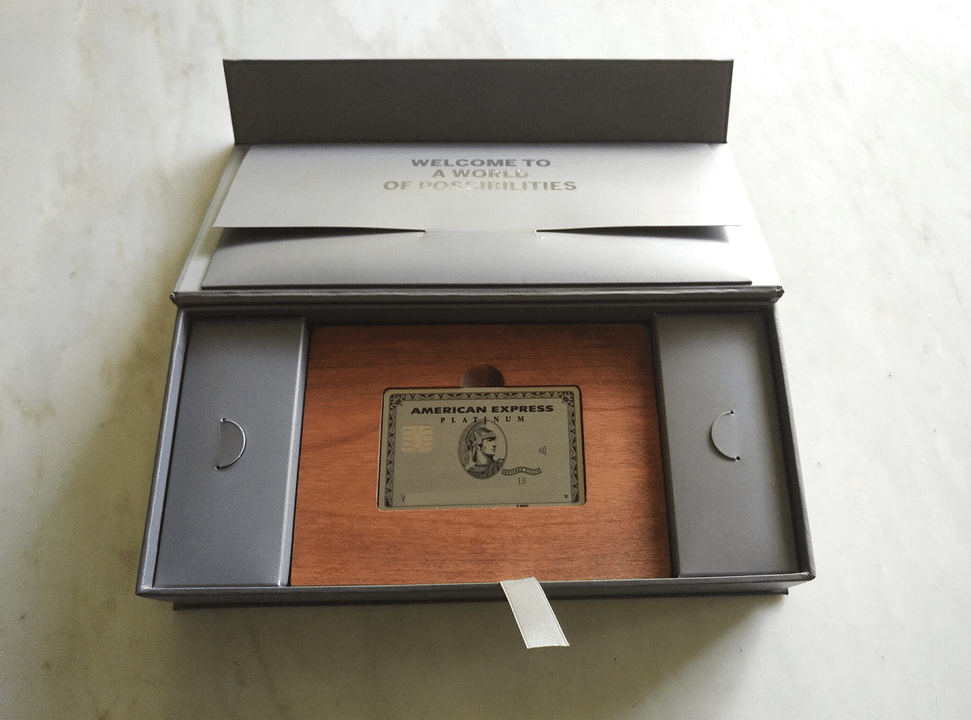

I’ve previously written about the published benefits of the newly-relaunched AMEX Platinum Charge card, as well as why I decided to get it despite the hefty $1,712 annual fee.

In the time that I’ve had the card, I’ve had fun digging into some of the lesser-known benefits, but only recently became aware of one unpublished benefit that could be the best of them all.

AMEX’s “One Annual Fee” Policy

AMEX’s policy is that Platinum Charge cardholders will only pay one annual fee– the highest annual fee of all the cards they hold. In other words, a Platinum Charge cardholder will only ever pay a maximum of $1,712 in annual fees. This is subject to a maximum of 3 cards, 2 credit and 1 charge. In other words, you can get the annual fee of up to 2 more cards absolutely free.

Apply for the AMEX Platinum Charge here

This creates a great opportunity to “upsize” your Platinum Charge benefits by signing up for a few other American Express cards…

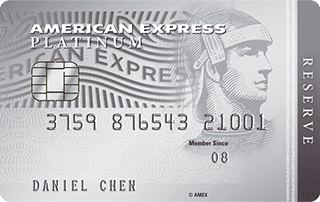

AMEX Platinum Reserve

The AMEX Platinum Reserve normally carries an income requirement of $150,000 per year and an annual fee of $535. Platinum Charge card members will presumably already met the income requirement, and with no annual fee to pay, getting this card is a no brainer.

I applied for the card online (too bad the AMEX Platinum Reserve has no member-refer-member mechanism) and got it within two days.

