Back in March 2025, Instarem stopped awarding InstaPoints for card-linked Amaze transactions. This effectively forced cardholders to choose between earning InstaPoints or credit card rewards, and with a meagre earn rate of 0.5 InstaPoints per S$1 (0.17 mpd), there was only going to be one winner.

But InstaPoints might not be dead just yet, because Instarem is now offering 6 InstaPoints per S$1 (2 mpd) on wallet-linked Amaze transactions in the dining, hotel, and travel categories. The offer was originally set to expire on 31 July 2025, but has now been extended till 31 August 2025.

This has the potential to be very compelling— especially for foreign currency (FCY) spend, where you’ll enjoy Amaze’s FX rates while still earning miles on your spend (remember, Amaze offers superior rates for wallet-linked transactions compared to card-linked ones).

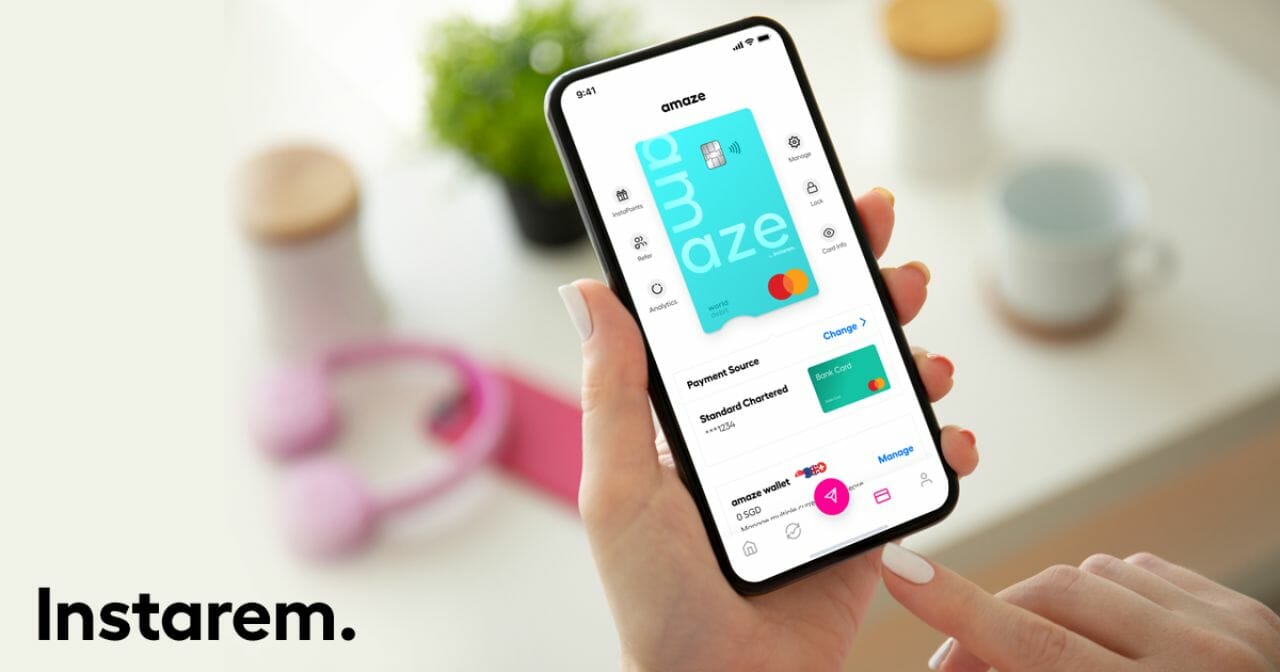

|

| Apply here |

| Review |

| Use code MILELION for 1,000 KrisFlyer miles (in the form of 3,000 InstaPoints) |

Amaze offering 2 mpd on dining, hotel and travel spend

From 2 June to 31 August 2025, transactions made with a wallet-linked Amaze Card will earn an uncapped 6 InstaPoints per S$1 (2 mpd) on dining, hotel and travel spend, defined below.

| MCC | Examples (non-exhaustive) |

| 4121 Taxicabs and Limousines |

Uber, Grab, DiDi Taxi |

| 4722 Travel Agencies and Tour Operators |

Traveloka, Klook, Pelago |

| 5812 Eating Places and Restaurants |

Hai Di Lao, Jumbo Seafood, Paradise Group |

| 5814 Fast Food Restaurants |

Burger King, McDonald’s, KFC |

| 5499 Misc. Food Stores |

FamilyMart, 7-Eleven, Lawson |

| 7011 Lodging- Hotels, Motels & Resorts |

Airbnb, Pan Pacific, Montigo |

Both SGD and FCY spend are eligible for this promotion, and while Amaze charges a 1% domestic fee on all SGD-denominated transactions ever since 10 March 2025, this only applies to card-linked transactions, not wallet-linked ones.

As always, any transaction less than S$10 will not earn InstaPoints, nor will card-linked transactions.

For the avoidance of doubt, the promotional rate of 6 InstaPoints per S$1 already includes the base rate of 0.5 InstaPoints per S$1.

Is it worth it?

Amaze wallet top-ups can only be done via PayNow, so it’s not possible to double dip on credit card miles. In other words, you either earn credit card miles, or InstaPoints.

With that in mind, are there any situations where this promotion would be worth giving up credit card miles?

For SGD spend

I’m a bit hesitant about recommending the Amaze for SGD spend, because there are many cards which can earn up to 4 mpd on dining, hotels and travel spend.

