In recent months I’ve received a large number of questions about the MCO Visa, a crypto-backed prepaid card that offers rebates and travel benefits.

Well I did some research on the topic, and I’m concerned. Not because the MCO Visa is a bad product, but because it’s being marketed to the wrong people.

If you’re not well-versed in the credit card market, the perks offered by the MCO Visa may sound enticing. However, they come with a major caveat: exposure to cryptocurrency. That’s not a decision to be taken lightly, hence my belief that this card should only be considered by seasoned crypto users.

In this post, we’ll take a detailed look at the MCO Visa, its benefits and risks, and crucially, why it’s not for everyone.

What is the MCO Visa?

https://youtu.be/HMqqWCMNDPU

The MCO Visa is a prepaid metal card offered by Crypto.com, a Hong Kong based startup founded in 2017. It allows customers to spend cryptocurrency in the real world wherever prepaid Visa cards are accepted, and avoid fees on overseas transactions and ATM withdrawals.

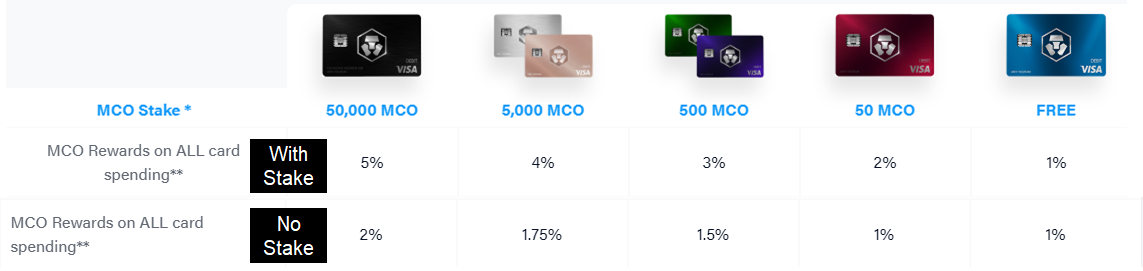

MCO Visa Cards are currently available in the USA and Singapore, with five different tiers. Each tier (except Midnight Blue) comes with a metal card and requires you to “stake” a certain amount of MCO for at least 6 months.

- Obsidian Black: 50,000 MCO (~S$250,000)

- Frosted Rose Gold/Icy White: 5,000 MCO (~S$25,000)

- Royal Indigo/Jade Green: 500 MCO (~S$2,500)

- Ruby Steel: 50 MCO (~S$250)

- Midnight Blue: Free (plastic card)

| SGD equivalents based on prices as of 22 October 2019 |

As you can see, the cost of entry ranges from negligible to very steep. The highest tier requires you to put a quarter of a million dollars on the line, and even the mid-tier Royal Indigo/Jade Green requires a four digit outlay, higher than most credit card annual fees in Singapore.

What is staking?

Although MCO Visa Cards have no setup fees, shipping fees or annual fees, the catch is you’ll need to buy and hold a certain amount of MCO for at least 6 months. This is referred to as “staking“.

After the 6 month period ends, you can unlock your MCO stake and sell it, although by doing so you’ll lose certain benefits such as enhanced cashback and travel rebates (see below).

