This article is meant to investigate whether there is value in selecting to use a credit card that award miles over the cashback ones. I had spent some time trawling the internet, hear the sharing from the Milelion meet up and crowd-sourcing our Milelion Telegram group to piece up this article with the objective to breaking down fuel spending for a mile chaser.

It is a jungle out there when it comes to fuel spend because there are so many credit cards offering various discounts on petrol spending with different retailers. Some people swear allegiance (or for the convenience) to certain brands while others reminded me that NTUC LinkPoints earned can be converted into Asia Miles (440 LinkPoints to 110 Asia Miles). So guys, caveat emptor, have a read and see for yourself which credit cards suit you best in your quest for miles.

Most people will prefer cashback..

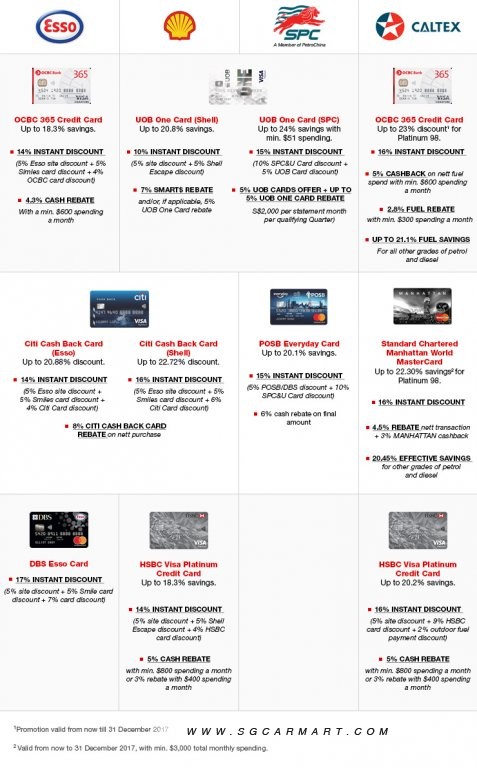

And there is a good reason for it. It is the most direct form of savings and there are some good cashback cards that offer substantial savings on fuel spending such as the Citi Cash Back, OCBC 360, UOB One, POSB Everyday, giving savings up to 24% (read the fine prints and conditional spending for each card). SgCarmart has a good illustration on them, at a glance.

There are a lot of cashback cards that are good for fuel spending. 24% savings on the UOB One card (if you are able to achieve the required spending) for SPC fuel is indeed substantial (SPC does not award UNI$, while Shell awards SMART$). Most of the other cashback cards give around 20% in savings with some conditional card spending as well.

But if you are into miles…

So with such attractiveness of cashback cards in the market, is there still a value proposition to use miles cards for fuel spending? Surely there is no free lunch where one gets fabulous savings and still generate a good 4mpd. Still I did a research on the miles cards that are suitable for fuel spending and I found that it is possible to use a 4mpd card on fuel spending, however with limitations.

| Standard Chartered Visa Infinite (1.4mpd* local, 3mpd overseas)

*min. spend of $2,000 per statement cycle, if not 1mpd |

16% discount at Caltex (for 98 grade) + 10.8% SC rebate on nett amount (min. $600 monthly spend) = 25.07% savings |

utilize with Plus card for LinkPoint rewards |

| OCBC Voyage (1.2 mpd local, 2.3mpd overseas) | 19% discount at Caltex instantly |

OCBC waives points redemption fee |

| Maybank World Master (4mpd at Shell stations and selected merchants) | 19.1 % savings at Shell stations (15% from Corporate Fuel Card + 4mpd on fuel spend*)

* Maybank calculates that 10 TREATS Points can redeem 4.85% worth of cash credits to offset fuel, after applying the 15% discount. |

TREAT points do not expire |

| Maybank Visa Infinite (1.2mpd local, 2mpd overseas) | 19.1 % savings at Shell stations (15% from Corporate Fuel Card + #4mpd on fuel spend)

#particularly 4mpd only on Shell stations for fuel spending via the corporate fuel card – confirmed by CSO. 1.2mpd for other local spending. |

TREATS points do not expire |

| Maybank Horizon Visa Signature (@3.2mpd)

@ Earn 3.2 air miles (8X TREATS Points) with every dollar spent on dining, petrol, taxi fares and hotel bookings at Agoda.com/horizon |

no promo with fuel retailers. earns a straight 3.2mpd at all petrol stations. |

|

(edit: The Maybank Horizon Visa card is added as another miles card for petrol spending)

