| An updated review of this card is now available. Check it out here. |

This morning, Singapore Airlines and UOB held a joint event to announce the launch of the new KrisFlyer UOB Credit Card.

I’ve covered some of the broad strokes in this initial reactions post, but now that the T&Cs have been released it’s time to do an in-depth review of the product’s key features.

KrisFlyer UOB Credit Card Basics

The UOB KrisFlyer Credit Card has a minimum income requirement of $30K ($40K for foreigners) and an annual fee of $192.60. The annual fee is waived for the first year, and you earn 10,000 miles when you pay subsequent years’ annual fees. This is on par with what similar cards like the DBS Altitude and Citi PremierMiles Visa offer.

The foreign currency transaction fee is 3.25%, in line with what we see on the UOB PRVI Miles cards.

As this is a cobrand card, the miles you earn will be credited directly to your KrisFlyer account with no transfer fees (this also means your three-year expiry countdown will start immediately).

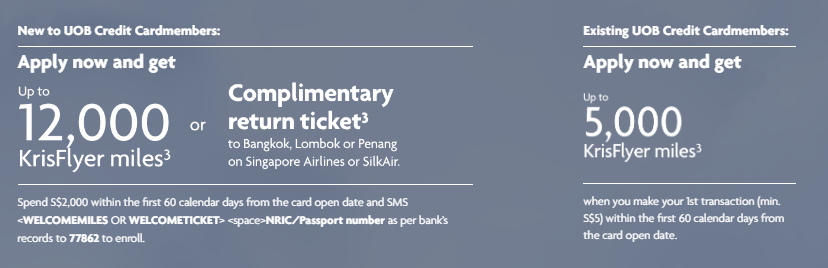

Sign up bonus of up to 12,000 miles

KrisFlyer UOB Credit Card applicants who receive approval before 30 June 2019 will earn 5,000 KrisFlyer miles when they spend a minimum of $5 within 60 days of card opening (that $5 is a bit of a weird figure, but I think it has something to do with UOB’s policy of rounding down spending to the nearest $5 when awarding points).

If you’re a new-to-bank customer, you get an additional 7,000 KrisFlyer miles or a complimentary return ticket to Bangkok, Lombok, or Penang when you spend at least $2K in the first 60 days. This is on top of the 5,000 welcome mile offer. You will need to register via SMS to enjoy this, so refer to the instructions on the website carefully.

In other words, new-to-bank customers who spend $2K in the first 60 days get:

- 5,000 welcome miles with first spend

- 7,000 bonus miles with $2K spend

- 2,400 base miles with $2K spend

That’s a total haul of 14,400 miles for $2K of spending, which is one of the better offers out there. Moreover, I’m pleased to see that UOB is not doing one of their usual “limited to first X approvals only” campaigns- if you hit the spending, you’ll get the bonus.

Earn 3 mpd on SIA-related purchases, dining, online shopping and transport (but…)

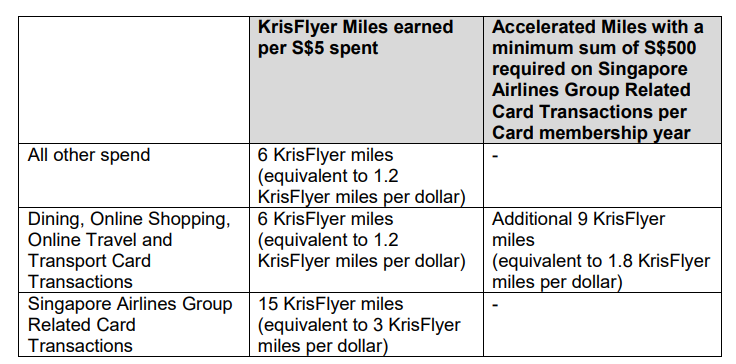

Cardholders will enjoy the following earn rates:

- 3 mpd on Singapore Airlines, SilkAir, Scoot and KrisShop purchases (a.k.a SIA-related transactions)

- 3 mpd on dining, food delivery, online shopping and travel, and transport (subject to min $500 spend per membership year on SIA-related transactions)

- 1.2 mpd on everything else

Although the 1.2 mpd general spending rate is below other cards in the market (including UOB’s own PRVI Miles cards which clock in at 1.4 mpd), the 3 mpd bonus categories are very impressive.

