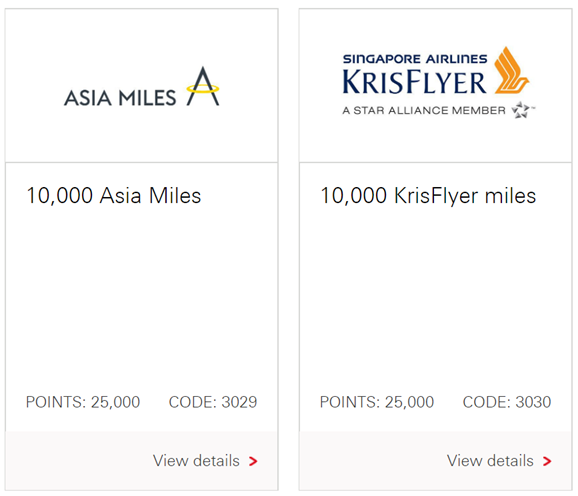

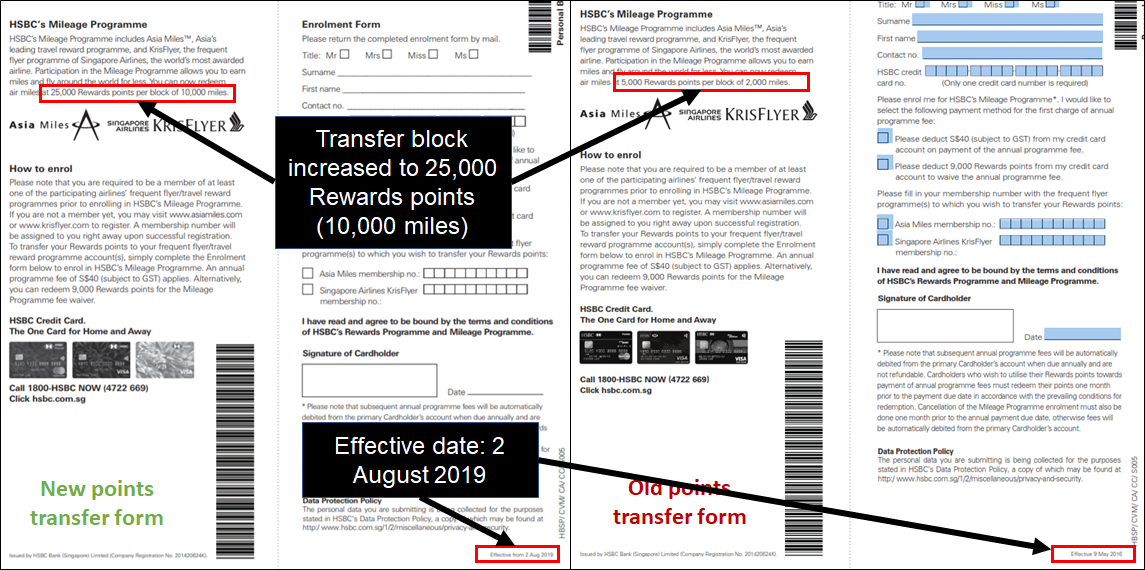

HSBC has quietly raised the minimum block of points needed for KrisFlyer/Asia Miles transfers from 5,000 points (2,000 miles) to 25,000 points (10,000 miles).

It seems this change took place on 2 August 2019, based on the updated points conversion form on the HSBC website.

HSBC’s conversion fee remains the same at S$42.80 per year. Unlike most other banks which charge per conversion, HSBC charges an annual fee for the “HSBC Mileage Program” which allows cardholders to make as many transfers as they want for one flat fee.

With a 2,000 miles block and unlimited conversions, HSBC cards were great for topping off KrisFlyer or Asia Miles accounts with small amounts. Now that the minimum block is five times as large, it’s somewhat less nimble.

Why do minimum conversion blocks matter?

To save on transfer costs, most cardholders will accumulate a large chunk of points before transferring to their frequent flyer program. It’s not uncommon to see transfers of 100,000 or 200,000 miles, well in excess of any minimum block. Why does it matter then?

It matters because it affects flexibility, both when redeeming miles and cancelling a card.

Suppose you want to redeem an award but you’re short of just 2,000 miles. You have points on your DBS Altitude card, but the minimum block is 5,000 DBS Points/ 10,000 miles. This means you’ll have to transfer more points than you need, and remember: DBS Altitude points do not expire, but KrisFlyer miles expire in 3 years. The larger transfer block means you’re unnecessarily “starting the clock” on 8,000 miles. Contrast that to an OCBC VOYAGE cardholder, who can transfer exactly 2,000 miles because the minimum block for him/her is 1 VOYAGE mile.

Or suppose you’ve decided to cancel a card. Assuming your points do not pool, you’ll need to transfer them out before cancelling, or else forfeit them. A smaller conversion block means less incremental spending to hit the next “cash out” point.

How does this compare to other banks?

Most banks have adopted minimum transfer blocks of 10,000 miles, although there are some noticeable exceptions. Maybank requires only 5,000, SCB requires 1,000, AMEX requires 250 and OCBC VOYAGE cardholders can convert as little as one mile (with no transfer fees, to boot).

Here are the minimum transfer blocks by bank, assuming you decided to transfer your points to KrisFlyer.

| Bank | Minimum Transfer | KrisFlyer Miles |

|

450 MR points (AMEX Platinum Charge: 400 points) |

250 miles |

| 30,000 BOC points | 10,000 miles | |

| 25,000 ThankYou Points /10,000 Citi Miles |

10,000 miles | |

| 5,000 DBS Points | 10,000 miles | |

25,000 HSBC Points |

||

|

12,500 TREATS1 | 5,000 miles |

| 25,000 OCBC$ /1 VOYAGE Mile |

10,000 miles/1 mile | |

| 2,500 360° Rewards Points (Visa Infinite & X Card2) 3,500 360° Rewards Points (other cards) |

1,000 miles | |

| 5,000 UNI$ | 10,000 miles |

1. 5,000 TREATS can be converted to 2,000 Asia Miles

2. SCB X Card minimum may range from 2,500 to 5,000 depending on partner

Conclusion

It’s never a good thing when banks increase minimum transfer blocks, but HSBC’s move is in line with where the rest of the market already is.

It’s worth noting that HSBC cardholders have the option of topping up additional Rewards points at S$8 per 1,000 Rewards points, but this does not apply to redemption of air miles. This is only available when you’re redeeming points for merchandise, like a coffee machine or drone.

(HT: Jonathan on the Telegram Group)

Hmm.DBS does offer the option of Quarterly conversion at a rate of 500 DBS points/ 1000 Krisflyer points

yup, but then you have no control over when your 3 year countdown starts. might as well keep my points where they don’t expire than continually push them to krisflyer where they do. uob has also started an auto conversion program, i believe.

Aaron, it may be worthwhile to do a post on topup options when one is short of a few miles for an award.

Good idea, will give it some thought