(EDIT 3 May: OCBC has reached out to me and let me know that they’re updating their existing webpages to bring them in line with the new transparency campaign. In the screenshot below, you can see that the presence of the annual 120,000 OCBC$ cap has been added. I still think proper disclosure of sponsored posts is a big issue, however, but I acknowledge this has more to do with Mothership than OCBC)

Seasoned readers will know that I’ve always had a general discomfort about monetizing this website. The costs of operation are really minimal, I’m not relying on the site for income, and at the end of the day if I save one person from using cashback cards I’ll know I’ve done my job.

Besides, when you’re running a site which explicit purpose is to compare credit cards, highlight T&Cs that banks may not necessarily want you to be aware of and call out anyone (airlines, banks, OTAs, online dating platforms) for BS, it generally helps if you’re not relying on said entities for financial remuneration.

But at the same time I think it’s good to be open to areas where genuine collaboration can lead to real benefits for readers (eg promotional sign up codes, giveaways). So I’ve reached what I think is a partial resolution by opening up the Milelion to partnerships, but pledging whatever money is raised to our sponsored charity.

Everyone has their own way of dealing with this conundrum, and there is no right way of resolving this. But there is a wrong way, and that’s what Mothership has done with this poorly disclosed sponsored post for OCBC.

The Mothership Article

This post (dated 14 April) caught my eye, because whenever I’m researching a newly-launched credit card, I have to be hypervigilant to the T&C. A small misreading of terms could turn a 10X earning opportunity into a 1X, or make what a decent-sounding sign up bonus into a meh one (like I’ve called out UOB many times for). So I clicked on it and started reading.

Now, the best practice with any sponsored post is to disclose sponsorship upfront. This allows the reader to decide for themselves whether or not they want to continue reading. Indeed, you’ll see that that’s what I’ve done with the sponsored posts I’ve written so far.

What is not best practice is to have a post that only discloses sponsorship at the very end. When you’re already done reading it. Which is what Mothership has done here, at the bottom of the article.

![]()

Granted, Mothership is hardly the most egregious of offenders when it comes to disclosure. I’ve seen much worse. But if you’re writing a post that’s ostensibly about straightening up and flying right, does it really make sense to put a material disclosure like this all the way at the end?

I think what grinds me a bit more about this is that the general tone of the article is a very haha look at us poking fun at the banks haven’t we all been there guys haha you know what we’re talking about right until you get roughly 3/4 down and we have the “but seriously folks” moment-

That said, this new ad by OCBC promises to cut the BS out of their ads

I don’t know what Mothership’s disclosure policy is regarding sponsored posts, but I want to state for the record that placement of disclosure notices is just as important as presence.

And that brings me to my second point.

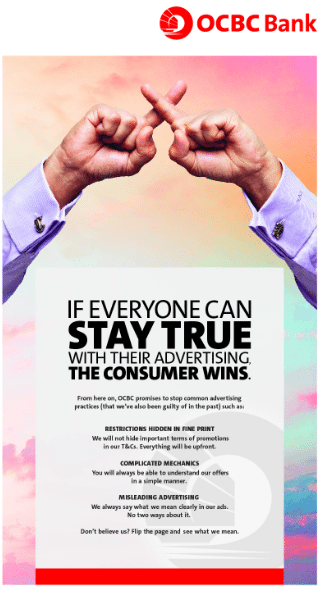

OCBC’s commitment to transparency ad campaign

OCBC wants to take the BS out of advertising. To that end, they’ve launched a series of full page ads and media buys (you can see all the ads here) promoting their new transparency policy. And that’s great. I want transparency. You want transparency. The people shooting each other with waterguns at Songkran now want transparency (of another sort). But as they like to say in politics, the rhetoric needs to match the record. So what has OCBC’s record been like here?