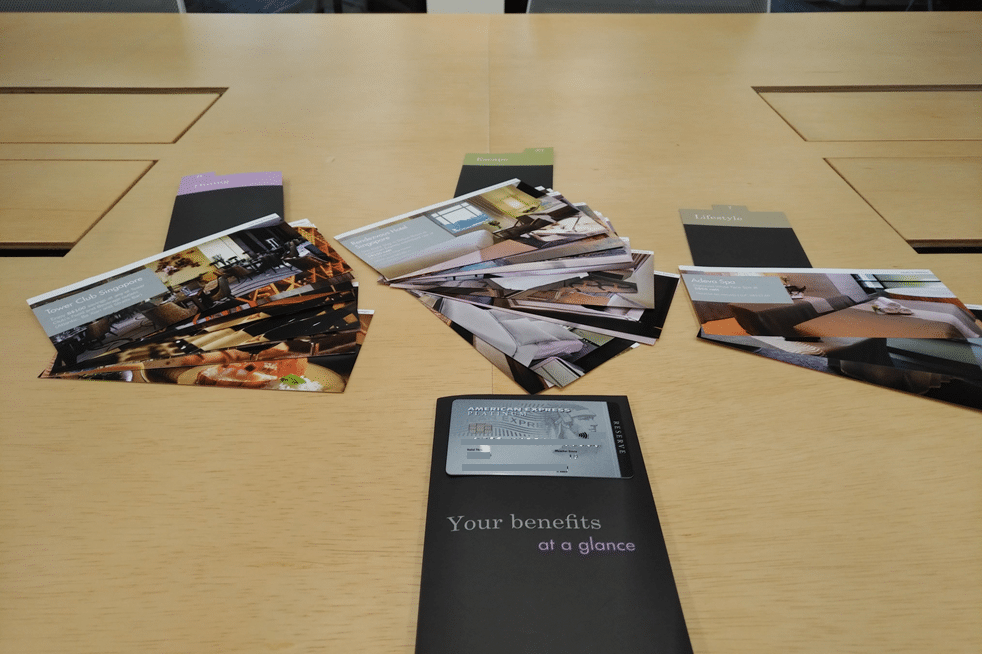

The Plat Reserve comes with a big stack of welcome vouchers, including the following:

- $100 Tower Club F&B voucher

- $50 Marriott dining voucher

- Marriott Cafe 50% off high tea certificate for 2-6 pax from Mon-Fri

- Lawry’s The Prime Rib Singapore 40% off for 4-20 pax from Mon-Sat lunch

- 50% off bill for 8-10 pax at Asian Market Cafe, Ellenborough Market Cafe or Cafe Swiss

- 2 x Complimentary cake or house wine at any FAR card restaurant

- Complimentary bottle of house wine with 4 pax at buffet lunch/dinner at Marriott Cafe

- Complimentary bottle of wine at Napolean Food & Wine Bar, Praelum Wine Bistro, and Burlamacco Ristorante

