Unlike bank-issued cards, cobrand cards have a direct crediting agreement with a particular airline. This means that whatever miles you earn from your spending are credited directly into your frequent flyer program as soon as transactions post.

Whether you find this feature helpful depends on your circumstances. On the one hand, there’s no need to pay a transfer fee, and you’re able to act quickly on whatever award space you see. On the other, your three year expiry period starts straight away.

American Express offers two cobrand KrisFlyer cards in Singapore- the KrisFlyer Credit Card (which I call the KrisFlyer Blue, for obvious reasons), and the KrisFlyer Ascend. These cards may not offer the 4 mpd earning rates that you can get with specialized spending cards, but their sign up bonuses make them an essential part of any miles collecting strategy.

Comparing the KrisFlyer Blue and Ascend

In this post, I’m going to compare the KrisFlyer Blue and KrisFlyer Ascend to help you understand which one suits you better. To start with, here’s a summary table of the two cards:

| KrisFlyer Blue | KrisFlyer Ascend | |

| Income Req. | $30,000 | $50,000 |

| Annual Fee | $176.55 (First Year Free) | $337.05 |

| Sign up bonus (first 3 months) | Spend $3,000, get 15,800 miles (including 5,000 first spend bonus) | Spend $10,000, get 43,000 miles (including 5,000 first spend bonus) |

| Local Spending | 1.1 mpd | 1.2 mpd |

| Overseas Spending | 2.0 mpd in June/December | |

| Specialized Spending | 2.0 mpd on Singapore Airlines/ Silk Air tickets 3.1 mpd on Grab, first $200 per month & 500 miles with first spend |

|

| Additional Benefits |

|

|

| SingSaver Sign Up Gift | $150 | $150 |

Please remember to fill out the SingSaver rewards form after you apply

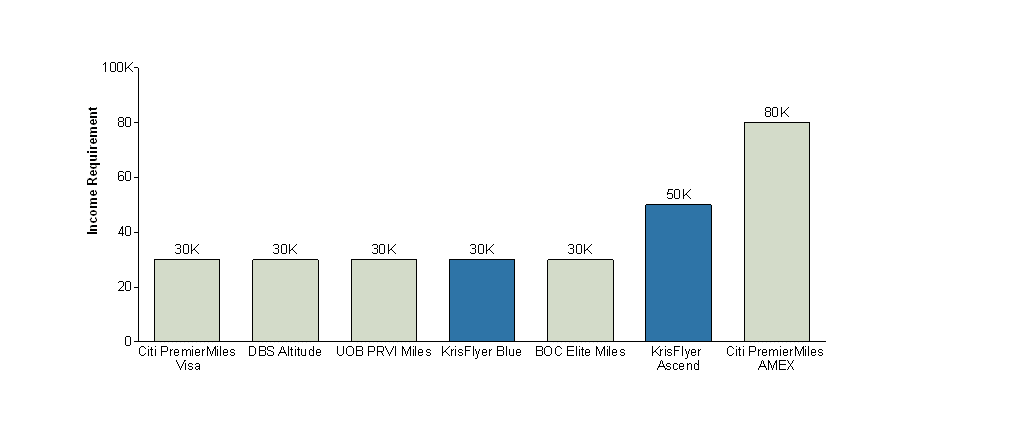

Income Requirement

The KrisFlyer Blue is an entry level credit card with a $30,000 income requirement, while the Ascend is positioned slightly higher at $50,000 income per annum.

Are they strict about this requirement? Anecdotal evidence suggests no- I understand some people who were slightly shy of the $50,000 mark can still get approval, depending on their history with American Express.c

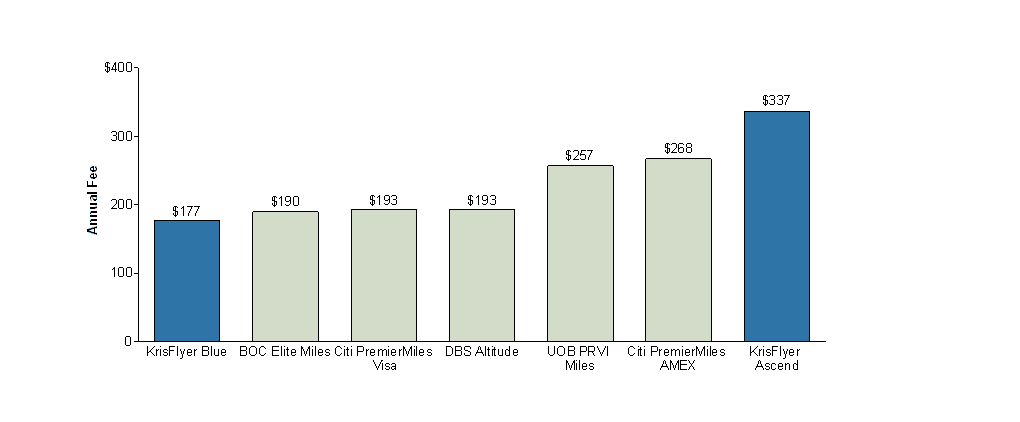

Annual Fee

The KrisFlyer Blue has a lower annual fee ($176.55) than the Ascend ($337.05), and waives the first year’s fee. The Ascend’s higher annual fee reflects its additional benefits, such as lounge vouchers and a complimentary night at selected Hilton properties.

