[Update 2: DBS has reversed course and removed the restriction]

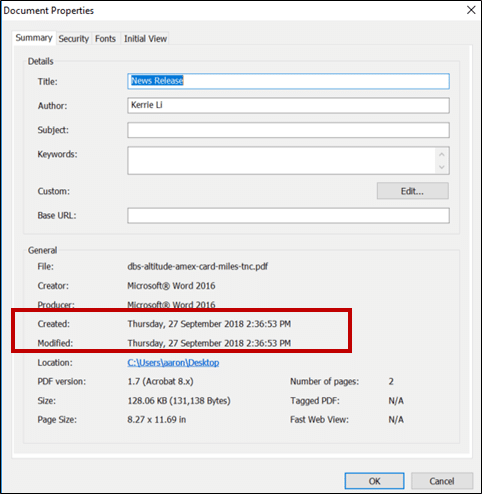

[Update: DBS has indeed confirmed that the T&Cs were tweaked on 27 September]

At the start of September, DBS started offering a 10,000 mile sign up bonus for its Altitude AMEX card. This was a welcome move, given that it had been almost 2 years since we’d last seen a sign up bonus on this product.

New DBS Altitude AMEX cardholders who spent $2,000 each month for the first 3 months after approval would get 10,000 sign up miles and 7,200 base miles, or a total spending to miles ratio of $6,000:17,200.

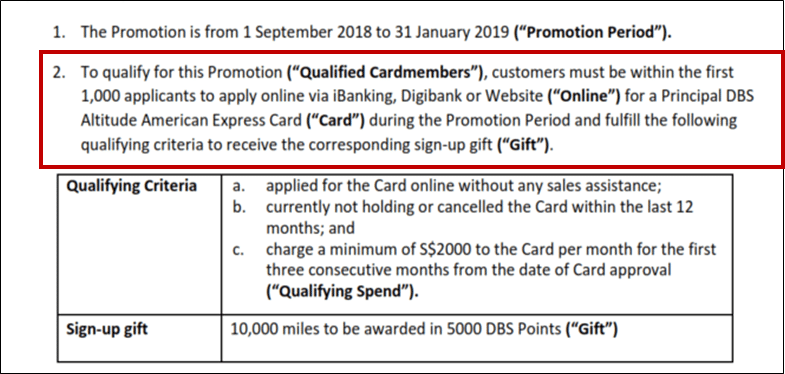

However, it seems that DBS has very quietly updated the T&Cs of this promotion:

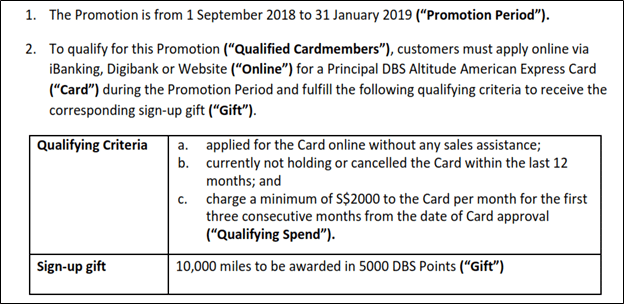

Compare that to the previous version (thanks to Benjamin from the Telegram Group for sending this over):

The upshot is that DBS has retroactively capped this sign up bonus to the first 1,000 applicants who apply and meet the criteria. Of course DBS has every legal right to do this, but that doesn’t mean retroactive tweaking of T&Cs is anything other than poor form.

Moreover, it’s disheartening to see another bank going down the “UOB sign up bonus” route, where bonuses are limited to the first X customers and there’s no way to tell ex-ante if you’re still part of the first X.

For example, the UOB PRVI Miles cards are currently offering a 10,000 mile sign up bonus with $6,000 of spending, but this is limited to the first 2,000 customers only. How do you know if you’re within that cap? You don’t. You spend and hope for the best. This makes sign up bonuses more Russian Roulette than sure thing, and it’s very customer unfriendly.

For what it’s worth, Matthew found something interesting lurking in the metadata of the new T&C PDF that suggests the new T&Cs were added on 27 September.

Conclusion

In and of itself, the DBS Altitude AMEX still has a very attractive sign up bonus. However, I’m no big fan of banks retroactively amending T&Cs, and this may end up being a detrimental move for DBS insofar as it spooks people from signing up for fear the cap has already been hit.

In my opinion, it’s still better to go for the “sure things” offered by the sign up bonuses for the AMEX KrisFlyer Blue or AMEX KrisFlyer Ascend cards.

Hey DBS, don’t go down the route of UOB please. I like you a lot.

Aaron, please inform your readers they are also going for the ‘sure thing’ of bad service for signing up anything via singsaver!

I applied my amex cards with singsaver and got my money with no fuss. So what’s the problem?

You broke Betteridge’s Law of Headlines

updated with the latest details, and to fix the breaking.

Darn it!

Everybody stand down. I repeat, everybody stand down!

Despicable Bank of Singapore.

This is surreptitiously akin to giving no notice, surely MAS should wake up and pay attention?

Why don’t you start the ball rolling and write to the MAS?

I recently did online spending with my DBS cards. One transaction was in Russian rouble (to pay a events organiser for hotel) and another was in USD (to pay for a conference). i thought I would have gotten the 4 mpd since there were online transactions. Anyway I was eventually told that they both wont any miles earned as they belonged to excluded categeries e.g charities/social organisations. ??? It seems like DBS cards now have a very very long list of exclusions and it’s not worth trying to get their miles. I will definitely use citibank cards or rebates cards… Read more »

@DK.. Look before you leap.. Citi is also introducing a whole heap of exclusions, w.e.f. 04 Oct 2018..

Sigh, looks like tough times are ahead for miles lovers. Sigh! Maybe I shd max up my Citibank reward cards tonight. :))

Poor form indeed, DBS. It’s like they dangled this carrot, get people to spend on their card with increased AMEX FCY rates, get them to spend on the card for at least three months and THEN hope their new customers won’t cancel it for the annual fee miles benefit.

Meh. Apart from that annual fee miles benefit there’s simply no use for having this card.

Called DBS Customer Service to verify if my new Altitude AMEX still qualifies for the sign up bonus….CSO checked with the relevant department and called back within 2 hours confirming that I qualified. Suggest that anyone who is trying to earn the sign up bonus to call and verify as well, otherwise you could be spending for nothing…

Think DBS changes T&Cs again, removing the first 1000.

Woah…let me check this with them.

[…] this month, I wrote about how DBS had retroactively tweaked the T&Cs of its Altitude card sign up bonus to add a cap of 1,000 customers. This change was quietly made on […]