First, the good news. There is no cap on the 3 mpd earn rates, which is awesome. Yes, it’s not the highest in the market- there are cards offering 4 mpd on dining, online shopping and transport. However, all those come with caps of between $1-2K per month, and in any case I think UOB is positioning this product as the go-to solution for those who just want one card.

Do note that UOB awards miles in intervals of $5, so technically speaking, someone who spends $5 earns the same number of miles as someone who spends $9. Here’s a table from the T&Cs illustrating the earning rates:

Now, the catch. The bonus 1.8 mpd on dining, online shopping, online travel and transport transactions will only be credited 2 months after your card membership year. The T&Cs further make it clear that “expedition of accelerated miles is not allowed”.

That’s a long time to be waiting for your miles, and it makes reconciliation a major headache. Is that a deal breaker? Maybe not, but remember that the 1.2 mpd is credited immediately to your KrisFlyer account, while the 1.8 mpd takes anywhere from 2-14 months to be credited. When you take into account that KrisFlyer miles expire after 36 months, you may find the time frame for using your miles tighter than you’d like.

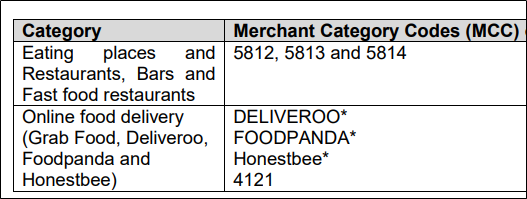

Dining

UOB has fortunately taken a very broad view of dining (unlike Maybank which only includes MCC 5812: Eating Places and Restaurants)- traditional restaurants, fast food and bars all qualify, as do online food delivery services like Deliveroo, Foodpanda, Honestbee and 4121 (Taxicabs and limousines- presumably so that GrabFood qualifies).

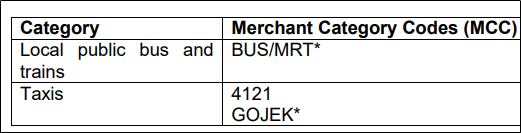

Transport

Both Grab and gojek qualify for 3 mpd, and I assume that if Ryde, TADA et al also code as 4121 they’ll get 3 mpd as well. Your regular taxi rides will also qualify.

I’m impressed that Bus/MRT transactions will enjoy 3 mpd. This means that you can tap your KrisFlyer UOB Credit Card at the gantry and earn 3 mpd through the SimplyGo scheme.

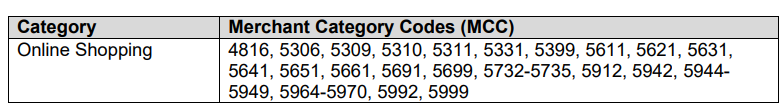

Online Shopping & Travel

UOB has a very, very broad definition of online shopping as well. Here’s what all those numbers mean:

- 4816: Computer Network/Information Services

- 5306: (I can’t actually find this one, anyone wants to assist?)

- 5309: Duty free Stores

- 5310: Discount Stores

- 5311: Department Stores

- 5331: Variety Stores

- 5399: Misc General Merchandise Stores

- 5611: Men/Boy’s Clothing and Accessories Stores

- 5621: Women’s Ready to Wear Shoes

- 5631: Women’s Accessory and Specialty Stores

- 5641: Children’s and Infants’ Wear Stores

- 5651: Family Clothing Stores

- 5661: Shoe Stores

- 5691: Men’s and Women’s Clothing Stores:

