Yesterday, a reader in the Telegram Group spotted in his monthly statement that Citibank was quietly making some significant changes to their cards program.

Matthew covered the broad strokes of these changes yesterday, but now that the new T&Cs have been uploaded I wanted to talk about them in more detail.

What’s happening?

From 4 October onwards, Citibank is adding a large number of exclusion categories for its rewards program.

First thing to note: these changes affect every single one of Citi’s rewards-earning credit cards. That’s not just miles and points- cashback cards are affected too.

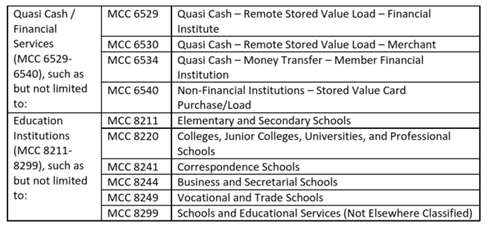

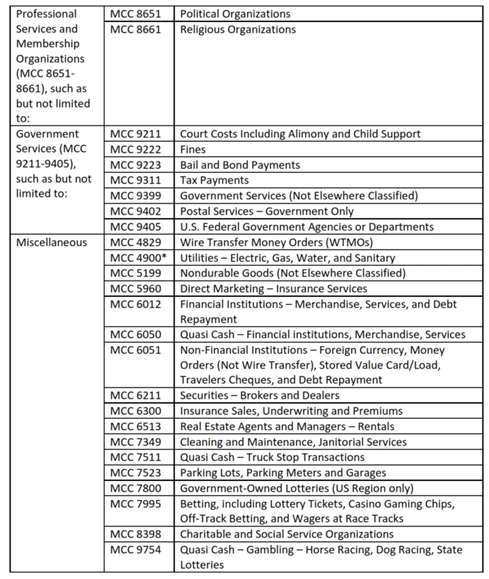

Second, Citi has restricted rewards earning on entire MCC ranges, as shown below:

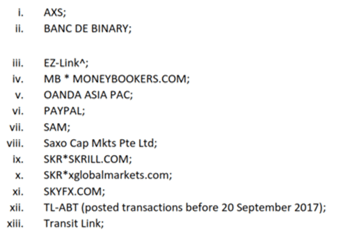

Third, in addition to excluding entire MCCs, Citi is also excluding specific merchants.

Why the exclusions?

To understand why this has happened, we first need to understand a little bit about the economics of card transactions.

When a merchant applies to accept credit cards as a form of payment, one of the key points of negotiation is around the Merchant Discount Rate, or MDR. The entire card payment process is a complex mix of acquiring banks, merchant banks, issuers, networks and stuff that makes my head hurt, but to put it simply, the MDR is the share of the transaction that merchants give up in exchange for accepting credit card payments. If the MDR is 3%, for example, then the merchant keeps $97 of a $100 transaction.

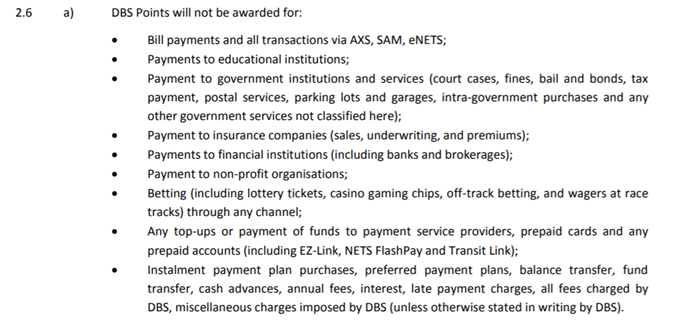

Certain merchants are granted lower MDRs in light of their industry, eg charities, educational institutions or non-profits. The problem is: banks rely on the MDR to earn money, and if the bank’s share of the MDR is less than the value of the rewards given out, then the bank loses money on that transaction.

