UOB became the first bank in Singapore to launch a Visa Infinite card in September 2003, with the debut of the (imaginatively-named) UOB Visa Infinite Card. Called “an exceedingly-exclusive card for the mega-rich”, this invite-only card had a minimum income requirement of S$350,000, targeting the top 0.1% in Singapore.

While it’s unclear whether a Visa Infinite still holds the same kind of prestige today, given how you get one just by pledging a minimum fixed deposit of S$30,000, what’s clear is that UOB really loves the product.

Most banks offer one, at most two Visa Infinite cards. UOB? They offer a total of five:

| Card | Description |

UOB Reserve Diamond Card UOB Reserve Diamond CardT&Cs |

|

UOB Reserve UOB ReserveT&Cs |

|

UOB Privilege Banking Card UOB Privilege Banking CardT&Cs |

|

UOB Visa Infinite UOB Visa InfiniteT&Cs |

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardT&Cs |

|

What’s the difference between the five options, and which (if any) should you be applying for?

| ⚠️ A note about nomenclature |

|

Because of UOB’s rather unimaginative naming convention, it’s easy to get confused when talking about the five different UOB Visa Infinite cards (it doesn’t help that one of them is literally named the UOB Visa Infinite Card!). So when I’m referring to the cards collectively, I’ll use the term UOBVI Cards instead. When I’m referring to individual products, I’ll use their full names as mentioned in the table above. |

Eligibility & annual fees

While a Visa Infinite card may not be the status symbol it used to, it’s safe to say that UOB doesn’t just give them to anyone. To get a card, you need to either have a privilege/private banking relationship with UOB, a high income, or both.

The UOB Reserve is strictly by invitation only, and if you don’t earn at least S$500K a year or have a UOB Privilege Reserve (min. AUM S$2M) relationship, you can forget about it. That’s not even mentioning the UOB Diamond Reserve, which is only available to those who spend a whopping S$1M on their card, or S$10M on the UOB Payment Facility (which would cost S$170,000 in fees).

More attainable is the UOB Privilege Banking Card, which requires a minimum AUM of S$350,000, or the UOB Visa Infinite Metal Card with a minimum income requirement of S$120,000. Hey, it’s all relative, right?

In terms of annual fees, the only card here with the possibility of a waiver is the UOB Privilege Banking Card, which waives its S$1,962 annual fee so long as you maintain a minimum AUM of S$350,000.

Miles with annual fee

All UOB VI Cards offer miles (in the form of UNI$) for paying the annual fee.

The cost per mile ranges from 2.61 to 3.89 cents, which is well above my accepted valuation, but we can’t think about this from a pure miles-buying angle. After all, these cards come with other benefits that help to justify the annual fee.

Earn rates

Given their hefty annual fees, do UOB VI Cards have earn rates to match?

Yes and no. The UOB Diamond Reserve & UOB Reserve (1.6/2.4 mpd) and UOB Visa Infinite Metal Card (1.4/2.4 mpd) are about as good as it gets for a general spending card. They won’t be racking up 4 mpd like the UOB Preferred Platinum Visa or UOB Lady’s Cards, but that’s a criticism you could levy against any general spending card, really.

The UOB Privilege Banking Card and UOB Visa Infinite are relatively underpowered, however. The local earn rate of 1.2 mpd is middling at best, and where overseas spending is concerned, you only earn 2 mpd on specific dining and shopping MCCs- and even then, capped at S$10,000 per calendar month.

|

|

Given that your entry-level general spending cards all offer at least 2 mpd on all kinds of overseas spending (uncapped no less), this is hard to swallow.

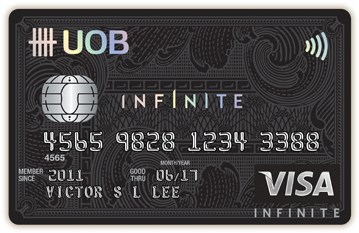

All UOB VI Cards, with the exception of the UOB Visa Infinite Metal Card, also earn 2 mpd on so-called luxury merchants including Audemars Piguet, Bottega Veneta, Burberry, Cartier, Dolce & Gabbana, Fendi, Hugo Boss, Louis Vuitton and many other chi chi places.

