I’ve mocked the Krisflyer Ascend card in the past as the best card you’ll never use. This was back when they were offering a 1st year annual fee waiver option that allowed you to get the card for free and enjoy things like a 1 night free stay at selected Millennium Hotels worldwide, 4 free SATS lounge vouchers, a complimentary upgrade to Millennium Hotels Gold status and 5,000 miles when you clocked the first spend on the card (Even if you opted to pay the 1st year annual fee, you could generate a decent amount of miles through their sign up bonuses and accelerator during the first couple of months).

Since then Ascend has parred the benefits down- the 1st year annual fee wavier option is no longer available and the free Millenninum Hotels night got additional conditions tacked on which made the voucher more or less useless at some properties. I’ve not followed developments on the card that closely because I’ve long since cancelled the card (first year fee came due, and AMEX almost never gives annual fee waivers)

EDIT: UK_Ship on the comments have reported successfully getting fee waivers, so it never hurts to ask!

Yesterday, existing Ascend cardholders received an alert that the T&C of the card would change from 1 May. To summarise the changes

- Revised Earning Structure: The Ascend card now earns 1.2 miles per S$1 of local spend, and 2 miles per S$1 of overseas spend during June and Dec. The accelerator of 300 miles for every $500 spent above $1,000 will cease

- Fast Track Krisflyer Elite Gold: If you spend S$15,000 on SQ tickets directly on singaporeair.com between 1 May 2016 and 30 June 2017, you get KF Elite Gold for 1 year. You also get a voucher giving you double Krisflyer Miles for your S$15,000 of spend, capped at 5,000 miles

- Annual fee increase: Annual fee increases 30% from $256.80 to $337.05

These changes do not by any means make the Ascend a great card. The cards issued by the banks are still superior to the Ascend in terms of miles earning. I suspect that Amex and Krisflyer took a long look at what their co-branded card was offering and realised it was completely uncompetitive compared to the banks.

Let’s look at the main changes-

Revised Earning Structure

The shift to a 1.2 miles per S$1 of local spend structure is welcome, but not a game-changer. Recall the rates the banks are currently offering per S$1 of local general spending

- Citibank (Premiermiles)- 1.2/1.3 miles (for Visa/AMEX versions)

- DBS (Altitude)- 1.2 miles

- UOB (PRVI)- 1.4 miles

- HSBC (Visa Infinite)- 1/1.25/1.5 miles (depending on annual spend and card tenure)

- ANZ (Travel Card)- 1.4 miles

As you can see, 1.2 miles is the bare minimum acceptable earning rate for anything that wants to call itself a miles earning card. In that respect, the Ascend has just come in line with the market rate (versus their pathetic S$1= 0.83 miles structure before)

Their offer of 2 miles per S$1 of overseas spend for June and Dec is clearly meant to target the holiday-going crowd, but one does wonder why they see the need to be so stingy about this. 2 miles per S$1 of overseas spend all year round is the bare minimum, as the market attests

- Citibank (Premiermiles)- 2 miles

- DBS (Altitude)- 2 miles

- UOB (PRVI)- 2.4 miles

- HSBC (Visa Infinite)- 2/2.25/2.5 miles (depending on annual spend and card tenure)

- ANZ (Travel Card)- 2.8 miles (Aust & NZ spend only)

Fast Track Krisflyer Elite Gold

This is a strange feature to have, because anyone who spends S$15,000 on SQ tickets is likely to hit the 50,000 miles required for Krisflyer Elite Gold anyway. That said, I can see how this will work for some people

- If you frequently book tickets for other people (family, colleagues), you may already be exceeding S$15,000 but not have elite status because only the person actually flying would earn elite miles

- If you frequently book tickets in the lowest ticket class (eg Super Deals) that earn 10% elite miles, you might be spending in aggregate more than S$15,000 but still not hitting 50,000 elite miles

- If you’re willing to tie up S$15,000 of your working capital in SQ fully refundable tickets, you could theoretically buy the tickets a year in advance, get your status upgraded and then cancel the tickets later for free (but remember that even Flexi tickets incur a USS$150 refund fee, so this may not be as costless as you envision)

