I thought that I’d said everything I needed to say about the new Krisflyer UOB account. I really did. And having done my civic duty, I then disappeared gracefully into the night, the hero this city deserves but not the one it needs right now. Or vice versa. I forget which is which.

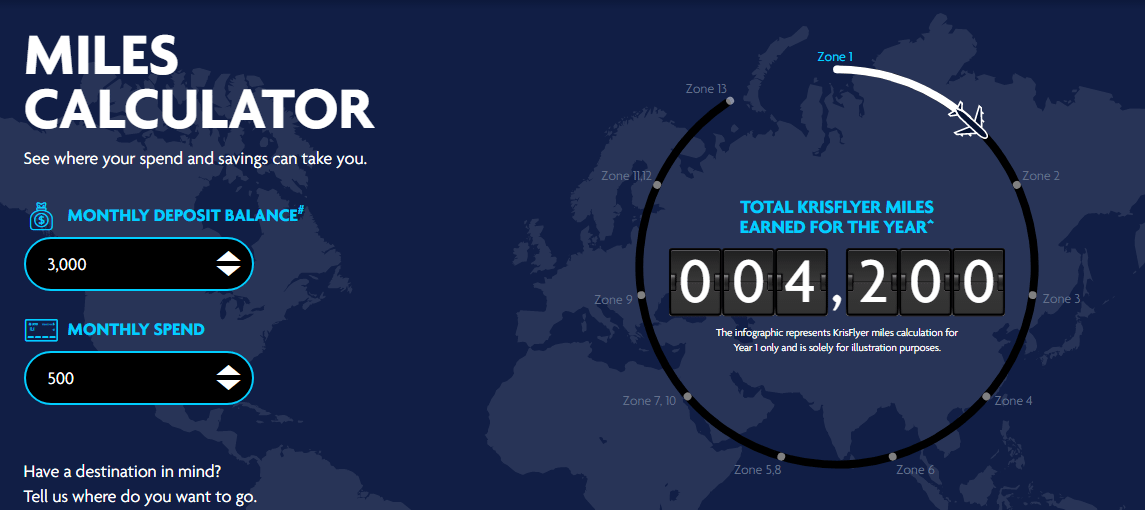

But man, reading Mothership’s latest sponsored UOB Krisflyer post got the blood pumping again.

We could start with the lack of proper sponsored post disclosure. Yes. I realise that at the bottom of the post, there’s this line-

This sponsored post is brought to you by UOB. We also want to be able to spend $500 a month on our debit cards to accumulate miles.

But that’s my point. It’s at the bottom. I’ve called out this problem before, but I’ll say it again: I fervently believe that such disclosures obey the letter but not the spirit of the law. Disclosure needs to be full, frank, and upfront. Because that can be the difference between someone choosing to read an article or not.

By only telling people at the end that a post was sponsored, you’re leading them up the garden path. They read an article with the lens that whatever is being said is a personal, objective opinion. Then you say, oh, by the way, this is sponsored. That’s just bad faith. You’re denying them an important piece of information that might affect whether they want to read it in the first place.

Does it really make a difference? Of course it does, and advertisers know it. I’ve seen sponsored post briefs that (if they mention disclosure at all) ask for disclosure to be at the end, rather than upfront. Because people don’t like being bs-ed, and the tendency is to switch off once you see a post is sponsored. And evidently Mothership’s writers know that it makes a difference too. Because why else would you bury the disclosure at the bottom if you felt otherwise?

Disclosing sponsored posts upfront is best practice. Let’s leave that point there. Mothership is hardly the most egregious of offenders when it comes to disclosure, but I would expect much more from them given their stature in the blogosphere.

I want to spend the bulk of this post talking about the content of Mothership’s article. You might be shocked to know that I don’t agree with their findings.