- Discount spa vouchers at Spa Rael, The Ultimate and Adeva Spa

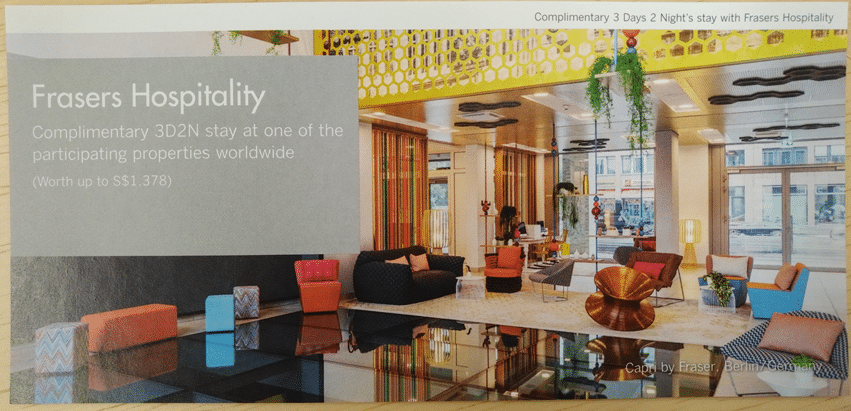

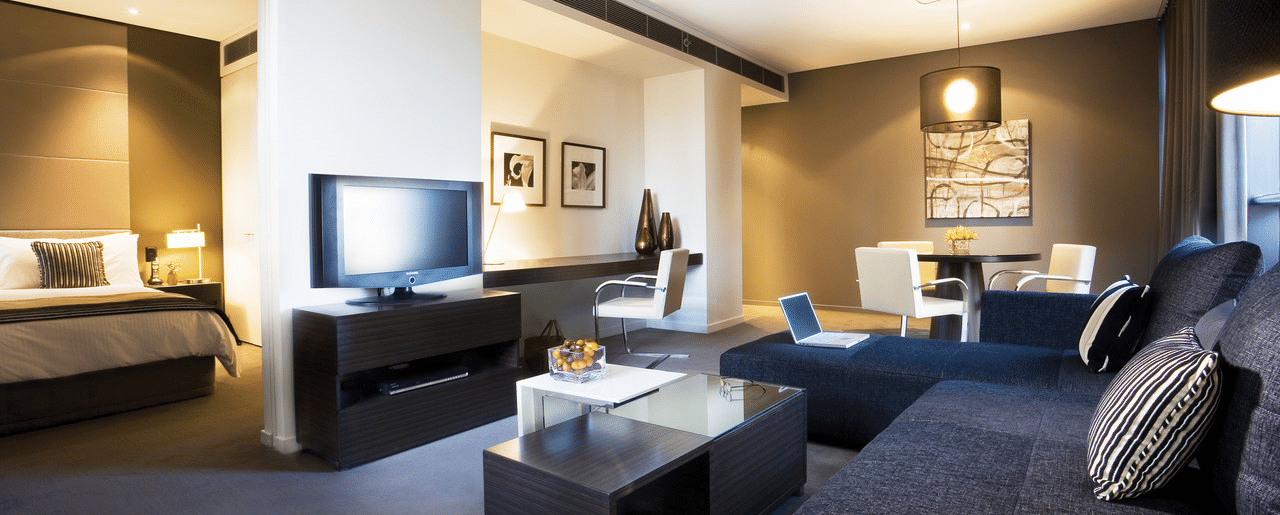

- Complimentary 2 night stay at any participating Frasers Hospitality property

- $190 nett stay at Amara Sanctuary resort, Hotel Fort Canning, The Quincy Hotel, YOTEL Singapore Orchard Road

- $150/190 nett stay at Dorsett Singapore and M Social

- $150 nett stay at Rendezvous Hotel Singapore, The Sultan

- Discounted weekend rate + complimentary room upgrade vouchers at both Fairmonts and Swissotel

The pick of the litter is undoubtedly the 2 night complimentary stay at a participating Frasers Hospitality property, a voucher you’ll receive each year you renew your AMEX Platinum Reserve membership. You can see the list of participating properties here, and make your booking online using the code AXPLAT.

The Near Away vouchers provided to AMEX Platinum Reserve cardholders provide access to discounted staycation rates in Singapore, with no room costing more than $190 nett. Other highlights include the $100 Tower Club voucher, $50 Marriott dining voucher and some additional group dining discounts (most of which you’d already have thanks to your AMEX Plat Charge membership).

All in all, a pretty nice haul at no incremental cost to AMEX Platinum Charge Cardholders. I think I even have a $20 NTUC voucher coming my way for applying through the SingPass MyInfo system…

AMEX KrisFlyer Ascend

The AMEX KrisFlyer Ascend normally has an annual fee of $337.05. This fee is not waived for the first year, but can be waived for subsequent years for Platinum Charge members.

Assuming you’ve not held the card before, you’ll be eligible for 43,000 KrisFlyer miles when you spend $10,000 within 3 months of approval. Even if you’re not, you’ll at least enjoy the four complimentary lounge vouchers (although as a Platinum Charge cardholder you’d have unlimited lounge access anyway) and the complimentary night stay at selected Hilton Properties in Asia Pacific.

You can sweeten the deal even further by applying for the AMEX KrisFlyer Ascend card via SingSaver, which gets you $150 of cash upon approval. Remember to fill out the rewards registration form after you apply so your gift can be properly credited to you.

Conclusion

The catch, if you want to call it that, is that you have to be a Platinum Charge cardholder first. With a $200,000 income requirement and a $1,712 annual fee, the pool of people willing/able to apply is likely going to be small.

But if you’ve already taken the plunge, then applying for the Platinum Reserve and Ascend cards can net you some additional free hotel nights and dining vouchers. Why not?

Yup. This is something the CSOs drop in conversation, when you talk about fee waivers… Applies to the lower platinum card as well.

Aaron how do you make the 200,000SGD when you work for yourself now?

Not organized crime.

Not instagram influencer.

Not human misery and suffering

Can this income continue post-marriage?

hope so, else it’s boogie street for me

Good tips Aaron. Just got the platinum charge card last week and this just adds to the benefits.

i did not receive vouchers for the amex credit card even though fees are waived. let me know if u understand differently.