- 5699: Accessory and Apparel Stores- Misc

- 5732: Electronics Sales

- 5733: Music Stores- Musical Instruments, Pianos and Sheet Music

- 5734: Computer Software Stores

- 5735: Record Shops

- 5912: Drug Stores and Pharmacies

- 5942: Book Stores

- 5945: Game, Toy and Hobby Shops

- 5946: Camera and Photographic Supply Stores

- 5947: Card, Gift, Novelty and Souvenir Shops

- 5948: Leather Goods and Luggage Stores

- 5949: Fabric, Needlework, Piece Goods and Sewing Stores

- 5964-5969: Direct Marketing Merchants

- 5970: Artist Supply Stores

- 5992: Florists

- 5999: Misc and Specialty Retail Stores

Although it’s a long list of MCCs, you do need to carry out your transaction online to earn the 3 mpd. So, for example, buying flowers at a florist’s physical store would not qualify, but buying them from the florist’s website (if they have one) would.

Online travel includes transactions made on Agoda, AirBnB, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, and UOB Travel.

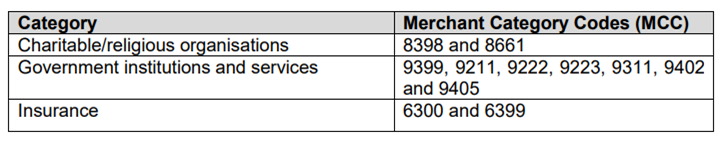

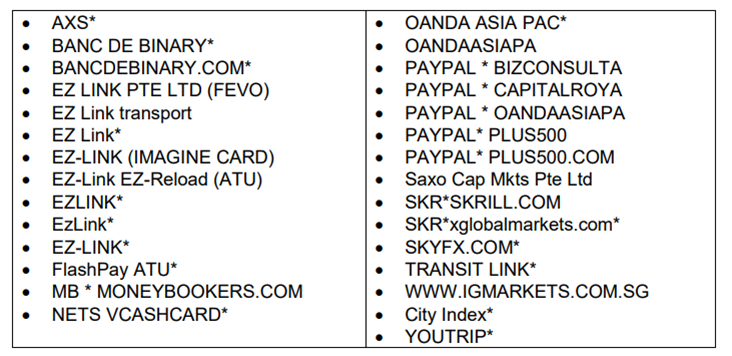

Exclusion Categories

Nothing too eye-raising to report here, as the usual insurance, government payments, charitable/religious organisations transactions are excluded from earning miles.

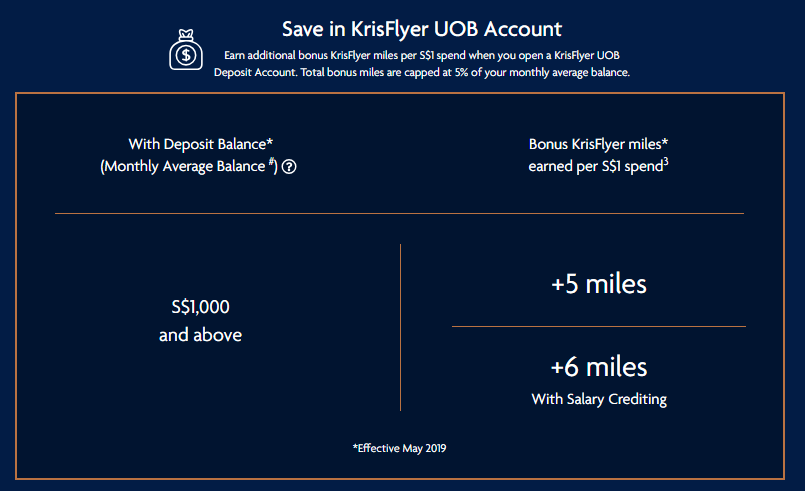

Bonus 6 mpd for KrisFlyer UOB Savings Account holders (but…)

One of the big selling points for UOB is the fact that you can earn up to 6 mpd extra on your KrisFlyer UOB Credit Card by putting money in a KrisFlyer UOB Savings account.