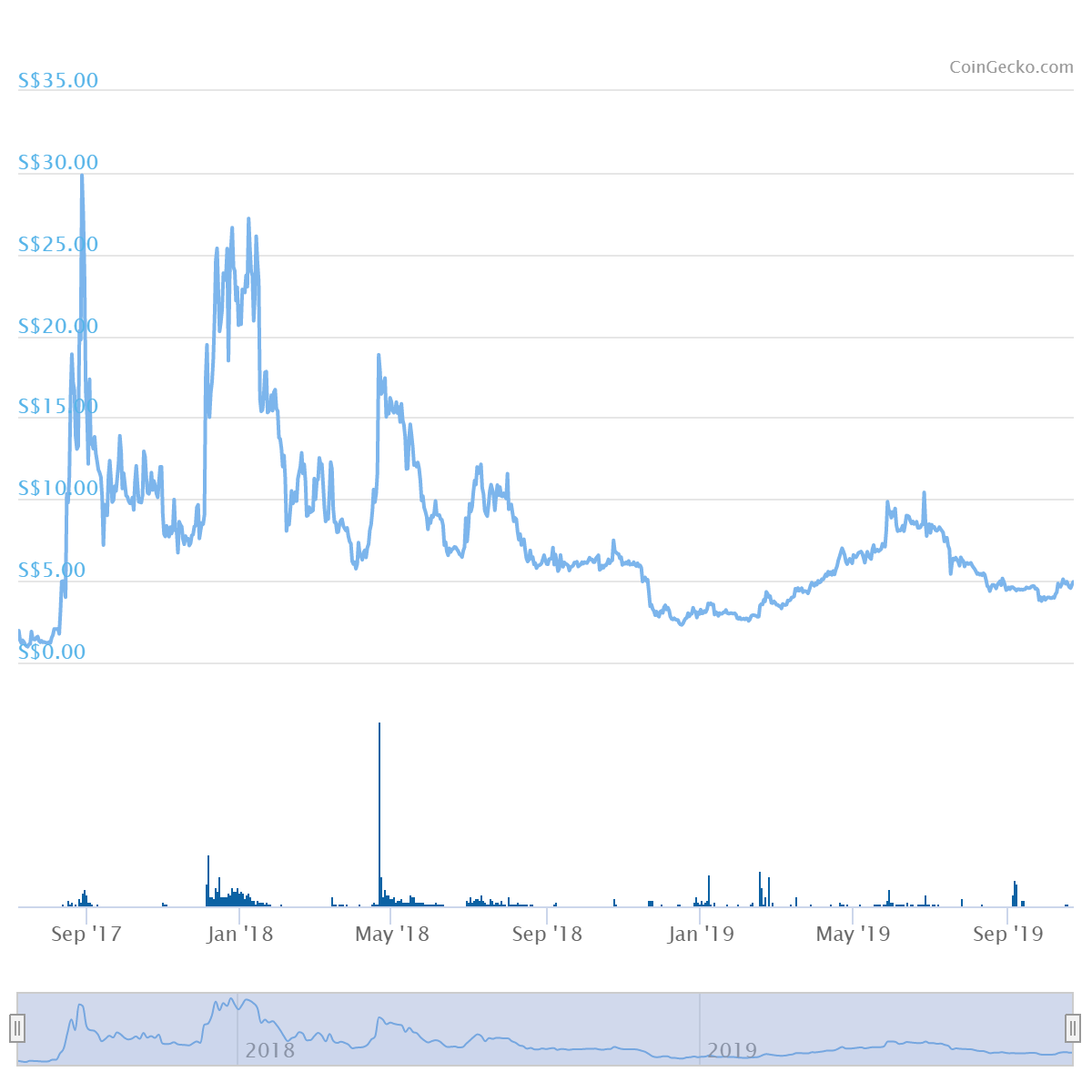

More importantly, there’s a very real risk that during this 6 month period, the price of MCO may move against you. For reference, here’s the historical price movements of MCO since launching in 2017:

As of 22 October 2019, MCO trades at a price of ~S$5, down from an all-time high of S$29.85. If your MCO position is underwater when your lock-in period ends, you either have to hodl, or accept a loss if you want your liquidity back.

What benefits does the MCO Visa enjoy?

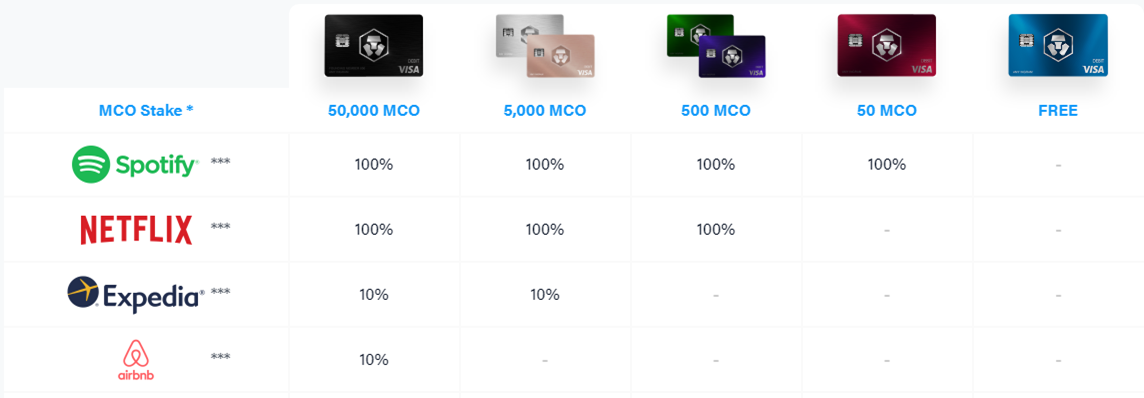

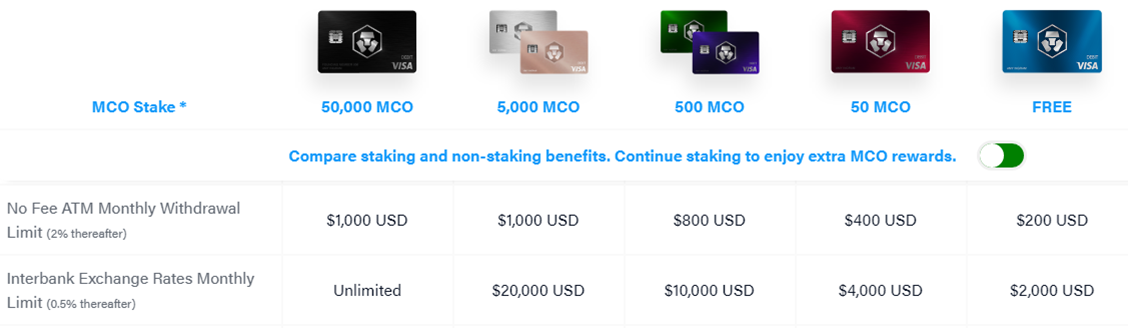

All MCO Visa cardholders enjoy a certain amount of no-fee foreign currency transactions and ATM withdrawals each month.