You have slightly over one year to incur this spend. While it’s certainly do-able with a moderate amount of travel, you’d probably hit 50,000 miles if you had 15k of travel spend

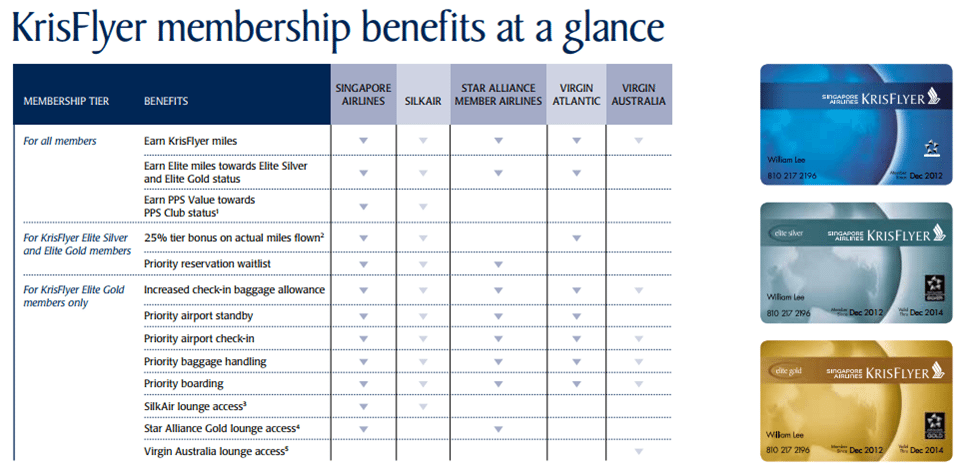

All things equal, it’s always better to have status than not have status, but if anyone thinks that Krisflyer Elite Gold status will dramatically change their life you should probably temper your expectations. You can expect lounge access (to the crappy Krisflyer Gold lounge in Singapore and the significantly better SilverKris lounges overseas), additional and priority baggage, priority boarding and (allegedly) higher priority when waitlisting for award tickets. But don’t expect upgrades, or a blocked empty seat next to you.

Annual Fee Increase

The powers at AMEX thought that these enhancements were good enough to justify increasing the annual fee 30% from $256.80 to $337.05. The conspiracy theorist in me thinks that Millennium Hotels increased the reimbursement rate they demanded for the free night hotel voucher, which meant that AMEX had to cover that cost somehow, and since the Ascend card was overdue for a refresh this was a chance to do all that at one go.

AMEX does not generally offer annual fee waivers, regardless of how much you spend. The rationale is that they need to cover the ancillary benefits their cards give (eg Feed at Raffles with their Platinum cards). I am a firm believer in not paying annual fees (unless you urgently need to buy miles), so this hike makes the card less acceptable in my eyes.

Conclusions

While the adjustment in the general spending rate is a welcome (and long overdue) move, it does not make the Ascend a must-have card, especially when you consider the 30% increase in the (non-waivable) annual fee.

Given that the DBS Altitude AMEX has reduced its income requirement to $30,000, there is really no reason why you need the Krisflyer Ascend Card. Unless you can block out $10,000 of spending within the first 3 months of getting your card to take advantage of the sign up promotion, you’d be better off with getting the Altitude card and pooling the miles with your DBS Woman’s World card.

photo credit: passportchop.com

photo credit: passportchop.com

The AMEX Ascend card is a strange beast. When it was launched, it seemed like Krisflyer/AMEX genuinely thought they had a competitive offering to challenge the mass affluent cards like Premiermiles, Altitude (before they lowered the income requirement) and PRVI. This despite the fact their base earn rate was one of the lowest in the market, and only through a complicated system of bonuses could one hope to match the earning rates offered by the banks. Some people, like me, found ways of taking advantage of the first year fee waiver to get a free hotel night. Others paid the annual fee, spent $10,000 on the card to get the bonus miles then chucked it away. Eventually more and more people realised that despite the roadshow promoter’s hype, the emperor really had no clothes. I don’t think these latest moves do anything to change that.