This is capped at S$10,000 per calendar month for the UOB Privilege Banking Card and UOB Visa Infinite (a shared cap with the 2 mpd for overseas shopping and dining), and S$20,000 per calendar month for the UOB Reserve and UOB Reserve Diamond Card.

Lounge access

Airport lounge access used to be a weak point for UOB VI Cards, but last year they shored up their offerings considerably.

Prior to 2023, only principal UOB Reserve & UOB Reserve Diamond Cardholders had an unlimited-visit Priority Pass, with no guest allowance. Today, principal cardholders get unlimited visits with one guest, while all supplementary cardholders get unlimited visits too.

Prior to 2023, UOB Visa Infinite Metal Cardholders had just four free lounge visits. Today, that’s been upgraded to unlimited visits, including one guest.

There is no lounge access for either the UOB Privilege Banking Card or UOB Visa Infinite. However, all UOB VI Cards enjoy access to the UOB Infinite Lounge in EmQuartier Bangkok, with free meals and drinks.

Airport transfers

| Card | Airport Transfer |

UOB Reserve Diamond Card UOB Reserve Diamond Card |

4x transfers per year |

UOB Reserve UOB Reserve |

|

UOB Privilege Banking Card UOB Privilege Banking Card |

N/A |

UOB Visa Infinite UOB Visa Infinite |

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Unfortunately, airport transfers are an area where the UOB VI Cards fall short.

Complimentary airport transfers are only offered to the UOB Reserve & UOB Reserve Diamond Card, and even then, they’re capped at just four per membership year.

These rides can be used for transfers to and from:

- Changi Airport

- Valencia Yachts reserved via UOB Reserve Concierge

- dinner reservations under the Reserve Dining programme

- cruises/staycations bookings made via the UOB Travel Concierge

All associated bookings and reservations must be charged to the UOB Reserve Card.

In fact, if it’s airport transfers you want, forget the UOB VI Cards. Get yourself a UOB PRVI Miles AMEX instead, which offers two rides per quarter with a minimum overseas spend of just S$1,000.

Miles purchase facility

| Card | Admin Fee (one-time payment) |

UOB Reserve Diamond Card UOB Reserve Diamond Card |

1.7% |

UOB Reserve UOB Reserve |

1.7% |

UOB Privilege Banking Card UOB Privilege Banking Card |

2% |

UOB Visa Infinite UOB Visa Infinite |

2% |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

2% |

The UOB Payment Facility allows UOB cardholders to buy as many miles as they wish, capped only by their credit limit.

How it works is that cardholders fill out an online form and specify how much they’d like to charge to the facility, e.g. S$5,000. UOB will then:

- Deposit S$5,000 into their designated bank account

- Charge S$5,000 plus an admin fee to their card

- Award UNI$ at a rate of UNI$2.5 per S$5 (1 mpd), or 2,500 UNI$ in total (5,000 miles; the payment facility fee doesn’t earn miles)

The cost per mile ranges from 1.9 to 2.2 cents, but UOB has a near-perpetual promotion that reduces the price to 1.7 to 2 cents.

The main advantage of the UOB Payment Facility is that it’s really no questions asked. But if you have legitimate bills to pay (with supporting documentation) like rent, insurance premiums, MCST fees, income tax etc., you could buy miles for much cheaper by using your UOB VI Card with a service like CardUp.