The KrisFlyer Blue has a lower annual fee ($176.55) than the Ascend ($337.05), and waives the first year’s fee. The Ascend’s higher annual fee reflects its additional benefits, such as lounge vouchers and a complimentary night at selected Hilton properties.

When it comes to annual fee waivers, I’ve heard it is possible to get a waiver (either 50% or 100%, depending on your spending patterns) for the Ascend, but if it’s waived you shouldn’t expect to get the free hotel night and lounge vouchers. I say “expect” because some people report getting the lounge vouchers, but this is a classic YMMV situation.

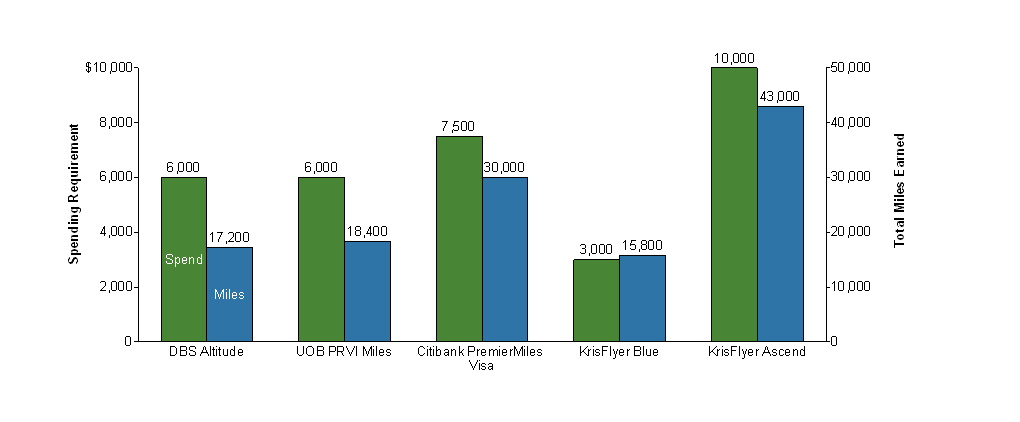

Sign Up Bonus

Sign up bonuses are a real highlight for the KrisFlyer cobrand cards. If you think about sign up bonuses on a miles to dollar spent ratio, then the KrisFlyer Blue actually comes out ahead- you get 15,800 miles for spending $3,000. That’s broken down into

Sign up bonuses are a real highlight for the KrisFlyer cobrand cards. If you think about sign up bonuses on a miles to dollar spent ratio, then the KrisFlyer Blue actually comes out ahead- you get 15,800 miles for spending $3,000. That’s broken down into

- 5,000 bonus miles on your first spend (only for first-time cobrand cardholders)

- 7,500 bonus miles for spending $3,000 within 3 months of approval

- 3,300 base miles for spending $3,000 (1.1 mpd)

If you think about sign up bonuses in terms of absolute miles earned, then the KrisFlyer Ascend comes out ahead- you get 43,000 miles for spending $10,000. That’s broken down into

- 5,000 bonus miles on your first spend (only for first-time cobrand cardholders)

- 26,000 bonus miles for spending $10,000 within 3 months of approval

- 12,000 base miles for spending $10,000 (1.2 mpd)

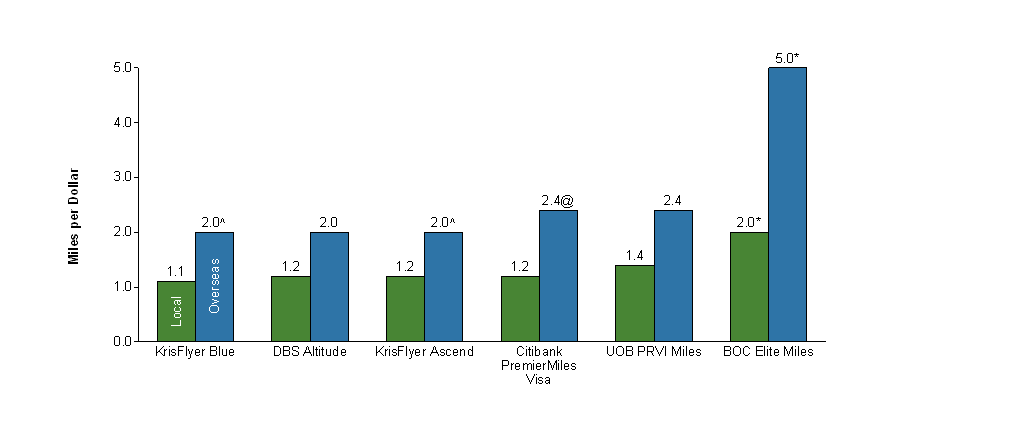

Miles Earning Rates

There’s not a lot to separate these two cards when it comes to earning rates, except that the Ascend earns 8% more miles (1.2 vs 1.1) than the Blue card on general spending.

