On 11 February 2025, Chocolate Finance partnered up with HeyMax to offer Chocolate Visa Debit Cardholders 2 Max Miles per S$1 on virtually everything — even AXS, charitable donations, education, hospitals, insurance premiums, and utilities.

This was really too good to be true, and as expected, AXS transactions were quickly blocked. Barely a few months later, Chocolate announced that it would be cutting earn rates in half, and placing a monthly cap of 100 miles on all bill payments.

That nerf came into effect on 1 July 2025, so it’s time to update this post with the latest information.

| Note: This article is only intended to cover the Chocolate Visa Card x HeyMax tie-up. If you have questions about the Chocolate Finance account specifically, do refer to their official FAQs. |

Opening a Chocolate Visa card and linking to HeyMax

How do I create a Chocolate Visa?

|

| Download |

To create a Chocolate Visa Card, you’ll first need to open a Chocolate Finance account. This can be created by downloading the app and registering using SingPass MyInfo.

Once completed, you’ll be able to add funds and instantly create a Chocolate Visa Card (you must have at least S$0.01 in your account to create a card).

A virtual card will be issued immediately, which can be used for online transactions, or added to Apple Pay or Google Pay for in-store payments using your mobile phone. There’s also the option of ordering a physical card, if you need a fallback option for situations where contactless payments aren’t accepted.

My physical card took about five days to be received, but with the recent surge in applications, you should expect wait times of 4-5 weeks.

How do I create a HeyMax account and link my Chocolate Visa?

|

| 👍 250 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 250 Max Miles as a welcome bonus |

| 250 bonus Max Miles |

To earn Max Miles with the Chocolate Visa Card, you’ll need to create a HeyMax account.

Once done, you must pair the Chocolate Visa Card with HeyMax under Your Cards > Add Card. A test transaction of S$0.01 will be charged and refunded within 14 days.

Can I earn Max Miles for transactions made prior to linking?

No. Be sure to link your Chocolate Visa to HeyMax before making any transactions.

Can I link more than one Chocolate Visa to a given HeyMax account?

No. You can link a maximum of one Chocolate Visa Card to one HeyMax account at any time.

In any case, the monthly bonus cap is set at the HeyMax account level, not the Chocolate Visa Card level. In other words, even if you were to link and unlink multiple Chocolate Visa Cards, your account would still be capped at earning 1 Max Mile per S$1 at a maximum of S$1,000 per calendar month.

Does the Chocolate Visa have any annual fee?

No.

Does the Chocolate Visa have any minimum income requirement?

No.

Earning Max Miles

How many Max Miles will I earn?

The Chocolate Visa Card awards:

- 1 Max Mile per S$1 on the first S$1,000 of spend per calendar month

- 0.4 Max Miles per S$1 on all spend above S$1,000 per calendar month

For example, spending S$1,500 would earn you 1,200 Max Miles (S$1,000 @ 1 mpd + S$500 @ 0.4 mpd).

This applies to both online and offline transactions, in local or foreign currency (FCY).

Do note that the cap is based on the HeyMax account level, not the Chocolate Visa Card level. For example, if you were to pair one Chocolate Visa Card with your HeyMax account, spend S$1,000, then delink it and pair a second Chocolate Visa Card to the same HeyMax account, any subsequent spending on the second card would earn only 0.4 Max Miles per S$1.

You cannot combine or pool Max Miles across different accounts.

What transactions are excluded from rewards?

Transactions with the following MCCs will be ineligible to earn Max Miles.

| ❌ Excluded Transactions | |

| MCC | Merchant Category Name |

| 4829 | Money Transfer |

| 6010 | Financial Institutions – Manual Cash Disbursements |

| 6011 | Financial Institutions – Automated Cash Disbursements |

| 6012 | Financial Institutions – Merchandise, Services and Debt Repayment |

| 6050 | Quasi Cash – Financial Institutions, Merchandise, Services |

| 6051 | Non-Financial Institutions – Foreign Currency, Money Orders (Not Wire Transfer), Stored Value Card/Load, Travelers Cheques, and Debt Repayment |

| 6529 | Quasi Cash – Remote Stored Value Load – Financial |

| 6530 | Quasi Cash – Remote Stored Value Load – Merchant |

| 6540 | Non-Financial Institutions – Stored Value Card |

| – | Wallet top-ups such as EZ-Link & SimplyGo wallet |

| – | Payments at AXS |

These MCCs are related to money transfers and prepaid account top-ups, like GrabPay and YouTrip.