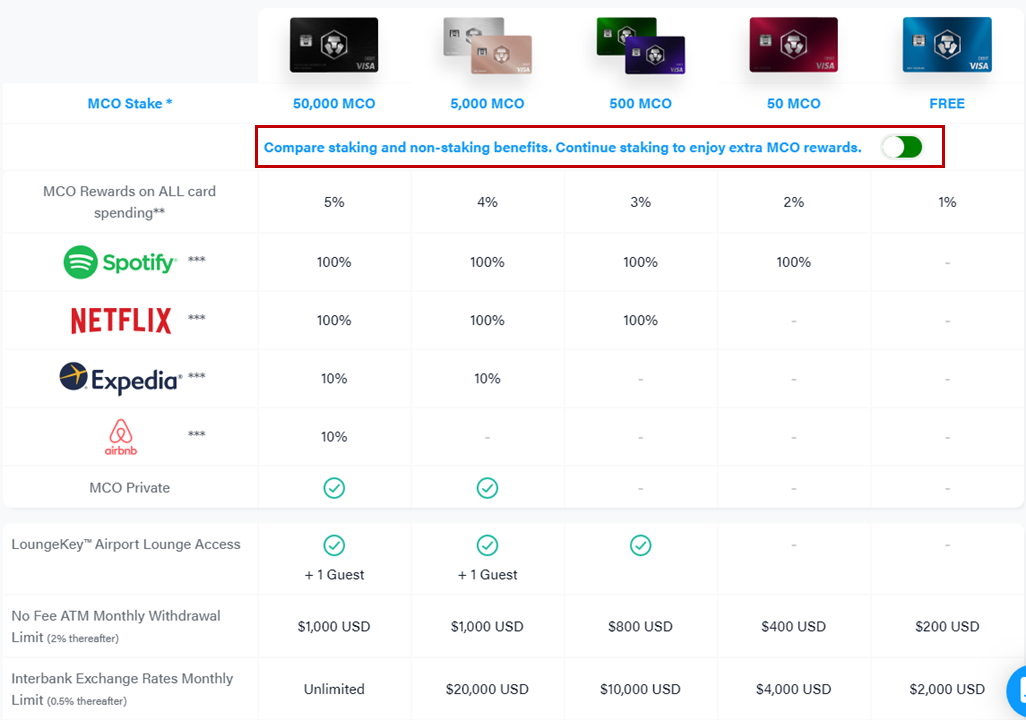

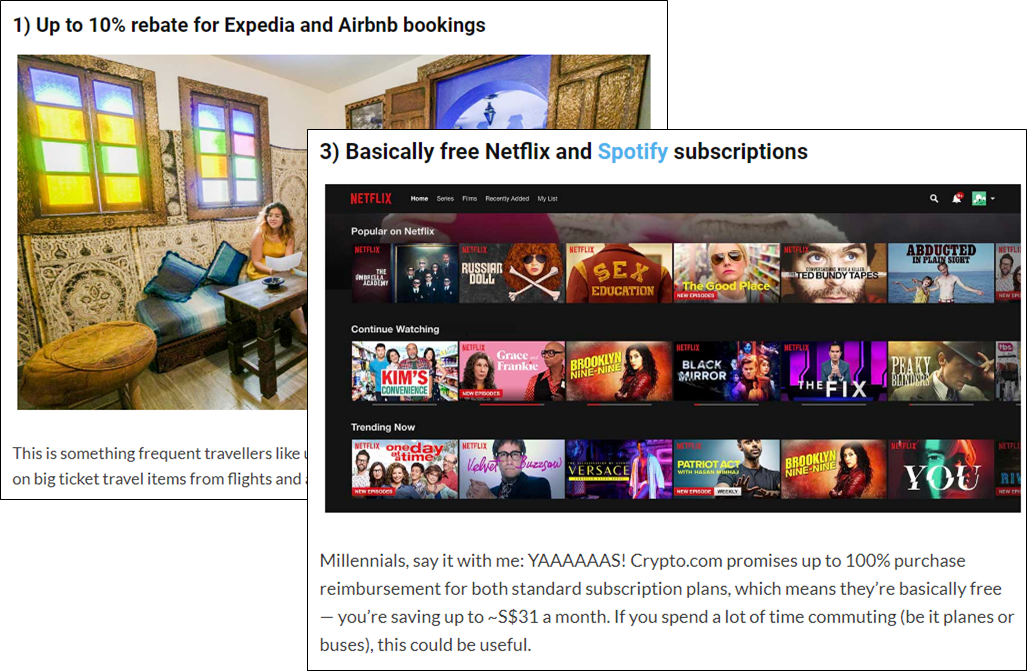

They’ll also receive 1-5% cashback on all spending (in the form of MCO tokens), with higher tiers enjoying benefits like a 100% rebate on Spotify and Netflix subscriptions, a 10% rebate on Expedia and Airbnb, and unlimited airport lounge access via LoungeKey.

