Bank of China has historically not offered a miles card in Singapore, preferring to stick to the dark, fetid corners of cashback. That’s all about to change, and potentially shake up the miles game in Singapore.

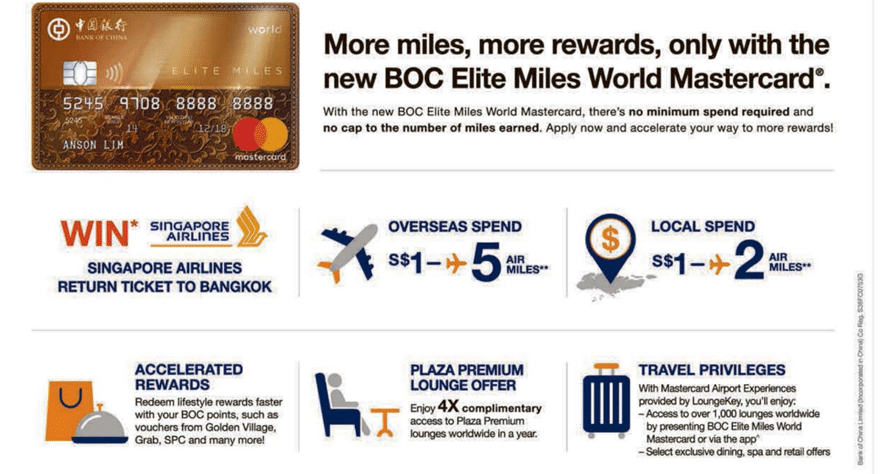

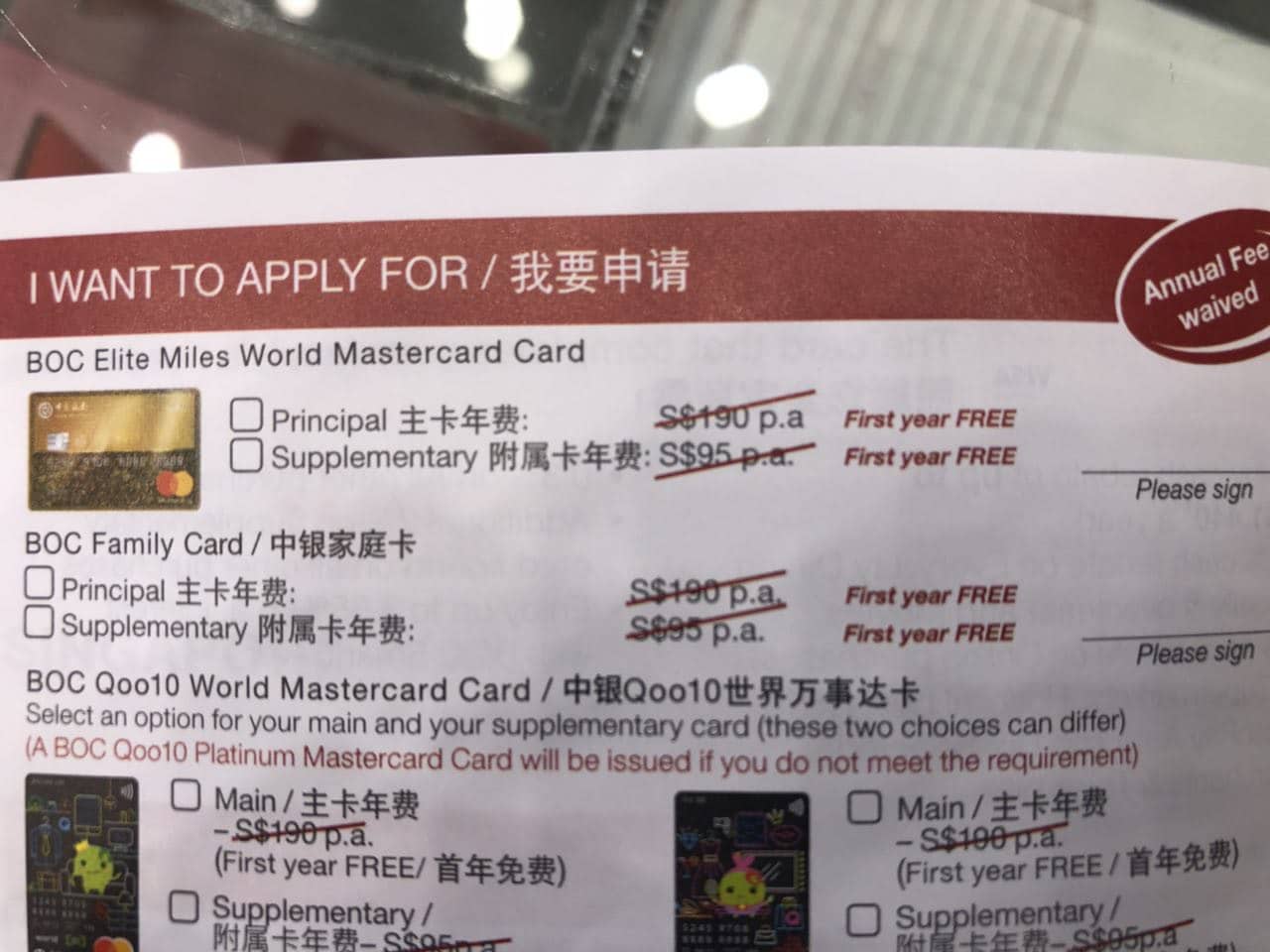

Here’s an ad from Page 5 of the Straits Times today:

Yes, BOC is entering the Singapore miles game with a bang. There’s no landing page for the card on the BOC website that I can find, so all analysis is based on the information in the ad plus the T&C.

The T&C for the BOC Elite Miles World Mastercard can be found here, and the T&C of the promotional miles earning rates can be found here.

A market-leading 2 mpd on local spending, 5 mpd on overseas spending

When I first saw this, I assumed there must be some sort of minimum spend/maximum spend catch. But the ad is very clear- holders of this card will earn 2 mpd on local spend and 5 mpd on overseas spend with no cap until 31 December 2018. To enjoy these rates, your card must be approved by 15 December 2018.

After 31 December 2018, the rates drop to 1.5 mpd on local spend and 3 mpd for overseas spend. These reduced rates would still make the BOC Elite Miles World Mastercard the best general spending card in Singapore, as the table below shows.