What transactions are subject to earning caps?

From 1 July 2025, Chocolate Visa Cardholders are capped at earning a maximum of 100 Max Miles per calendar month from bill payments, defined as transactions with the following MCCs.

| MCC | Category |

| MCC 4900–4999 |

Utilities |

| MCC 6300–6399 |

Insurance |

| MCC 6513, 6531 |

Real Estate and Property Management |

| MCC 7311–7399 |

Business Services |

| MCC 8011–8099 |

Medical Services, Health Practitioners, Hospitals, Dentists |

| MCC 9311–9399 |

Government Services |

| For the avoidance of doubt, the 100 miles cap is shared among all categories | |

Do exercise caution with MCC 7399, which includes CardUp, Points.com, and possibly some Shopee transactions.

For the avoidance of doubt, charitable donations and education are not subject to the 100 Max Miles cap.

Do I still earn miles if I set up my card as a recurring payment?

Yes. It doesn’t matter whether you make one-time or recurring payments, so long as the transaction’s MCC does not feature on the exclusion list, you’re good.

What if I’m paying in foreign currency?

The Chocolate Visa Card has no foreign currency transaction fees. Foreign currency transactions will be converted into SGD at the prevailing Visa rate, with no further markup.

You can use the official Visa calculator here to check how much you’ll pay (set the bank fee at 0%).

Is the Chocolate Visa Card subject to any transaction limits?

There is a maximum limit of S$1,000 per transaction and S$20,000 per day on the Chocolate Visa Card.

Unlike wallet-backed cards like Revolut or YouTrip, there is no annual spend limit.

What’s the minimum spend required to earn Max Miles?

The minimum spend required to earn Max Miles is S$0.50.

How are Max Miles calculated?

To calculate the Max Miles earned, multiply your transaction amount by 1 round it up to 1 decimal place. For example, a S$10.10 transaction will earn 10.1 Max Miles.

When are Max Miles credited?

Max Miles will be tracked as soon as the payment is charged to your card (you can check this in the HeyMax app).

They will be credited once the transaction posts, which can take anywhere from 1-7 days depending on merchant. This is not within the control of Chocolate Finance or Heymax.

What is the Miles Multiplier?

The Miles Multiplier feature awards bonus Max Miles based on the monthly average balance (MAB) in your Chocolate Finance account.

| Monthly Average Balance (MAB)* |

Multiplier % |

| <S$5K | 0% |

| S$5K to <S$10K | 5% |

| S$10K to <S$15K | 10% |

| S$15K to <S$20K | 15% |

| S$20K to <S$25K | 20% |

| S$25K to <S$30K | 25% |

| … | … |

| S$100K and above | 100% |

| *Includes both SGD and USD balances | |

Customers will earn a 5% multiplier for every S$5,000 MAB with Chocolate, capped at S$100,000 or 100%. The Miles Multiplier applies to all spending on the Chocolate Visa Card, not just the first S$1,000.

For example, if John has a S$50,000 MAB and spends S$1,300 on his Chocolate Visa Card during the month, he will receive 1,120 base Max Miles (S$1,000 x 1 mpd + S$300 x 0.4 mpd) and 560 bonus Max Miles (50% x 1,120).

Bonus Max Miles will be automatically credited in the first week of the following month.

When will the promotion end?

There is currently no end date for this promotion.

Using Max Miles

Do Max Miles expire?

No.

Are there any conversion fees?

No.

What programmes can I convert Max Miles to?

