After months of deliberation, I finally decided to pull the trigger and get the Citi Prestige card in May last year.

The $535 annual fee stung, and in fact was the first time I’d ever paid so much for a card (well, until a certain AMEX came along…), but I reasoned I’d earn it back through the card benefits. Besides, I was about to change careers and take a pay cut, and figured I should get whatever high SES cards I could while it was still possible.

Barely 12 months later, I’ve decided to cancel it. Here’s my thought process.

Complimentary airport limo transfers got nerfed

In April this year, Citi changed the T&Cs of its limo benefit dramatically. In the past, spending S$1.5K per quarter in foreign currency unlocked four complimentary trips. With the change, you now need to spend S$20K quarterly to unlock two complimentary rides. That’s right, the allowance was cut in half, and the spending requirement raised 13X.

This change led me to conclude that for all intents and purposes, the Citi Prestige doesn’t have a limo benefit anymore. If I need one, I’ll use my UOB PRVI Miles AMEX, which allows me to unlock two rides with S$1K foreign currency spending in a quarter.

| Which credit cards offer complimentary airport limo transfers? Read the analysis here |

Unlimited lounge access is covered by another card

The Citi Prestige comes with a Priority Pass that gives unlimited visits for the principal cardholder and one guest, but I already have this benefit covered through the AMEX Platinum Charge. What’s more, the AMEX Platinum Charge also gives my supplementary cardholder an unlimited visit Priority Pass with one guest benefit.

In addition to Priority Pass lounges, the AMEX Platinum Charge also gives me access to the Centurion Lounges and Delta Sky Clubs, and because of that, there’s really no reason to keep the Citi Prestige for lounge access.

25,000 miles per year are useful, but I don’t need to buy miles at the moment

Paying the annual fee on the Citi Prestige gives 62,500 ThankYou points per year, or the equivalent of 25,000 miles. At a 2 cent valuation, this is worth approximately $500.