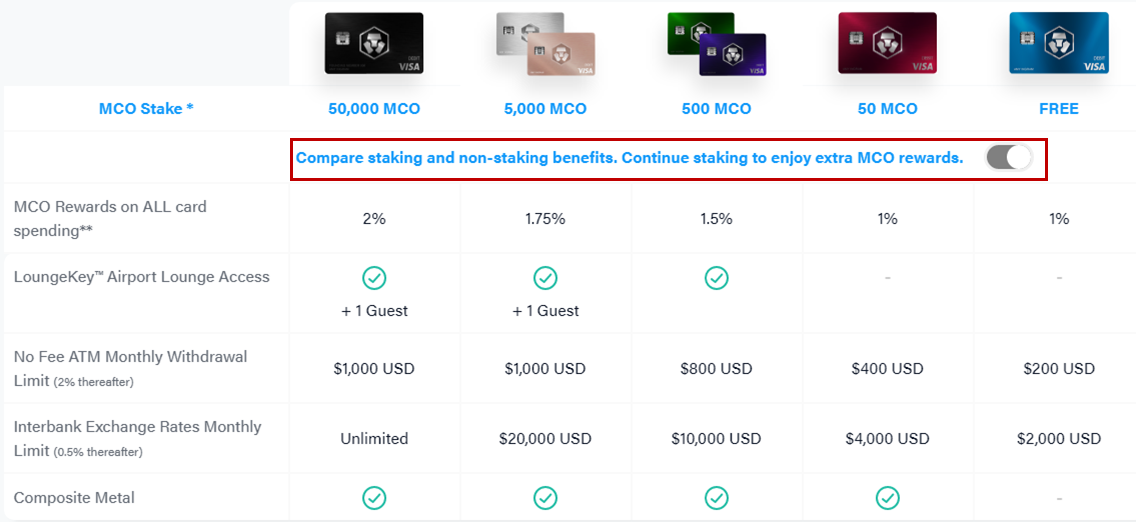

That’s provided you’re currently staking, however. Once you remove your stake, the benefits become a lot more pedestrian. Out goes the Spotify, Netflix, Expedia and Airbnb rebates, and cashback drops to 1-2%.

My issue with how the MCO Visa is being marketed

Let me preface this by saying I’m no cypto expert. Apart from a brief dalliance a couple years ago, I have little to no experience in the subject. But that’s the point- if you’re like me (and I’d hazard that most of the general public is), you absolutely should not be touching a product like the MCO Visa.

I have no issues with the MCO Visa per se. I think it’s a well-conceptualized product, and can appreciate how it bridges the gap between virtual and fiat currencies. I see it as a way for those already into crypto to spend it more easily while enjoying some rebates and travel benefits.

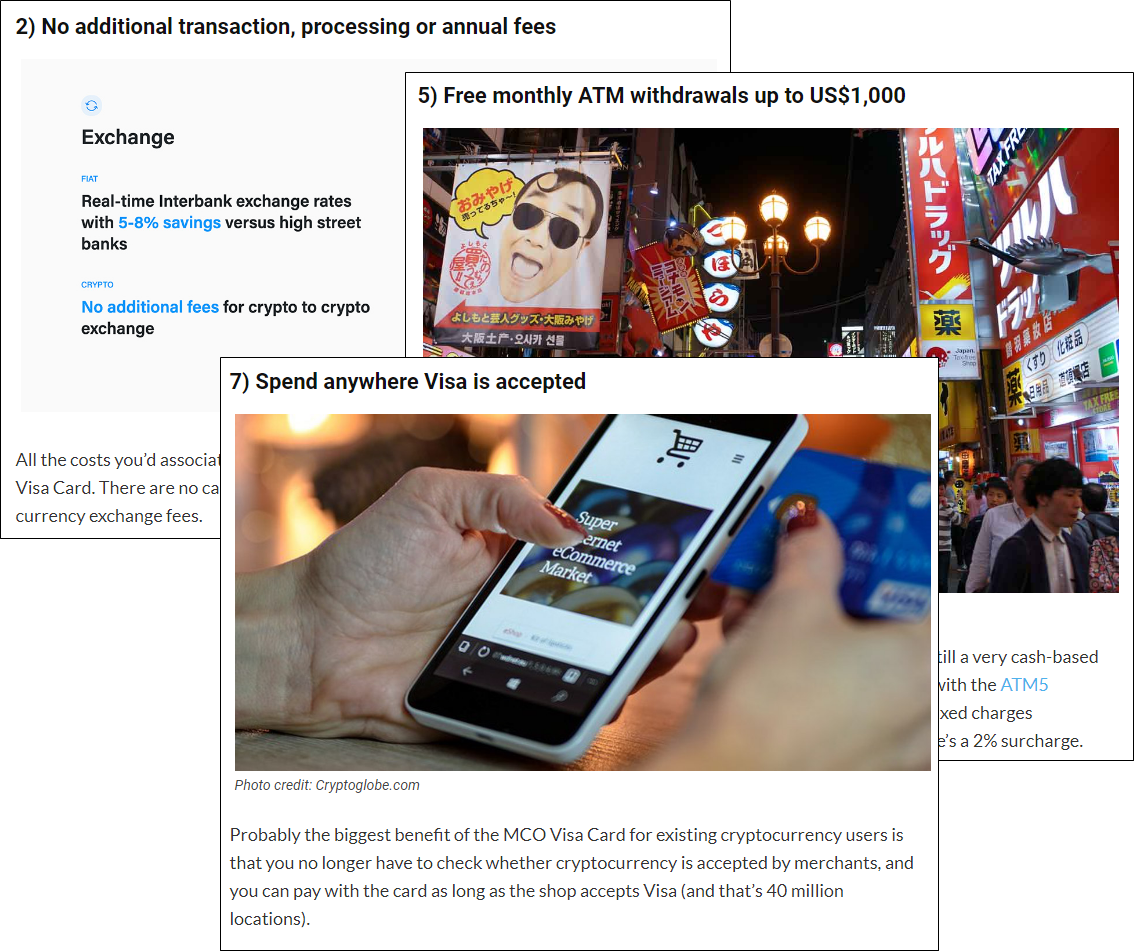

I do, however, have issues with how the MCO Visa is being marketed. Over the past few months, Crypto.com has been doing a paid media (i.e sponsored posts) push for the MCO Visa. It would be one thing if they ran these posts on crypto-focused blogs and publications. However, they’ve instead run them on sites with a lifestyle focus like Vulcan Post, City Nomads, Expat Living and The Travel Intern.