| Local Spending | Overseas Spending | |

| KrisFlyer Blue | 1.1 | 2.0 during June/Dec |

| KrisFlyer Ascend | 1.2 | 2.0 during June/Dec |

| DBS Altitude/Citibank Premiermiles Visa | 1.2 | 2.0 |

| OCBC VOYAGE | 1.2 (1.6 on Premier and Private Banking versions) | 2.3 |

| Citi Prestige | 1.3 | 2.0 |

| UOB PRVI Miles | 1.4 | 2.4 |

| Standard Chartered Visa Infinite | 1.4 (min spend $2K per month) | 3.0 (min spend $2K per month) |

| DBS Insignia/ Citi Ultima/ UOB Reserve | 1.6 | 2.0 |

| BOC Elite Miles World Mastercard | 2 (before 31 Dec 2018) 1.5 (after) |

5 (before 31 Dec 2018) 3 (after) |

This earn rates are exceptional for a general spending card. 5 mpd on overseas spending would even exceed the 10X rate that you could earn by using the UOB Visa Signature.

It’s not like the foreign exchange charges will be insane either- the Standard Chartered Visa Infinite offers up to 3.0 mpd on overseas spending, but has an insane 3.5% transaction fee. The UOB PRVI Miles offers 2.4 mpd on overseas transactions, but a hefty 3.25% fee. The BOC Elite Miles World Mastercard fee will be 2.5%, which is in line with most other banks.

2 mpd on local spending will be your best option once OCBC ends its 4 mpd mobile payments promotion on 4 August.