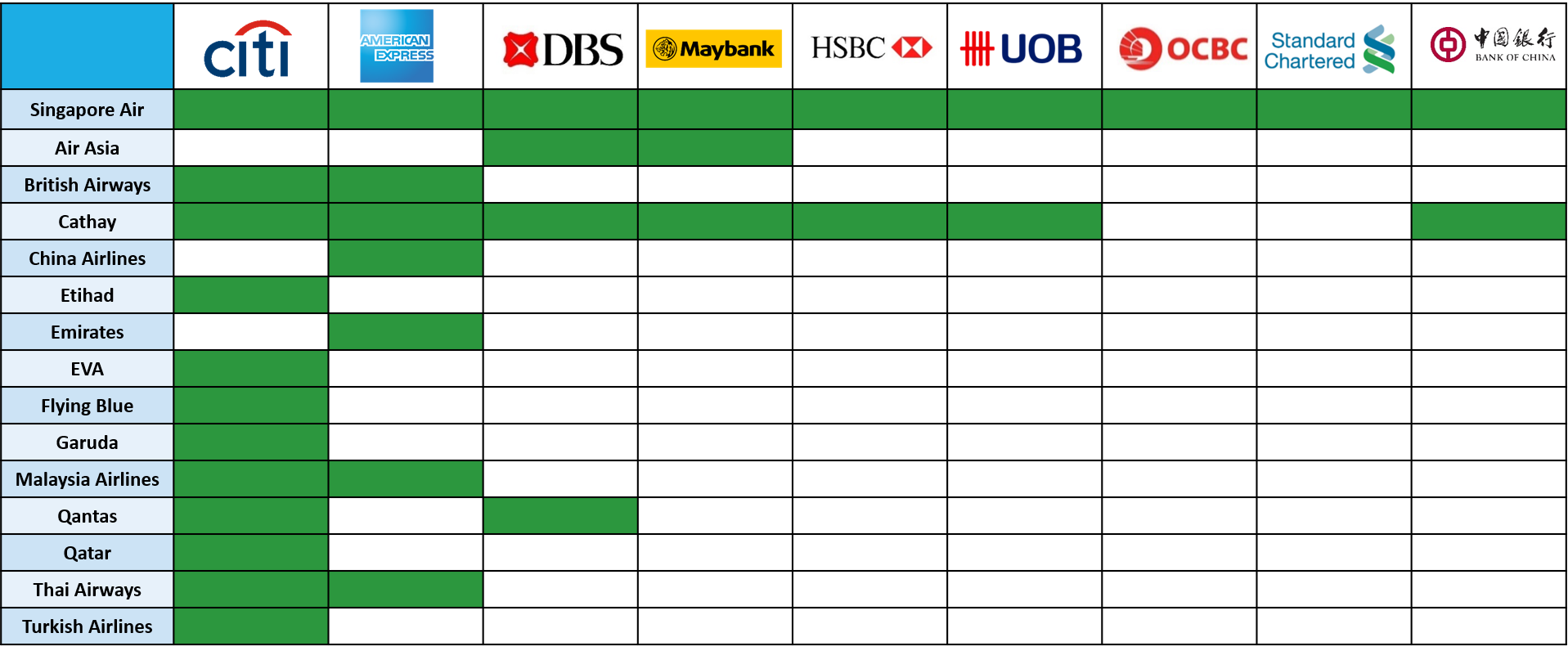

Some may argue that the recent KrisFlyer devaluations mean miles shouldn’t be valued at the traditional 2 cent mark anymore, but that’s forgetting Citi has the widest variety of transfer partners among all the banks in Singapore.

Not only do you get the usual KrisFlyer and Asia Miles, you also get access to programs like British Airways Avios, Turkish Airlines Miles & Smiles and Etihad Guest. That’s why I’m perfectly willing to maintain my valuation at 2 cents where Citi cards are concerned.

The thing is, I’m currently at a point where I don’t feel the need to pay out of pocket for miles. Now that I run my own business, I can generate a healthy flow of miles each month through business expenses. That’s why I’ve not jumped on any of the great miles buying opportunities that currently exist in the market.

|

Best opportunities to buy miles in Singapore

|

If I need to earn “exotic” points currencies, I’ll just use my Citi Rewards Visa or Citi Rewards Mastercard (especially now that it gives 10X on all online purchases).

