Historically speaking, it’s only been possible to use Atome in the country where you created your account. For example, if you created your account in Singapore, you can only use it within Singapore.

However, Atome has now launched a trial that allows Singapore users to shop at selected merchants across Malaysia. This allows them to take advantage of Atome’s many benefits, including interest-free instalments, turning offline spend into online, optimising bonus caps, and MCC standardisation.

|

| S$10 off first Atome purchase |

Atome Singapore users can now make payments in Malaysia

Atome Singapore users can now scan and pay at selected merchants across Malaysia.

The payment process is basically the same as in Singapore: scan the Atome physical QR code, enter the amount payable, and choose the card you want to pay with. As always, you’ll have the option of paying in three interest-free instalments.

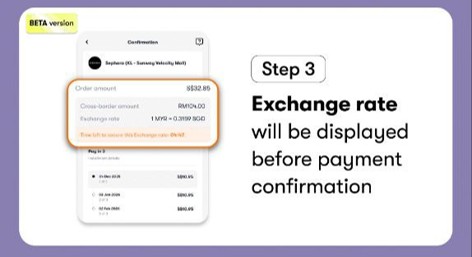

As for the payment currency, Atome will convert your purchases into SGD at “rates you can trust”. Once you enter the amount in Malaysian Ringgit, you will be able to see the converted SGD amount before confirming payment.

The amount you pay will be based on the exchange rate from Atome’s appointed licensed payment service provider, which may include an FX spread where applicable.

-Atome

For what it’s worth, the Atome screenshots show a RM104 transaction converted into S$32.85, versus S$32.83 on Google. That would be very decent indeed, if true. Of course, we should probably wait for real-world data points, and to see whether this will attract any cross-border DCC fees.

Atome has also confirmed that any refunds will be made in SGD, based on the original exchange rate confirmed at the time of purchase.

What brands are participating?

Atome Singapore users can currently pay at the following merchants in Malaysia.

|

|

Atome says it’s working to expand the number of participating merchants, and to allow for payments using digital QR codes.

Why pay with Atome?

BNPL services like Atome often get a bad rep. But if you use it responsibly, it can actually be a great tool for miles chasers.

With Atome, you can:

- Stretch your cashflow by splitting a payment into three interest-free instalments

- Optimise miles accumulation by splitting a large transaction into smaller amounts that fall within the monthly bonus caps on credit cards

- Turn offline spending into online transactions, for bonuses with the Citi Rewards, DBS Woman’s World Card and KrisFlyer UOB Credit Card

- Earn credit card rewards at merchants which would normally be excluded (e.g. education and enrichment), since transactions are coded under a standard MCC 5999

- Earn Atome+ points, on top of whatever you get from your credit card

That said, if you’re someone who struggles with impulse control and might use Atome to spend beyond your means, it’s best to steer well clear.

What’s the best card to use for Atome?

Atome transactions code as MCC 5999, and the following credit cards will earn up to 4 mpd, subject to the conditions shown below.

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1K per c. month Review |

HSBC Revolution Card HSBC Revolution CardApply |

4 mpd | Max S$1.5K per c. month Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

2.4 mpd | Min. S$1K spend on SIA Group in a m. year. No cap Review |

| C. month = Calendar month | S. month = Statement month | M. year= Membership year | ||

| ❓ Aren’t instalments ineligible for points? |

|

The T&Cs of credit card rewards programmes typically exclude instalments from earning points. But when banks say “instalments”, they’re referring to their in-house instalment plans. Atome spend is not treated the same way. |

A few additional points to note:

- MCC 5999 is not a whitelisted MCC for the OCBC Rewards Card

- MCC 5999 is not a whitelisted MCC for the UOB Lady’s Card or UOB Lady’s Solitaire Card, even under the Fashion category

- The UOB Preferred Platinum Visa has a mixed record for earning points for Atome transactions (despite MCC 5999 being on its whitelist). One recent data point says it does, but another says it doesn’t. Proceed with caution

- MCC 5999 does not appear to earn bonus points with the Citi Rewards Visa, though the Mastercard version is fine

For a full rundown of the cards you can use with Atome refer to the article below.

Double dip on Atome+ points

Paying with Atome allows you to double dip on credit card rewards and Atome+ points, which are awarded at a rate of 1 point per S$2 spent. These will also be awarded for transactions made in Malaysia.

Atome+ points can be redeemed for vouchers with merchants such as TADA, Sheng Siong, Grab, Watsons, Lazada, Dairy Farm Group, but they can also be converted to Max Miles (do note that there has been a slight devaluation since the partnership launched in April 2025).

|

|

| Atome+ Points | Max Miles |

| 760 | 400 |

| 1,900 | 1,000 |

Assuming you value a Max Mile at 1.8 cents each (based on FlyAnywhere value, though you could certainly get more value than this), then your effective rebate is 0.47%. It’s not life-changing, but remember, this is on top of your credit card rewards.

Another way of viewing it is that Atome allows you to earn an incremental 0.26 mpd on your transactions.

Conclusion

Atome Singapore users can now make payments at participating merchants in Malaysia. At the moment, payments are limited to physical Atome QR codes, though support may be expanded in the future.

We’ll need to wait for some on-the-ground reports to know what exchange rates are being offered, and mind you, like most fintechs, it’s likely to start off good and then quietly get worse over time.

Still, it could be potentially useful for those who want to enjoy the benefits of interest-free instalments, as well as better rewards optimisation and MCC standardisation.

What kind of exchange rates is Atome offering in Malaysia?