I recently wrote about the 10,000 miles sign up offer that UOB is running on the UOB Visa Infinite Metal Card. The offer is capped at the first 500/1,000 new/existing customers, and although it’s an all-or-nothing mechanic (with no way of knowing at the point of application whether you still qualify), it’s nothing we haven’t come to expect from UOB sign up offers.

But there was something new in the T&Cs that bothered me even more- a small but important line regarding supplementary cardholder spending:

| 3. For the avoidance of doubt, the eligible transaction as detailed under Paragraph 1 and 2 incurred on a supplementary Card will NOT accrue to the respective principal Card. |

I did a double take when I read that, because I was certain it couldn’t be right. I mean, I get annoyed when people ask whether supplementary cardholder spending counts towards sign up bonuses, because for me the answer has always been “yeah, duh“.

After all, whatever the supplementary cardholder spends is legally the responsibility of the principal cardholder to pay. So it stands to reason that if John spends S$2,000 and his supplementary cardholder spends S$1,000, it’s as if John spent S$3,000 in total. What’s the ambiguity here?

Curiosity piqued, I went to pull some T&Cs from UOB’s other ongoing promotions. UOB is currently offering S$230 cash to new-to-bank customers who open a UOB One Account (S$80) and apply for a new credit card (S$150). To qualify for the latter, cardholders need to spend S$1,500 within 30 days of approval.

Sure enough, the same clause appears in the T&Cs, saying that supplementary cardholder spend will not count towards the S$1,500.

| 5. For the purposes of this Promotion, “Eligible Transactions” refer to retail transactions made locally or overseas, and shall exclude: (i) cash advances, late payment, personal loan, balance and/or funds transfer, SmartPay, payments at government agencies, utilities bill payments, fees ,chargebacks, interests, reversals, interest charges and any finance changes imposed by UOB; (ii) transactions relating to top-ups of any pre-paid card and brokerage / securities; (iii) any transaction that is subsequently cancelled, voided or reversed for any reason; (iv) transactions made on supplementary cards… |

For what it’s worth, this does not seem to be a UOB-wide policy (yet), because the T&Cs for the KrisFlyer UOB Credit Card sign up bonus state that supplementary cardholder spending pools with principal.

| 2.2 (a)…For the avoidance of doubt, the benefit of all transactions incurred by a supplementary holder of the Eligible Card (“Supplementary Cardmember”) in respect of the Promotion shall accrue to the applicable Eligible Cardmember and form part of that Eligible Cardmember’s Eligible Transactions |

But the mere fact that it’s appearing in two separate UOB sign up offers is reason enough for concern.

How do other banks do it?

UOB’s exclusion of supplementary cardholder transactions from sign up bonus spending is really without precedent in the market. In every other example I looked at, supplementary cardholder spend is taken to be that of the principal cardholder.

Examples? Sure.

DBS Altitude sign up bonus (link):

| “Supplementary Cardmembers are not eligible to participate in the Promotion. However, spend made on Supplementary Card can be considered towards the Qualifying Spend.” |

AMEX Platinum Charge sign up bonus (link)

| Spend made by Supplementary Card Member(s) will be taken into consideration in the calculation of the S$20,000 spend threshold. |

OCBC 90N sign up bonus (link)

| The Qualifying Spend can be aggregated between Principal and Supplementary Cardmembers of the Eligible Card and is only valid for transactions posted. |

SCB X Card sign up bonus (link)

| The spends made by both the principal and supplementary X Card cardholders will be aggregated to calculate the number of 360° Rewards Points that will be awarded pursuant to this X Card Rewards Promotion. |

HSBC luggage & cashback promotion (link):

| “Qualifying Transactions” mean posted retail transactions, including Online Transactions and Overseas Transactions, charged to a Card account and/or to the account of the supplemental cardholder of the Eligible Applicant BUT shall exclude the Excluded Transactions. |

Citibank doesn’t state so explicitly in their T&Cs, but personal experience (and CSOs) have confirmed that supplementary cardholder transactions count towards sign up bonus spending requirements.

