use the code a total of 2 times, each one for a recurring payment arrangement of 12 months. i realise that may sound weird, since you can only pay your own taxes and not someone else’s. but what cardup told me is that in previous years they’ve had situations where people may want to pay a few month’s taxes via cardup first, then stop, then resume again later. this is to allow for that.

can i check how will the miles be credited?

unable to use cardup with choc card. it says authentication issue, anyone else having such issue?

Same here, have authentication issue

i managed to add my chocolate card, but i have heard that some people encounter issues. worth writing into cardup to check

Thank you, Aaron. Is it possible to set up a lower amount via CardUp, and let the balance get debited via GIRO on 6th? If I want to use Chocolate to pay $1000 via CardUp, and rest via GIRO, how should I go about it?

Hello there, does anyone have experiencing paying income tax using card up and may know what MCC code they will be posting under? I am thinking to use UOB Privi and DBS altitude, i had tried rent on UOB before but was denied :(, so wanted to be extra cautious this time.

Anyone faced issues when paying ur income tax with cardup + chocolate finance visa? it states that the card is being rejected. Is there a new cap for the chocolate card that i am not aware of? Many thanks. 🙂