I know, I’m a bit like this-

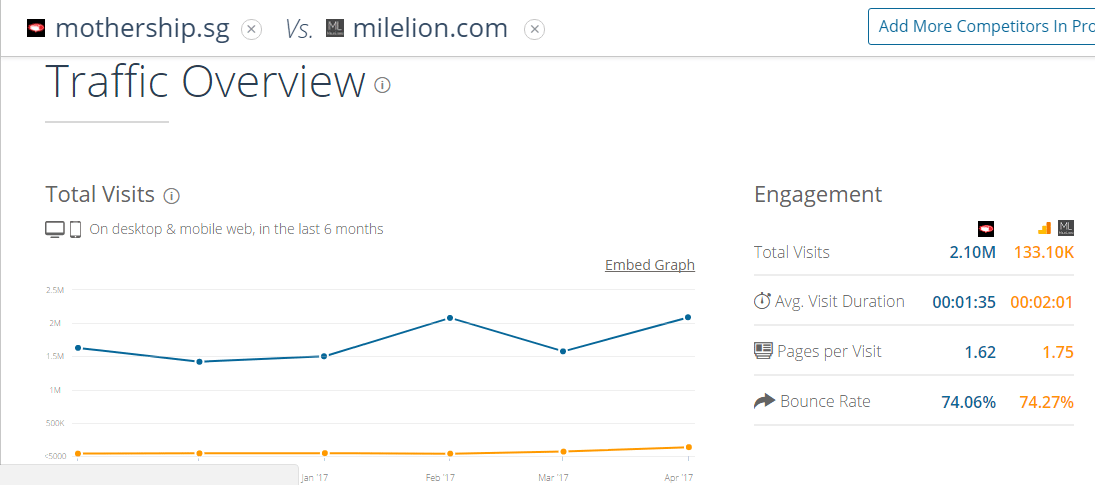

But Mothership is big. Like, register with MDA big. That blue line in the graph below is Mothership. That orange line below is The Milelion, for comparison. I get size anxiety.

If 2 million people read Mothership each month, that’s 2 million people who could potentially be misled. And some of those 2 million people could be chiobus. So I must do something, because everyone loves an internets hero.

Once more unto the breach…

Analyzing Mothership’s post

Let’s first set the rules of engagement. I’ll let Mothership do that

For the sake of this article, let’s assume you are a millennial who has been in the workforce for a couple of years and are considering getting the KrisFlyer UOB account. Since that’s UOB’s target audience anyway.

Hold on, lemme fix a typo

For the sake of this sponsored article, let’s assume you are a millennial who has been in the workforce for a couple of years and are considering getting the KrisFlyer UOB account. Since that’s UOB’s target audience anyway.

Ah. Better. OK, go on.

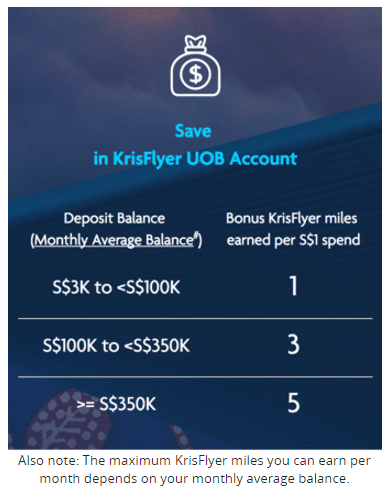

Mothership considers the 3 potential tiers of miles earning that the Krisflyer UOB account offers, based on account balance. To recap- that’s

- $3K-$100K: 1.4 miles per dollar (mpd)

- $100K-$350K: 3.4 mpd

- >$350K: 5.4 mpd

They rule out the >$350K and $100-350K tiers, thankfully, because that’s just plain unrealistic, and settle on the third.

That leaves the third tier, which starts at $3,000. Plenty of financial sites widely advocate having 3 – 6 months’ salary in savings stashed away in case of emergency. This tier seems more achievable for most people.

Fine. Now one assumption from me: I’m going to assume this millennial (there’s that word again!) grad earns at least $30K per annum.

I don’t think that’s too far a stretch, because I’ve shown previously that the average poly or uni grad should be earning at least $30K per annum, once the 13th month bonus is taken into account.