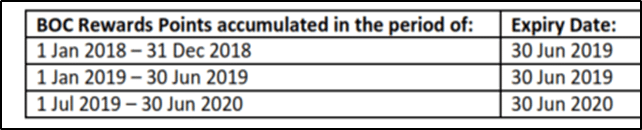

Points expire in 12-24 months

There’s been some confusion about this, because when the T&Cs first came out this morning, here’s what they said:

During lunchtime, however, a swarm of Milelioners descended upon the Chevron House roadshow, and met a corporate representative from BOC. After a bit of back and forth, the T&Cs were updated to reflect this:

That’s a real improvement- in the incorrect version of the T&Cs, your points were valid for 12 months maximum. In the corrected version, your points are valid for a minimum of 12 months and a maximum of 24 months.

(Remember that once you transfer your points to KrisFlyer or Asia Miles, you get an additional 3 year validity).

Here’s how that compares to other general spending cards:

| Points Validity | Remarks | |

| KrisFlyer Blue/ KrisFlyer Ascend | 3 years | Credited directly to KrisFlyer account |

| DBS Altitude | No expiry | DBS points earned on Altitude card do not expire |

| Citibank Premiermiles Visa | No expiry | Premiermiles do not expire |

| Citi Prestige | No expiry | Citi Dollars earned on Citi Prestige do not expire |

| UOB PRVI Miles | 2 years | |

| Standard Chartered Visa Infinite | No expiry | 360 Rewards points earned on the SC VI do not expire |

| BOC Elite Miles World Mastercard | 12-24 months | Points expire on 30 June |

The BOC Elite Miles World Mastercard will support mileage transfers to KrisFlyer or Asia Miles with a minimum block of 10,000 and 6,000 miles respectively and a conversion fee of S$32.10. Assuming you were gunning for KrisFlyer and did all your spending by 31 December 2018, you’d hit the minimum block with

- $2,000 of overseas spend

- $5,000 of local spend

If you do intend to get this card, you need to be wary of orphan points- nothing would be more frustrating than seeing your points go up in smoke on 30 June because you don’t have enough of them to cash out. It’s good to note that BOC points can be redeemed for GV vouchers, Grab vouchers (snigger) and other gifts, so even if you can’t hit the minimum balance for miles you’ll still have some options at least.

Lounge benefits from Plaza Premium and LoungeKey

Mastercard offers a service known somewhat convolutedly as Mastercard Airport Experiences provided by LoungeKey. This allows holders of selected Mastercards to access over 1,000 lounges worldwide, with additional dining, retail and spa offers. It’s not free for BOC Elite Miles World Mastercard holders, however, with access fees of US$27 per person per visit applicable.

What is free is 4X visits to Plaza Premium lounges for principal cardholders between 23 July and 30 June 2019. To enjoy this, you need to register your BOC card via this link (the link appears to be automatically redirecting to the Arrture homepage for now, which leads me to believe it’s not ready yet) and download the Arrture app.

Your 4X lounge passes can be utilized by either you or your travelling companions.

Win a return SQ ticket to Bangkok

The top 100 eligible applicants (i.e. those whose cards are approved by 15 December 2018) with the highest qualifying spend between 23 July and 31 December 2018 will win a return ticket to Bangkok on Singapore Airlines Economy Class.

This prize does not include airport taxes, and you must redeem it between 1 Feb 2019 and 30 April 2019 with travel by 31 October 2019.

It’s not the most generous of gifts, and the mechanics are more in line with UOB’s terrible sign up promotions, but let’s be honest- this is a sideshow. The real hero here is those incredible general spending rates. I certainly wouldn’t sign up for this card just because of free ticket prize.

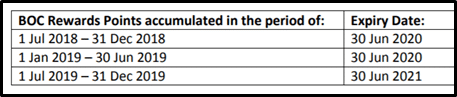

Annual Fee of $190 waived for first year, $30,000 income requirement

Thanks to the digging of reader Nobody Nobody, we know the card has a $190 annual fee which is waived for the first year, and an annual income requirement of $30,000. This only adds to the card’s overall attractiveness, because other miles cards at this price bracket earn fewer miles and offer fewer lounge visits (eg 2 with the DBS Altitude and Citi PremierMiles).

