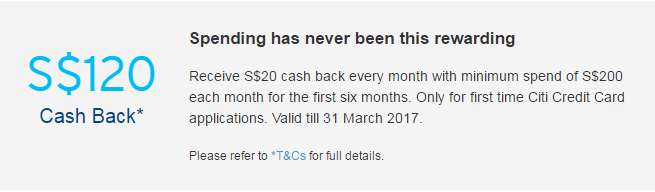

Citibank is running a promotion for first time Citibank credit cardholders where you can earn S$20 cashback a month for 6 months after the date of approval, with a minimum spend of S$200 a month.

There is some discrepancy between what’s on the website and what’s stated in the T&C. The T&C say that the sign up period is until 30 June 2017, but the website says 31 March 2017.

Either way, if you’re a first-time Citibank credit cardholder this might be of interest to you because something just dawned on me. I think I might have thought up a way to get some free money/points.

Suppose you apply for a Citibank card and buy a USD Amazon gift card with S$200 equivalent value (I recommend the Rewards card, given the 8mpd promotion that just got extended to 31 March 2017).

You then go to liquidate the gift card on a site like Carousell/Gift Card Granny/Raise/Gift Card Bin/Gift Card Spread or one of the many other gift card liquidation sites.

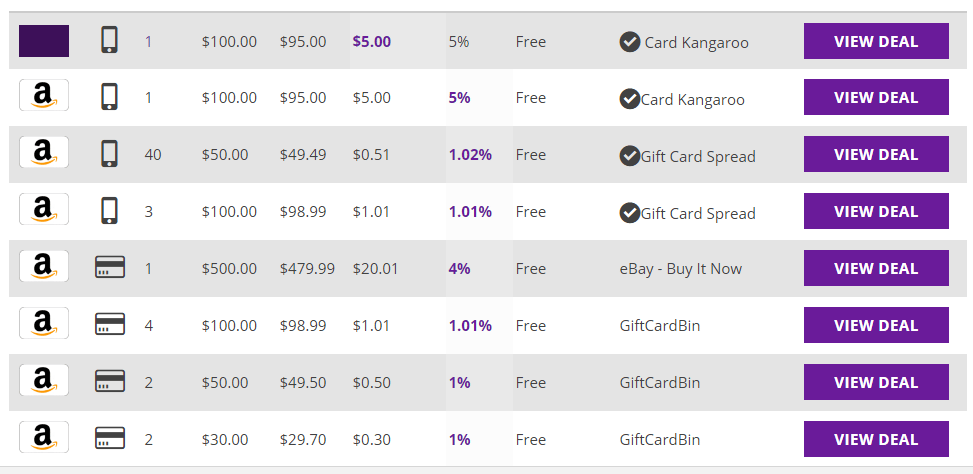

Because you can buy virtually anything on Amazon, Amazon gift cards liquidate on secondary exchanges at values very close to face. This screenshot from Gift Card Granny shows that it’s possible to liquidate Amazon gift cards at about 98%+ of their face value.

Of course, you need to factor in platform fees. Raise, for example, charges 12% commission on the selling price of the gift card (!). You might be better off trying eBay or another platform. Shop around and see which site lets you keep the most value.

Assuming you manage to sell you Amazon gift card at 98% face value, you will now have

- S$20 cashback

- 1,600 miles

Basically, you could take anything up to a 10% haircut on value (through forex fees charged by Citibank and selling fees when liquidating the gift card) and still end up on top, thanks to the 1,600 miles you’ll generate by buying the gift card.

Now repeat this each month for 6 months. Remember that buying gift cards on Amazon codes as any other Amazon purchase. Furthermore, I see nothing on Citibank’s T&C that excludes buying gift cards

5 “Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/ disputed/ unauthorised/ fraudulent retail purchases, (iii) Quick Cash transactions and monthly instalments, (iv) Paywise/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes, (v) bill payments made via Citibank Online/CitiMobile, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees.

You can sign up for pretty much any Citibank card but obviously the Rewards card makes the most sense given the promotion with Amazon

“Eligible Card” refers to Citi PremierMiles Visa, Citi PremierMiles American Express Card, Citi Cash Back Visa Signature (previously known as Citi DIVIDEND Visa Signature), Citi Cash Back World MasterCard (previously known as Citi DIVIDEND World MasterCard), Citi Rewards Visa, Citi Rewards World MasterCard, Citi SMRT Platinum Visa Card and Citi M1 Platinum Visa Card only.

This promotion actually started back in August 2016, apparently, but I’ve only thought of this now. I’m sure I can’t have been the only one. I think the potential monkey wrench in the works is liquidating the Amazon gift card, but worse come to worse you can always use it for yourself. You can even use your Amazon gift card to buy an AirBnB gift card, or some Playstation credit or otherwise convert it into a currency that you’ll find useful.

Too tedious!

hi aaron,

the screenshot from giftcardgranny only indicates the savings to buyers,

when i checked out the sellers page, the best offer to purchase Amazon gift cards only came in at ~85% of its retail value

=(

looks like the best option then isn’t to liquidate via one of these sites…in which case you can save a step and just buy an airbnb gift card or something you’ll actually use?

Think airbnb make sense, can also buy hotels.com gift vouchers. Just one thing to sort out is on the currency conversion between the gift vouchers in USD and booking currency in SGD. Any thought?

Actually, if the trigger point is $200 per month, Singtel customers can pair the Singtel Dash mobile wallet with the SC Dash bank account to chalk up S$200 monthly at zero cost to self, earning 4mpd using Citi Rewards card to pay bills while simultaneously earning the $20 cashback.

(As mentioned in a previous comment on another post)

Alas, I’m already an existing Citibank cardholder!

yeah but i’m not sure if that would be excluded as qualifying spend by citibank

On Citibank’s side, they register simply as Singtel bill payments (and not done via Citibank Online/CitiMobile), so I don’t see why they’d be excluded…?

Sorry, a noob question, what’s ms?

manufactured spend.