I’m distinctly uncomfortable about the MCO Visa being positioned as a “lifestyle card” suitable for “deal-loving travelers”, as well as the lack of acknowledgement about the very real risks of holding cryptocurrency.

Unfortunately, that’s exactly what’s happening in these posts. Take this one by The Travel Intern for example.

Let’s go point by point and try and give a fuller picture, coming from the point of view of someone who isn’t currently invested in crypto.

You’re putting a lot on the line for those rebates

The Travel Intern hypes up the MCO Visa by talking about the 10% rebate for Expedia/Airbnb bookings and free Netflix/Spotify subscriptions. Nowhere is it mentioned that the “free” Netflix requires staking 500 MCO (S$2.5K), the 10% rebate on Expedia requires staking 5,000 MCO (S$25K), and the 10% rebate on Airbnb requires staking a whopping 50,000 (S$250K) MCO.

What’s more, these rebates come with caps, which makes your upside limited, but your downside unlimited. Remember, all it takes is a small movement in the price of MCO to wipe out whatever savings you may have gained.

| Monthly Cap | 50,000 MCO | 5,000 MCO | 500 MCO | 50 MCO |

| Spotify | US$9.99 | US$9.99 | US$9.99 | US$9.99 |

| Netflix | US$12.99 | US$12.99 | US$12.99 | |

| Expedia | US$50 | US$50 | ||

| Airbnb | US$100 | |||

| Value over 6 months | ~US$1,038 | ~US$438 | ~US$138 | ~US$60 |

| Price Movement to Negate Benefit | -0.6% | -2.4% | -7.5% | -32.6% |

Would I risk a quarter of a million dollars for a 10% rebate on Airbnb? No, and neither should you.

There are other ways to enjoy fee-free spending and ATM withdrawals

The Travel Intern mentions how MCO Visa cardholders enjoy global card acceptance, plus fee-free ATM withdrawals and spending.

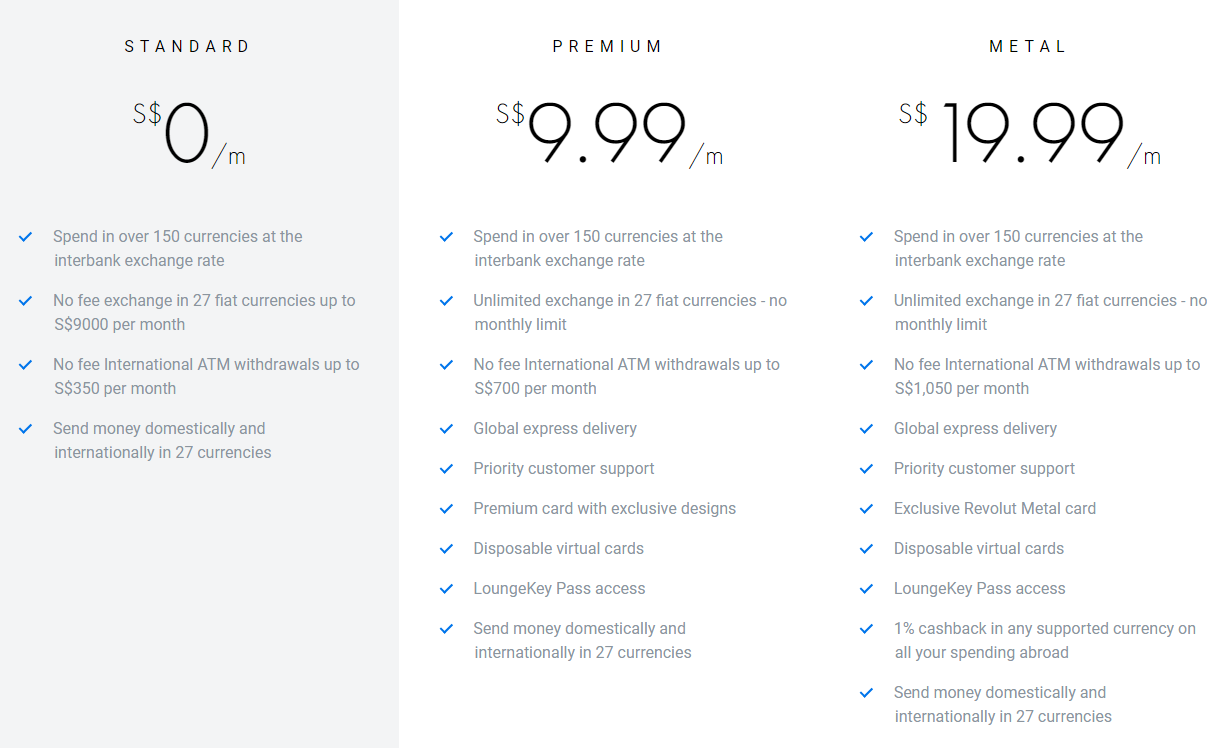

Those are good features to be sure, but you could enjoy the same benefits with a product like Revolut without having to dabble in crypto and its associated risks.

As the table below shows, the free version of the Revolut outperforms the free version of the MCO Visa, with S$350 of fee-free ATM withdrawals (MCO: US$200) and fee-free transactions of up to S$9,000 each month (MCO: US$2,000). If you need to go beyond that, the Premium version of Revolut still outperforms the next highest tier of MCO Visa.