The income requirement is actually lower if you’re aged 55-65; just $15,000 is required.

Conclusion: miles wars heating up?

For the longest time we’ve seen the general spending rates stagnate at around 1.2 to 1.4 (with up to 1.6 if you own some high end cards), but BOC’s new miles offering blows the competition out of the water.

I’ll be very interested to see how the other banks respond to this entry- BOC has not been a player in the miles game up till now, but nothing like some fresh blood to shake things up.

As I mentioned at the start, the card does not have its own landing page just yet, so if you want to apply you’ll need to SMS BOCCARD<space>EMST<space>NAME to 79777 or visit any BOC branch to apply. The Milelion does not have an affiliate arrangement with BOC.

Isn’t it amazing what competition in a market can do?

Hope the spending on this card will contribute to more interests on the Savings account!!

Hi Vk,

talked to sales ppl at the Charvon house (promo event today), they say it is considered the eligible spending toward the BOC Smartsaver.

needs to further verify with SCO once you have the card.

Hey thanks a lot. $$$$

I called the hotline advertised three times and each time, the line was cut off after I pressed for Credit Card. Not a good sign. Also, it’s crazy for points earned on 30 June 2019 to expire on 30 June 2019. Who does this?

who offers 5 mpd on overseas spending? 😉

swings and roundabouts.

Hope the spendings are counted for the BOC SmartSaver account~~

It’s call Arrture entitlement access. Download the Arrture app with BOC card info and for access are pushed to your Arrture app.

Lest those flatware lovers cry foul in future over this card… Make sure you are comfortable with these terms: BOC Reward Points earned under this Promotion shall be awarded to the Eligible Applicant two months after the relevant card transaction(s) referred to under Clause 1 above has been posted to the Card Account. The Bank shall have the absolute discretion to postpone any awarding of BOC Reward Points under this Promotion for a reasonable period in the event of unforeseen circumstances, including any delay arising from system issues. The Bank reserves the right to determine at its sole and absolute… Read more »

This is pretty standard boilerplate for such promos tbh

That is not entirely correct. The catch-all clause to unilaterally vary amend etc is boilerplate. The absolute discretion to postpone any awarding for potentially ambiguous “unforeseen circumstances” is not, and is in fact not present in SC VI, UOB VS, nor DBS Altitude bonus points T&Cs. I was at the roadshow just a while ago and the marketing people were so pushy and even claimed they had filled up the form for me already. Opened the filled-up form and found a load of incorrect statements about my details. Not a good impression and I am thinking carefully before I decide… Read more »

I suppose that they system is new(and new to miles), and we all know BOC IT sucks, they are being upfront about it

The milelion has to take one for the team. May he be the first to redeem his BOC miles, hopefully not the last, and thus report success here 🙂

min income is $50k

Do you think there will be sign up bonus?

going to BOC at lunch to see if i can pick up an application form. update you guys later.

Just one point. This is a world mastercard. If compared to the other wmc (e.g., the dbs unisex card). Def not a 30k card, I’d say……. 60k to 80k req.

Nope. World mc can be obtained at 30k income req. Case in point: Citi rewards mc

income req is only 30k, confirmed at roadshow @chevron.

Ha! You missed the milelion party. About 6 or 7 of us there

UOB Krisflyer Debit card is also a World Mastercard lol

Roadshow at Chervon house. Min income required 30k PA. Annual fees at $190 PA, Sup card $95. First year free waiver.

sign up bonus = 20″ vintage hardcase luggage bag when spent SGD500 within the first month. (limited to first 200 principal card holder)

What time are they packing up for today at the roadshow at Chevron House?

think is 7pm. i asked earlier

Just tried to apply at Toa Payoh branch and they didn’t have the form. Scanned my doc, took my details, and will call me when the form is available. This is a good card for me because I do a lot of O/S spend.

Thanks Aaron!

Annual income is 30k. First year fee waiver. They having a roadshow at Raffles Place.

