Here’s something important to take note of if you’re currently spending with Apple Pay and Citibank to earn 20X points (8 mpd).

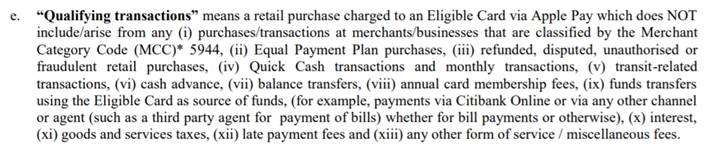

Originally there were no excluded MCCs on the list, but the T&Cs have been quietly updated to exclude MCC 5944: Clock, jewelry, silverware and watch stores.

I guess this was totally foreseeable, but people must have been using this time to make all those luxury purchases they always dreamed about. If your high end watch boutique or jewelry store takes Apple Pay, why not earn 8 mpd while you’re at it? I know I was certainly asking every store about Apple Pay when picking out my wedding bands.

I would assume that any purchases made up to and including the date of the change (5 July 2018) are safe, but it doesn’t help that the change was made quietly. There are no doubt going to be quite a few worried people monitoring their Citi points balance over the next few days waiting to see what happened with their recent transactions.

It’s poor form when banks change the T&Cs of promotions, but there’s precious little we can do but to point it out when it happens.

>people must have been using this time to make all those luxury purchases

Or buy 1kg of gold bar with AP….

what can be done if they do not honor apple pay for purchases before july 5 for jewelry or watches?

This clearly reflects poorly on citi. They MUST use power given to them in agreement carefully ..ultimately if they have such behavior they will suffer in the long term. And yes Sam to your question hope at least they don’t do this with retrospective effect…They shall honor all the points before the change date i.e. July 6th…I am sure there will be so much huge and cry if they do

Join the discussion…

Bank basically came up with a promo with tons of loopholes in it and now LITERALLY doing the breach of trust to stop themselves bleeding.. Maybe good idea if consumers can unite and lodge the complaint to the watchdog. Please do not play with peoples hard earned money. Join the discussion…

Any idea what card I should use for buying a watch around SGD 12k?

Thinking of using krysflyer Amex for first 5K (30500miles) but what about the 7k left?

Amex Platinum Charge or Credit cards (co-brand ones cannot) at The Hour Glass and Watches of Switzerland (Amex 10X Rewards retailer) gets about 3.2 mpd

Thanks!

What do you mean co-brand cannot? The Krysflyer AMEX can be used there right ?

Cannot.. SQ KF Amex is a co-brand amex Card.. different perks/ benefits

Ahh I see, I am planning to use the Krysflyer cobrand to hit the signup bonus (30500 miles for 5k spend) and split the rest on different cards to get 4mpd on paywave

thanks for the info!

@Kevin, Actually, maybe you should look into your planning/ purchasing a bit more.. If you want to maximize your KF Ascend sign up bonus, you’ll do so by spending $10k in first 3 months of card activation, you’ll be in a bit better standing than putting $5k on your KF Ascend and another $5k on a 4 mpd card on paywave (especially when you’re limited by having MUST use paywave, whereas for the KF Ascend, can be anywhere). Do you math again, in case I’m wrong, but by my calculation, if you charge $10k onto you KF Ascend within the… Read more »

Thanks Ken!

I meant using the blue Krysflyer for 30500 miles on the first 5k$ (the acsend has a higher bonus, but as you said, it is on 10k$ and also needs to pay the card fee non waivable)

So in my calculation, I’d rather put 5k$ for 30500 (6mpd) then the rest on paywave or citirewards.

Thanks for checking for me,

Cheers

????

Has Citibank Sunk To A New Low..? Or Have I..? So.. I didn’t have to do it yet, but I would’ve had to do so next month anyways.. so of course instead of waiting until next month it would make more sense to head down to Best Denki to buy the few things I need to, now, use Apply Pay and get my 8 mpd, and then arrange fo delivery for a later date, right..? Sigh… If only….. In summary.. At cashier, my charge was DECLINED.. okay, maybe, just maybe, it was a little on the larger side, never mind..… Read more »

Just as a update to my adventures yesterday… Today, my Citi (or Sh***y) Apple Pay works again.. which kinda leads me to believe that maybe Sh.. u get the point.. presets a daily limit on how much a cardholder can zap on his/her Apple Pay..? To me, it’s still stinks, but at least it seems to clear up the mystery… Anyone else had similar experiences? Cos I was lead to believe (until yesterday) that with Apply Pay, the limit that one could charge for any purchase would be one’s Available Credit, but didn’t seem to be the case (by a… Read more »

Citibank has been very sneaky in setting a limit at their back end, even though it advertised as no limit. Tried to charge 8k for electical appliances but declined. So had to try smaller amount. In the end only able to charge 3k. Called Citibank and they asked me to use physical card, but of course i didnt want to as i want to earn the 8mpd. Then they said there is a limot but they cant disclose the limit to me. That is unheard of. It just gives me more inconvenience in trying to figure whats the limit by… Read more »

So I guessed correctly.. I’m not the only one.. sigh.. sh***ybank is an accurate description..

PSA – Citibank transfer to miles is now in 25,000 increment. No longer in 5,000.

[…] it took a little more seriously, because on 6 July 2018, 70 days after the promotion started, Citibank quietly updated their T&Cs to exclude spending at MCC 5944 (Clock, jewelry, silverware and watch stores). Presumably, the […]