The new and improved AMEX Platinum Charge card comes with a host of benefits and perks to match its $1,712 annual fee. Most people would be familiar with the main highlights– $800 of travel credit, a 2 night stay at selected Banyan Tree/Mandarin Oriental Hotels, a 1 night stay at the St Regis or W Singapore, several lounge memberships, elite status with various hotel and rental car programs and so forth.

Sign up for the AMEX Platinum Charge and get 40K bonus MR points

However, there are some lesser-known benefits that AMEX Platinum Charge cardholders have access to. These may not get front-and-centre emphasis in the marketing materials, but they’re pretty nifty nonetheless.

A four hour grace period on Hertz rentals

You may know that AMEX Platinum Charge members get complimentary Five Star status with Hertz Gold Plus Rewards. But what you may not know is that AMEX Platinum Charge members get a four hour return grace period. Why is this important?

Imagine the following situation: you land at 2 p.m. but only fly off at 8 p.m. Unless you’re willing to head to the airport by 2 p.m on the day of your departure and wait 6 hours, you’re going to have to bite the bullet and pay an extra day, since most car rental companies don’t pro-rate by the hour.

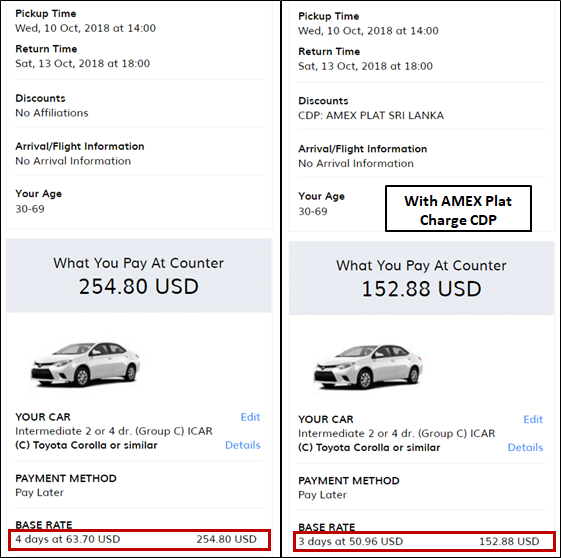

That is, unless you’re an AMEX Platinum Charge member. Enter the CDP#: 1631611 during your booking and see what happens:

On the left hand side, you have the quote for a car rental at LAX airport without any code. You’ll see that even though I’m picking up the car on 10 October and returning it on 13 October, I’m still charged for 4 days because my return time on 13 October is 4 hours after the pick up time on 10 Oct.

On the right hand side, you see what happens when you use the AMEX Plat Charge CDP. I have exactly the same dates and pick up times, but I’m now only being charged for 3 days. Not only that, my base rate has been discounted by 20%.

Complimentary roadside assistance in Singapore/West Malaysia

If you’re a driver in Singapore, you’re probably paying anywhere from $80-110 per year for an AAS membership.

AMEX Platinum Charge receive complimentary roadside assistance in Singapore and West Malaysia. You can read the full details of the coverage here, but to highlight some key points:

- Emergency roadside assistance arising from an accident or breakdown is covered up to S$130 per incident

- If roadside assistance cannot resolve the issue, towing costs of up to S$130 will be covered to bring the vehicle to a repair shop

- If you car is disabled in West Malaysia and can’t be repaired in 3 hours, you and your passengers will have transportation back to your usual place of residence covered, up to a maximum of S$300

- If your car is disabled in West Malaysia and repaired within 48 hours, your transport to the workshop to retrieve your vehicle is covered up to a maximum of S$65

- If your car is disabled/stolen in Singapore and can’t be repaired within 48 hours, you’ll be reimbursed for alternative transportation in Singapore for up to 3 consecutive days, capped at S$400

The maximum payable for roadside assistance is capped at S$400 per case, and this is capped at two towing or roadside repairs per year. Your vehicle can only be a maximum of 3 years old- so obviously after that you’re going to want to get regular AAS coverage.

To my knowledge, the only other card offering a similar benefit is the UOB Visa Infinite Metal card, and their roadside assistance is capped at two incidents per year. They also do not cover the cost of alternative transport.

Travel Insurance that covers miles and points bookings

I wrote a recent post reviewing complimentary travel insurance offered by credit cards. My conclusion was that most of these policies did not provide sufficient coverage to be your primary form of protection.

The complimentary travel insurance that comes with the AMEX Platinum Charge, however, offers excellent coverage. In the table below I’ve compared it with the “best” complimentary travel insurance I found in my other article, offered by HSBC Visa Infinite and underwritten by AXA. Do note that definitions may vary between policies, so it’s always best to read the policy wording carefully:

| AMEX Platinum Charge | HSBC Visa Infinite | |

| Underwriter | Chubb | AXA |

| Accident resulting in death or TPD | $1,000,000 | $2,000,000 |

| Medical Expenses | $1,000,000 | $100,000 |

| Flight Delay | $800 (4 hours) | $1,000 ($100 per 8 hours) |

| Baggage Delay | $800 (4 hours) | $1,000 (6 hours) |

| Baggage Loss | $800 | $5,000 |

| Trip Cancellation | $10,000 | $10,000 |

| Trip Curtailment | $10,000 | $5,000 |

| Loss of personal belongings | $1,250 (travel documents) $1,500 (otherwise) |

$400 (only for travel documents) |

| Rental car excess | N/A | $2,000 |

| Personal liability | N/A | $100,000 |

You’ll note that the AMEX Platinum Charge policy has higher coverage for medical expenses, trip curtailment and personal belongings, while the HSBC Visa Infinite has higher coverage for accidental death & TPD and baggage loss, while providing cover for rental car excess and personal liability.