Whats the processing time for roadshow applications?

the number of references to grab’s sucky devaluation in this article… hahaha

Anyone has any idea what time the booth at Chevron closing?

7pm

Application form is not available at BOC Tampines branch yet. Was told to go back from Thursday onwards.

Anyone knows if the booth is still there today?

Thanks.

Yes.

why is there no mention / comparison agains UOB Visa Signature Card which gives 4 mpd for overseas use?

If you look at the marketing collaterals, it is quite apparent – they indicate no minimum sum and no cap. How does the Visa Sig come into comparison when they try to nail you on the minimum spend and then cap it?

It happened on my 1st trip with the card when some transactions did not come in by statement date and I lugi’ed some points… They make it so difficult that I am half inclined to give up on the Visa Sig.

I SMSed ‘my interest’ yesterday, got phone call today asking for my email address and that they would email me the Application Form by the end of today.

PDF of Application Form was received yesterday evening by email as promised, Form was filled up, and emailed back.. Let’s see how long card takes to appear in letterbox…

Yo ken, can you forward me a copy of the pdf form ? Wanna signup soon. Got a big OS spending to whack very soon.

edgarang89(…at…)gmail(dot….)com

Don’t know if this is allowed.. apologies, Aaron, if I overstep.. if I did, I won’t do it again..

https://www.dropbox.com/s/5617wnegxtj4q50/boc-application-form.pdf?dl=0

Awesome ! Thank you ken 🙂 either way, even if we sms to signup still need to fill up this form ya ?

Hi Ken, can you share what’s the email address for us to send the completed form back to BOC?

cardcentre-sales_sg@mail.notes.bank-of-china.com

“2 mpd on local spending will be your best option once OCBC ends its 4 mpd mobile payments promotion on 4 August.”

Did something happen to UOB PPV? Isnt it 4mpd save for merchants that issue SMART$.

yes, but remember the cap.

Any roadshow at tiongbahru BOC ?

Anyways, for those who signup via the sms. I have checked and verified w cso that an agent will followup with you to complete the signup process. Suggest not to wait for them to followup as they can take awhile……

Has anyone received the card?

Not yet. However, I noticed that 60K BOC points are required to exchange for 10K KF miles under the BOC rewards summary web page… could there be an error?

Likely to be an error in the TnC on the earn rate: 1 Miles should be equiv to 6 BOC points and not 3 points.. if not the miles will be halved

How much BOC we get for very $ spend??

If my math not wrong, $1 earn 9 BOC point which is equivalent 1.5 miles based on the conversion of 60k pt for 10KF

Cardmembers will earn BOC Rewards Points for all Qualifying Spend made

with the Card at the following earn rate:

Base Earn Rate

Cardmembers are entitled to 9 BOC Rewards Points (equivalent to 3 Air Miles) per

S$1 Overseas Spend and 4.5 BOC Rewards Points (equivalent to 1.5 Air Miles) per S$1 Local Spend.

From the T&C, it states 4.5 BOC Rewsrds Points per S$1 local spend. (4.5BOC Points = 1.5 KF Miles)

However, base on BOC reward catelogue, 1KF miles require 6 BOC Rewards Points.

Seems like the numbers are not correct.

I wonder whether payment via CardUp or ABT for bus/mrt are excluded. based on the TnCs, doesn’t seem so?

Good spot. I am quite intrigued about abt, as 2 mpd on bus/mrt rides would be the best possible option (apart from HSBC revo+ ezreload)

Yes. 1.5 miles (or 2 miles during the promotion period between now and 31st December 2018) per $1 spent on bus and MRT journeys via ABT

I’ve been thinking of ditching my DBS altitude visa for the UOB PRVI Miles since I already have the DBS Women’s World Mastercard for online spend. This throws everything into question though. Given that this is BOC’s first foray into the miles world, are they reliable enough to go for this card? Additionally my loyalty is with Asia Miles and not Kris Flyer. Thoughts? Should I apply? I was hoping to apply before September