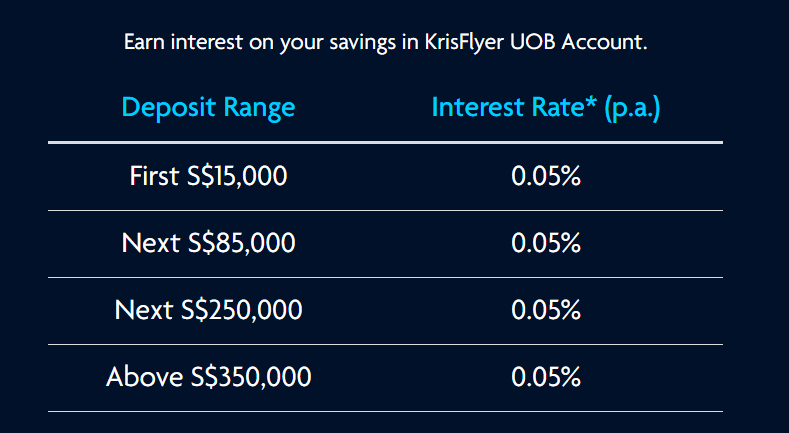

6 mpd is headline-grabbing, but the main issue for me is that the opportunity cost of placing money in the KrisFlyer UOB Savings Account is too high. The account earns a paltry 0.05% of interest, no matter how much you put in it.

You might try to rationalise it by telling yourself you’ll earn back the lost interest in the form of miles, but that’s where the other shoe drops. The maximum bonus miles you can earn is capped at 5% of your Monthly Average Balance (MAB).

In other words, if my MAB is $50K, the maximum bonus miles I can earn per month is 2,500– which I’ll hit with just $417 of spending!

I value 2,500 miles at $20, so my total “return” for the month is $20 of miles + $2 of interest. For $50K of capital, that’s extremely abject.

Moreover, you only earn 6 mpd if you credit your salary to this account. That means forgoing some very generous bonus interest on other hurdle accounts like the BOC Smart Saver, the DBS Multiplier and the OCBC 360 account. Without crediting your salary, you’ll earn 5 mpd.

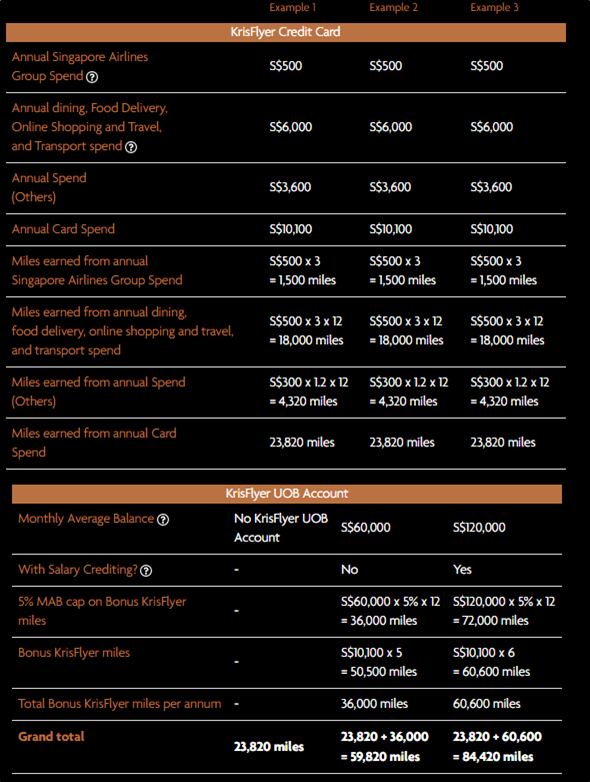

UOB’s own worked examples only serve to highlight how dismal the returns on this account are.