I got the full works for the reserve , not sure about which card you’re referring to

yes i get the full for reserve too. but for KF ascend, they mentioned that no voucher pack is issued should i request for AF to be waived as KF are partnership with them, not “directly” under AMEX program for AF waiver with the perks.

would like to confirm if the same goes for u? or you still managed to snag the Hilton stay?

this is very much YMMV. some people get waived and still get the voucher pack, possibly because they spent a lot on the card. for me, i didn’t actually get waived for kfa, only got the reserve waiver.

AMEX charged AF for my kfa today. Called them and they now say kfa not counted as part of OneAF now. But on basis of my total spend on overall AMEX waived the annual fee but no vouchers. YMMV.

Does the maximum three cards policy include the Platinum Charge card itself?

2 credit, 1 charge

At least to me it doesn’t, which I can confirm after seeking clarifications on separate occasions.

The 1 charge card limit applies, which is the Plat Charge Card itself. Cannot apply Gold Charge Card.

No limit to the number of AMEX cards you can concurrently hold. But if you have a KF Ascend, you cannot keep your KF blue, vice versa. Same for Plat Reserve and Plat Credit Card. These examples are considered upgrades.

Im currently holding onto a Plat Charge, Plat Reserve, KF Blue, True Cashback, and I am only paying the forementioned one annual fee.

Hi Aaron, I just called the hotline and was informed that unfortunately the spend offer (50,000 bonus MR points when you spend $5,000 within the first 6 months) will not be applicable due to the annual fee waiver.

Have you heard otherwise?

Yes. I’ve been told twice by diff cso that it applies

but…if you can wait, i’m asking the product team and they’ll get back next week

Thanks for this great tip! Is there any clarification on the spend bonus?

platinum reserve will not get first spend bonus if AF not paid.

Hi Aaron, how do you get the details of the one annual fee policy?

I tried to look it up online but I could not find so. Unfortunately I have just got my Amex plat reserve

Hi, Aaron.

My income is still some way from the Charge Card’s requirement but do qualify for the Platinum Reserve.

Does this also work if I’m paying the annual fees for Platinum Reserve and would be able to get the Platinum (non-charge) card with no annual fees but still be entitled to all the free perks (free hotel stay, free gifts that comes with minimum spending) that come with the normal Plat card. Thanks.

Perk is only available for plat charge.

Hi Aaron, if I GT my AMEX Charge to the US version and keep my 2 SG AMEX credit cards, do I need to pay annual fee for the 2 SG cards or will it still be covered by the new US one?

You’d best check with amex

Got it, thanks!

Hey Aaron,

Do you know if the AMEX KrisFlyer Ascend annual fee still waive-able in subsequent years if you have the Platinum Charge card? I’m thinking of getting the charge card so I spoke to an AMEX sales rep and he said it isn’t waive-able but I’m not sure whether he knows what he is talking about or have policies changed recently?

apparently the first year ascend fee cannot be waived, subsequent years can. although this seems to be a YMMV situation because some people can still get first year waived “by left”

Hi Aaron, do you recall the validity period for the complimentary 2 night stay at Frasers Hospitality properties? Did the expiry date apply to booking, or the actual stay?

Trying to time my applications as I’ve maxed out my leave for the year!

my voucher expires 31 dec 2019. expiry date applies to actual stay.

Can i check if the One Annual Fee still apply? Cant seem to find that in the terms & Conditions of the card.

you won’t find it, because it’s not there. you’ll get the platinum reserve card FOC as a platinum charge cardholder

I had the KF Ascend for many years. I noted the renewal fee was charged to my account even though I’ve held the Plat Charge for 6 months.

Who do I call to ask about waiver of KF Ascend? I wonder if waiver of KF Ascend will mean no 1 night Hilton voucher….

I’m also getting charged for KF Ascend. Wonder if anyone knows if this can be waived and still get the benefits

Recently visited a Amex Booth and inquity if I can have A Secured Amex Charge Card.

To my surprise they told be and confirmed that I need to produce a bank statement stating I have SGD 3 Million in assets.

With a further secure amount with my bank for the limit I want for the card.

Forget it I told them.

Easy to take OCBC, HSBC and DBS cards with just SGD 250,000 secured.

this is interesting. I’ve not heard of a secured AMEX before, much less an amex charge card.

Hi Aaron,

Would the same strategy work when i go work with just the Amex Platinum reserve and Amex krisflyer ascend? This means presumably i would just play for the higher annual fee.

I still get atleast 2xfrasers, 1xhilton, 4xcomplimentary and numerous local vouchers.