So here’s how this will work. Mothership will make the case for using the UOB Krisflyer account. I’m going to make the case for using the DBS Altitude Visa card (minimum income required: $30K).

And I’m going to give Mothership 3 major handicaps.

- I’m going to assume the fresh grad doesn’t take advantage of the 10,000 mile sign up bonus that the DBS Altitude has, nor the double miles earning promotion that’s on till 31 July

- I’m going to assume that this fresh grad doesn’t spend anything on foreign currency transactions (2.0 mpd) or air tickets (3.0 mpd), instead earning 1.2 mpd everywhere. That’s unrealistic, but I’m feeling generous.

- And I’m going to assume that our fresh grad just uses this one card. Yup, I’m not going to suggest any of my multiple card strategies. That’s a big problem for anyone pursuing a miles strategy, but I read that chiobu like cocky guys

Your move first, Mothership.

Round One

1. Fresh grad: $3,000 monthly account balance, $500 monthly spend

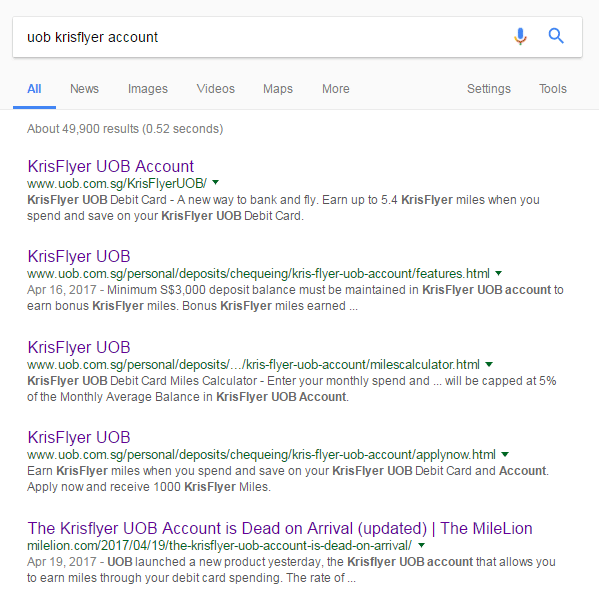

Mothership shows the working from the Krisflyer UOB miles calculator- with $500 monthly spending and a $3K monthly account balance (MAB) you’ll end up with 4,200 miles at the end of the year.

You might be wondering- $6,000 of annual spending at 1.4 mpd, isn’t that 8,400 miles? Yes, it is. Except that the bonus miles you can earn each month is capped at 5% of your MAB. In this case, that’s 0.05*$3,000=150 miles.

Which means that each month, your first $150 of spending earns 1.4 mpd. Your next $350 is earning 0.4 mpd!

Mothership notes this restriction, but apart from this caption above, they don’t mention it anywhere in their calculations. Don’t you think it’s a pretty crucial point?

My turn: if our fresh grad spends $500 a month at 1.2 mpd for a year, he’ll have 7,200 miles. Boom. He doesn’t even need to put that $3,000 in a 0 interest earning account, and he’ll have 3,000 more miles than if he followed the Mothership option.

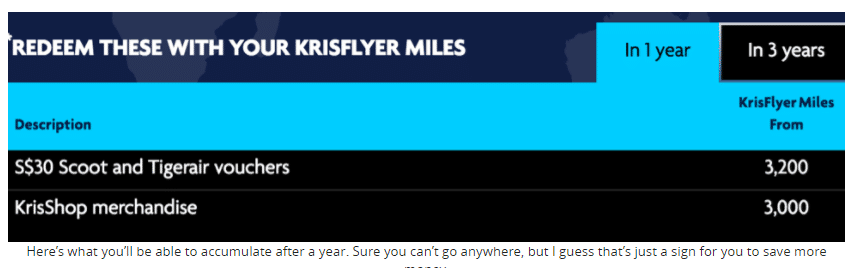

Mothership then presents some suggestions as to how you should spend this veritable bounty. They note, correctly, that you can’t go anywhere.

