Here’s The MileLion’s review of the HSBC Visa Infinite, which with an annual fee of up to $662.15, is the most expensive card in the entire $120K segment.

For that price you’d expect it to perform accordingly, but it’s actually been a bumpy past year for this card, which lost its extra 1% cashback from the Everyday Global Account (EGA), its dining tie-ups with Goodwood Park Hotel, Fairmont Singapore and Marriott Tang Plaza, as well as its step-up earn rates– leaving it with a dismal earn rate of just 1/2 mpd on local/overseas spend.

At the same time, however, HSBC points have become so much more valuable. They now pool, there’s 21 airline and hotel partners to choose from, points transfer instantly in blocks as small as 2 miles, and conversion fees are waived till 31 January 2025.

So where does that leave us? Is the HSBC Visa Infinite worth its hefty price tag?

HSBC Visa Infinite HSBC Visa Infinite |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The HSBC Visa Infinite offers excellent travel benefits and versatile points, but has absolutely abject earning potential. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: HSBC Visa Infinite

Let’s start this review by looking at the key features of the HSBC Visa Infinite.

|

|||

| Apply Here | |||

| Income Req. | S$120,000 p.a. | Points Validity | 37 months |

| Annual Fee |

S$497.12 (HSBC Premier) S$662.15 (Regular) |

Min. Transfer |

25,000 points (10,000 miles)^ |

| Welcome Gift | 35,000 | Transfer Partners |

21 |

| FCY Fee | 3.25% | Transfer Fee | Free till 31 Jan 25 |

| Local Earn | 1 mpd | Points Pool? | Yes |

| FCY Earn | 2 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

| ^After the first block of 10,000 miles, additional transfers are in blocks of 2 miles |

|||

The HSBC Visa Infinite is part of the so-called $120K segment, a group of premium credit cards that offer upgraded travel and lifestyle benefits. However, unlike most $120K cards it has yet to switch to metal card stock (though it’s made from 85.5% recycled plastic, for those of you who care about that sort of greenwashing).

If you have the kind of fragile masculinity that can only be placated by the resounding thud of an embossed piece of metal, you might want to consider other alternatives like the Citi Prestige or OCBC VOYAGE Card.

How much must I earn to qualify for a HSBC Visa Infinite?

When the HSBC Visa Infinite first launched in October 2011 at a glitzy party hosted at Avalon, membership was strictly by-invitation only with a minimum income requirement of S$250,000.

Over the years, however, the requirements became much less strict and today, you “only” need a minimum income of S$120,000.

If you don’t meet the income requirement, HSBC does offer a secured version of this card, with a minimum fixed deposit of S$30,000.

How much is the HSBC Visa Infinite’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$662.15 (S$497.12 for HSBC Premier) |

Free |

| Subsequent | S$656.08 (S$497.12 for HSBC Premier) |

Free |

The HSBC Visa Infinite has an annual fee of S$662.15, reduced to S$497.12 for HSBC Premier customers (minimum AUM: S$200,000). The annual fee is strictly non-waivable, regardless of how much you spend per year.

Up to five supplementary cards are free for life, which is great because they include perks like unlimited lounge access (see below for more details).

Cardholders receive a welcome gift of 35,000 miles for paying the first year’s annual fee, which works out to:

- Regular customer: 1.89 cents per mile

- HSBC Premier customer: 1.42 cents per mile

While this is a decent price (more for HSBC Premier customers than regular ones), it’s only available in the first year. HSBC does not officially award any miles for paying subsequent years’ annual fees, but if you call up to appeal you might get something.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1 mpd | 2 mpd | N/A |

SGD/FCY Spend

HSBC Visa Infinite cardholders earn:

- 2.5 HSBC Rewards Points per S$1 spent locally (1 mpd)

- 5 HSBC Rewards Points per S$1 spent overseas (2 mpd)

In the past, a “step-up earn rate” of 1.25/2.25 mpd on local/overseas spend was offered to cardholders who spent at least S$50,000 in the previous membership year, but this has since been phased out.