Both cards earn 2.0 mpd on overseas general spending, but that’s only for June or December (something I think AMEX could really improve on for this card). You’ll earn 2.0 mpd on Singapore Airlines/Silk Air tickets (but note that you could use the DBS WWMC for 4 mpd on the first $2K of online spending per month, or the DBS Altitude for 3 mpd on the first $5K of air ticket spending per month), and 3.1/3.2 mpd on the Blue/Ascend for the first $200 of Grab transactions each month.

Card Benefits

Here’s what really separates the two cobrand cards. The KrisFlyer Blue is a pretty bare bones card (probably why they’re willing to waive the first year annual fee). The only benefit to speak of is that you get a S$150 cashback on singaporeair.com when you spend S$12,000 by 30 June 2019.

The KrisFlyer Ascend, on the other hand, packs quite a punch in this area. Here’s what you get

- 4 complimentary access each year to any participating SATS Premier Lounge in Singapore and Plaza Premium Lounge around the world

- Complimentary night stay each year at one of over 110 Hilton Properties in Asia Pacific

- Hilton Silver status

- A double KrisFlyer miles accrual voucher (capped at 5,000 miles) when you spend S$15,000 or more on singaporeair.com by 30 June 2019

- Fast track to KrisFlyer Elite Gold when you spend S$15,000 or more on singaporeair.com within 12 months of card approval

Hilton Silver is just one step above base membership, but crucially it gives you the 5th night free on award redemptions. If you’re in the market to buy Hilton points (Conrad Maldives for US$396 a night anyone?), then this is definitely something you want to have (or get Hilton Gold by signing up for the AMEX Platinum Charge card)