Well, to be fair, neither can my fresh grad who has 7,200 miles. But my guy is 300 miles shy of a one way economy class ticket to Bali. Their guy is 3,300 short.

No worries, Mothership has another suggestion-

An alternative option here is for you to redeem the Scoot voucher to offset your budget travel. The KrisFlyer UOB account also gives you perks with Scoot such as priority check-in and boarding, additional 5kg luggage when you purchase of 20kg baggage, and free seat selection.

An alternative option here is for you to redeem the Scoot voucher to offset your budget travel.

redeem the Scoot voucher to offset your budget travel

redeem the Scoot voucher

I hate myself for what I’m about to say.

If you’re going to use the miles you earned from your Krisflyer UOB account for Scoot vouchers, you might as well be using a cashback card.

There. I said it. Are you happy now, Mothership? You made me recommend a cashback card.

I feel so dirty right now. But it’s true. With $500 a month spending on a 1.5% cashback card (eg. AMEX True Cashback Card/ SCB Unlimited Cashback Card), you’d earn $90 cashback in a year. That’s $60 more than a $30 Scoot voucher, and it’s not in a captive currency.

Redeeming Scoot vouchers with your Krisflyer miles is a terrible, terrible option that values them at just under 1 cent each. Mothership writers, you can club baby seals. You can play keepaway with an orphan’s bindle. You can unilaterally pull out of the Paris climate accords. But whatever you do, for the love of all things bright and beautiful please don’t redeem Scoot vouchers.

Mothership’s article goes on to helpfully point out-

A quick comparison here: if you kept your $3,000 in a savings account that gives you 0.05% interest on your savings, you would be getting $1.50 in interest a year – which doesn’t quite compare to $30 in Scoot or Tigerair vouchers to go travelling.

But that’s a false dichotomy. Our fresh grad’s alternative option is not just to put $3,000 in a savings account and earn 0.05% interest. As I’ve shown, our fresh grad can get an entry-level DBS Altitude card and outearn the Krisflyer UOB account. Hell, our fresh grad can get an entry-level cashback card and still end up better off than with the Krisflyer UOB account (based on a valuation of 2 cents per mile)

Because ending their example with a $30 Scoot voucher would be a bit of a damp squib, Mothership shows the position you’d be in after 3 years too

If you spent $500 per month for three years and have $3,000 in the account, you would be able to accumulate 12,600 KrisFlyer miles.

Great. My fresh grad? He’s got 21,600 miles ($500*12 months*3 years*1.2mpd). He’s jetting off to Shanghai, Beijing, Hong Kong, Taipei, Male, Perth, while the furthest Mothership’s fresh grad can get to is Bangkok.

Next!

