In July 2018, UOB relaunched the UOB Visa Infinite card as the UOB Visa Infinite Metal Card (the similarity in nomenclature simply adding to the confusion surrounding their five Visa Infinite offerings).

Frankly speaking, I’m none too impressed by the product. It has an income requirement of S$150,000 and a non-waivable annual fee of S$642, but only comes with 25,000 welcome miles and four Dragon Pass lounge visits. There’s no limo benefit or private club access, and the Gourmet Collection membership provided is a stripped down version without the vouchers. For that annual fee, you can do much better with other cards at the S$120-150K income range.

In any case, from 1 October 2019 until 30 November 2019, UOB is offering a sign up bonus of 10,000 miles on the UOB Visa Infinite Metal Card. The spending requirement depends on whether you’re a new-to-bank or an existing customer.

The T&C of the promotion can be found here.

New-to-bank customers: Spend S$2K, Get 10K miles

New-to-bank customers who spend S$2,000 within 1 month of card approval will receive a bonus of 10,000 miles (in the form of UNI$5,000). This is capped at the first 500 successful applicants.

| New-to-bank customers are defined as those who do not currently hold any UOB credit cards, and have not done so in the past 6 months. |

The 5,000 UNI$ will be credited to your account by 29 Feb 2020. If you close your card within 9 months of approval, UOB is entitled to claw back the UNI$. In any case, it wouldn’t make sense to cancel the card before the 9 month mark; you’ve already paid for the full year, might as well see it through.

Existing customers: Spend S$6K, Get 10K miles

Existing customers who spend S$6,000 within 1 month of card approval will receive a bonus of 10,000 miles (in the form of UNI$5,000). This is capped at the first 1,000 successful applicants.

The 5,000 UNI$ will be credited to your account by 29 Feb 2020. Unlike the case for new-to-bank customers, the T&C do not state a minimum holding period for existing customers.

Spending on supplementary cards does not count

What is odd about this sign up bonus is that spending on a supplementary card does not accrue towards the principal card. UOB states this clearly at Point 6 of the NTB offer, and Point 3 of the Existing Customer offer:

For the avoidance of doubt, the eligible transaction as detailed under Paragraph 1 and 2 incurred on a supplementary Card will NOT accrue to the respective principal Card.

This is a departure from usual practice, where supplementary cardholder’s spending is imputed to be that of the principal. For example, if a sign up bonus requires me to hit S$5,000, I can do this by spending S$3,000 on my principal card and having my supplementary cardholder spend S$2,000.

I don’t understand why UOB would do this, but it’s in line with how they’re running their other sign up offers at the moment. UOB has a separate S$150 cash gift offer for new-to-bank customers who spend S$1,500 in the first 30 days of approval, and at point 5 in their T&Cs they again exclude transactions made on supplementary cards:

| 5. For the purposes of this Promotion, “Eligible Transactions” refer to retail transactions made locally or overseas, and shall exclude: (i) cash advances, late payment, personal loan, balance and/or funds transfer, SmartPay, payments at government agencies, utilities bill payments, fees ,chargebacks, interests, reversals, interest charges and any finance changes imposed by UOB; (ii) transactions relating to top-ups of any pre-paid card and brokerage / securities; (iii) any transaction that is subsequently cancelled, voided or reversed for any reason; (iv) transactions made on supplementary cards… |

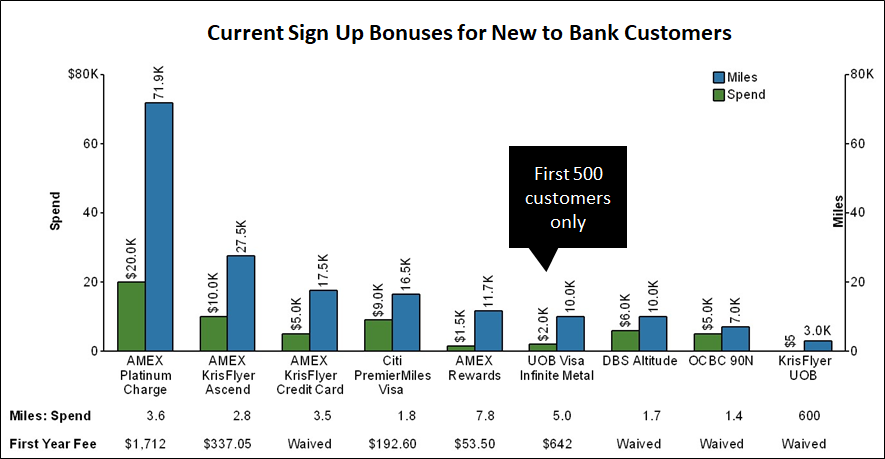

How does this compare to other sign up bonuses?

Here’s a summary of all the current sign up bonuses for new-to-bank customers. You can always find a detailed list in this article.

In absolute terms, a 10,000 miles sign up bonus is on the small side. There are mass market cards like the Citi PremierMiles Visa and the AMEX KrisFlyer Ascend/KrisFlyer Credit Card offering more miles.

However, in terms of miles: spend, the UOB Visa Infinite Metal Card has a favorable ratio, provided you’re within the first 500 customers. And therein lies the problem with UOB’s classic “first X to spend Y” style offers- you never know for sure whether you’re still eligible. It’s basically a game of Russian Roulette.

Conclusion

As I said in the intro, I’m not too hot about paying S$642 for a card with four lounge passes and a hobbled Gourmet Collection membership. But if you’re convinced for whatever reason that this card is right for you, you should really try and get your application in before the first 500/1,000 spots are gone.

Typical UOB sneakiness. Of course you won’t know if you’re the first 500 / 1000 to qualify. Enough said.

And the exclusion of supplementary card spending is senseless.

i’ve come to expect the first 500/1000 style format from them, but the exclusion of supp card spending is what really throws me. what on earth is the rationale for excluding that.

who runs the marketing department at these banks. how do these stupid campaigns pass through several layers of management.

“for those who value exclusivity in it’s most extinguished form”

the funny thing is the “it’s” annoyed me more

🤣