There are other cards such as the HSBC Premier Mastercard/HSBC Visa Platinum that are essentially cashback cards that reward points in exchange for miles (Thanks to Peter who shared this at the recent Milelion meet up). There is also the Amex Platinum card that will earn MR points (you should know that is bad value). However I did not feature these cards here because these are essentially not miles cards. Based on my best search, these are the 4 miles card that have partnered with fuel retailers here. Both SC VI and OCBC Voyage cards give upfront discounts on Caltex while the Maybank WMC and VI give discounts for Shell. If I were to pump at Caltex, I will choose the OCBC Voyage over the SC VI because of the former’s lower annual income requirement and no minimum spending requirement. (edit: The Maybank Horizon does not have partnership with any retailer for discounts but it awards a respectable 3.2mpd at all petrol stations islandwide.)

If I pump at Caltex

One should be looking at either the OCBC 365 cashback card or the OCBC Voyage card. Let’s have a look at both cards side by side:

| OCBC 365 | 23% savings: (i) 16% upfront Platinum 98 discount which includes station onsite discount and OCBC Credit Card discount (ii) $10 rebate with a minimum $300 nett fuel amount charged at Caltex to OCBC 365 Credit Card within a calendar month (iii) 4.2% cashback on the gross fuel amount (or 5% cashback on nett fuel spend) charged to OCBC 365 Credit Card; minimum spend of $600 on the credit card |

| OCBC Voyage | i) 19% discount (any fuel type), ii) 1.2mpd for fuel spend |

Between these 2 cards, the miles side of me is inclined to the OCBC Voyage because of the attractive 19% savings and ability to earn 1.2mpd. I also like that fact that OCBC Voyage waives the points redemption fee. There was a recent review of the Voyage card by our guestwriter, Louis, and you should read it here before deciding if it is the card for you. That said, I am very put off by the high annual fee of $488 for a measly 15,000 VM (3.25cpm is way too expensive) and that is a deal breaker.

As for the OCBC 365, I like the $10 rebate since I can easily spend more than $300 nett on fuel per month but the 4.2% cashback puts me off because of the minimum $600 spending on the card per month.

Scenario based conclusion: I will use the OCBC 365 to pump petrol at Caltex stations, getting a 16% discount + $10 rebate (equivalent to 3% off) for a total of 19% savings.

If I pump at Esso, SPC or Shell

| Citi Cashback Card (Esso) | 20.88% savings: (i) 14% off with station discount + Esso Smiles card + Citi cards (ii) Up to 8% cash back is applicable with a minimum spend of S$888 per statement of account. A maximum cash back of S$25 may be accumulated in each statement of account. |

| Citi Cashback Card (Shell) | 20.88% savings: (i) 14% off with site discount + Shell Escape card + Citi cards (ii) Up to 8% cash back is applicable with a minimum spend of S$888 per statement of account. A maximum cash back of S$25 may be accumulated in each statement of account. |

| UOB One Card (SPC) | 24% savings: (i)15% discount with SPC&U + UOB cards (ii) 5% off ($3 off every $51 nett spend) (iii) Enjoy up to 5% cash rebate based on a min. spend of S$2,000 monthly for each qualifying quarter (3 consecutive statement periods) with min. 3 purchases monthly to earn the quarterly cash rebate of S$300 |

| POSB Everyday (SPC) | 20.1% savings: (i)15% discount with SPC&U + POSB/DBS cards (ii) 6% cash rebate on final amount |

| Maybank World Master Card (Shell) | 19.1 % savings at Shell stations (15% from Corporate Fuel Card + 4mpd on fuel spend) |

The Citi and UOB cashback cards have something in common: achieve minimum spend to get the cashback. Citi Cashback requires $888 in spending for 8% rebate and the rebate is capped at $25 per statement period while UOB One card requires a minimum spend of $2,000 per month to earn the measly 5%. If I were to chase miles, I should not be spending $2,000 on a cashback card, period. Failing which to achieve the minimum spendings, I am looking at a maximum of 20% discount at SPC using the UOB One card and 14% discount at Esso and Shell using the Citi Cash Back card (DBS Esso card provides better value in offering 17% discount at Esso). For the POSB Everyday card, it is a lot simpler. You get 20.1% savings from SPC.

Scenario based conclusion (for Shell): Given the restrictions on the Citi Cash Back, I would use the Maybank World Master card to purchase Shell fuels. There is no minimum spending required and the fact that TREATS points do not expire give the additional perks in this scenario.