Other unique perks

| Card | Special Perks |

UOB Reserve Diamond Card UOB Reserve Diamond Card |

|

UOB Reserve UOB Reserve |

|

UOB Privilege Banking Card UOB Privilege Banking Card |

|

UOB Visa Infinite UOB Visa Infinite |

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

UOB Reserve Diamond cardholders enjoy some additional benefits over run-of-the-mill UOB Reserve cardholders:

- Complimentary 2nd night hotel stay: usable once a quarter, capped at S$400 per night

- Complimentary meal for two people: UOB chooses a restaurant each quarter and the cardholder plus one guest dine for free

- Complimentary birthday treat: the cardholder receives a gift for his/her birthday

- Mandala Club invitation, with joining fee and first year’s subscription paid for

These perks are enjoyed in the first year of Diamond card membership, but in subsequent years require a further S$1M spending (!) to enjoy.

The complimentary 2nd night hotel stay sounds attractive at first, until you realise that the value of the free night is capped at S$400 and you can only use the benefit once a quarter. The Citi ULTIMA has a similar benefit, but allows up to two complimentary nights per outward journey. This means you could get many more free nights out of the ULTIMA (and not have to spend S$1M for the privilege of doing so).

UOB Reserve Cardholders enjoy two complimentary meet & assist services per year, reserved tables at Michelin-star restaurants (but only on Wednesday), four free golf games, and 100,000 bonus miles with a minimum spend of S$250,000 in a membership year. I don’t find any of these to be life-changing perks, quite frankly, which explains my overall indifference towards the UOB Reserve in general.

UOB Visa Infinite Metal Cardholders used to get complimentary Singtel ReadyRoam packages and a Gourmet Collection membership, but those have long ended and the only additional perks are 15,000 bonus miles with a minimum spend of S$100,000 in a membership year.

I’m not aware of any other noteworthy benefits for the UOB Visa Infinite or UOB Privilege Banking Card, other than auto/home/travel and medical assistance for the latter.

Conclusion

UOB VI Cards have high annual fees, but relatively modest benefits, and therefore I find them very hard to recommend.

If I wanted a $120K card, I’d look at something like the Citi Prestige, which offers an easier route to fee recovery via its 4th Night Free benefit, or maybe even the AMEX Platinum Charge, which has a hefty four-digit annual fee, but offers so much value in the first year you’ll almost certainly earn it back.

And if I ever qualified for a $500K card, I’d go for the Citi ULTIMA in a heartbeat. The annual fee is just under 10% more, but you get so much more out of it- the 2nd Night Free benefit puts the UOB Reserve Diamond Card’s perk to shame!

Come to think of it, the UOB cards I like the most are the entry-level ones; I’d recommend the UOB Preferred Platinum Visa, the UOB Lady’s Card and the UOB Visa Signature to pretty much anyone. Once you move up the tiers, however, you’re better off looking elsewhere.

These cards just feed your ego and make you feel good about yourself when you open your wallet.

Some shallow minded people will think people actually look inside your bi-fold to see what cards you have. Yes, perhaps if you’re out with like minded people.

Other than that, why would you ever use a lower mile reward card at each occasion.

It’s like bringing your own fancy bowl to buy economy rice. why bother?

Some might argue that’s all part of the appeal 😉 it would explain why so many cards have gone metal recently

These metal cards are magic. They make your wallet lighter while making it heavier.

Haha! This I like!

you win the internet. +1 milecoin for you.

I have the classic UOB Visa Infinite card but don’t pay the annual fee due to the AUM I have with the bank. I actually don’t use the card and only hold it because transfer of UNI$ to miles (accrued from my spending with other UOB cards) is free if done through the VI card.

yeah, that’s pretty clever since they waive the AF anyway. any unpublished benefits you’ve been getting?

How do you do this?

Uob points pool- if you’ve one card that doesn’t impose fees for xfer, all your points can be xfer for free

These cards do make the Amex Plat Charge a bargain.

Can you use the UOB PRVI Miles card to get free transfer of UNI$ to miles?

very lacklustre cards from UOB, Amex plat charge offers better value

UOB Visa Infinite Metal Card also has the Infinite Dining programme, similar to Reserve Dining programme.

https://infinite-dining.com/dining-privileges/