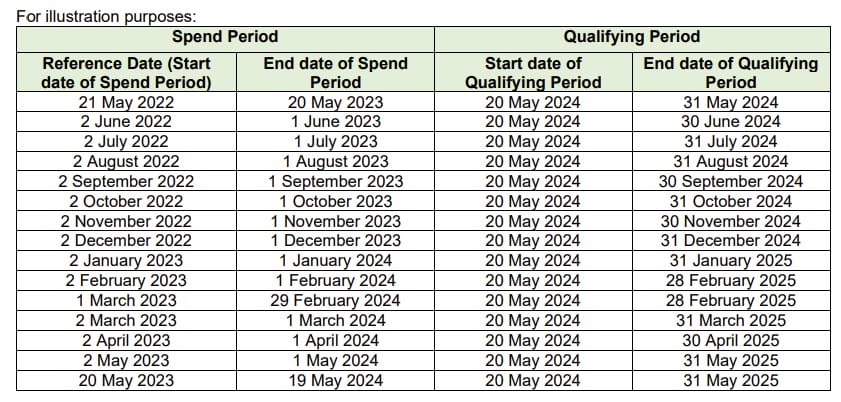

There is a transitionary provision in place for HSBC Visa Infinite Cardholders who meet the following conditions:

- card was approved before 20 May 2023, and

- spent at least S$50,000 in qualifying transactions in their previous membership year

Such cardholders will be eligible for the step-up earn rate till the last day of the month in which their next card anniversary falls. HSBC has provided the following illustration:

This is rather unfair to HSBC Visa Infinite Cardholders approved after 20 May 2023 but before 20 April 2024, when the nerfing of the step-up rate was announced. If you were approved in June 2023, for example, and spent 11 months dutifully clocking transactions towards the S$50,000 mark in anticipation of enjoying the step-up earn rate from your second membership year onwards, I imagine you’d be very angry about the changes.

Given that HSBC only announced the termination of the step-up earn rate in April 2024, a much fairer way of implementing this would be to remove the feature for cardholders approved from May 2024 onwards, since this group would have been fully aware of the situation going in.

In any case, the revised earn rates of 1/2 mpd are woefully underpowered compared to the competition.

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd# | 3 mpd# |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2 mpd^ |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank #With minimum S$2K spend per statement month. Otherwise 1 mpd for both |

||

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 2 mpd earn rate and a 3.25% FCY fee, using your HSBC Visa Infinite Card overseas represents buying miles at 1.63 cents apiece.

When are HSBC Points credited?

HSBC Points are credited when your transaction posts, which generally takes 1-3 working days.

How are HSBC Points calculated?

Here’s how you can work out the HSBC Points earned on your HSBC Visa Infinite.

| Local Spend | Multiply spend by 2.5, round to the nearest whole number |

| FCY Spend |

Multiply spend by 2.5, round to the nearest whole number, then multiply by 2 |

The minimum spend required to earn points is S$0.20 (local & FCY).

Unlike some cards which award points for every S$5 spent (such as the OCBC VOYAGE and UOB Visa Infinite Metal Card), the HSBC Visa Infinite has much smaller earning blocks, allowing it to outperform ostensibly higher-earning cards for smaller transactions.

If you’re an Excel geek, here’s the formulas you need to calculate points:

Regular rate

| Local Spend | =ROUND((X*2.5),0) |

| FCY Spend |

=ROUND((X*2.5),0)*2 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HSBC Points?

A full list of transactions that do not earn HSBC Points can be found at point 3 of the HSBC Visa Infinite’s T&Cs, as well as point 4 of the HSBC Rewards T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay top-ups

- Hospitals

- Insurance

- Professional services providers (e.g. Google & Facebook Ads, AWS)

- Real Estate Agents & Managers

- Utilities

Do note that HSBC excludes CardUp, ipaymy and RentHero transactions from earning points. This just makes its already-mediocre earn rates an even bigger problem, since you couldn’t even purchase additional miles through such platforms if you were willing to pay an annual fee.