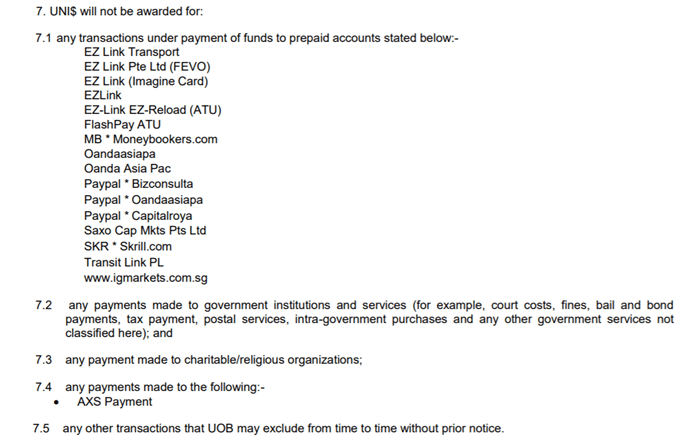

In that sense, what’s perhaps more surprising is that some of these categories earned rewards or cashback for as long as they did. I don’t actually know if Citibank was always blocking rewards or cashback on these categories and has only now formalized it, but DBS and UOB have for a long time excluded charities, government institutions and educational institutions from earning points.

What does surprise me is that Citibank has gone beyond the usual exclusion categories. For example, they’ve explicitly excluded parking lots, parking meters and garages (MCC 7523) from earning points.

I get that something like Parking.sg is pretty much a government payment, but if you go overseas there are plenty of privately-run lots that can be paid for via credit card (I’m thinking of the US). I would imagine that those operators have more of a regular MDR so I’m not sure why Citibank has decided to exclude this altogether.

MCC 6513 is also excluded, which means iPayMy payments will no longer earn any points with Citibank cards. [Edit: iPayMy’s CEO has reached out with the following clarification which I’m going to quote wholesale: We process payments over several MCCs depending on a number of factors including card bin range. We have the ability to programmatically move payments to a specific MCC as needed via various backend MID setups. While we do put many transactions through 6513 today, that is a choice, not a requirement. To prepare for the Citi changes, we will flip all Citi bins to a different MCC to make sure our customers are not impacted] I have confirmed with Cardup that they are unaffected by the changes, however.

Why exclude PayPal?

The complete exclusion of PayPal is confusing. I get that Citibank doesn’t want to award points on peer to peer money transfers (if this five year old article still holds, those aren’t possible in Singapore anyway), and indeed DBS has stopped awarding points on payments to personal PayPal accounts for a while now. But a lot of e-commerce merchants use PayPal for checkout, and this covers bona fide commercial transactions.

In the first place, PayPal’s fees make it a rather pricey way of manufacturing spend. If you were thinking of sending money to a friend’s business just to earn points, you’d pay 3.9% plus 50 cents per transaction. Assuming that 10X rates don’t apply to PayPal, using a 1.4 mpd card would imply buying miles at more than 2.79 cents each, a rate too high to be practical.

I don’t think you can blame this on the recent Apple Pay Citibank 20X promotion either, because PayPal never accepted Apple Pay. So mark this down as something that really confuses me, but be sure to remove all Citi cards from your PayPal account before 4 October.

The good news is that there are still ways of earning miles on the exclusion categories- your parking, insurance and public transportation spending can earn 2.0 mpd till 31 December with the new BOC Elite Miles World Mastercard.

Conclusion

Citibank’s new T&Cs bring its official position in line with many other banks in Singapore. The exclusion of charities, non-profits, educational institutions and government services from rewards doesn’t thrill me, but ultimately it’s the way the market works.

What does worry me, however, is that Citibank’s gone further and excluded some merchants which I’d consider to be otherwise legitimate commercial transactions. Some might say that this is Citi doing belt tightening after its costly Apple Pay promotion, and the timing is admittedly hard to ignore.

If you’re a Citi cardholder, do take note of these changes and switch your cards accordingly from 4 October.

Does uob exclude insurance also?

Hi Aaron,

Cardup still earns only 1x after 4th Oct right?

I wonder if GrabPay falls under the category of “MCC6530 Quasi Cash – Remote Stored Value Load – Merchant”?

Was wondering the same thing. Anyone can shed some light on this?