Scenario based conclusion (for SPC and Esso): I guess this is quite clear. For the lack of a miles card partnering with SPC and Esso, the cashback cards are the clear choices here. If you cannot meet the minimum spend on Citi Cash Back card, you should use the DBS Esso card to get greater savings at Esso stations. Likewise apart from the UOB One card, the POSB Everyday card also provides similar good savings without conditional spending.

Right now till April 2018, I am using the Amex KF card with SPC that gets me 21% petrol savings and earn 1.1 KF miles (no need to pay conversion fees). If this promotion does not extend, I will likely apply for the Maybank WMC for the savings + miles rewards at Shell stations (maybe I should ask for an invite for the Maybank World VI, hmmm). So eyes wide open, choose a card that suits you.

(edit: some have commented that they have been getting 4mpd at SPC using the UOB Visa Signature (more than $1,000 spending and capped at $2,000 er statement period) even though the UOB website states ‘No UNI$ will be issued for all transactions at SPC’. If anyone has experience of getting 4mpd at SPC from UOB VS, please add in at the comments section. If all true, it will be 20% savings and 4mpd! Who says you can’t have your cake and eat it too?)

How about the UOB Visa Signature card? You get 4mpd for petrol as Long as you hit 1k local spend, but what are the restriction and how it stack with cards that have tie up with each of the station?

UOB PPV PayWave at Caltex should give 4mpd without minimum?

Was under the impression that UOB does not award any UNI$ for fuel purchases…

Based on this link(below), caltex is smart$ merchant and therefore Uni$ is not issued. But when I checked the Caltex receipt , I don’t see the smart$ summary at all. So , is it confirmed that we receive 4mpd when using PPV?

http://uobsmartdollar.yc.sg

SPC doesn’t award UNI$, regardless of whichever UOB card you use.

That’s inaccurate. UOB VS gives 10x UNI$ at SPC, with 1K min spend a month. It’s shell that doesn’t as they are smart$ http://www.uob.com.sg/personal/cards/credit-cards/travel-cards/uob-visa-signature-card.page

Thanks Chris. Yes indeed, Shell gives SMART$.

Have a look at this website http://www.uob.com.sg/personal/cards/cards-privileges/fuel-power/spc.page

Scroll down to about 4/5 of the page. There is a statement that starts with “Note”.

Yes, as per their FAQ:

Q. Do I earn UNI$ and/or SMART$ for my transactions at SPC?

A. No UNI$ or SMART$ will be awarded on your UOB Card for any spend at SPC, unless

otherwise stated for any respective UOB Card entitled privileges

So you can still earn UNI$ for specific card privileges.

“Note: No UNI$ will be issued for all transactions at SPC.”

http://www.uob.com.sg/personal/cards/cards-privileges/fuel-power/spc.page

Hmm uob is confusing as hell.

If UOB VS indeed provide 10x UNI$ @ SPC with 1k min spend, it’s probably the best miles card for SPC?

We would get the following

– 10% from SPC&U card

– 5% from using UOB card

-^5% for 3 dollar off every 60 dollar spend

– 4 mpd w/1k min spend, the petrol purchase would help in reaching the 1k min spend so we get 4mpd in other paywave spends as well, up to 2k spend per month…

would love you to try and give us a field report on that!

Yes, Jr. What u stated is what I have been doing and getting. It’s always $120 to the attendant to make sure I get $6 off as well. 4mpd is confirmed with UOB VS. note the $3 or $6 rebate is only deducted after payment. Enjoy all!

1k foreign spend right?

1k foreign spent is for foreign spent. It’s two separate categories to local spend

Is this applicable to the UOB PPV too?

no

I am currently using OCBC titanium rewards Apple Pay to pay for petrol at Caltex. 14% plus 4 miles. Not the most efficient though

ignore this, I did a duplicate post

did you pay at the pump or the counter inside ?

Paid at the cashier Paywave terminal

OCBC Bank 06:44 PM 23-01-2018

Featured Sponsor for Money Mind, EDMW

Originally Posted by vagtky26:

Hi

If I use this on Apple Pay to pay at the petrol kiosk, will that be eligible for 10X?

Hi vagtky26,

Yes, Apple Pay transactions made by tapping the phone physically at the merchants’ terminals will be eligible for 10X OCBC$ (till 31 Dec 2018).