Round Two

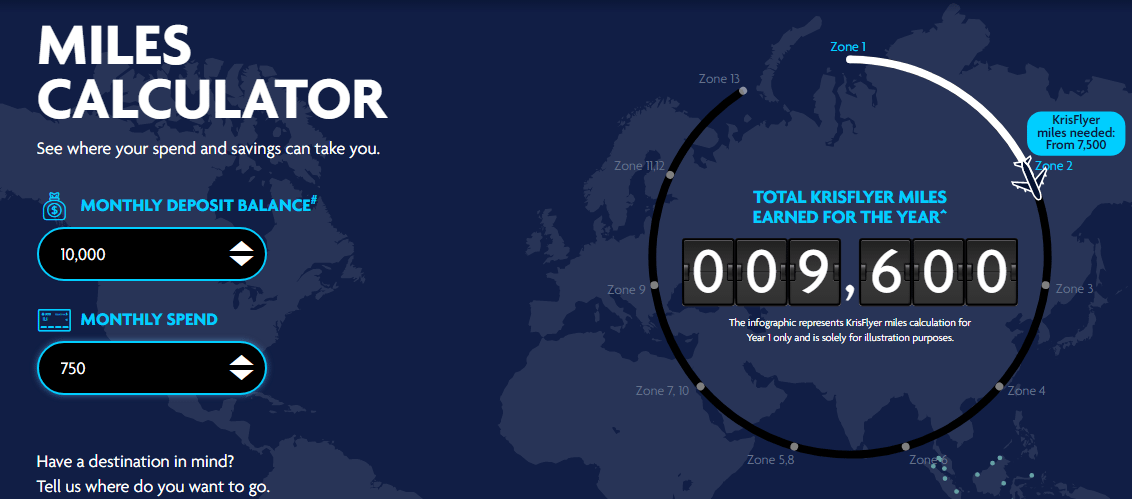

2. 20s in their second job: $10,000 monthly account balance, $750 monthly spend

Mothership proposes a second scenario. Crunch a $10,000 MAB with a $750 monthly spend into the trusty miles calculator, and 9,600 miles is the outcome.

9,600 miles puts all the Malaysia, Indonesia and Brunei destinations on the SQ award chart within reach.

But again, this person using the Krisflyer UOB account has triggered his monthly bonus cap with his $750 spending. That $9,600 annual spend at 1.4 mpd should have given him 13,440 miles. Remember though, his bonus miles are capped at 500 per month (0.05*$10,000 MAB). He earns 1.4 mpd on the first $500, and 0.4 mpd on the next $250.

What about my guy? $750 a month at 1.2 mpd=10,800 miles in a year. He’s ahead by 1,200 miles. And he didn’t have to put $10,000 in a 0 interest earning account.

Again, if you kept your $10,000 in a savings account that offers 0.05% interest, you would be rewarded with $5 interest a year – would you rather have that or a ticket to one of the above destinations?

False dichotomy alert #2. I mean, I could paraphrase that and say “Again, if you kept your $10,000 in the UOB Krisflyer account that offers 0% interest, you would be rewarded with 9,600 miles a year- would you rather have that or 10,800 miles plus 0.05% interest?”

Here’s Mothership’s 3 year scenario

And the end of three years of spending $750 per month, you’ll accumulate 28,000 KrisFlyer miles – which is enough to visit most of SIA’s locations.

Cute. My guy is now on 32,400 miles ($750*12 months* 3 years * 1.2 mpd) and feelin’ fine.

What’s that, you say? I’m forgetting annual fees? Yes, it’s true. The DBS Altitude Visa has a $192.60 annual fee, waived for the first year. The UOB Krisflyer debit card has no annual fee.

Here, our guy has two options. First, he can try to apply for an annual fee waiver when it comes due. Banks are usually quite generous with this. Second, if the bank does not waive his annual fee, he will end up with 10,000 miles for each year he renews his DBS Altitude card. So by the end of the third year, he will have 20,000 bonus miles for $385.

If the second option comes to pass, the two propositions after 3 years are

- Mothership: Spent $27,000, got 28,000 miles

- Mine: Spent $27,000 + $385 on annual fees, got 52,400 miles

I don’t know about you, but I think I’d pay $385 to earn an additional 24,400 miles. My guy can now fly one-way business class to Cape Town, the destination that Mothership recommends we redeem our miles for.

Basically: Mothership’s seat on the Capetown flight

My guy:

I think we’ll have to agree to disagree.

Does Mothership adequately point out the drawbacks to the account?

Mothership provides two caveats at the bottom of their article. They point out that the account doesn’t earn interest, and they point out that all Krisflyer miles expire after three years.

Fair enough, but this doesn’t anywhere near adequately explain one of the biggest problems with the Krisflyer UOB account: the 5% cap on bonus miles earning. This is the deal killer for me, and for a lot of people in the miles game.

If wanderlust is in your blood and you want your daily spend and savings to help you satisfy that wanderlust, the KrisFlyer UOB account is something for you to consider.

No. It’s not. If wanderlust is in your blood and you want your daily spend to help you satisfy that wanderlust, drop me a note. We’ll talk.