What do I need to know about HSBC Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 37 months | No | Waived till 31 Jan 25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles (2 miles after) |

21 | Instant* |

| *For all partners except Club Vistara, Hainan and JAL | ||

Expiry

HSBC Points expire at the end of 37 months following the month they were earned.

The table below illustrates how the validity period works.

| Points Earned Period | Expiry Date |

| 1-31 August 2023 | 30 September 2026 |

| 1-30 September 2023 | 31 October 2026 |

| 1-31 October 2023 | 30 November 2026 |

Pooling

Back in May 2024, HSBC added points pooling to its cards, bringing them all onto the same platform.

Therefore, if you have 10,000 HSBC Points on the HSBC Visa Infinite, and 15,000 HSBC Points on the HSBC Revolution Card, you can redeem a combined balance of 25,000 HSBC Points.

Do note that even though HSBC Points pool, you will lose any unutilised points if you cancel a card. Be sure to cash them out before cancelling.

Transfer Partners & Fees

HSBC offers 21 airline and hotel partners, by far the most of any bank in Singapore.

| ✈️ HSBC Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

The catch is that not all partners share the same transfer ratios. With airlines, for instance, the ratio ranges from 25,000-50,000 points : 10,000 miles.

This is important, because the HSBC Visa Infinite Card’s advertised earn rates of 1/2 mpd only apply if you choose a partner with a 25,000 points : 10,000 miles ratio. The earn rates drop as the transfer ratio worsens, going as low as 0.5/1 mpd at the other end of the spectrum.

| Transfer Ratio (Points : Miles) |

HSBC VI (Local)* |

HSBC VI (FCY)^ |

| 25,000 : 10,000 | 1 mpd | 2 mpd |

| 30,000 : 10,000 | 0.83 mpd | 1.67 mpd |

| 35,000 : 10,000 | 0.71 mpd | 1.43 mpd |

| 40,000 : 10,000 | 0.63 mpd | 1.25 mpd |

| 50,000 : 10,000 | 0.5 mpd | 1 mpd |

| *2.5 points per S$1 on local spend ^5 points per S$1 on FCY spend |

||

Cardholders will need to convert a minimum of 10,000 miles. However, the subsequent conversion block drops to just 2 miles after that, which means you could convert 10,002 miles, or 200,006 miles for instance. That’s great, because it helps avoid the problem of orphan miles. So long as you keep at least 10,000 miles in your account, you can cash out your entire balance with almost no miles left behind.

All conversion fees are waived till 31 January 2025.

Other card perks

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

All principal HSBC cardholders receive a complimentary copy of The Entertainer, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

As a premium HSBC card, Visa Infinite cardholders enjoy access to a wider range of merchants, as well as three offers per merchant (versus 2 for standard cards).

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary airport limo & expedited immigration clearance

HSBC Visa Infinite cardholders receive:

- HSBC Premier: 4x complimentary airport limo transfers and expedited immigration clearances per calendar year

- Non-HSBC Premier: 2x complimentary airport limo transfers and expedited immigration clearances per calendar year

One additional ride and expedited clearance can be unlocked by spending S$2,000 per calendar month, capped at 24 per calendar year (including the complimentary entitlements).

This is one of the lowest spending requirements on the market, and a genuine competitive advantage for the HSBC Visa Infinite. With the cost of airport limo services rising, one hopes they can continue to maintain the current minimum spends.

| 💳 Airport Limo Benefits (income req.: S$120K) |

||

| Card | Qualifying Spend | Cap |

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month for 1 ride* |

24 per year |

Maybank Visa Infinite Maybank Visa Infinite |

S$3K per month for 1 ride | 8 per year |

Citi Prestige Citi Prestige |

S$12K per quarter for 2 rides | 2 per quarter |

OCBC VOYAGE OCBC VOYAGE |

S$12K per quarter for 2 rides | 2 per quarter |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A |

DBS Vantage DBS Vantage |

N/A | N/A |

SCB Visa Infinite SCB Visa Infinite |

N/A | N/A |

UOB VI Metal Card UOB VI Metal Card |

N/A | N/A |

| *First 2 (Regular customer) or 4 (HSBC Premier) per membership year are free | ||

Earned limo rides can be utilised from the start of the following month after which the minimum spend criteria was met, up till the end of the calendar year. This gives them a validity of up to 12 months, though some will be valid for as little as one month.