MCO Visa MCO Visa |

Revolut Revolut |

|||

| ATM | Spending | ATM | Spending | |

| Free | Free | US$200 | US$2K | S$350 | S$9K |

| 50 MCO (S$250) | Premium (S$9.99/mth) |

US$400 | US$4K | S$700 | Unlimited |

| 500 MCO (S$2.5K) | Metal (S$19.99/mth) |

US$800 | US$10K | S$1,050 | Unlimited |

| 5,000 MCO (S$25K) | US$1K | US$20K | N/A | |

| 50,000 MCO (S$250K) | US$1K | Unlimited | N/A | |

| Subsequent withdrawals and transactions beyond the free limit attract a 0.5% and 2% fee for both the MCO Visa and Revolut |

There are safer ways to enjoy cashback

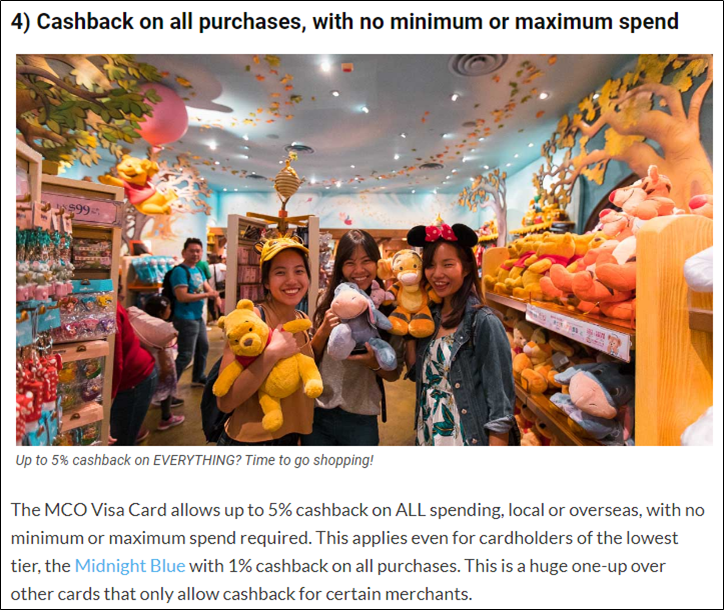

The Travel Intern talks about how the MCO Visa offers up to 5% cashback on all spending (never mind that the 5% tier requires you to spot a quarter of a million dollars), and how this is better than other cashback cards which may only award cashback for certain merchants.

Now my feelings on cashback have been well-documented, but I will say this: even if you swing that way, there’s no need to get an MCO Visa just for its cashback rates.

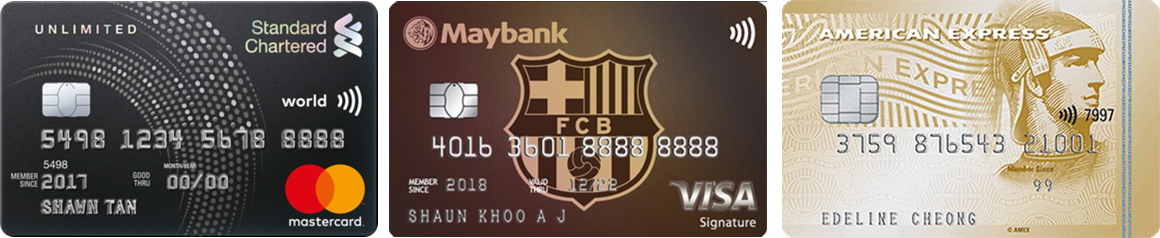

Assuming you don’t want to stake any MCO, then your only option is the Midnight Blue MCO Visa with 1% cashback. That’s worse than traditional cashback cards like the SCB Unlimited (1.5%), AMEX True Cashback (1.5%) and Maybank FC Barcelona Card (1.6%).

Yes, it’s true that insurance premiums and government services transactions won’t earn cashback on the SCB or Maybank cards, and although they will on AMEX, acceptance isn’t as widespread. But you can simply top up your GrabPay account with your AMEX True Cashback card to earn 1.5% cashback and use GrabPay for all your bills via AXS m-station.

Once you step up to the next tier of MCO Visa, your cashback rate goes to 2%. This is higher than the local earning rate for any cashback card (AMEX True Cashback gives 2.5% cashback on all foreign currency transactions till 30 June 2020), but that’s provided you continue to stake.

You’ll need to decide whether an incremental 0.5% cashback is worth the risks of staking, plus the inconvenience of buying crypto to top up the MCO Visa.

There’s no need to fork out so much for lounge access

The Travel Intern highlights the unlimited free airport lounge access that comes with the MCO Visa. Let’s assume you went with the Royal Indigo/Jade Green card, the cheapest version with this benefit. You’d have to stake 500 MCO (S$2.5K), which is many times what you’d pay for an unlimited lounge pass via other cards on the market:

| Card | Annual Fee | Lounge Access |

| Citi Prestige | S$535 | Unlimited Priority Pass visits for principal cardholder + 1 guest |

| HSBC Visa Infinite | S$488 (Premier Banking) /S$650 (Regular) | Unlimited LoungeKey visits for principal + supplementary cardholder |

| OCBC VOYAGE | S$488 | Unlimited Plaza Premium lounge visits for principal + supplementary cardholder |

| Maybank Visa Infinite | S$600 (first year free) | Unlimited Priority Pass visits for principal cardholder |

| Is it unfair to compare the stake to an annual fee? Yes and no- the annual fee must be paid each year, whereas you could technically redeem your stake after 6 months and still enjoy the lounge benefits indefinitely. It all boils down to what you believe the value of MCO will be in 6 months. My point is to say that if you really wanted an unlimited lounge pass, there are safer ways to get it. |

Remember: some of these credit cards offer miles with the annual fee too, which reduces their effective cost.