^DG

Reply by OCBC on hardwarezone forum

Maybank WMC over Maybank VI for me because the former has more options for 4mpd (dining, shopping, etc.). 🙂

Agreed! Maybank WMC provides a nice balance between earning miles and fuel discounts. Plus the 4 mpd dining merchants are pretty decent too!

http://www.uob.com.sg/personal/cards/cards-privileges/uob-fuel-power.page

For anyone who has the UOB cards, can have a read here.

Hi Jon, I see the remark under spc in your link that no uni$ will be issued. But the VS page only excludes Shell. And I have been credited with the 10x uni$. I suspect the point is more for UOB One card that qualifies for the additional discount on top of other cards?

hmm.. time to launch another investigation. just afraid that might wake up the sleeping dragon.

hi Chris, I believe you are referring to this page that says VS earns 10UNI$ for petrol except at Shell.

http://www.uob.com.sg/personal/cards/credit-cards/travel-cards/uob-visa-signature-card.page

I’m getting convinced. will try this out at my next VS statement period.

Any luck Jon? Did SPC petrol count towards the $1K spend and award you 10 UNI$?

I’m going with SCB VI + Caltex. 1.4mpd plus 23.29% discount/rebate.

SPC fuel is notorious for being of poor grade, so those cards that tie-up with SPC to give fantastic discounts and rebates, well this is because it’s offset by the fact that it’s SPC which is not good for your car. In that case, that leaves Esso, Shell and Caltex with similarly good fuel. With that, the best card will be DBS Esso Card. No conditions, no hoops to jump over (minimum spending, insane income requirements which also require insane annual fees (read: OCBC Voyage, SCB VI)), just pure BAM upfront 17% discount. So best combo >> Esso, pay with… Read more »

yes, agree that DBS Esso card gives the best bang for the buck if you cannot meet the minimum spending on the cashback cards mentioned in the article. Whether SPC is notorious for having poor grade fuels, I’m not too sure.

I do get a smoother drive on Caltex, but I don’t really feel the significant difference between the rest. Shell tends to feel more powerful (like more go for the same accelerator depressed), esso is esso, and SPC is average. I spoke to a mate who works in the refinery, and basically he says it’s just down to the additives added. Otherwise by and large the petrol is similiar. Having 4mpd with UOB VS swings it to SPC for me. The miles earned really adds up over the course of a year.

plus the fact that my car is second hand, maybe that’s why i don’t feel much difference between any fuel brands. A car enthu once told me: Shell is good at acceleration, your wallet will feel good with less cash too.

Haha, i like how he puts it.

i’m no gearhead, but isn’t it true that unless you have a super high end car you can’t really feel the diff between different brands/grades of gas. a honda with 92 will perform like a honda with 98 right

Ok in petrol head speak, it all depends on how sensitive the individual’s butt dyno is. I would say the diffence is definitely more significant when you go from a tank of 98 to a tank of 92. The higher the Ron, the more the engine management is able to advance the timing without any premature denotation, which translates to higher performance. I don’t think you need a supercar to feel the difference but it’s perhaps more pronounced on performance cars and turbo charged engines.

hee heee. premature detonation.

I am using Maybank Horizon Signature Card… For 3.2mpd and min spent of $300.

I think 300 min spend is easy to achieve if you need to pump petrol every week and it is also usable for dining.

Wonder why it wasn’t mentioned.

hi billy, thanks for pointing that out. I have added the Maybank Horizon VS.

If I pump at SPC and use my UOB PPV to pay using Paywave, will I get 4 mpd? Thanks.

No. No UNI$ awarded for SPC fuel charged onto PPV.

VS is different story. Once $1k min is hit, all your SPC is counted as ‘petrol spend’ eligible for UNI$.

https://docs.google.com/spreadsheets/d/1ffbzrIlK7iTO_IAT7nzk8ULWf1zsRX9F-rniLbRwwR4/edit#gid=1 -> have been using this as my bible, latest is that 10x is available at SPC haha. Someone please please try and verify on statement! 🙂

Yes, 10X only if the following conditions are met:

1) Use solely UOB VS card. No other UOB cards will be awarded UNI$ for SPC pumps.

2) For UOB VS card, must hit at least $1k spending within statement month.

Using AMEX KF @ SPC

20.1% + 5.1mpd (mobile payment, capped at $300 till March)

20.1% + 1.1mpd (normal swipe/tap)

Only spend ~$200 nett monthly on petrol, so most of the other miles cards are meh.