All limo bookings must be made at least 24 hours ahead of the pickup time, and a maximum of three passengers (including the cardholder) can share one vehicle. A full list of FAQs can be found here.

The benefits of expedited immigration clearance may be less apparent in a place like Singapore where everything runs like clockwork, but seasoned travellers will know of airports where it can be the difference between a five minute and multi-hour wait.

These fast track services are available at more than 30 airports across the Asia Pacific region, including Bali, Colombo, Dubai, Hanoi, Ho Chi Minh City, Kuala Lumpur and Seoul.

Unlimited complimentary lounge visits

HSBC Visa Infinite cardholders enjoy unlimited airport lounge access to more than 1,100 airport lounges worldwide via LoungeKey. LoungeKey and Priority Pass have the same owner (Collinson International), and for all intents and purposes have identical participating lounges and benefits.

No separate Lounge Key card is required; cardholders need only present their HSBC Visa Infinite Credit Card and boarding pass and mention LoungeKey at reception.

A guest fee of US$35 applies, but the good news is that up to five supplementary cardholders can enjoy the same benefit, free of charge. Therefore, an entire family could access the lounge for free, assuming the principal cardholder issues supplementary cards to his/her spouse and children.

This means the HSBC Visa Infinite has arguably the best lounge benefit amongst the $120K segment, assuming you don’t need a guest allowance.

Complimentary travel insurance

| Accidental Death | S$2,750,000 |

| Medical Expenses | S$100,000 |

| Others | Trip Cancellation: S$10,000 Travel Delays: S$1,000 Rental Car Excess: S$2,000 |

| Policy Wording | |

HSBC Visa Infinite cardholders (and their immediate family) will enjoy complimentary travel insurance when they charge their airfares to the card. Travel insurance is also activated when a cardholder redeems airline miles, and charges the taxes and fees component to his/her HSBC Visa Infinite card.

The travel insurance policy features coverage of up to:

- S$2,750,000 for accidental death, or total and permanent disablement

- S$100,000 for overseas medical expenses

- S$10,000 for post medical expenses in Singapore

- S$5,000 for overseas hospitalisation allowance

- S$10,000 for trip cancellation

- S$1,000 for travel delays

- S$2,000 for rental car excess

- S$100,000 for personal liability

In terms of coverage, it’s one of the most comprehensive policies I’ve seen offered by a credit card. Complimentary insurance policies by other cards may not cover travel inconvenience (e.g. flight and luggage delay, luggage damage, missed flight connections), rental car excess, or personal liability, but HSBC’s policy includes all of this and more.

Other Visa Infinite benefits

HSBC Visa Infinite Cardholders will enjoy the following benefits provided by Visa Infinite:

- Avis President’s Club status

- 50% off weekday golf at 50 participating golf clubs across Southeast Asia

- 50% off weekday golf at Sentosa Golf Club

- Visa Luxury Hotel Collection

For more information on how these perks work, refer to the post below.

Summary Review: HSBC Visa Infinite

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

The HSBC Visa Infinite is a frustrating card.

On the one hand, HSBC points are amazing. There’s 21 transfer partners, free and instant conversions, and conversion blocks as small as two miles.

On the other, HSBC points are simply impossible to earn at any decent rate, given the HSBC Visa Infinite’s paltry earn rates, its exclusion of CardUp and ipaymy, the discontinuation of its tax payment facility and absence of bonus categories. The points are great, but they’re so hard to earn- it’s quite a tease, as I’ve discussed in this post.

On the one hand, the HSBC Visa Infinite has some serious travel credentials, such as unlimited lounge access for the main cardholder and up to five supplementary cardholders, a relatively low spending requirement for limo rides (and 2-4 free rides each year), and complimentary travel insurance that’s comprehensive enough to be your main source of coverage.

