The MAS stipulates that the minimum annual income required to grant someone unsecured credit facilities is S$30,000. Any requirement in excess of that is bank-imposed and purely arbitrary.

How do banks decide what the minimum income required for a particular credit card should be? Marketing. Pure marketing. Cards with a higher income requirement are not necessarily better. In fact, some of them are downright useless. The banks play a balancing game. It is in their interest to have as many people sign up for a given card as possible. But it’s also in their interest that some people see the card as having some level of exclusivity and prestige, so that they’re willing to pay the annual fees.

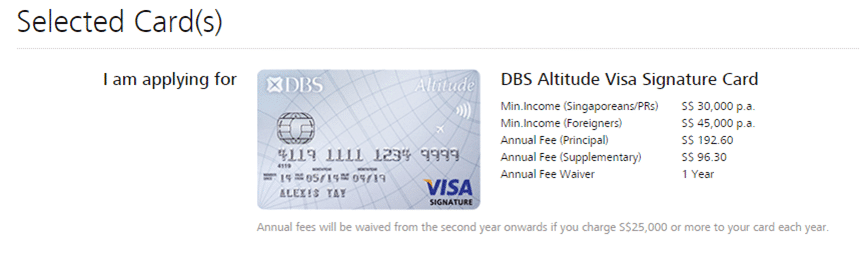

When the DBS Altitude Card first launched, the minimum income required was $80,000. That fell to $50,000 after a couple of years. Now, thanks to a tip on the comments, I’ve learned that it’s down to $30,000

I said before that there wasn’t a good “general spending” card at the $30,000 threshold. That’s now changed. With the numerous generous sign up bonuses and ongoing promotions available for the Altitude card, this should be one of the first cards any fresh grad should sign up for.

This should introduce a very interesting dynamic into the Singapore credit card market. UOB PRVI Miles has still has an annual income requirement of $80,000. ANZ Travel Card requires $60,000. Citibank Premiermiles requires $50,000. Since all these cards are competing for the mantle of “best general spending card”, I fully anticipate some of them to follow suit, if not lower their headline income requirement.

I really applaud what DBS has done with the Altitude card- although the headline earning rate of 1.2 miles per $1 and 2 miles per overseas $1 is not the market leader (UOB PRVI 1.4 miles and 2.4 miles for local and overseas spend), DBS is still making waves in this market with its generous sign up bonuses for Altitude and its moves to make great miles earning cards available at any income bracket

Kudos.

cover photo by sjliew

thanks for the tip. just applied for it 5 mins ago to earn miles

Applied yesterday, approved today. Reflected in my ibank. Thanks for the heads up!

Hey Aaron,

Given that miles are easily earned more by the masses, do you think the waitlist to redeem flights will be longer and will airlines likely review their miles charts?

not really. if anything, I was worried when krisflyer became a transfer partner of citibank and jp morgan in the US because that meant all the americans who had earned easy miles through generous sign up bonuses and manufactured spend could start dumping their points into krisflyer accounts and start competing with us for awards. so competition has definitely gone up, but no devaluation has happened (yet). and those guys had way more miles than us. you’d need to have a substantial amount of overseas and online hotel/airfare spending to really maximise the DBS altitude card, and that’s not something… Read more »

https://www.dbs.com.sg/personal/promotion/altitude_visa_promo

Exclusively for new to DBS/POSB credit card customers.

Here’s how:

Step 1: Apply online for the DBS Altitude Visa Signature Card by 31 March 2016; and

Step 2: Get 8,000 bonus miles* when you charge a minimum of S$1,000 per month to your new Card for the first 2 months from the date of card approval date.

UOB PRVI miles has a expiry date of 2 years. this is a not an ideal card for fresh grads without heavy spending ability.

only dbs altitude and citi premiermiles have no expiry date. even you have to earn lesser miles but its still more worth it in the long run.

just my 2 cents.

not to mention the income requirement for prvi is 80,000… quite high for any fresh grad.

well, most banks can’t wait to give you unsecured credit. based on experience, as long as you meet the MAS 30k income rule, the bank will most likely give the card. After all they cap you by the credit limit they set.

Hence i signed straight away and is working towards the 3000 bonus miles.

Visa 8000 miles seems to be harder. Need consecutive 2 months of 1k spending. And there’s no double miles. Easier to hit for amex but lesser merchant acceptance (went jb and the merchant don’t have amex, only visa/mc)

i know it is stated that this is “Exclusively for new to DBS/POSB credit card customers.” but does anyone know (perhaps from prev sign on bonus promotions) if they are strict on this? I have a live fresh & posb everyday card and wondering if i can still enjoy the sign on bonus.

Hi, I checked on this before. Apparently DBS considers each card application as new. For example, if you are applying for an Altitude card, but currently has a DBS live fresh and POSB everyday card, you can still enjoy the sign on bonus for Altitude card.

The letter i received for my dbs altitude card (had posb everyday before altitude) says on this promo of bonus miles with certain spending l, like the one you post above. Hence i believe it is applicable for my case. Like what Daniel say, it should work.

Hi Anonymous, best you call the CSO and check rather than rack up the spend without the sign on bonus. Please note it is for online sign ups and the new conditions on DBS altitude. I.e 3 miles for expedia spend capped at 5k per month

This card earns 3 miles per $1 for online flights and (prepaid) hotels transactions. Coupled with the 30k p.a requirement, I think this card is a good card for new credit card users.

Only downside is that to convert the DBS points to miles, its by annual membership of $42.80/year.

I don’t get this part “Only downside is that to convert the DBS points to miles, its by annual membership of $42.80/year.”

Anyone?

I don’t get this part “Only downside is that to convert the DBS points to miles, its by annual membership of $42.80/year.”

Anyone?

This was the old system. Now they have changed to a per transaction basis

Dear Folks, since 2 July dbs change the system. Insurance no dbs point plus top up any mrt card no dbs point.

https://www.dbs.com.sg/iwov-resources/pdf/cards/rewards_programme_tnc.pdf

[…] That said, we know that income requirements for general spending miles cards are falling across the board so I’d be surprised if BOC went with a high requirement like $80,000 or $120,000. A card […]