Crypto is not as whimsical as they make it sound

Finally, The Travel Intern pitches the MCO Visa as a low cost, easy way of getting into cryptocurrency investing. I mean, it’s just the cost of a plate of chicken rice!

There is so much to unpack here. First of all, it’s completely absurd to make the point that because 1 MCO costs much less than 1 Bitcoin, it’s easier to start investing in MCO. Bitcoin can be bought in fractions as small as 0.00000001 (known as one “Satoshi“, named after the creator), which means that if you have ten cents in your pocket, you can buy some bitcoin.

Second, it’s flat out irresponsible to suggest that this is in any way a suitable investment for beginners. Crypto is a highly volatile instrument and is not to be entered into casually- just ask all the inexperienced investors who got burned in the 2018 Bitcoin crash.

Third, to say that “cryptocurrencies value higher the more people purchase a stake in it” is to basically endorse a bubble. There is no underlying asset here, there is no intrinsic value.

Perhaps what’s most alarming to me is the complete lack of any caveats or cautions in these posts. Where’s the warning that your staked amount might be worth a lot less after the lockup period? Where’s the warning that crypto can fluctuate wildly on a daily, even hourly basis? Where’s the warning that past returns may not be indicative of future results?

Keep in mind, you’re not writing for crypto enthusiasts who know the risks and rewards of the game. If you’re advertising “up to 5% cashback”, it’s only fair that you mention “up to 92% losses” (based on MCO’s all-time high and subsequent all-time low price).

Conclusion

If you have no idea what MCO is (and arguably, even if you do), you’re basically gambling. You’re hoping that MCO appreciates or stays the same over the next 6 months, so at the end of it you can cash out and retain a free unlimited lounge pass for life, plus get some free Netflix and Spotify along the way. Now that could very well happen, and if so, good for you! For me, however, that’s too big a risk to jump in.

The MCO Visa is a good product, for the right crowd. The right crowd are people who are already into crypto and looking for an easier way to spend it in real life, while getting some additional perks along the way. The wrong crowd are people with no crypto experience who can’t tell their bitcoin from dogecoin.

At the end of the day, if it’s cashback, lounge access and no-fee foreign currency spending you want, there are other products which offer you all that and more without the need to get involved with crypto.

So unless you’re a seasoned trader, do yourself a favor and steer clear of the MCO Visa. After all, it’s never a good sign when you read people writing stuff like this:

I waited for a week for me to receive my card and it feels so GOOD and I was in ecstatic to use it. Actually, I am more willing to invest my money to them rather than putting it on my local bank which only gains low interest per month. The probability of doubling your money using crypto assets is huge!

Wow. Just wow.

Another home run, Aaron.. and yes, you are smarter than the average bear, Duh.. 😉

Thanks for highlighting the issues, I was considering this for the free Spotify. The risks don’t seem worth it now.

You did a great service for pointing out the major risks of this card. I hope this article appears at the top of every MCO Visa search on Google.

Crypto is scam, stay away and don’t get burned!

you were right, i got burned real bad 🙁

Could i ask how, I’ve had my card since February and thinking of taking the next level up as it’s working great. But maybe im missing something?

Lol not all crypto is a scam.. and MCO is not a scam, but you need to realize the full spectrum of what you are getting into. MCO is a currency that fluxuates in value, so if you brought MCO at a high price to get your benefits but now the value of MCO has dropped, well that means you didnt do your research did you.. ? It would be a much smarter option to buy MCO now that it has been decreasing in value for quite some time increasing the chances of your money increasing in value.. Never put… Read more »

>It would be a much smarter option to buy MCO now that it has been decreasing in value for quite some time increasing the chances of your money increasing in value..

Buy low? Sell lower?

“The probability of doubling your money using crypto assets is huge!” – The probability of me doubling my money if all my readers put their money in this crypto “asset” is huge!

Crypto is really not for the masses

Bitcoin at 40,000 seems to disagree with you

And I hope MAS is reading this and taking action under the FAA.

I’d like to offer this in response to your article. https://link.medium.com/7pbLdX8d10

Yup someone pointed me to it! Very good read. I think my objection is more about how it’s being sold as a lifestyle product without adequate disclosure of the risks involved, rather than the product per se. If you know what you’re getting into, by all means

Thanks, and I agree on that point. It makes the card seem super scammy and counter productive to what the community wants for adoption. However, I do think there is an opportunity for the average user, whereas your title suggest otherwise, hence I wanted to cover that aspect.

To end off, I do think your analysis was very objective and extensive, so kudos to you for that. Most articles don’t go enough in-depth, and oversimplify rather than be concise and accurate.

So it seems there has been a change and it is now even more reasonable to get the Crypto.com Visa Card: https://medium.com/p/7523a929c275

Strongly disagree to touch on any crypto no matter what benefits they are giving.

Very well said! Thanks for yet another awesome article 👍👍👍

fyi – Card is actually issued by Wirecard Singapore.

Oh and talking about the sponsored posts concept, this is actually a bigger issue, cos that is what has been happening for several years already – e.g. the likes of MoneySmart, SingSaver etc are all swayed by which ones ‘sponsors’ their products…

It’s been working very well for me so far! Have been able to pay for all my contactless payments. Moreover, I am getting 6% interest from the ‘EARN’ feature every 7 days (50 MCO staked). Highly recommend

At this point of writing, it seems to only be available in most parts of US, Singapore and some parts of EU. My guess is that when it gets rolled out gradually to other parts of the world, it will only make sense that the currency will appreciate.