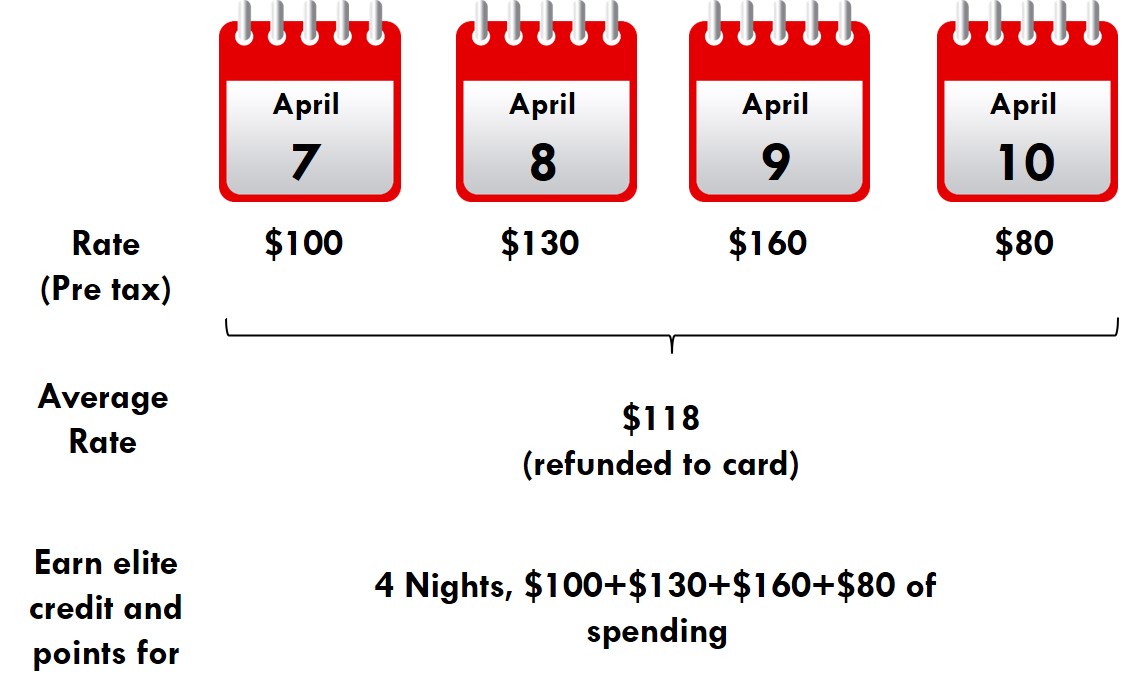

I never used the Fourth Night Free benefit

When I first got the Citi Prestige card, I reckoned that I’d easily earn back the annual fee by using the fourth night free benefit (4NF).

It sounds great on the surface: book any hotel in the world for a minimum of four consecutive nights, and get the average nightly pretax rate refunded. What’s more, the refund is on the back end, so you still earn elite night credits and points for four nights.

But in my 12 months of membership, I’ve used the 4NF benefit exactly 0 times.

It wasn’t meant to be like this. When I got the card, I figured I’d use it for business travel. Then I switched careers, which marked the end of traveling on someone else’s dime. For personal travel, I’m more inclined to use some of the hotel points I accumulated during the incredible AMEX-Hilton transfer bonus we saw last year, or my leftover Marriott stash from consulting days.

Come to think of it, if points burning opportunities are not available, I’m more likely to look for an AirBnB or try my luck with a Hotwire/Priceline reservation. I did consider using the fourth night free benefit at the Post Ranch Inn, but it was already painful to pay for two nights, and I just couldn’t bring myself to pay for a third, even if it meant a free night.

It’s also worth nothing that the 4NF benefit has been capped to two uses per year for Citi Prestige cardholders in the US, and although the Singapore benefit remains uncapped for now, you have to consider the possibility it may happen here.

