What Credit Cards Should I Get?

This is the most common question people ask me. And the answer, of course, is “it depends.” The first and most important question is- what are your objectives? Are you interested in getting cashback on your spend? Are you keen on turning your spend into flights and holidays? Do you want cards that give you special “lifestyle” privileges, e.g access to clubs, private concierge, illuminati initiation ceremonies? It goes without saying that you should absolutely be using a credit card wherever possible. Every time I see someone pay with cash, NETS or a debit card, I die a little inside, because that’s basically wasted spending. If you’re going to spend money, might as well get something out of it.

Fixed vs Variable Rewards Cards

Rewards credit cards can be broken down into 2 main types

- Fixed rewards cards (Cashback)

- Variable rewards cards (Miles and Points)

Fixed rewards cards, as the name suggests, offers you certainty. If I own a cashback card, I know I will get back x% of my spend in the form of a statement credit. I may get different percentages depending on what category of spending I do (eg groceries may get 3% cashback while fuel gets 5%), but the value of what I get out of the transaction is fixed. $1 is $1. I’m not a big fan of cashback cards because of the relatively small rebate % as well as the multitude of conditions attached. I spell out more problems with cashback cards here, but to summarize

- The cashback you can earn is capped each month

- You need to spend a minimum amount per month to enjoy the advertised cashback

- Because of minimum spend requirements, it is difficult to adopt a “best of breed” strategy, i.e. using one card for petrol, one card for groceries, one card for online etc

- Once you pay an annual fee on a cashback card you’re essentially starting from a net negative position

Variable rewards cards, on the other hand, give you their own currency (eg DBS Points) or an airline’s currency (eg KrisFlyer miles). Why I call this “variable” is that the value you get depends on how you spend it. For reasons which I’ll explain in a subsequent post, the value of a mile depends on what you redeem it for. All things equal, a mile applied towards a first class redemption will be worth more than a mile applied towards an economy class redemption. Of course, since the value you get depends on how you spend your miles, variable rewards cards require a bit more thought and micromanagement than fixed rewards cards. If you’re willing to invest that time, however, the incremental value can be tremendous.

Understanding Credit Card Rewards Points

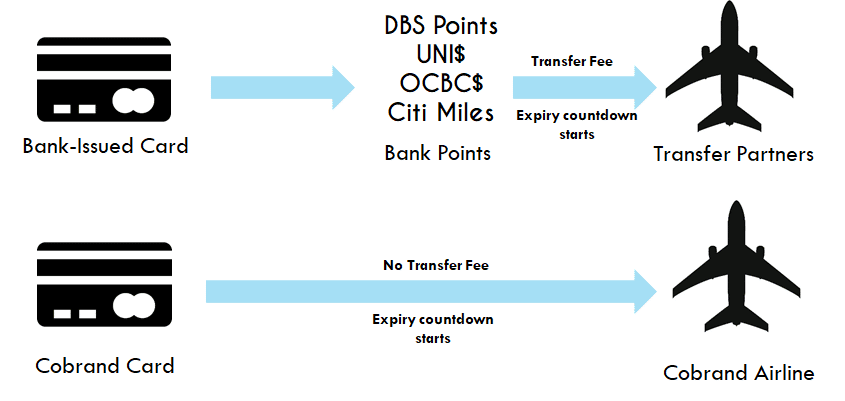

Unless you hold a cobrand card like the AMEX KrisFlyer Ascend or KrisFlyer Blue, you’re not actually earning miles when you spend- you’re earning bank points. Bank points can then be transferred to frequent flyer programs such as KrisFlyer or Asia Miles.

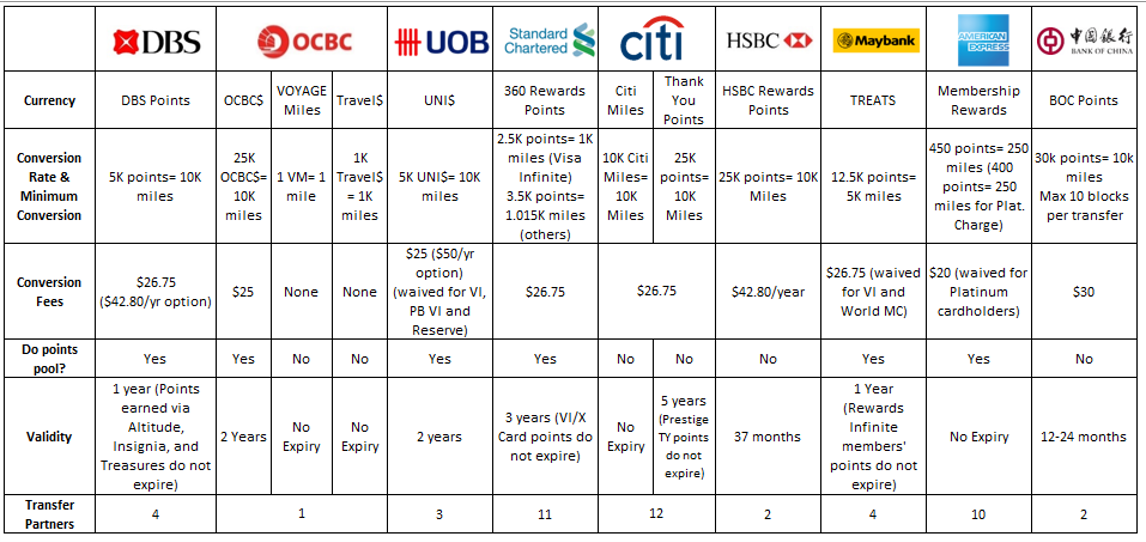

That means there’s an additional layer to understand here in the form of the various bank currencies. So I’ve put together the following table with the nine banks in Singapore whose currencies can be converted to airline miles.

Now, what cards do you need?