But hey, at least you don’t need to pay a conversion fee.

it is a joke that their own flagship card is worse than what bank credit cards offer.

surely they acquire miles at the lowest cost relative to the banks…?

they will point to things like no cost mile transfers, the free hotel voucher and the lounge vouchers as why their card is “superior”

but in reality this is part of the sq we’re better than you and you should be privileged that we let you fly us mantra. which is why they don’t upgrade even solitaire pps members (well, except on their birthday), why they’d rather let first/business class cabins fly out empty than open up more award space and why they refuse to let you upgrade anything other than full Y tickets

What a pointless exercise. All the ground work to present a subpar product to the market.

Their upgrade policy is very questionable.

I know someone who bought a premium economy seat from HK to SG via travel website. The flight didnt have Premium Economy cabin…they ended up in business class. Good hack.

As someone without KFEG, S$150 for that isn’t so bad..:)

haha admittedly i speak from a bit of an ivory tower, given that i’ve long requalified for KF EG this year (all economy class flights, before anyone gets jealous. i really felt each and every one of those miles), but given how tough it will be to clock $15k in 2 months, is it really worth it? i mean if youre going to spend that money anyway by all means, but i wouldn’t go out of my way to do it

ah, for the days of aegean gold…

@Aaron I not sure I understood the part about clocking $15k in 2 months? Can you pls elaborate on the 2 months part?

not relevant anymore.

Got an email on revisions to and rebranding of Krisflyer Amex gold as well.

Wonder if this is part of a system wide roll out of revisions across all the Amex Krisflyer co branded cards and whether PPS co branded cards will have better perks as some sort of differentiation.

Interesting. Details? Yeah I didn’t even mention how the pps/solitaire pps versions of this card are just as laughable. And those are your best customers!

Actually i realise it was a physical mailer which I’ve binned because the propositions weren’t attractive. From what I remember the main points should include, and take effect from 1 May 2016: – rebranding of Amex KF gold to Amex Krisflyer card. – revised local earn rate of 1 buck to 1.1 mile – revised overseas earn rate of 2 miles per dollar in June and December – $150 cash back for every $12,000 (or 10k, can’t quite rmb) spent on singaporeair.com – abolition of current bonus miles 50+50% system. Given the abolition of the current bonus miles promotion for… Read more »

Regarding the point about the pps versions of the amex cards, given the “aspirational” value of the card, and how an Amex itself may be perceived as a prestigious / upmarket credit card to have, I know people who despite the lack of value put all local and overseas spend on these cards. What a bad deal. Add to that the fact that a majority of credit card consumers in SG may be ambivalent / apathetic / ignorant of the value in redeemed miles that had out of credit cards, here is where Amex SG is probably quite a lucrative… Read more »

Hi Aaron,

If i cancel my Amex KF Ascend card and apply for Amex KF Gold Card, Do i still get 5000 welcome miles for 1st transaction ?

I’m pretty sure you don’t. T and c say for first time cardholders only

T n C said :

This Promotion is only applicable for first time applicants of the American Express® Singapore Airlines KrisFlyer Gold Credit Card who do not hold any other American Express® Singapore Airlines Credit Card.

so i i cancel AMEX KF Ascend and never have Amex KF Gold before, what do you think ?

here’s your answer- no.

https://icm.aexp-static.com/Internet/IntlHomepage/pdf/KrisFlyerAscend.pdf

Not to add to more work, but with this change and one makes a 10k single transaction within the first month, will we be worse off than the current approx. 56k miles?

I am not 100 % clear on how this change will affect the sign up bonus, unfortunately

The only reason why I am keeping this card around is that I have a couple more of the lounge vouchers to use. They made a saving gesture to up the local currency miles earn rate, but the condition for the foreign currency earn rate is annoying. The nail in the coffin is the increased annual fee with no free miles (unlike Citi PM and DBS Altitude and ANZ). Previously I have managed a 50% AF waiver (if cardholder has already received the lounge and hotel vouchers) or 100% waiver (if cardholder has spend on the card from the past… Read more »

You made one interesting point about the fast track KF EG. If one has to park $15k with SQ for a whole year in order to get and maintain the KF EG status, then arguably it’s not worth it. But if you can spend the $15k on refundable tickets, get KF EG status, then immediately cancel and get a refund, then theoretically your money is only tied down for a month or so at most. In this case, it might not be so bad, assuming you really want KF EG. The question is, will SQ revoke your status in such… Read more »

Parking $15K for KF EG status is a terrible investment.