Wrapping it up

I’m confused as to what UOB’s social engagement strategy is. Their influencer campaign backfired, not just for want of disclosure, but also because it was painfully clear these influencers hadn’t the faintest idea what miles were about. They laid low for a while to let things die down, and then they went to Mothership with a sponsored post proposal.

I mean, what was the endgame here? Damage control? The hope that by presenting a few scenarios where the account might make sense, people would change their minds (if so they should have asked Mothership to write about a student or retiree who doesn’t qualify for any credit cards at all, period. But even then, the retiree could probably get a secured DBS Altitude card with a fixed deposit…)?

What was this sponsored article supposed to achieve? I don’t know. I’m as puzzled as you are.

What irks me is that I’ve always considered Mothership to be one of the good guys. I mean, they’re not batshit crazy like All Singapore Stuff. They’re not xenophobic racemongers like TRE (favourite TRE headline: Jollibee discriminates against Singaporean staff. Reason given in article–> Jollibee writes on Facebook “we welcome all Jollibee fans to apply for a job at Jollibee!–> Jollibee has never been in Singapore before–> Only Filipinos could be fans of Jolibee–> Jollibee only wants to hire Filipinos. No, this really happened). They don’t have the existential, prepubescent angst of Amos Yee.

Mothership is a perfectly decent editorial platform. So why are they taking advertiser money to encourage people to sign up for a bad deal?

“Where can a regular twenty-something realistically travel to with the KrisFlyer UOB account?” Mothership asks in their article title. The answer: nowhere great. But fortunately, that’s why we have miles cards. Proper ones.

“This sponsored post is brought to you by UOB. We also want to be able to spend $500 a month on our debit cards to accumulate miles.” Mothership concludes.

Guys, reach out to me. We’ll have coffee. On me. And I’ll show you a better way.

I love every word on this article. So hilarious. This shows how easily the general public are misled by publicity stunts and most of these bloggers have the slightest idea of what a miles game all about!

Well written bro!

I know I´m repeating myself, but why expect higher editorial standards of the Singaporean equivalent of the Daily Mail? Why write an article on why the DM spews ignorant and xenophobic BS to their huge audience, who sadly don’t know any better? 🙁

But that’s my point. they’re not the sg equivalent of the daily mail. i’d put A.S.S in that category, but not mothership. So it’s extra disappointing that they’d go down this path.

They are just a Pappy supporter web site la.

3 things we don’t discuss on the milelion.

1. cashback

2. the kardashians

3. politics

that said, 100 milelion points to anyone who comes up with a haiku involving all 3.

100 Milelion points can redeem flight to where? Must be premium class ok.

trump and politics

scary movie no cash back

simi card, asians?

Once again a great article – factual and humorous! Dumbfounded why UOB keeps flogging this dead horse. The only thing they should keep is the design of the card and re-use it for something better…

It’s like target practice right, with every chiobu you save you get better and funnier hahaha!!

Thanks for another excellent article Aaron. By the way CIMB gives 1%p.a for balances above $1,000 , so for $10,000 you will get bit north of $300 after 3 years which can cover a big part of card annual fees.

Haha in your last line, I’m pretty sure you meant ‘girls, reach out to me’, instead of ‘guys’..

Eligible ladies, the milelion is single and available! I’ve seen his krisflyer miles balance, you won’t be disappointed!

As my cell group leader you really need to do a better job pimping me out

Playing the devil’s advocate here – perhaps UOB has studied their own deposits and customer’s deposit/withdrawal/expenditure habits and found that many of them have substantial savings lying around and doing nothing and they have regular expenditure monthly – so that’s why they see and opportunity here.

Another point, this UOB card is a debit card, it may be the only way for people who don’t qualify for miles credit cards to earn miles.