@Ozair.. Is there a question here..? “…are they reliable enough to go for this card?” Are you thinking that they won’t honour their 1.5/3.0 and/or 2.0/5.0 mpd promise? That’s going to be reeeeally unlikely, no? At worse, they could yank the deal early or even change the mpd rates at any time, but they can’t go back on those charges that are already posted.. and it’s not even a case of their “first foray” cos even Miles-earning ‘veterans’ like Citi, HSBC, OCBC, UOB etc etc have all done this before, no? In other words, what’s there to lose? Or what… Read more »

Sorry for not clarifying. I was thinking more from the perspective of customer service around the card but you’re right. Nothing to lose. Sent the text today

???

Does anyone know where BOC will be having the roadshow this weekend (28 & 29 Jul)?

[…] card was announced barely a week ago, but given its outstanding earning rates (2/5 mpd on local/overseas spending until the end of the […]

can you use transferwise on this BOC card?

[…] you’ve applied for a BOC Elite Miles World Mastercard, I’d strongly advise that you wait until it arrives before pulling the trigger on this sale. […]

So how do I apply for this card? I sent a sms as stated above. Does the SMS method work? or do i need to go to the branch personally?

If you reread this post from top to bottom, all the mysteries will no longer be.

[…] fee of 3.0% is on the high side compared to the 2.5-2.8% which most other card issuers charge (i.e BOC), it’s still lower than what UOB charges for foreign currency transactions at 3.25% on the […]

[…] The good news is that there are still ways of earning miles on the exclusion categories- your parking, insurance and public transportation spending can earn 2.0 mpd till 31 December with the new BOC Elite Miles World Mastercard. […]

Are utilities payments eligible for to earn miles on this card?

Has anyone actually received the card yet? It’s been almost a month..

I have received my card just yesterday. Submitted application on the first day of launch at roadshow!

Did you post it in via the postage envelope that the roadshow people gave? Or did you hand it in directly to BOC building at Battery Road? I posted mine via that envelope the week of the roadshow and nothing from BOC so far. Definitely concerning – they seem to have launched a card without first being prepared for the volume of application and customer service required. Even till today, the BOC website does not have a product page for the BOC miles card.

Yup, I posted the envelope prepared by the folks at the roadshow on the day after the launch. Haven’t heard anything at all since.

yeah i received mine last week, the card looks like some shiny card which reminds me of my childhood days collecting those shiny game character cards!

Reminds me of Northern lights.. very artistic HAHA. I cant wait to get my hands on them. Ready to Swipe!!!

i’m still waiting. submitted via email on the 30th July.

Hi all,

How do you apply for the card? Cant seems to find the application form online

Have you tried calling BOC to ask?

Credit check performed on 17 Aug. No sign of card still

Mine was on August 3rd, I have not received the card yet.

BOC has a very ‘interesting’ card processing system. I send the application form via email on the 24 July and I was told the card took one month to process. 22 days later I received a call from BOC informing me that I have missed a signature on one of the section. Within 10 minutes on the same day I send back the documents via email with additional signature. I called BOC to check have they received my documents , the answer was yes and he apologised for informing me about my “mistakes”22 days later and he will tried to… Read more »

[…] BOC announced its entry into the miles game on 23 July with the launch of the Elite Miles World Mastercard, everyone sat up and took […]

Arrture link: https://www.arrture.com/openBOCEnrollment?partner=PA123

May I ask if the card’s mile rate is fine for me to pay rent online via ipaymy?

Aside from a few exclusions like EZ-link top-ups.. BOC only differentiates between local (S$) and Foreign Currency charges.. 1.5 mpd and 3.0 mpd, respectively… for now..

[…] confusion as to whether the miles would expire in Jun 2019 or 2020 (refer to Milelion’s post here). Eventually, it was settled as 30 Jun 2020 for miles that were accumulated in 2018 as what was […]

[…] brings exciting news in the realm of cards, including the introduction of BOC’s Elite World Mastercard and much-needed upgrades to Citibank Rewards as well as (finally!) the UOB Lady’s Card. My […]