Even if those bonus caps were exhausted, you could use the KrisFlyer UOB Credit Card to earn an uncapped 2.4 mpd on the following MCCs:

- MCC 4121 Taxicabs and Limousines

- MCC 5812 Eating Places and Restaurants

- MCC 5814 Fast Food Restaurants

- Selected OTAs under MCC 4722 e.g. Agoda, Booking.com, Traveloka, Trip.com, Pelago (3 mpd)

This requires a minimum spend of S$800 on Singapore Airlines, Scoot or KrisShop in a membership year (or S$1,000, if your card was renewed or approved from December 2024).

That said, if you’re dealing with other MCCs, or simply don’t have a KrisFlyer UOB Credit Card, then an uncapped 2 mpd would be the next best option.

For FCY spend

I’m a lot more enthusiastic about this, because wallet-linked Amaze Card transactions enjoy substantially better FX rates than credit cards.

“Doesn’t Amaze have a 2% spread over Mastercard rates?” you ask. Yes— for card-linked transactions. For wallet-linked transactions, you can expect rates that are very close to mid-market, at least for supported currencies on weekdays.

| 💳 Amaze Wallet Supported Currencies | |

|

|

Do note that there will be a spread on weekends (~1%) and during periods of high currency volatility. Also, the exchange rate for unsupported currencies will be based on the prevailing Mastercard rate.

But in an ideal situation, this can be an opportunity to earn an uncapped 2 mpd on selected FCY spend, with minimal spreads.

Of course, for other categories of FCY spend, you’re going to want to stick to the following options.

| Card | Earn Rate | FCY Fee | CPM |

UOB Visa Signature UOB Visa Signature |

4 mpd | 3.25% | 0.81¢ |

DCS Imperium Card DCS Imperium Card |

4 mpd | 3.25% | 0.81¢ |

StanChart Beyond Card (PP) StanChart Beyond Card (PP) |

4 mpd | 3.5% | 0.88¢ |

StanChart Beyond Card (PB) StanChart Beyond Card (PB) |

3.5 mpd | 3.5% | 1¢ |

Maybank World Mastercard Maybank World Mastercard |

3.2 mpd | 3.25% | 1.02¢ |

Maybank Visa Infinite Maybank Visa Infinite |

3.2 mpd | 3.25% | 1.02¢ |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.8 mpd | 3.25% | 1.16¢ |

StanChart Beyond Card (Regular) StanChart Beyond Card (Regular) |

3 mpd | 3.5% | 1.17¢ |

StanChart Visa Infinite StanChart Visa Infinite |

3 mpd | 3.5% | 1.17¢ |

You can read more about these in the article below.

What about the Chocolate Visa Card?

|

|

|

| Amaze Card | Chocolate Visa | |

| Earn Rate | 2 mpd | 1 mpd |

| Eligibility | Dining, hotel, travel | All spend |

| Cap | No cap | S$1,000 per c. month |

| Points Currency | KrisFlyer miles | Max Miles |

| FX Rates | Amaze & Mastercard | Visa |

The Chocolate Visa Card is another option for earning miles on FCY spend without FCY transaction fees, so how do the two compare?

First, the Amaze Card’s 2 mpd earn rate is uncapped, but only covers dining, hotel and travel. The Chocolate Visa Card’s 1 mpd earn rate is capped at S$1,000 per calendar month, but covers all categories of spending (though remember that so-called “bill payments” are capped at 100 miles per month).

Second, InstaPoints earned by the Amaze Card can only be converted into KrisFlyer miles, while Max Miles earned by the Chocolate Visa can be converted into 28 airline and hotel loyalty programmes.

Third, the Amaze Card uses its own FX rates for supported currencies (which can be close to mid-market), or Mastercard rates for unsupported currencies. The Chocolate Visa Card uses Visa rates which are usually ~0.3-0.5% above mid-market.

Beware of orphan points!

|

|

| InstaPoints | KrisFlyer miles |

| 1,200 points | 400 miles |

| No conversion fees; all conversions are instant | |

One important thing to remember: InstaPoints can be converted into KrisFlyer miles at a rate of 1,200 points = 400 miles.

Any points outside these blocks are effectively orphaned— unless you fancy spending 100 points for S$1.25 off an Instarem overseas funds transfer. Therefore, you’ll want to watch your spending and make sure it’s in blocks of S$200.

Terms and Conditions

The T&Cs of this promotion can be found here.

Conclusion

|

| Apply here |

| Review |

| Use code MILELION for 1,000 KrisFlyer miles (in the form of 3,000 InstaPoints) |

From now till 31 August 2025, transactions with a wallet-linked Amaze Card will earn 6 InstaPoints per S$1 (2 mpd) on dining, hotel and travel spend.

While this can’t be stacked with credit card rewards, I can see a case for picking Amaze in situations where you can earn 2 mpd on FCY spend with minimal FX spreads.

Just be careful to keep your spending in blocks of S$200 to avoid orphan points, and preferably in currencies supported by the Amaze wallet for better rates.

Would be a lot more interesting if it’s a broad 2mpd.

Unfortunately, can’t trust them anymore as they’ve changed their offerings too often for my comfort.

My guess is that Instarem has had a huge drop in card usage, their business is bleeding, and this is an attempt to get some to start using the card again. Suspect will take a lot more than this though………..

With the previous nerfs, I have already changed my card mix from citi (mainly for the convenience of citi reward + amaze) to UOB. This current “promotion” is just too little incentive to dig out the amaze card again. Believe I’m not the only one.

Hi to be careful with hotels and restaurants MCC though. Many big hotel chains have their own MCC and won’t code as 7011.