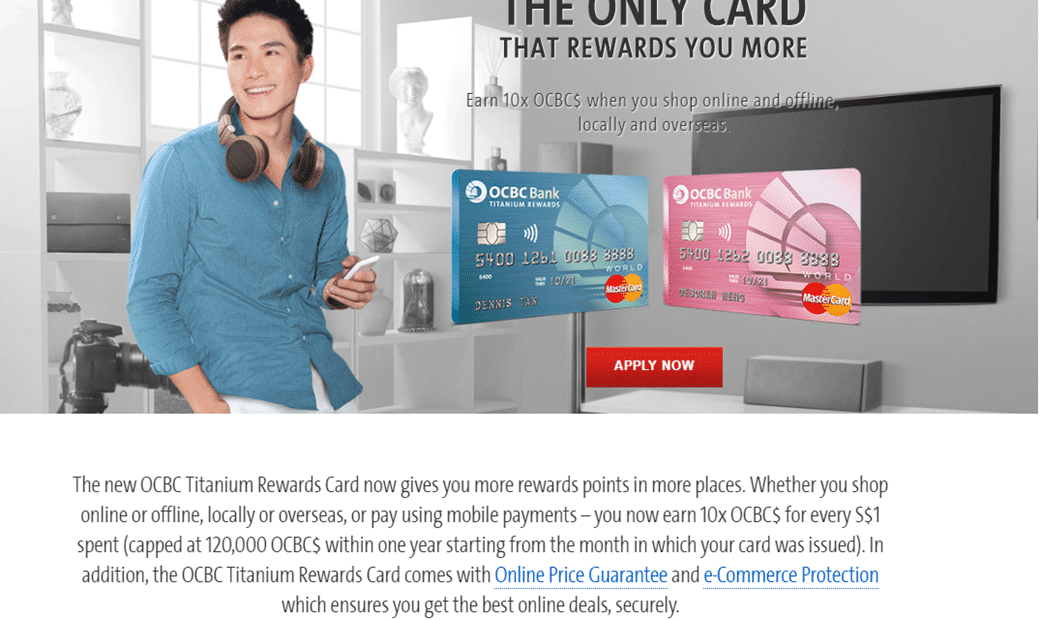

Take the homepage for OCBC’s recently relaunched Titanium Rewards card, for example. I wrote a brief article when this card was rejigged because I think it’s a genuinely good opportunity to maximise 4mpd opportunities on your spending.

The problem is, this webpage leads with the 10X rewards on online and offline shopping. It gives examples of what categories of spending get you 10X

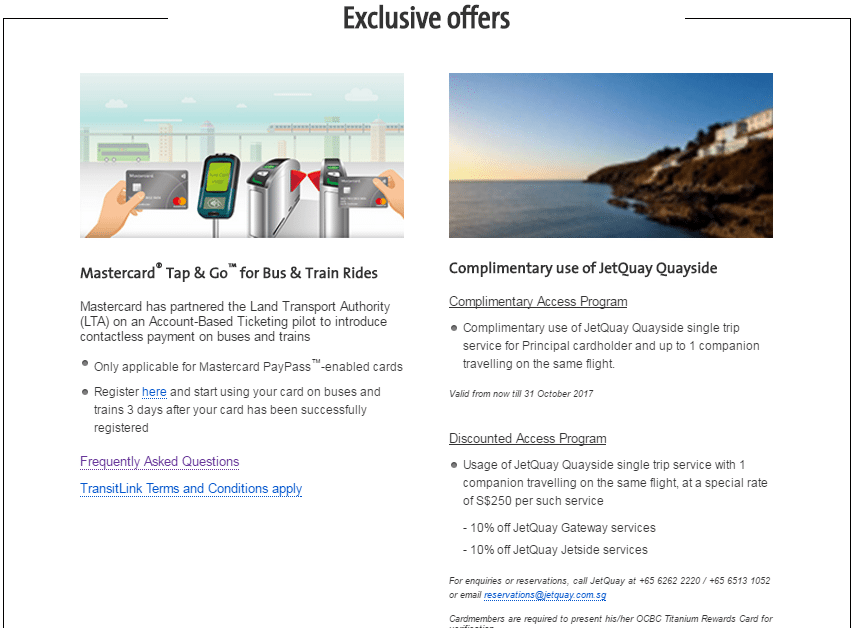

It talks about a few exclusive offers for cardholders (which, by the way, aren’t really exclusive in the sense that the one on the left is available to anyone with a Mastercard and the one on the right is open to World Mastercard holders)