Unless you’ve screwed up your credit history, it’s not that difficult to qualify for credit cards. Either $30k min income, or $10k fixed deposit (which earns interest unlike UOBs account). The 10k on savings scenario is already envisaged in the above scenario. If you’re under $30k income and don’t have $10k for a FD, then: – get a DBS live fresh student card if you’re a student: 1.2mpd on online and paywave. This can also be used to get an altitude card* – for everyone else there are other debit card incentives available, eg dbs debit Visa 5% cash back… Read more »

I wonder if the guys / ladies at SIA loyalty marketing who worked with UOB on this account / card have any basic knowledge on miles credit card. Frankly, they don’t.

Haha! Good one. Why else would SIA be making losses and their own Loyalty/Marketing team know shit nuts about what it is they are promoting. They are merely riding on the SQ Kebaya girls and that dresses. Nothing else. PLUS SQ hard wares have always been 2 steps better than any other US/European airlines. It’s a no brainer to redeem KF miles from those regions to Asia.

I lost it at “redeem the Scoot voucher”.

Aaron and Mile lion readers are on the whole, I argue, prosumers and NOT the average Mothership target demographic. You know the people who queue up hours for 1. Hello Kitty cafe entrance openings, 2. Arcade money changers to save $1.72 on foreign currency, and 3. Buying apparels from retail malls when there is a big emblazoned “SALE” ? That’s Mothership’s target audience. Caveat emptor: all credit cards misrepresent to some degree. Cash back cards claim you can save 13% off dining (putting tje min spend and max cashback cap in asteriks fine print), miles cards proclaim priority pass entry… Read more »

reminds me of a dilbert comic strip where scott adams wrote in the margin: thank God for double standards. otherwise we’d all be in jail.

and yes, the lack of transparency is a problem across the board, be it with cashback, miles or other financial products. fortunately if you know what you’re doing you can still make the game work for you. and that’s what we hope to do over here- tell you how you can make it work!

I love your comment, and that was even before I realised I had misread your nickname and it wasn’t fattybottom.

Sadly enough, I don’t disagree with this post – if there weren’t casual earners unwilling/unable to optimise their mileage earn pattern, there’d probably be even less opportunities (for the ones who are) to capitalise on.

I think avenues like this blog serve a good intermediate by providing information to all who wish to take the trouble to update themselves on such matters, but for those who don’t…

whenever i hear prosumer, i think of digital camera.

i’m not quite sure why.

Salute! Aaron!!

3 years for 54,000 miles after stinging so much….Aaron thank god for your LifeMiles hack with sgd3500 I have over 200,000 miles. That’s SIN-JFK return in FIRST CLASS. All I need to do is just Budget away the 3500 and save elsewhere…..all these bank nonsense are a scam.

Haven’t we already shown way better alternatives than the UOB Krisflyer in our collab article? Haven’t sponsored influencers learnt a thing or two about doing their homework before they make any sort of financial recommendations?

Oh wait, I forget. They haven’t. CALL THEM OUT AARON BLOW THEIR BS.

Coffee?

Real coffee. Not the gta hot coffee

I’m interested in miles and cards now. So I’m going to read your blog in detail. Thank you for the information you provide on your platform!

This is an awesome write-up! First time here and found it hilarious!

Awesome!

And like to seek your comments on my current strategy whereby i use Ocbc titanium for all places that I can pay with samsung pay, if not possible, the anz 5% cashback on dining while dbs altitude for the rest.

Is there any other better strategy? Hope to here from you and thanks!!

The Milelion will refuse to advise you because you mentioned the most vulgar word in his dictionary.

The most vulgar word?

cashback… don’t say cashback…

other words that annoy me: revert, irregardless, gaia

What did Gaia ever do to you?

totally ruined the ending of avatar for me. dressed as eywa. was all ready to see the hippies get slaughtered.

I was wondering what you had against Gaia, mother earth.

Btw have you seen the article by ValuePenguin arguing that cashback cards are better ? http://www.theindependent.sg/cashback-cards-are-better-than-miles-cards-for-most-singaporeans-valuepenguin-analysis/

Let it go man, let it go. Plenty more hippies.

this really depends on what you’re spending on “for the rest”. there are still other bonus categories that you might not have fully tapped out. what are you using for your online spending? your air ticket purchases? your paywave spending? I assume you don’t have a specialized miles card like the UOB PP Amex for dining?