Hi Aaron, This morning, I got to thinking.. and I haven’t really thought this out completely, so this comes across as being messy, ill-conceived, insulting and anything negative in any way or form, please note that I really do have the best intentions here and so, to the rest of the world too, no flames, please.. How these thoughts come about this morning, in the first place.. As mentioned before (probably more than just a few times), I’m very new into the miles-game.. well.. not exactly new into it, I’ve been using miles to fly for some years now.. but… Read more »

I believe Aaron would be very very careful about entering the realm of paid services to Milelion “clients” – he should look no further than the locus classicus of Hedley Byrne…

once i get patrons I’m only a few steps away from making squat cobbler.

Can I take that as a “maybe”..? ?

You may have confused a cause of action in contract with that in negligent misstatements.

You should have thought it out better and more than halve the spew above. I don’t understand why would anyone “consciously” disclaim so much and then proceed on anyway. Just saying. NOT a flame. Well, no.

Evanesco!

Screw Citi. I cancelled all 3 of my cards earlier this week, and even their own agents acknowledged that their cards were not competitive

ipaymy payments will not be impacted by this change. As usual, the author of the post did not contact us for clarification on this matter. It should be known that Aaron has a personal relationship with the founder of CardUp is is unable to write unbiased content on this subject.

Going forward, we would be happy to provide any relevant information prior to publication.

Ethan

CEO of ipaymy

Hi ethan! I do not know the founder of cardup and have only spoken to their public affairs team. in fact, given the collaborations I’ve done with ipaymy in the past, it’s probably more accurate to say I’ve got a personal relationship with the ipaymy team! Would you be able to reach out to me via your official email so we can straighten this out? i’m at aaron at milelion.com. edit: actually now that I recall, the founder of cardup and I were on the same panel at a seedly event back in december 2017. would hardly call that a… Read more »

Hahaha @Ethan you really should hire a media person to help you write non-accusatory comments.

Hi Ethan, please consult with your lawyers before opening ipaymy to a potential defamation suit with your comments above unless you can prove the alleged personal relationship that led to the alleged bias. On a related note, you should also be aware that it was reported that don’t your own customer service staff declined to provide ipaymy’s mcc code when asked. On your statement, since you put out the bold guarantee that if Citibank does not award 10x points using Citirewards, can we look to ipaymy to reimburse us the points? Please confirm. Please also let us know how we… Read more »

I think it is one thing to say that Aaron has a relationship with Cardup and it is another to say that he is writing biased material. I believe that it is nothing wrong for Aaron to have relationships with credit card/payment teams. In fact, I would be surprised if he doesn’t. He interacts with these teams and in return, he is able to share more with the miles community. I respect his dedication and effort to reach out (or rather they reach him lol) to these credit card/payment team. Even in my earlier comments where I hinted that BOC… Read more »

To add on to my earlier message, a simple email to the Milelion would have suffice. No need for any unfriendly accusations.

Wow. The salt is real.

You really end up making ipaymy look bad. Imagine if have a dispute with your company and have such a childish response from the CEO no less.

Good luck with your PR. If you want to look dickish at least be as successful as Elon Musk first.

Wow. Please elaborate on what personal relationship this is and what is the evidence to support this.

Also, it’s time to consult a lawyer and ask what defamation is and what can be done to avoid being sued for defamation. It sure looks like you’ve even gone past biased to being outright defamatory.

IPayMy is definitely off my list from now.

As usual, what a reply coming from a CEO. Can’t you take it offline and clarify the matter behind closed doors with the author instead of wailing out in the public?

I guess you are more happy making false allegations instead.

Ethan you are unbelievable. Not using iPayMy anymore.

[…] Citibank’s new rewards exclusion categories: what you need to know […]

Based on “Citi Rewards Card – 10X Rewards Promotion Terms and Conditions (effective 4 Oct 2018)”, there will only be 10x points for specific MCCs. ie don’t think ipaymy fall under any of the MCC, no more online shopping that don’t fall into the specific MCC’s. This is even more restictive than the long list of exclusions.

Hope Citibank continue to be liberal on this after 4 Oct

Has anyone recently used Citi Rewards Visa to top up ther Mileslife wallet? Still getting 4mpd?

Thanks in advance…

Looks like Citibank now only excludes miles arising from PayPal transactions with specific merchants.

http://www.citibank.com.sg/global_docs/pdf/Rewards_Exclusion_List.pdf