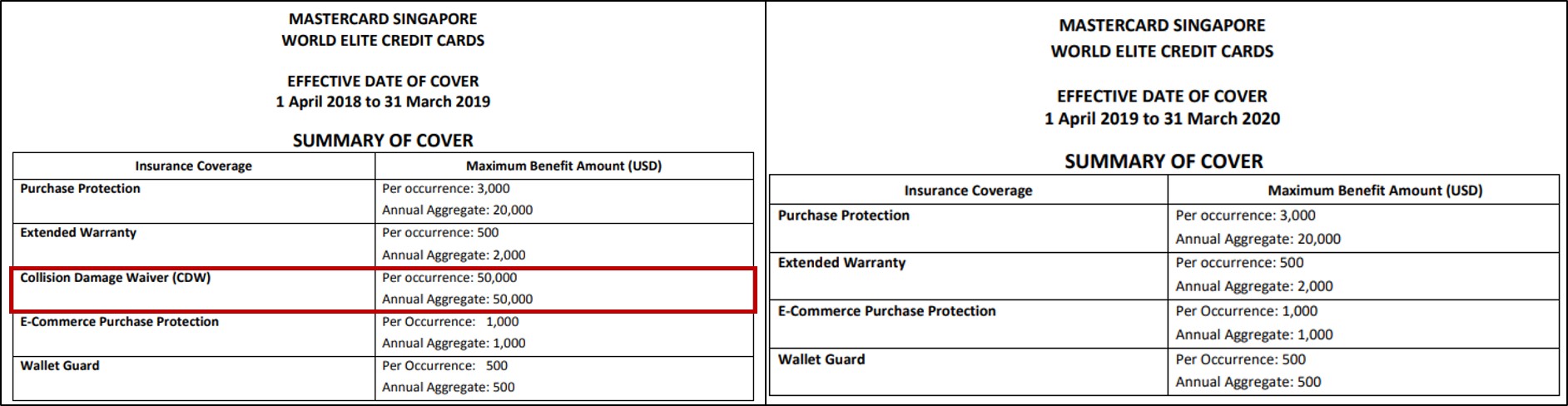

Complimentary CDW coverage is no longer offered

When I was reviewing the complimentary travel insurance policies offered by different credit cards, I realised that the Citi Prestige had one great benefit- Collision Damage Waiver (CDW).

For the uninitiated, CDW is basically rental car insurance. In the US, buying CDW can cost you US$15-25 additional per day, which can really add up on long trips (your regular travel insurance may cover rental car damage, but most likely up to $2 or 3K maximum).

The CDW coverage wasn’t a benefit from Citi Prestige per se. Rather, it was from Mastercard and available to all World Elite Mastercards. This contract gets renewed every year, and the latest version (effective 1 April 2019) does not have CDW anymore.

It’s not Citi’s fault this happened, obviously, but it is one less thing going for the card. If you’re looking to get additional rental car coverage, try third party providers– it’s much cheaper than buying from the car company itself.

Conclusion

In a big way, part of the reason why I’m not renewing the Citi Prestige has to do with my recent acquisition of an AMEX Platinum Charge, which benefits I feel either overlap with or supersede those of the Prestige.

Yes, I know it’s not an apples to apples comparison- the AMEX Platinum Charge’s annual fee is more than 3X that of the Prestige. It’s just that if you’ve decided to pay the $1,712 Platinum Charge fee, there’s very little reason to pay for the Citi Prestige too.

This isn’t a rage quit because of what happened with the limo benefit. I’m cheesed off with what happened there (and the way the news was broken- “enhancement“, really?), but in the cold light of day, even without a limo benefit the Citi Prestige remains a compelling offering at its price point.

My decision not to renew is born more of a realisation that I wasn’t getting my money’s worth. Don’t get me wrong- if you find the AMEX Platinum Charge’s fee too expensive, regularly use the 4NF benefit, love the 1 for 1 gourmet dining offers and use the golfing benefits, the Citi Prestige card can still work for you.

As for me, I only have the appetite for one high-end card, and that role is currently filled.

Nicely put.. no interest in citi prestige too

On a similar note, does it make any sense to retain the SCB VI card if (a) I’m not travelling overseas very often, and (b) also have the Amex Plat charge card?

After the first year? Probably wouldn’t keep it esp since the renewal miles are only 20k

Thanks! Yeah third year now. Used to travel a lot on work, so was great for that but don’t see the point any more.

Good summary. But if you utilise the 4NF benefit alone, the savings are substantial. I’ve used it multiple times this year and it remains the main reason I hold the card. If Citi nerfs it, goodbye CP (from a long time member of over 6 years)

oh, definitely. if i had done even one 4NF stay this year, it’d probably have made me think a lot harder about cancelling

Your reasons above (except for CDW which I wasn’t aware of) is why I have not gotten the Citi Prestige.

I think for the rest of us who don’t qualify for the amex, don’t run our own businesses, don’t have that many hotel points and air miles in the pocket, the prestige is still pretty useful

Payall, Pp, 4nf, renewal and repeat

correct. although i wouldn’t consider payall in my list of benefits when deciding whether or not to keep, because i can access that with the citi premiermiles AMEX at the same 1.3 mpd and not pay an annual fee

Hi Aaron, hoe do you deal with orphan points? Since citi cards don’t pool the points. Thanks

i sucked it up, paid $25 and cashed them out. bo bian.