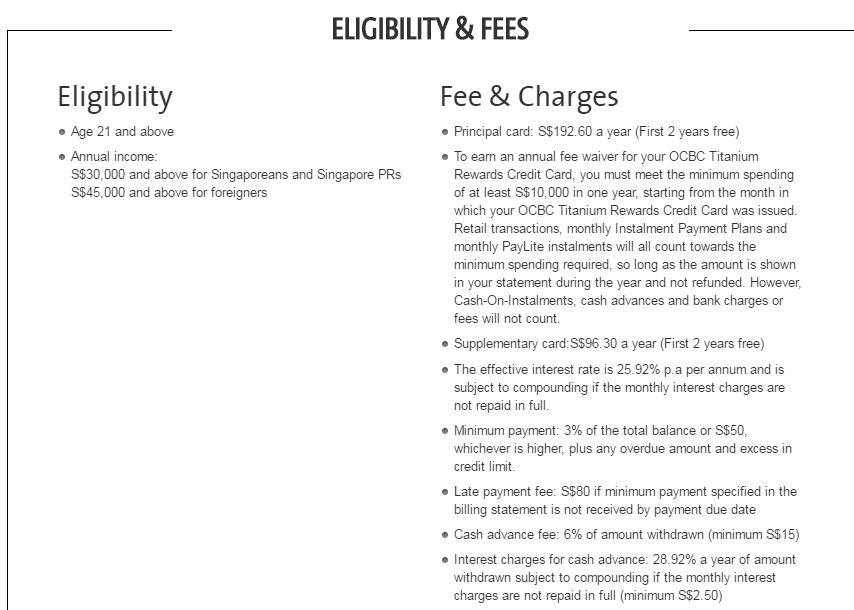

At the bottom it lays out eligibility + fees & charges for the card in a relatively straightforward manner.

But nowhere on the page does it talk about the cap on 10X rewards earning. Which, to me, is a pretty crucial part of the picture.

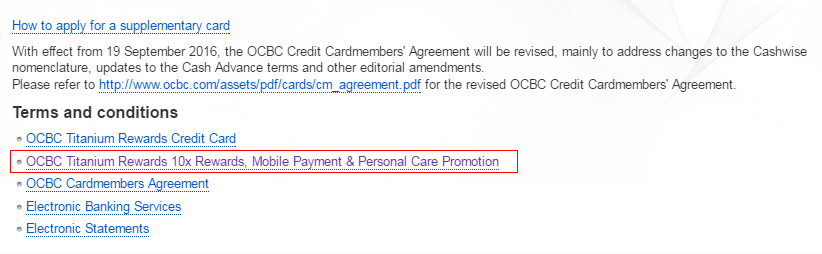

To learn about that, you’d have to click on this single line link at the bottom of the page (I’ve added the box in red)

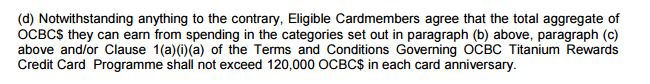

Which links you to a 2 page T&C document, where down in paragraph (d) you’ll find this

Reading this tells you that the maximum bonus OCBC$ you can earn each card anniversary year is 120,000, meaning that the maximum spending you can earn 4 mpd on is $12,000. Don’t you think that’s important enough to mention front and centre?

Now, let me emphasise- this isn’t a problem for me, because by this point in time I’ve had enough experience in the credit card game to be suspicious of any offer until I’ve gone through the T&C multiple times. I’ve accepted that as part and parcel of any deal.

But OCBC’s ad campaign isn’t targeted at people like me who have the time (no girlfriend) to read this sort of thing and don’t really care. It’s targeted at the 80% of people who hate reading fine print. And what they’re trying to do is hold themselves out as a company which is going to rise above this and deliver clear cut messages without hidden restrictions.

You could point out that other banks with 10X rewards cards (Citibank Rewards, UOB PPV etc) also have similar caps and disclose them in similar ways (i.e. hidden in the T&C ). And you’d be right. But if you want to position yourself as the bank who doesn’t do that kind of thing then, well, you can’t do that kind of thing.