Look at Example 3 in particular: here’s someone parking $120K for a year at virtually 0 interest, spending ~$10K on his KrisFlyer UOB Credit Card and only having ~84K miles to show for it. He’s basically accepted a return of ~$1,690 on capital of $120K- less than what he’d get with a fixed deposit (plus, if he opted for the fixed deposit he could still generate miles on the $10K of spending with other cards)

So I fancy the card, but not the bank account. Fortunately, you don’t need the latter to open the former, and I think you should steer clear of it.

Card features

The UOB KrisFlyer Credit Card comes with additional benefits, which I’ll cover briefly.

KrisFlyer Elite Silver Fast Track

Cardholders who open a card between 23 April 2019 and 22 April 2020 can unlock KrisFlyer Elite Silver by spending $5K on SIA-related transactions within the first membership year.

Your account will be upgraded within 6 weeks of the last calendar month of the first year membership anniversary (i.e. not immediately after hitting the spend), and you’ll subsequently need to re-qualify through the usual route of hitting 25,000 elite miles in a membership year.

KrisFlyer Elite Silver is…nothing to get excited about. I should know, I’ve just been downgraded to this tier. You get 25% bonus miles on certain fare classes, priority waitlisting and standby, complimentary standard seat selection and discounted service fees, but that’s it.

| The AMEX KrisFlyer Ascend is offering a fast track upgrade to KrisFlyer Elite Gold for cardholders who spend $12K in 3 months (1 Mar-1 Jun 19), of which at least $3K is on singaporeair.com. Learn more here. |

$20 KrisShop Rebate

Cardholders who spend a minimum of $100 in a single transaction will enjoy a $20 rebate on KrisShop purchases, capped at one rebate every calendar year. The rebate will be credited to your account within 3 months of the eligible transaction.

Scoot Privileges

Cardholder enjoy priority check-in, boarding, additional baggage allowance, complimentary seat selection, and a waiver of the $10 convenience fee per sector per transaction. For the record, Scoot charges a $20 credit card fee, so make of that what you will.

You also enjoy a one-time booking flexibility waiver per itinerary on Scoot flights, which means you can change your flight date/time or passenger name (the principal cardholder’s name cannot be changed).

$15 off Changi Wi-Fi

Cardholders enjoy 2 ChangiWiFi redemption codes worth $15 in a calendar year. This code may be redeemed once per half yearly (ie. Jan-Jun, Jul-Dec) and is limited to the first 1,000 redemptions per month.

$15 off two Grab Rides

Cardholders will get two Grab promo codes worth $15 each that can be used to or from Changi Airport. This code may be redeemed once per half yearly (ie. Jan-Jun, Jul-Dec) and is limited to the first 1,000 redemptions per month.

What’s missing?

I kind of wish there were more SQ-specific benefits on this card, because KrisFlyer Elite Silver is really nothing to write home about. Sure, you get special treatment on Scoot, but I don’t think that should be the height of aspirations on a product like this.

It’s also curious that there’s no lounge benefits provided on this card- no one’s asking for SilverKris lounge access, but if AMEX can provide a tie-up with Plaza Premium, couldn’t UOB do something similar?

Although there’s a pseudo airport limo benefit on this card (in the form of the 2 Grab airport vouchers), I wonder if UOB considered adding something more substantial before worrying that their UOB PRVI AMEX would be cannibalized.

Conclusion

As I mentioned in my initial reactions post, the UOB KrisFlyer Credit Card is a worthy product in and of itself (the less said about the accompanying bank account, however, the better). Customers who want a card with competitive miles earning rates and wider acceptance than the KrisFlyer AMEX cards will certainly be attracted.

It will be interesting to see how AMEX responds to this new salvo. Although the KrisFlyer AMEX cards have higher sign up bonuses and better card benefits (at least on the Ascend), UOB’s offering generally outperforms them for day-to-day spend.