On the other, there’s no longer an extra 1% cashback with the HSBC EGA, the 50% off dining offers are gone, and with the perpetual nerfs to the HSBC Revolution, there isn’t much of a card strategy to be built around HSBC cards.

So it’s very clear to me that if you do get the HSBC Visa Infinite, it should be in the capacity of a “benefits card”, rather than a “spending card”. In other words, you shouldn’t be charging a lot of transactions to it, unless perhaps you want to earn the airport limo rides, or trigger the admittedly-solid travel insurance coverage.

I’d personally be more inclined to get this card if I were a HSBC Premier customer (to enjoy lower annual fees and four free limo rides), though I’d have to think long and hard about ditching it in the second year when there’s no renewal miles.

So that’s my review of the HSBC Visa Infinite. What do you think?

DBS Vantage

DBS Vantage

I’m a little lost, how is a $5 local spend not 5 miles if its 1mpd?

You earn 2.5 pts per $1. $5 is 12.5 pts. 12.5 pts is rounded down to 12pts, which is 4.8 miles

Got it thanks! Slightly cheeky as on their website they advertised as ‘SGD1 = 1 air mile’…

4 guests can use the limo service I think. (Cardholder + 3 guests)

9. Can Supplementary Cardholders use these services?

These complimentary travel services are exclusive to for Primary Cardholders up to 3

accompanying guests (3 accompanying guests for Limousine and 1 accompanying guest for

expedited immigration service) for each utilisation.

FAQs seem to be out of sync with T&Cs, which say this:

Two accompanying guests of the primary Cardholder can use the Airport Limousine Service with the primary Cardholder provided that the parties

take the the same limousine and are on the same flight

I’ve often used it for 4 people and asked for a maxi cab and they’ve been fine

My wife renewed her card recently, and upon request, they gave her 80,000 points (32,000 miles), which is fairly generous. If you have a reason to spend the annual $50,000 (e.g. if you have to pay a major hospital bill), it is a good card to keep for the tax payment benefit, which can be used simultaneously with Citibank Payall.

Worth mentioning the horrendous application timeline – it’s been over a month and I’ve followed up twice on the status, and was told even if my application was approved tomorrow it would take another 5-7 days to actually receive the card. Was looking forward to the benefits but this does not give me confidence in their customer experience, so I cancelled my application.

I finally got my card after 2+ months of waiting and being asked to submit various documents at least twice, I was close to cancelling but soldiered on….we’ll see in over the next year if its worth it (travel insurance and lounge access is the main win for me).

I am speculating HSBC is pondering who they should give the cards to. They maybe looking for new customer acquisitions and your income level. Hope it turned out well since you got the card. Some cases, they turned down the applications without any reasons.

I think it is rather up to the dreadful HSBC customer service mindset. I am a years long premier customer exceeding the income threshold by far and had to wait 2 months for a HSBC premier credit card, which comes kind of for free with the premier account. If you want to bank with them, be a patient client…

To be fair I use this as my general spending card- with the multiple spend and earn promotions through the year (I’ve had a night at capitol k hotel, $200 of pan pacific vouchers, $80 of Goodwood and a suitcase this past 12 months alone) – it pays for the annual fee and the income tax payment scheme is pretty good. I think the overseas mileage works quite well if you just have a couple of months of spending abroad at higher levels than worrying about caps and min spends etc. I usually get 25-30k miles for renewing and with… Read more »

It was good in the days when you got unlimited airport transfers, access to JetQuay at Changi, and a lady on a golf-buggy waiting to wisk you through immigration in Bangkok. Ah, those were the days! But with #1 above reduced significantly, and #2 and #3 gone, it is no longer worth it. I cancelled this card a few years back already.

i would rank this card as leave it… completely unecessary. i think aaron is over-valuing lounge visits. no one is signing up for a credit card just for limo rides either. with mediocre restaurants, poor earn rates, imho this card is a complete miss/leave it… no situation would you pick this card.

Agreed especially seeing how lounge visits can be had from free miles cards anyway. Can’t see how I’m going to recover anywhere near the AF they’re asking.

If I were getting a 120k card this is probably the last one I’d pick.