Here’s $50USD to get started by using the referral code *removed*

Cheers!

Personal view: Stake 500MCO to enjoy the 3% rebate for all spend, then direct transfer the money (for spending) to MCO card wallet (no need to convert to MCO currency to take the risk for the money you going to spend) from SG debit card with zero charge. And spend it to get the additional MCO rebate 3% with All spend (even spend on 1 dollar 7eleven orange juice, bills, fave pay, overseas, any currency overseas with no fee, instant live rate convert, muahahahaha) This is good for people who like to grab cheap thing, in long term. After 6months,… Read more »

think you got a few things wrong though the 500 MCO doesnt go to fees. You can take it out after 6 months and still keep your card, lounge access and cashback. the free card doesn’t need investment in MCO, just use it like a debit card – no exposure to crypto if you don’t want to the 50 MCO card for free spotify costs about $250 now, at $10 per month, 2 years of spotify premium pays for itself already. AND you get the 2% cashback and you get to take back whatever the MCO is worth if you… Read more »

yup! I didn’t mention that it goes to fees, in fact I mentioned it’s probably unfair to compare the stake to a fee, in that one is recoverable but the other isn’t. however, if your MCO loses value in that 6 months (And who among us can honestly say they’re very certain that won’t happen), then that’s your implicit fee. your assumption with the returns on the 50 MCO card is that there’s no depreciation in MCO. Again, are you willing to risk that? re: free card- why not just get a revolut/youtrip instead, if the goal is to save… Read more »

Thank you for your analysis. I was considering applying for a metal card, but the risk is not low. No one knows the value after six months.

Yup, that’s really the main concern, that what’s clearly an investment product is being pitched as a lifestyle one

Ive been a MCO user for 1 year. Yep truth to be told, its a new experience. Yes it does benefit if you have a proper guidance and if you read more. I did use it for trading, also for savings and for staking. But it is unwise to just judge on things that you dont simply understand or refuse to read and further to research on. This not only goes for crypto but for other things as well. I hope we all dont quickly judge on things that we dont understand. If crypto is a scam, I will be… Read more »

After I have invested 3 month term of CEO.

Now I facing issue on withdrawer of my deposit.

Anyone can guide me how can I get back my deposit ?

Other cards on the markets charge you excessive amounts of fees for similar services. Fees cannot be compared to staking MCO, which is optional anyway. Fees are irrecoverably lost money. That definitely will not happen to your MCO stake you might choose to get those extra benefits. It’s more like a time deposit which pays your interest on top of the benefits you are receiving. Therefore it is also wrong to say there is no intrinsic value. As the intrinsic value is basically the massive amount of cashback, the infinite free lounge access, the Netflix and Spotify perks and so… Read more »

i started looking at MCO Visa card when I found that it actually provide cashback for insurance and e-wallet top up which are excluded for most other credit cards. In addition, it does not require to pay for annual fee if I just simply hold a free card and enjoy 1% cashback.

You mentioned that AMEX true cashback card does offer cashback for Grabpay wallet top up. Is it still valid today?

I’m have a Jade Card (500 MCO Stake) and I would like to mention my review after personally using it. I will also list some of the pros and cons that the author didn’t mention including how much money was actually gained during the course of my experience along with documentation. I will also mention Tips on how you can avoid losing money in case the MCO value does drop. MY MEMBERSHIP With my Level 3 Jade Card membership, I had to put a Deposit down of $2,140 for 500 MCO ($4.28 Each) at that time to gain the following… Read more »

Some recent changes today. MCO is now being swapped to CRO. Not much to comment on this. For now if you swap your MCO now to CRO u get a 20% bonus and that nice on a short term earn. But now the stake amount is quite ridiculous as of this posting. What used to be for Jade tier 500 MCO stake ($3000 give and take average) is now a 50,000 CRO stake ($11,700 approx). Now that’s really a major jump and reckon a very hard pill to bite. Even the lowest tier is 5,000 CRO or approx $1,170 to… Read more »

Boy, this didn’t age well at all. Should you moved your money into BTC at that time…

Well, if you had thought about staking back when you wrote this, lets say, the mid tier green/blue card with 500MCO for S$2500 back then. In Nov 2019, the MCO auto swapped to 1MCO = 27.6CRO. Which gives you 13800 CRO. If you had done the early swap program, 1MCO = 33CRO. Which could have given you 16500CRO. Today (31/8/2021), 13800 CRO is worth S$2760. 16500 CRO is worth S$3300. Adding the benefits of Netflix for 20 months (since you wrote this article), they offered a reimbursement for up to S$18.8 per month = 18.8*20 = $376. Lets say you… Read more »

Lol. Adding on to what you are saying. Today (29/11/2021) CRO is worth 1.05 SGD.

So that’s 14,490 – 17,325.

However, who would know just 2 later CRO would moonshot so quickly! Looking at it now, I do think CRO (previously called MCO) definitely has shown its potential with more to come.

But, I agree with Aaron. The position of the card 2 years ago as a Lifestyle card was misleading and most certainly a risk/gamble. Kudos to those who did it!

LoL this aged like fine milk. CRO was a 10x investment for me this year.

This has aged poorly. Not to mention that you completely ignored the weekly interest on the stake and the increased interest on earn. Maybe people who know nothing about Crypto shouldn’t write about it.