The aggregate coverage limits for flight and luggage delays are higher for the HSBC Visa Infinite, but it’s important to note that their definitions are stricter. For example, the AMEX Platinum Charge’s insurance pays you $400 per person ($800 max) once your flight is delayed by 4 hours. With the HSBC Visa Infinite, you get $100 per person per every 8 hours of delay ($1,000 max).

A final important point to note for miles chasers: HSBC Visa Infinite travel insurance is underwritten by AXA, which explicitly excludes coverage for award tickets and stays.

[Edit: Good news! HSBC VI’s travel insurance will now apply even for award tickets so long as the taxes and fees are paid for with the HSBC VI card. However, air miles will not be reimbursed in the event of trip curtailment]

The AMEX Platinum Charge travel insurance is underwritten by Chubb and covers such things. This is especially important if you’ve booked an award ticket under KrisFlyer’s Spontaneous Escapes promotions, as those are strictly non-refundable.

Purchase & refund protection and extended warranty coverage

Items purchased with your AMEX Platinum Charge card qualify for purchase, refund and extended warranty protection.

Purchase protection: If within 90 days the item you purchase is stolen or damaged, you’re covered for the replacement or repair cost up to $10,000 per incident.

There are some exclusions to this policy (eg you’ll need to pay 10% of the claim amount yourself, and this coverage doesn’t include items left unattended in a public place), but all things considered, the knowledge you’re protected if you accidentally drop your brand new iPhone XR provides one heck of a peace of mind.

Refund protection: If you buy an item and want to return it within 90 days for whatever reason but can’t, you’re covered up to $1,000 per item.

For this coverage to be effective, the item must be in a new and saleable condition, free from all defects and in full working order. Also note that the policy does not apply to the following: jewellery; precious stones; rare and precious coins or stamps; one-of-a-kind items including antiques, art work and furs, cash or its equivalents, travellers cheques, tickets or negotiable instruments; services, mobile phones and their accessories, recorded media (including but not limited to CD’s, DVD’s, computer software, video and audio tapes); books; animals and living plants; consumable and perishable goods; healthcare items; used, rebuilt and refurbished items; closing down sale items; vehicles and their parts.

Extended warranty: If you purchase an item that costs less than $10,000, and said item stops working within a 24 month period (or twice the original manufacturer’s warranty, whichever is shorter), you’ll be covered for the cost of repairs and replacement.

Based on what I could find online, no other card in Singapore offers this kind of protection, except for World Elite Mastercards (Citi Prestige, UOB Lady’s Solitaire). Here’s how the coverage compares:

| AMEX Platinum Charge | World Elite Mastercard | |

| Purchase Protection | $10,000 per occurrence $50,000 per year |

$3,000 per occurrence $20,000 per year |

| Extended Warranty | $10,000 per occurrence $50,000 per year |

$500 per occurrence $2,000 per year |

| Return Guarantee | $1,000 per item $5,000 per year |

N/A |

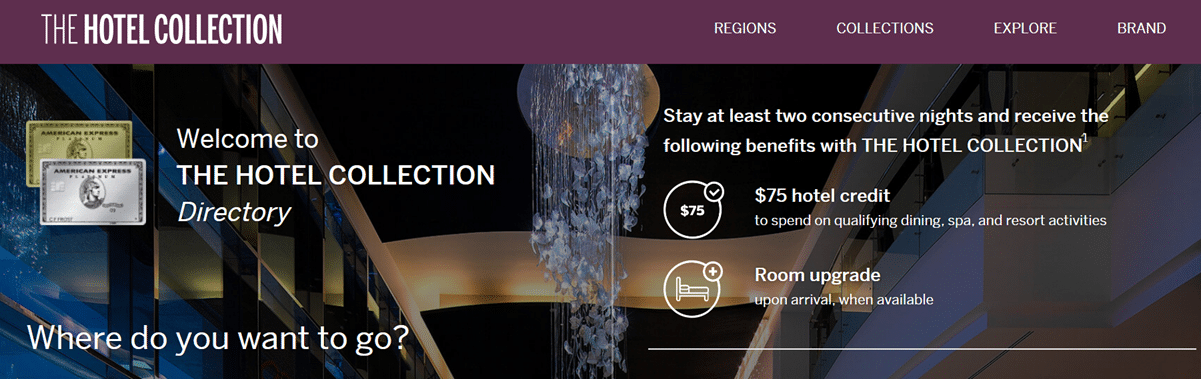

The Hotel Collection

In the AMEX publicity materials, the Fine Hotels and Resorts (FHR) program gets all the limelight. This leads some card members to assume that unless they’re willing to stay in an uberluxe hotel, there’s nothing of value for them here.