My main issue with the UOB KrisFlyer Credit Card is the delayed crediting of the bonus miles- I get that from a technical point of view, you can only know after the fact whether someone really spent $500 on SIA-related transactions throughout the year. But wouldn’t a better way of implementing this be to tell people “ok, you earn 1.2 mpd on all transactions, but once you hit $500 with SIA you unlock the 3 mpd on these categories for the rest of the year”.

That would encourage people to front-load their SIA spending (I suppose you might have gamers who buy a refundable ticket and later try to get their money back, but there are ways of checking that behavior), and it would avoid what I’m sure will happen 14 months from now when distressed customers start jamming the UOB phone lines to do manual miles reconciliations.

If that doesn’t bother you, then I believe you’ll find the UOB KrisFlyer Credit Card to be a good card to add to your wallet.

Great summary in such a short period of time, thanks for that.

Though I don’t think the most recent devaluations justify a “I value 2,500 miles at $20” 🙂

Scoot charges a $20 credit card fee. So with the waiver essentially there will not be any convenience fee?

i guess the delayed credit of the bonus miles may be an incentive/ransom for people to hold on to their card rather than cancel it since there will be no way around a waiver for annual fee in such a circumstance. Win-win for UOB

You get 10k miles for paying the annual fee. So okay to pay.

Agree – it’s a way to hold us ransom to make us pay the 2nd year annual fee. I can earn 10k miles through spending instead of paying for the miles.

Such a good and proper detailed post, thanks Aaron.

Since Grab are categorized under travel, would grab wallet top up be eligible for 3mpd too?

No. They specifically say 4121 to exclude grabpay top up. Others they just use deliveroo* honestbee* but not grab*

Oh.. so there’s a different MCC for Grab wallet top up? I’ve only used the KF Amex card and they count Grab wallet top up the same as rides. My understanding is that they belong to the same merchant so will also count.

Based on this article. Grab has a different MCC for Grab rides, Grab food and Grabpay.

https://blog.moneysmart.sg/credit-cards/mcc-codes-singapore/

Two months after end of membership year. The bean counters at UOB have clearly been hard at work trying their best to make this a product that works best for UOB. Just imagine if there is any further devaluation and one has a big chunk of further 1.8 miles waiting to come in another 12 months. Nope.

Bus and mrt rides won’t hit the min $5 hence you won’t be getting any miles?

Simplygo consolidates over a few days

Yep. But Visa is on daily settlement. Therefore if at some point MC follows Visa method it will be excluded

Might also be good to note that spending at SMART$ merchants will earn cardholders SMART$ instead of KrisFlyer Miles. Stated in Section 10.1 of the T&Cs.

“No UNI$ will be awarded for all transactions made with the Card. For spend at SMART$ merchants, the Card will only earn SMART$ but not KrisFlyer miles”

The 2,500 miles is a monthly earning opportunity. In other words, you’d be earning $2 in interest and the equivalent of $240 in miles (assuming all criteria met) per annum, or at an equivalent interest rate of 0.487%.

Correction- The interest on a $50k deposit at 0.05% is $25, not $2. So the rate is 0.533%

Since when do “we” value miles as $8/k?

I’m using Aaron’s example. YMMV depending on how you value the miles.

Wont the return tickets to Bangkok worth more compared to the 7k miles (using 0.02 cents per mile as the value)?

Does payment for taxes on award tickets count towards the $500?

You will earn 6 KrisFlyer miles for every S$5 spent (equivalent to 1.2 KrisFlyer miles

per dollar) (“Base Miles”) on Card Transactions (excluding Singapore Airlines Group

Related Card Transactions) that are successfully charged and posted to your Card in

a calendar month.

Based on this I guess UOB will calculate miles based on the spending in a calendar month, rather than every S$5 spent per transaction. If not it doesn’t make sense that we will be able to earn from MRT/bus spending.

No, MRT spending has been consolidated over a few days using the PRVI Mastercard, that should be the same here. E.g. I’m billed in ~$10 chunks/week or so which is perfectly eligible for miles following UOB definition.