I also notice that this revision is not on their website. Is it only for existing cardholders?

i had a look at it briefly, i thought the 15K spend is between 1 may 2016 and 30 june 2017? So isn’t that 1 year and 2 months to hit the 15K spend?

I might be wrong though..as I only had a brief look at it..

My info is second hand because I don’t have the card anymore… but 1 year would make a lot more sense. Can you help me check what they sent to you?

an accelerated KrisFlyer membership upgrade to the KrisFlyer Elite Gold Membership tier for one year, when you spend S$15,000 or mor eon your Card on singaporeair.com between 1 May 2016 and 30 June 2017; and a Double KrisFlyer Miles Accrual Voucher when you spend S$15,000 or more on your Card on singaporeair.com between 1 May 2016 and 30 June 2017 (capped at 5,000 bonus KrisFlyer miles).

Thanks for confirming. That makes much more sense (but still not a good deal). Will update the article

Ive had my Annual fee waived the past two years, and ive been spending less than $10k annually. They said in order to waive the annual fee they would not give me the lounge or hotel vouchers but they still arrived anyway….

interesting. i did not know they waived fees for amex cards. i’ve updated the article.

@S You’re on to an interesting point on consumer education- I know more than a few people, very smart guys in every way, who simply assumed they were getting best value with the krisflyer amex card because it’s issued by sq directly. Perhaps the issuers see it as a form of arbitrage in that there will always be people like you and me who maximize the shit out of the bonuses and then dump, but there are many more who just go with a one card strategy. Regarding prestige, as hard as it is for me to believe there really… Read more »

FYI, there are changes to the “Gold” KF Amex card too. Same thing, got improvement but still worse than other miles earning cards.

would you mind filling me in on those details if you have them? i’m curious. it seems there is an overall shift in the co-branded card strategy….

btw, i don’t think anyone can sign up for the krisflyer cards for the time being? i called up AMEX and they told me that they are in the midst of reorganising the card benefits and will revert after 4 May. Guess I was abit late to try to get the 5000 miles.

@aaron not sure if uve seen the details on the new Amex kF gold above!

sorry, completely missed that. Thanks! Well given that the differential in the earn rate between Gold and Ascend is 0.1 miles per $1 for local spend, I’m not impressed by the overall positioning of the 2 cards (I don’t think the hotel + lounge vouchers are enough to justify the difference in annual fee given that many competing cards offer lounge access via priority pass and the hotel voucher has some new restrictions in desirable properties)

also note, the bonus miles on the AMEX KF Gold card do not arrive in your account until a year later. Very inconvenient.

Curiosity got the better of me. Called the Amex pps line.

Revised earn rate for pps amex is 1.4 miles per $1 local spend. 2 miles per $1 overseas spend year round.

50% krisflyer flight redemption voucher seems to be back, issued 6-8 weeks after renewal of card each year (not sure of exact terms).

Also, all spend above $15,000 a year gets double miles, up to cap of 10,000 bonus miles.

Was also told by the amex officer that there is no more offer for 35,000 bonus miles on the krisflyer ascend.

I’ve managed to waive my annual fee for this card the past 2 years. Don’t think I’ve spent more than 10k per annum. Never hurts to ask for a waiver.

thanks for the data point. I always assumed they didn’t waive amex-issued amex annual fees based on my dad’s experience with their platinum cards (Which was admittedly some years ago). Maybe they’re more lenient with the cobranded stuff.

Detailed T&C here: https://icm.aexp-static.com/Internet/IntlHomepage/pdf/KrisFlyerAscend.pdf

Thanks Vin, do you happen to know the new t&cs for the Krisflyer Gold card as well ??

Hi Aaron, thanks for the informative write ups. I am keen on the idea of getting the KF EG using the ‘hack’. Referring to your point “If you’re willing to tie up S$15,000 of your working capital in SQ fully refundable tickets, you could theoretically buy the tickets a year in advance, get your status upgraded and then cancel the tickets later for free (but remember that even Flexi tickets incur a USS$150 refund fee, so this may not be as costless as you envision)” Are you aware of success cases? Does the KF EG status get revoked upon the… Read more »