Max Miles can be converted at a 1:1 ratio to 28 airline and hotel partners.

| ✅ HeyMax Transfer Partners | |

| ✈️ Airlines | |

|

|

| 🏨 Hotels | |

|

|

What programme should I transfer Max Miles to?

For more on the sweet spots you can redeem with Max Miles, refer to this post.

Are there any other uses for Max Miles?

In addition to airline and hotel programme conversions, Max Miles can also be used to:

- Pay for commercial air tickets at a rate of 2 cents per mile, using the FlyAnywhere option

- Redeem vouchers and gift cards at a rate of 1 cent per mile

Other questions

Can I withdraw money from an ATM using my Chocolate Visa Card?

No.

What precautions should I take?

As the Chocolate Visa Card is a debit card, not a credit card, you should take additional precautions with regards to fraud.

That’s because any successful fraudulent transactions will be immediately debited from your account balance, as opposed to a credit card where the bill is only payable later, giving you time to spot the transaction, report it, and receive a temporary credit pending further investigation.

There is, of course, a proper fraud reporting process to get such transactions reversed from your account, but you’ll be out of pocket during the investigation period. Mind you, these concerns aren’t unique to the Chocolate Visa; it’s the same for every debit card.

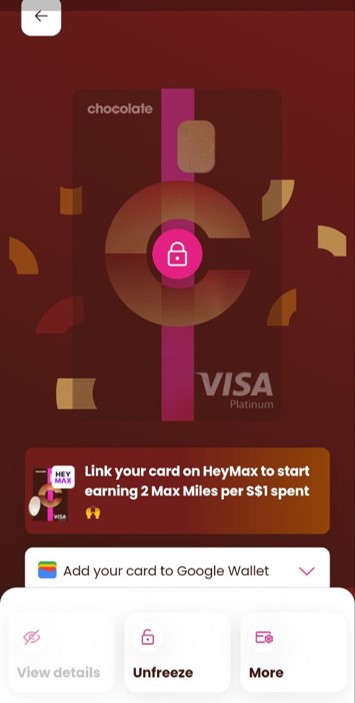

To be extra safe, I recommend locking your card via the Chocolate app whenever it’s not in use. This can be done via the app with a few taps.

Conclusion

Chocolate Visa Card Chocolate Visa Card |

|||

| Apply here |

Prior to July 2025, the Chocolate Visa Card offered an excellent earn rate of 2 Max Miles per S$1 on almost everything. Unfortunately, that has now been cut in half, and with a monthly cap of 100 Max Miles on bill payments, the value proposition is a lot less attractive than before.

While it is possible to buff the earn rate through the Miles Multiplier feature, this requires you to deposit and hold funds in your Chocolate Finance account. I’ll leave it to the financial experts to comment on whether a return of 3% p.a. on the first S$20,000 and 2.7% p.a. on the next S$30,000 is respectable, but either way, the Miles Multiplier only adds an incremental 0.24% p.a. to your earn rate, and shouldn’t be a major factor in your decision.

At least this card still doesn’t charge any FCY transaction fees, so using it overseas would help you save on conversion costs, while still enjoying some rewards.

Not sure how relevant it is but all card transactions are apparently in the stable coin XSGD not in SGD.

Using Chocolate Visa to ride public transport now yields 5mpd (and Heymax even rounds up…) I’ll take it but really need to enjoy it while it lasts.

I would like to highlight the conv rate from USD to SGD by the visa card doesn’t seem to be 0% anymore. Using the visa calculator, USD 5 is SGD 6.567 currently. I was charged 6.62.

how recent was your trxn? i did usd/sgd on 10 april and got the same rate as visa with 0% fee.

just today. 5 mins before i posted this.

At where cash rates are today (and falling) their savings account is no brainer at 3% for first 20k. I use the card for overseas and you get cash back (thru HeyMax) from it. What not to like?

It is not a savings account so no SDIC protection

The chocolate has melted and this card is a waste of time.

Agree. Might as well use a general spending card

now which general spending card still reward points for utilities?