From what I hear, those with large families love this card. Get 5x supp cards and bring the whole brood in for free, as many times as you want. Not sure how many cards can offer that.

firstly i dont even care much about lounges and I regard them as having zero value for credit card miles chaser, but that’s just me. I would never pick a credit card to pay AF based on limos/lounges. But at a 120k segment the card holder I would assume that person be earning 10k / month approx. for such travellers i dont know if they value going to sats/plaza premium lounges (which is always packed like some wet market) to eat chicken nuggets, fried rice or rather most 120k segment card holders would eat outside of the lounges in a… Read more »

I didn’t think it was possible to apply for supp cards for children under 18 anyway? Or is there a way around that?

Unless by “large families” you refer to childless couples and their parents/grand-parents?

that’s my question too. how to get children into lounge for free if they can’t have supp card?

I use this card (amongst others), and for me this card has been very good and pays for itself handsomely

– unlimited lounge access for 5 in the family

– free limo transfers … use at least 10 times per year

– 1.25 mpd spend + 1% cash back (up to $50k charges per month)

– use miles to pay for AF which is then “rewarded” back, so its basically free

– fast track … use it once in a while

other perks negligible and admittedly, it used to better before

I’ve kept this card for the airport transfers mainly- as Aaron said the costs have gone up a lot and getting 2 Alphards a quarter for trips more than covers the cost. They do random spend and earn promos as well- earnt $200 cash and $100 grab vouchers recently- and the 1% cash back somewhat offsets the poor earn rate. But I am surprised they have not improved the earn rate to at least match the Travelone card- surely this will be cannibalising the VI market share?

When you say 5 in the family? Are children under 18 included in that? And if yes, how does one apply for a supp card for a child?

Good evening to All,

children under 18 cannot be supplementary card holder. Confirmed with HSBC customer service.

Hi Aaron,

I am quite curious about the travel delay policy covered by different credit card travel insurance.

For example, I would like to know how long it takes to trigger compensation? Also if I need to purchase air tickets using the card to trigger the delay compensation.

Could you please provide a comparison review of it?

Thanks.

Not sure when it changed, but as far as the free insurance coverage goes – both the FAQ https://www.hsbc.com.sg/content/dam/hsbc/sg/documents/credit-cards/visa-infinite/frequently-asked-questions.pdf and the policy wording explicitly exclude COVID19 and pandemics. Given that the world has moved forward to treating COVID19 as endemic, this probably isn’t a big deal unless you’re too sick to get on the plane, I guess. Still worth being accurate though. Love your blog and trying to help keep it current by fact checking.

I signed up the card and pay the fee so me and my family can utilise the benefits for travels. Became a necessity once kids become adults and don’t always travel with parents.

Hardly ever charge anything to this card.

Sadly, Revo is no longer what it used to be for earning points.

Hi Aaron,

Just saw FAQ link reveals the following, if true, u may wish to update your article from “including the cardholder” to “excluding the cardholder”:

9. Can Supplementary Cardholders use these services?

These complimentary travel services are exclusive to Primary Cardholders with up to 3 accompanying

guests (3 accompanying guests for Limousine and 1 accompanying guest for expedited immigration service)

for each utilisation.

This card stinks. I am planning to cancel it since they nerfed it, but mostly because CS sucks. They charge so much annual fees, but the hsbc visa infinite helpline puts you on hold forever, and for a travel card doesn’t like people to travel. I get blocked multiple times a year and have to be on hold for upwarda of 30mins each time to unblock. This is very problematic when they block you abroad. Very hasslesome card I would not even expect of a free no fee card.

Just an update, one month later hsbc visa infinite card blocked again last week. I’m just gonna keep checking in here whenever card gets blocked so people can see what a hassle this travel card is because their risk team is unable to take on any risk for a card that costs so much.

As of April, it has temporarily stopped offering the card: https://www.hsbc.com.sg/credit-cards/products/visa-infinite/

looks like you can’t even access the lounge now with HSBC infinite card and quoting LoungeKey. Can Milelion review this? Thanks!