I think OCBC’s ad agency has preempted such criticism by including the line “that we’ve also been guilty of in the past” as a sort of catch-all in case anyone goes digging trying to nitpick (no girlfriend). A sort of- yeah, we did that before, but y’know, that’s the old us.

And if that’s true, fair enough. I’m all for Damascene conversions. Let’s see what happens in OCBC’s advertising and card promotions in the months to come. But OCBC has generally had a difficult track record of communicating things clearly to customers (go look at the series of changes to the 360 account over the years and the confusion it always results in. Or this limited time CNY promotion offering 6mpd on the Titanium Rewards card that ended up being targeted, but the T&C didn’t say anything about that).

I still think UOB takes the cake for promotions that aren’t really promotions, but it’s clear that all the banks have a lot of work ahead of them if they want to be truly transparent.

TL;DR-

(1) sponsored posts need proper disclosure

(2) glass houses in throw stones people shouldn’t

Loved the acerbic wit hahahaha we all need someone to snark them on our behalf.

PS: What’s with UOB and OCBC? The only 2 banks with a good starter savings account have shit service whereas DBS has amazing service.. but no good savings solution. Sigh.

i’ve actually found all the banks’ service to be more or less the same with no one particularly better or worse in my experience. American Express has hands down the best customer service, always a delight to deal with them. the problem is I have no love for their cards…

If Amex customer service can mix with citibank type rewards. Winner winner chicken dinner!

Agree that DBS is in a different league altogether. Haven’t noticed any unethical practices from them. In Hwz, there are separate threads on how poorly UOB and OCBC treat their customers.

Aaron, I would not expect high editorial standards of a website that peedles alternative facts and fake xenophobic news stories 🙂

Re transparency and local banks, the main reason I reckon is that there are no rules forcing them to be that transparent to the consumer. UOB and OCBC have a cozy relationship with the establishment and even their ownership structures are opaque so…

hmmm. i would say that i generally hold mothership in higher esteem than sites like all singapore stuff which is just awful. which makes this a bit more disappointing.

Aaron, as you said we beefcakes need to stick together.

I agree with you and have also been mentioning in HWZ that ocbc credit card rewards are the worst. UOB a close competitor.

I am going to join in the UOB ranting here, and I’ve raised it in another forum before about their misleading or confusing advertising practices: – why the hell do people accept that DBS and UOB round down to the nearest $5 before awarding points? Especially when PRVI is advertised as a 1.4mpd earn rate. “You’ll Love 6 miles for every S$1 spent on major airlines and hotels 2.4 miles for every S$1 spent overseas 1.4 miles for every S$1 spent locally” Straight out false. Spend $4.99, get zero miles. Top up your ezlink at a GTM, get zero miles.… Read more »

Since we are on UOB, new product from them to earn miles

http://www.straitstimes.com/business/banking/uob-krisflyer-launch-deposit-account-that-rewards-with-air-miles

yup. i’m running some numbers on this now…

Guess what if you look very closely at the closed up pic of the ocbc ad, you can see the initials CWH on the cuff of the purple shirt in the ad. CWH stands for ching wei hong who is heading the consumer bank… so there you go if ching wei hong the head of ocbc consumer bank can approve an advert that requires one to scrunitinize a transparency ad closely with partially ‘hidden’ things, this really speaks much about OCBC and their new campaign… totally BS.. customer service uesless and product teams totally inflexible.. desperate for late fees and… Read more »

hahaha woah. that’s either an oversight or some illuminati shit going on right there.

I have just looked up the name of the lady (or gentleman, apologies) on LinkedIn and it is not in there 🙁

Would not be surprised if that marketing campaign was signed-off without much of an assesment from the business though, and this is common in many companies.

[…] Yes, there are conditions in play that annoys consumers. That said, most banking products also have conditions though OCBC is trying to make a play to stop this. […]

[…] Financial blogger MileLion also wrote about the matter detailing how the bank hasn’t really behaved any differently after the campaign launch and giving examples of how it continues to hide behind its terms and conditions. […]

[…] candid admission that they’d been guilty of some of these tactics in the past, but couldn’t help but be more than a bit skeptical. Not so much because I felt the bank had a particularly bad reputation in the market or anything, […]