For everything else this still sounds like “charge $4.99 to you card and get nothing” to me.

i see… i know dbs also have the same policy. Is there any credit card that can earn miles per dollar??

i see… i know dbs also have the same policy. Is there any credit card that can earn miles per dollar??

BOC EM earns for every cent.

@YSL – DBS site says “Earn 3 DBS points* with every S$5 spent on all other local spend”

But in reality it pro-rates the spend in blocks of $1.67 / 1 DBS point (2 miles).

So if you spend $2 on a transaction you are still good:

Earned 1 DBS point (2 miles) on a $2 spend.

Btw I am refering to DBS Altitude

Amex SIA cobrand earns on every dollar

CITI PM earn miles per dollar too.

I think they go by merchant code. For example all your mrt rides transactions will share the same code which allows them to consolidate your spendings for that merchant to calculate the miles by rounding down to the nearest $5. But the catch is on other spendings unlike transport which you use often, honestly earning only 6miles for a $9 spending is not very attractive to me.

How about other airlines such as Jetstar, Airasia,etc. are they included in online travel ?

Nope. Has to be booked via one of the specified OTAs.

are Hospital bills classified as Govt Insitutions?

depends on the hospital. private hospitals probably would not?

Aaron, the way I think about the issue of paying annual fee and forgoing interest to get miles is akin to “paying for miles with dollars”. It’s a function of how much the “price” is, before it makes sense. We all know that if we claim Business savers, the value of a mile recouped is >2cts per mile. If economy, it’s <2cts per mile. People like us are willing to pay banks an admin fee to pay taxes. So, in your past examples, if you can get a HSBC Premier Card or a StanChart card, you pay 1.25cts per mile,… Read more »

this sounds good in theory- to be honest i haven’t read the fine print so i’m not sure how this will work. you’ll still have the same issues with the up to 14 months crediting time though

For the additional 1.8miles per dollar, does it only start after you have accumulated $500 in SIA-related expenditures or will it be for the entire membership year even if you only accumulated the $500 only day in Month 11.

the latter. the problem is going to be reconciliation.

Do KrisShop purchases qualify as SIA-related expenditures? Anyone have datapoints on this?

Would cardup transaction be counted as an eligible online transaction?

Please could you update the “which card to use” page with where KrisFlyer UOB Credit Card lies between the other cards – I think that will help people clearly see whether they should be getting the KrisFlyer UOB Credit Card or other cards.

Thank you, great site as always.

take a peek at the page now…think you’ll be surprised!

Interesting part on the Online Shopping Card Transactions..in the T&C it states: “Online Shopping Card Transaction(s)” means the Card Transaction(s) made at fashion websites that sells clothes, shoes, jewellery, accessories and bags as its main business activity including card-not-present transactions like ecommerce/mail/phone order transactions in local and foreign currencies, provided that such merchant fall within any one of the following Merchant Category Codes (MCC). UOB determines an online retail transaction based on system indicators. Business classifications and system indicators are both decided by the merchants and their bankers, and passed to UOB when the transaction is posted to the Card.”… Read more »

4816 is because some merchants use an outsourced payment processor which may code not as the merchant per se but the party handling the transaction. I could be wrong but I think cardup is 4816

If Cardup is 4816 and it falls into the MCC listed..does that mean it will definitely earn 3mpd?

Or does UOB have the discretion to look at the vendor/merchant’s business and not credit the 3mpd even though the MCC on the transaction is 4816?

i’d ask you to test it for yourself, but you’ll only know the answer in 14 months…. 😉

Hah! That’s the problem I guess! The dilemma is that I have a monthly transaction that falls under 4816 and with my Stanchart card it gives 1.4mpd..so the question is do I risk the 1.6mpd to try?

I called cardup and they told me their MCC is 7399. Any gurus out there that has actually used cardup can tell if its 4816 or 7399? Thanks!

Or did I read this wrongly?