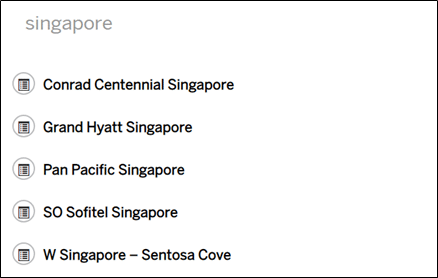

That’s not exactly true. AMEX has a lesser-known portfolio of hotels called The Hotel Collection, where card members who stay at least 2 nights receive a US$75 hotel credit and a space-available room upgrade. Here’s a sample of hotels available in Singapore:

These aren’t going to provide you with Capella levels of luxury, sure, but they’re still very high quality places to stay and much more realistic options for most people. Couple that with the hotel credit and space-available room upgrade, and you’ve got a good deal on your hands.

There is a website where you can see the properties on offer, but booking via the website is only for US-based cardholders to book. Singapore-issued Platinum card holders have to call up the Platinum concierge to secure these bookings.

Conclusion

None of these benefits, in and of themselves, will probably be sufficient to get someone to pull the trigger on an application. However, if you’re on the fence or have recently decided to get on the AMEX Platinum Charge bandwagon, these are useful benefits to be aware of.

Sign up for the AMEX Platinum Charge and get 40K bonus MR points

I should be getting my card early next week, and will be taking some very unglam unboxing photos when that happens.

Don’t think your ‘dropping your iPhone XR’ example is a good one as mobile phones are excluded from this policy.

My reading of t and c is that mobile phones are excluded from refund protection, not purchase protection

Just did my first hotel collection stay at a Hilton property. Im not sure if my room was upgraded (I didn’t care that much since this was more of a regional hotel, so not much to upgrade to) but I did get the usd75 credit from hotel collection as well as the free breakfast as Hilton gold, so the benefits stacked for me.

How does Osteria Francescana fit into this? Extended warranty against you not being happy with your burrata..?

Stock footage best footage.

extended warranty.. only applicable to items above $150 and note depreciation of payout per year. basically you wont get 100% warranty throughout the extended warranty.

Do you know if the travel credits and vouchers can be used by the supplementary card holder instead of the main card holder?

This is the 4th dedicated article about the Amex Plat Charge card in recent times. And Aaron has not even receive the card yet. Bias or not, it does feel touch too much attention paid to Amex.

Well, it’s shiny and expensive. Haha.

@MSflyer.. If there was more coming, I’d be excited! Because for many years, I used to think that the Amex Plat Charge Card was ‘a joke’, along with the (then) $1.2k annual fee.. what I’ve subsequently found out quite recently, in part thanks to Aaron., is that this card is the best thing since sliced bread.. BECAUSE I can now use a lot of the benefits that come along with the card and, to me, the $1.7k AF is nothing compared the the benefits I can get in return! Just because YOU don’t/ can’t/ won’t use it, doesn’t mean all… Read more »

well, it’s a newly relaunched card with an extensive range of benefits that can’t be covered in 1 or 2 posts

Aaron. Believe this hsbc visa infinite now covers award travel from 1 Oct

got a link? i’m referring to this: https://www.hsbc.com.sg/1/PA_ES_Content_Mgmt//content/singapore/personal/cards/09/hsbc-visa-infinite-credit-card/pdf/hsbc_visa_infinite_insurance_policy.pdf

https://www.hsbc.com.sg/1/PA_ES_Content_Mgmt//content/singapore/personal/cards/09/hsbc-visa-infinite-credit-card/pdf/hsbc_nac_faq.pdf

[…] the time that I’ve had the card, I’ve had fun digging into some of the lesser-known benefits, but only recently became aware of one unpublished benefit that could be the best of them […]

Hi Aaron, regarding the complimentary Travel Insurance, if we are claiming our miles for travel (hence not using the Platinum charge card to make payment), how does this benefit gets ‘activated’?

@Aaron

The Hertz CDP code 1631611 doesn’t grant even 1 extra hour in Australia. Maybe this is only for US ?

Eddie

Dunno about australia. It seems to be ok for Europe and usa

Seems the plat insurance T&C moved to https://www.americanexpress.com/content/dam/amex/sg/benefits/Plattravelinsurancetncs.pdf

Does the card still cover complimentary roadside assistance? I can’t find the terms on their website. Thanks.

Maybe try phoning Amex..? You’ll get instant response instead of having to wait here and possibly without ever knowing answer..? 🤣

Hi Aaron one other benefit I learnt from this card recently is that all your other AMEX cards (non co-branded excluded) annual fees are waived off. So if u have the PPS AMEX Card that’s another $550 off benefit

yup! mentioned here: https://milelion.com/2018/11/02/the-coolest-perk-of-amex-platinum-charge-the-little-discussed-one-annual-fee-policy/