I’m in the exact situation. Newbie question, which frequent flyer program would you transfer the points though, given KrisFlyer’s devaluation?

Did you also have to spend a bit more to round up your Citi points to the next 10k block? If you did, and you spent on something that could have gotten 4mpd on other cards, would the maths have worked out better by renewing?

With an annual fee of 535 there’d have to be some substantial spending involved to make it worthwhile to renew. I had some orphan points which I used on shopping vouchers. Again, not ideal but that’s what happens when points aren’t pooled

Same situation, can you please share where u transfered the points to? As in which programz

For your use case, yeah it seems silly to keep it. Like others have said the killer app for me is the fourth night benefit and (shh) I have made cold hard cash back from the card many times over the annual fee. That kind of upside doesn’t exist on Amex Plat imo.

Plus, Prestige is still a decent general spending card. Where’s your general spending going to now?

Neither the Prestige nor Amex plat charge were ever my general spending cards. I always saw them as “benefit” cards. General spending was always on Boc elite miles or uob prvi

Though you can make some of your Amex Plat CC money back if you’re conscientious about redeeming their offers.

Yeah another one I discovered the other day is using the Amex Plat CDP for Hertz bookings — saved me ~ $120 usd for an upcoming rental in US compared to using the MC World Elite CDP. I know it’s commonly understood that you don’t have to hold the card to use the CDP, but at least now having the card makes me feel better about it. Probably will charge it to BOC EM though lol.

Will payAll be counted towards 20K minimum spend?

I’m with you on this, Aaron… I used to call this “the best card to have and never use it”, for its benefits, and that was (for me) primarily the airport limo perk, which WAS especially useful as it COULD be used for inbound as well as outbound and aside from this benefit, was the occasionally use of Priority Pass when traveling inter-EU or regional trips on either Y or LCC and there’s a group of us so every +1 for Priority Pass is useful. Other than those… 4th Night Free.. I’ve booked this a few times only to cancel… Read more »

What would your strategy be for a general spending card now?

Prestige was never my general spending card. Always used prvi/boc

For me Prestige is still the best general spending card. Difference to PRVI is marginal (especially as I have 10+ years with citi due to Premiermiles) and Citi miles don’t expire and can also transfer to BA. Also no 5 SGD rounding and general UOB nonsense (unlike at UOB, Citi promotions are always clear and fair). Not sure why Aaron (and many readers) are so obsessed with the transfer fee, to me that’s marginal as I only transfer once or twice a year. Also never had a problem with reconciliation at Citi. And certainly I wouldn’t want to deal with… Read more »

If you frequently us Citi Payall, it may be worth your while to keep.

I had Citi Prestige for only a few years, this June will be the first time I am using the 4NF. I will try to use more to make it worth while, just that it’s not always easy for me to stay put at one place for 4 nights.

But why do you need Citi Prestige for PayAll? You could just as well use Citi PremierMiles Amex which annual fee can be waived

Citi Prestige, with relationship bonus = 1.4~ mpd..

Thanks for highlighting. Citi PremierMiles Amex will indeed serve the same if just looking at PayAll.

My situation is that I am still holding on a whole bunch of ThanksYou points from the 8MPD campaign last year…. so will probably keep until I clear the points into an airline program.

After that I can be free to change over to Premier Miles.

Hi Aaron, can you share your card strategy for business expenses?

Hi Aaron,

Perhaps sometime in future you can do a cost/benefits comparison of the Amex Platinum Charge vs the Citi Prestige. Is it more worthwhile to pay $1712 for the Amex card or $535 for the Citi card?

Thanks!

+1

i would, but the problem is that value is just so subjective that what works for me may not work for you. for eg, i didn’t get any value out of 4NF with Citi Prestige, but i know other people who have earned back thousands with it. your best bet is to look at the benefits of each and decide what works for you.

Very useful information. Appreciated. Car Washing Pune

Very useful informative article. I love this type article. Outstation CabsDelhi