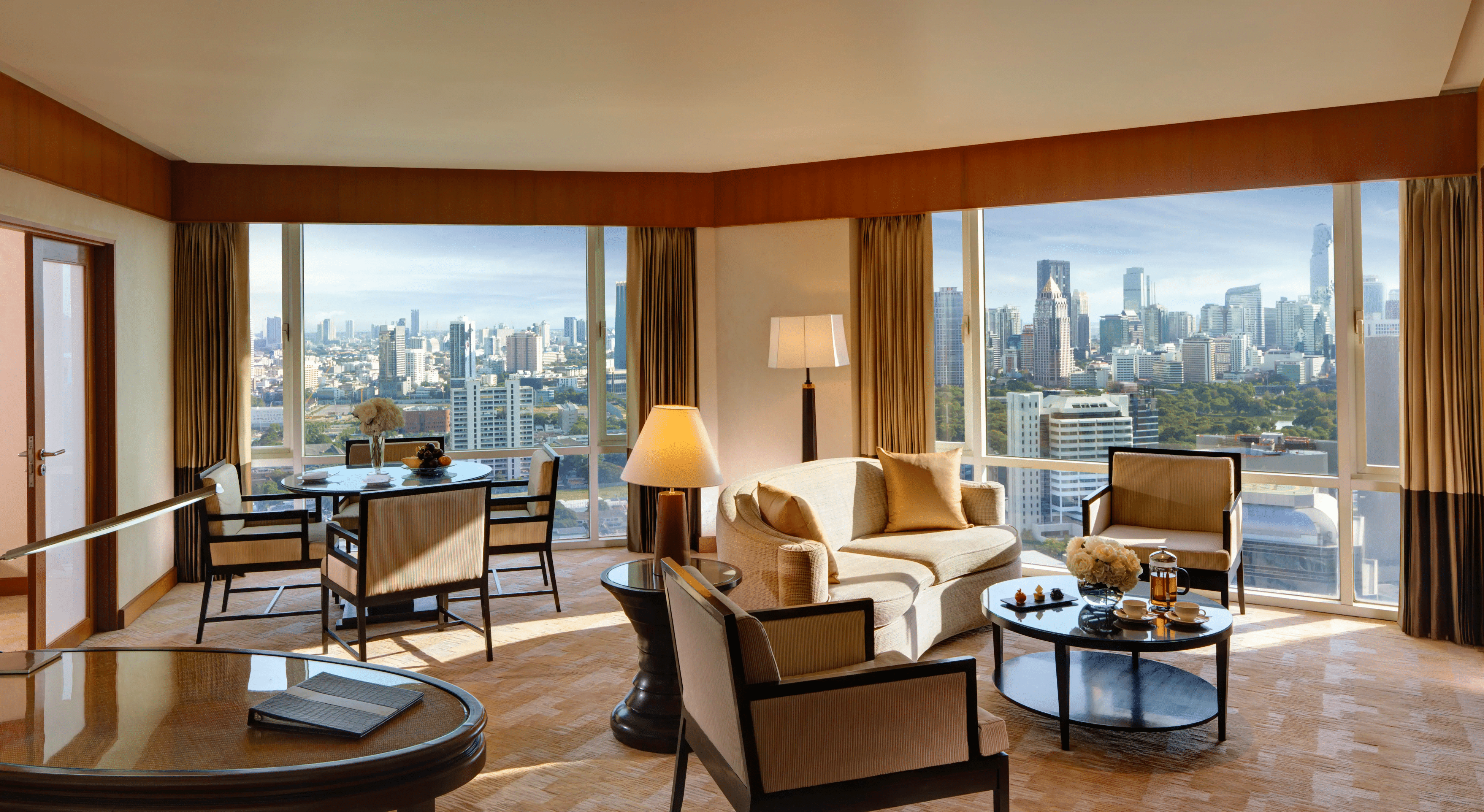

The complimentary night stay is for selected Hilton properties in the Asia Pacific region, which unfortunately does not include the Conrad Maldives (it does include the Conrad Bangkok though).

SingSaver sign up gifts

Regardless of which card you pick (you can only apply for one or the other), you’re entitled to a $150 sign up gift from SingSaver. Please remember to fill out the rewards claim form after you apply, or else there’s no way to give you your gift. There’s a further $20 NTUC voucher provided by AMEX if you use the MyInfo feature from SingPass to apply.

Conclusion

Which cobrand card you prefer depends on what you’re looking for. If you just want a bare bones card with an easier-to-hit sign up bonus, go for the KrisFlyer Blue. If you’re eyeing the benefits and higher sign up bonus of the KrisFlyer Ascend, then the SingSaver sign up gift should go some way to offsetting the non-waivable annual fee.

Apply for the KrisFlyer Blue here

Apply for the KrisFlyer Ascend here

*Remember to fill out the rewards form after applying to get your gift

P.S: I realise the UOB KrisFlyer debit card technically counts as a cobrand card. Let’s, er, let’s pretend it doesn’t exist.

If one has had the Blue card before and cancelled it, is there a time interval before one is eligible for the sign up bonus again or is that one-off bonus a forever one-off thing?

the first spend bonus of 5k miles is a once in a lifetime thing. the sign up bonus, i’m less sure. i know you can get the sign up bonus for the ascend if you’ve held the blue before, but i dont know what the “time out” period is between getting another sign up bonus for blue if you’ve held before.

spoke to cso before. amex take 12 mth before consider you as new customer but the first spend is forever in record

the first spend jointly applies to both cards. i.e. if you had the ascend before, cancelled, when got the blue card, you also don’t get the first spend 5k. (lesson I learn the hard way)

Need 12 months to be eligible?

Just applied through singsaver for the bonus miles. Cancelled around 6 months ago.

The 15k fast track to kfeg is only for ex-sin travel.

So Aaron, do you have any of these cards?

Have the blue for the sign up cash. Not eligible for bonus sadly

Hi Aaron,

Have you confirmed with AMEX that you are not eligible for the sign up bonus? When did you cancel your card?

Thanks.

Hi Aaron.

I talked to customer service of AMEX and he told me that I am eligible for the signup bonus, which is spending 3K for 7.5 bonus miles. I cancelled my previous AMEX krisflyer card end of last year or early this year, though i was not offered the miles bonus for my previous AMEX krisflyer card because the promotion was different then, I think.

Can you please help me check again with AMEX to confirm whether I received proper advice on this?

Thanks.

yes, you are eligible for the sign up bonus.

Can your next review on KrisFlyer include other banks…not limited to Amex only?

Correct me if I am wrong. Amex is the only one issuing krisflyer co-brand cards.

[…] SingSaver has continued its $150 sign up gift for the KrisFlyer AMEX cobrand cards for November. Can’t figure out which card is right for you? Have a read of our comparison article of the KrisFlyer Blue versus KrisFlyer Ascend. […]

“Complimentary night stay each year at one of over 110 Hilton Properties in Asia Pacific…”

Well, now you can update it to “over 150 Hilton Properties in Asia Pacific” (but of course it’s still technically over 110). The updated list also includes Hilton Narita Airport, so those who take SQ11 -> SQ637 from LAX to SIN, they could make use of this voucher for a night stay near Narita Airport.

https://icm.aexp-static.com/Internet/IntlHomepage/pdf/AscendHotelsParticipatingList.pdf