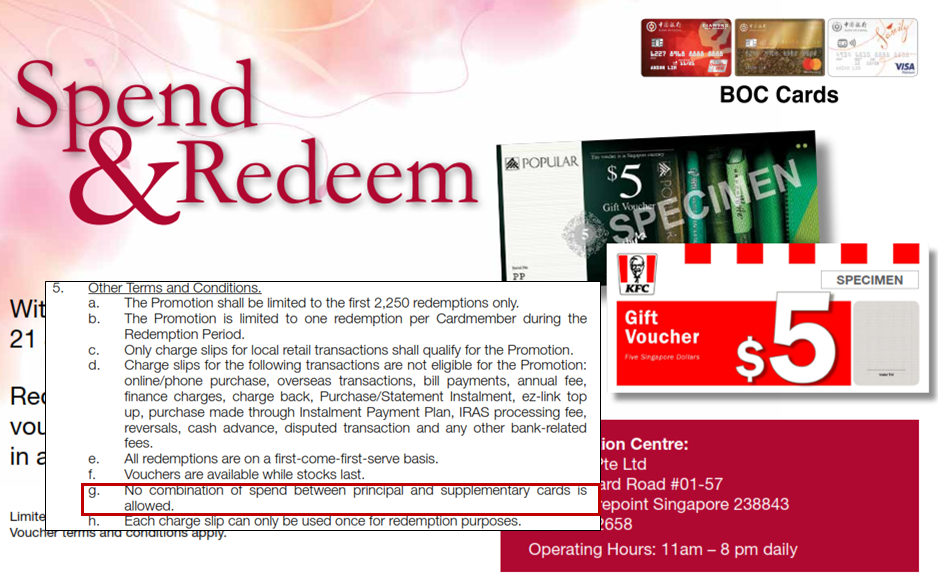

OK, fine, there is one other bank which excludes supplementary cardholder spending…

…but this is an entirely different sort of promotion altogether. This is a Spend and Redeem promotion, where both principal and supplementary cardholders are entitled to redeem gifts of their own. Not allowing pooling makes sense in that case.

You know it’s bad when you’re being benchmarked to BOC…

Why is UOB doing this?

I’ve always believed in not ascribing malice where simpler explanations exist. But in this case, it’s hard to see any other reason for this exclusion.

- It can’t be a typo, because of the way it’s been phrased and repeated

- It can’t be because UOB is unable to track and combine spending across principal and supplementary cards

- It can’t be because both principal and supplementary cardholders are entitled to sign up bonuses of their own

So where does that leave us? From the consumer’s point of view, it simply looks like the UOB is trying to minimize the number of bonuses it needs to give out- something you’d think would be unnecessary, since they’ve already capped them in the first place!

It doesn’t even make sense for UOB. Wouldn’t they want to encourage people to get supplementary cards so as to increase overall spending? It’s not like printing another supplementary card or maintaining a supplementary account is a big hardship for the bank.

Here’s a workaround

Although the exclusion of supplementary cardholder spending is a hopelessly arbitrary restriction, there’s a very simple workaround.

Instead of getting a supplementary card for your spouse, simply add your card to his/her digital wallet (Apple Pay, Google Pay etc). You can then use the physical card, and he/she can use the digital card wherever contactless payments are accepted. This way, you’ve basically “duplicated” your card, and can combine your spending to hit whatever threshold you need.

Conclusion

When I see a UOB sign up gift or offer, I already find myself having to go through the T&Cs with a fine tooth comb looking for the cap. I don’t want to have to start checking for principal/supplementary cardholder distinctions too.

It’s basic logic that you shouldn’t penalize someone who wants to give a supplementary card to a family member. And that’s exactly what this restriction does. I can only hope that this is a once-off and doesn’t apply to future offers, because it’s a bad (and completely unnecessary) development.

(Cover photo: UOB)

After many years of shooting itself in the foot, pain turns into pleasure so why stop there right? Just keep going..

As ugly as UOB tries to be, there’s always another way to skin the cat. Take the principal card and digitise it in as many ApplePays or AndroidPays for each of your supplementary cardholders.

Problem solved.

UOB is one ugly bank