I’m so glad for your blog and reply! Went to read through your blog and realise that uob preferred platinum can actually earn 4 miles with paywave too, which is better than ocbc titanium- mobile payments only which some places don’t accept despite having paywave. Also, for travel, I’ll use the DBS Altitude Card and Online spending will be Citibank Rewards card if it’s shoes clothes or bags.. But otherwise I’ll just use the DBS. And I don’t have the UOB PP Amex card too.. saw your post on it but I guess I’m too late already! Also I went… Read more »

there’s a caveat for uob pp visa though- if the merchant participates in UOB’s SMART$ program, you won’t earn uni$. this eliminates merchants like cold storage, guardian etc. you can google a full list of smart$ merchants. everything else is fair game.

uob visa signature has a minimum spend for 4 mpd on petrol, be aware of that too. note for your travel you can use dbs woman’s world card for air tickets and get 4 mpd for the first 2k.

hope this helps!

Min spend of $1k for local categories preclude UOB VS as a useful card for regular use.. mostly for overseas..

Thanks alot!! That really helped and I’ll just stick to the PP and remember the merchants. Hahaha

And first.. Need to.. ask my woman to apply that card HAHA

Anyway just wondering.. I actually always say paywave and pay through my samsung phone- ocbc titanium.. you have any idea if that gets 10x points?

There was one other point which to give them credit is mentioned in the small print, but easy to gloss over.

UOB has also got ads on mothership with clickbait titles like “fly for free to bali, mandalay, bangkok” etc.

But the detailed calculations in the sponsored article are for ONE WAY tickets. How are they supposed to fly back ? Especially since one way tickets on full service carriers typically cost at least 80 percent the price of a return ?

I guess they could always use the Scoot voucher for the return leg ?

One thing I have learnt in life is always put yourself in other people’s shoes. The poor guy writing this sponsored post is probably as aware as you that the UOB Krisflyer account is not the best way to earn miles (not that the post did not said so), BUT he has a job to do and that is to market the account. Just like if you are a management consultant and working for others, you don’t choose your client (be it gambling, tobacco or birth control companies). It’s a job and you gotta deliver to the client’s request. All… Read more »

It’s one thing to earnestly write good things about a bad product because you don’t know any better. But if, like you suggest, they know it’s bad and still promote it because they’re getting paid, then that’s just cynical and reprehensible in my view. Money should not affect your editorial policy. People put their trust in you to provide them with fair, impartial commentary about what’s what. For you to leverage that trust to sell people something you know isn’t great in order to line your own pockets is an abuse of that trust. so on that point i’m going… Read more »

Also, his job as a writer isn’t to market the account. His job as a writer is to continue putting out fair, impartial articles that readers of the site can rely on. It is more than a bit disconcerting if we believe his job is primarily writing what advertisers want. If it is, you should go into copywriting, not journalism. Perhaps it’s like you said, and the writer is more of a helpless pawn in all this, stuck between his conscience and mothership’s editorial policy. That may well be the case. I don’t know. But that’s why you’ll note that… Read more »

Or to put it another way- were the influencers who promoted this product just “doing their jobs” ?

Agree with the MileLion. If the writer (or the website) is simply doing his/her job, then just stick a disclaimer right at the top of the article so it is clear to all that this is a paid advert. Masquerading as an independent opinion is aa good as misrepresentation in my view.

Nice read, but you should credit xkcd if you are going to use Randall’s cartoon…

you’re right. Have added this

Hahaha why are u still single…

I blame affirmative action

“Mothership writers, you can club baby seals. You can play keepaway with an orphan’s bindle. You can unilaterally pull out of the Paris climate accords. But whatever you do, for the love of all things bright and beautiful please don’t redeem Scoot vouchers.”

You had me at this. (Y)