“Online Shopping Card Transaction(s)” means the Card Transaction(s) made at fashion websites that sells clothes, shoes, jewellery, accessories and bags as its main business activity including card-not-present transactions like ecommerce/mail/phone order transactions in local and foreign currencies, provided that such merchant fall within any one of the following Merchant Category Codes (MCC).”

Which means fashion websites and vendor merchants(within the MCC listed) that payments are made online will earn the 3mpd?

Hi Aaron, would you or your contacts know when the 5K welcome miles (when sgd5 is spent on the card within 60 days) is credited into the KF acct?

Is it credited 2 months after the subscription year-end date like the bonus miles?

And are you allowed to terminate the card without incurring any cancellation or penalty fees after the first year is over?

First 3k miles will be credited within a month of which the spend was made.

Next 2k miles will be credited by 31 October.

If you cancel the card after the first year, there shouldn’t be any fees.

So there are no further conditions attached to the 5k Miles other than spending $5 and holding the card till Nov?

What if i made the $500 spend on Scoot during my first month of card membership? will i be able to enjoy the additional 1.8 miles from the next two months onwards or do i still have to wait 14 months?

Still 14 months.

shucks, that sucks man. cant believe such an atas airline agree to such a ridiculous credit card term.

Hey, just to clarify as this question kinda confused me.

If I meet the $500 spend in my first year of holding the card, I will be able to get the additional 1.8 miles on all eligible spend for the year right? Only catch is that I will only receive it 2 months after the card membership year?

Also, another question: Say I got my card in June 2019 and I only meet the $500 spend in May 2020, will I still get the additional 1.8 miles on my eligible spend from June 2019 to April 2020?

Thanks!

The answer is yes, someone above already asked this

For the 12k sign up bonus, the T&Cs say $2000 in eligible transactions. Any idea what they define as eligible?

(i.e. would a $2000 insurance payment count as an eligible transaction for the sign up bonus despite not earning any KF miles otherwise?)

https://www.uob.com.sg/assets/pdfs/kf-cc-acq-offer-tnc.pdf

Look in the T&C. It’s on the UOB website. https://www.uob.com.sg/personal/krisflyer-uob/credit/applynow.html

im curious about something though – if the accelerated miles are given 14 months later.. what if we decide to terminate the card (if we do not want to pay for the annual fee).. will we still be granted those miles post the 1 year?

No. Your card must still be active to receive the miles.

Am I the only one that thinks that this scheme is going to be very much like a Civil Servants’ 13th Month Bonus? Everyone knows they’re getting something…… but won’t know exactly what, until told at the end! 🤣🤣🤣

No SMS code to apply for existing UOB cardmembers?

Waiting a year for meager bonus points is not worthwhile as there maybe a krisflyer points devaluation.

to unlock the 3 mpd everyday spend, we have to spend $500 with singapore airlines group. im assuming thatincludes scoot?

Anyone got this card yet? I signed up on the first day and there’s still no sign of it.

just received sms from UOB that my application has been approved.

Hello Aaron! Thanks for sharing the information! I just got the credit card today.

Just wondering, does the Qoo10/Lazada categorized under “Online Spending” which awards 1.2mpd + 1.8mpd?

should be, but you won’t know for sure until 14 months later 😉

I’ll try to call them up tomorrow and see if they say anything about this 😀

Just got the physical card, and I must say the actual card itself looks much nicer than the pic shown.

1 question though: since the 3 mpd spending category only specifies mcc, does it mean that even foreign currency spending in these categories will get 3 mpd?

Just spoke to UOB to clarify on their definition of existing customer as I was previously holding a UOB card which was cancelled in 2017. In short, UOB’s answer is that you are classified as a existing card customer as long as you have held a UOB card previously. Shucks! There goes my extra welcome bonus miles. Time to keep this card in the drawer, except for SIA flight tickets.

pretty sure that is wrong. it should be 12 months.

Is it written anywhere in the T&C on the 12 months?

Can earn KF mile from KrisFlyer UOB for Medical or hospital bill (30-50k) ?