For the month of November, SingSaver is offering S$100 cash for new-to-bank customers who get approved for a KrisFlyer UOB Credit Card. Existing customers will continue to receive the usual S$20 cash gift.

Get up to S$100 when approved for the KrisFlyer UOB Credit Card here

To be eligible, applications must be submitted by 30 November 2019. New-to-bank refers to “a new UOB (Singapore) Limited principal account and cardholder who does not hold any UOB accounts, cards or other products as at 30 April 2019 and is not an existing holder of any UOB account, card or other products on the date of application.”

| Do note that the new-to-bank restriction also includes UOB bank accounts, in addition to credit cards |

Once you’ve submitted your application, be careful not to close your browser window! Note down your application reference number, and use it to fill out the rewards redemption form that will be sent to your email address.

If you’re eligible, you’ll receive an email about your gift within 1.5 months of card activation. The cash will be dispensed via PayNow, so there’s no need to go to a physical collection centre.

Key Features: KrisFlyer UOB Credit Card

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Transaction Fee |

| S$30K | S$192.60 (first year free) | 10,000 | 3.25% |

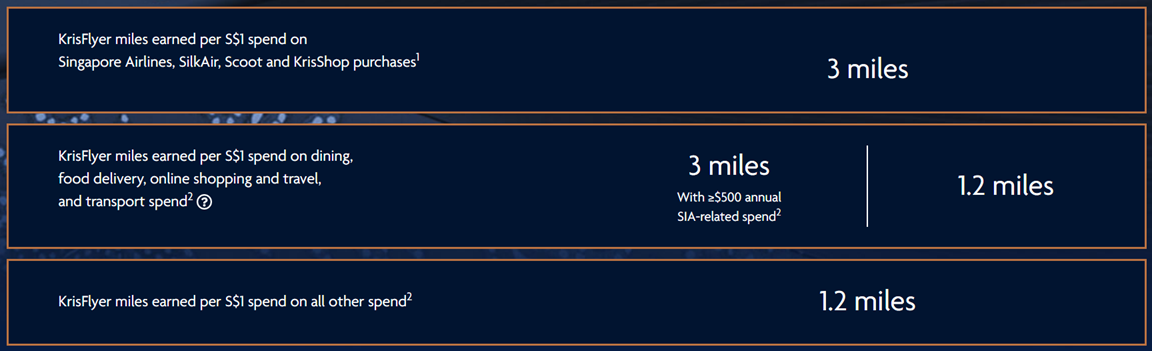

| Local Earn | Overseas Earn | Special Earn | Points Validity |

| 1.2 mpd | 1.2 mpd | 3 mpd on SIA-group 3 mpd on dining, food delivery, online shopping & travel, transport (spend min S$500/year on SIA-group) |

3 years (auto transfer to KrisFlyer) |

With a 1.2 mpd earn rate on both local and overseas spending, the KrisFlyer UOB Credit Card clearly isn’t the highest-earning miles card out there. However, it can be the best card for someone who insists on a “one-card strategy”.

That’s because the KrisFlyer UOB Credit Card has the most bonus categories of any general spending card. Cardholders earn 3 mpd on Singapore Airlines, SilkAir, and Scoot tickets. If they spend at least S$500 on these tickets in a membership year, they’ll also earn 3 mpd on dining, food delivery, online shopping and travel, and transport.

The catch is that only 1.2 mpd is awarded upfront- the remaining 1.8 mpd is awarded 2 months after your membership year. Depending on your redemption patterns this may well prove to be a problem, so be sure you know what you’re getting into.

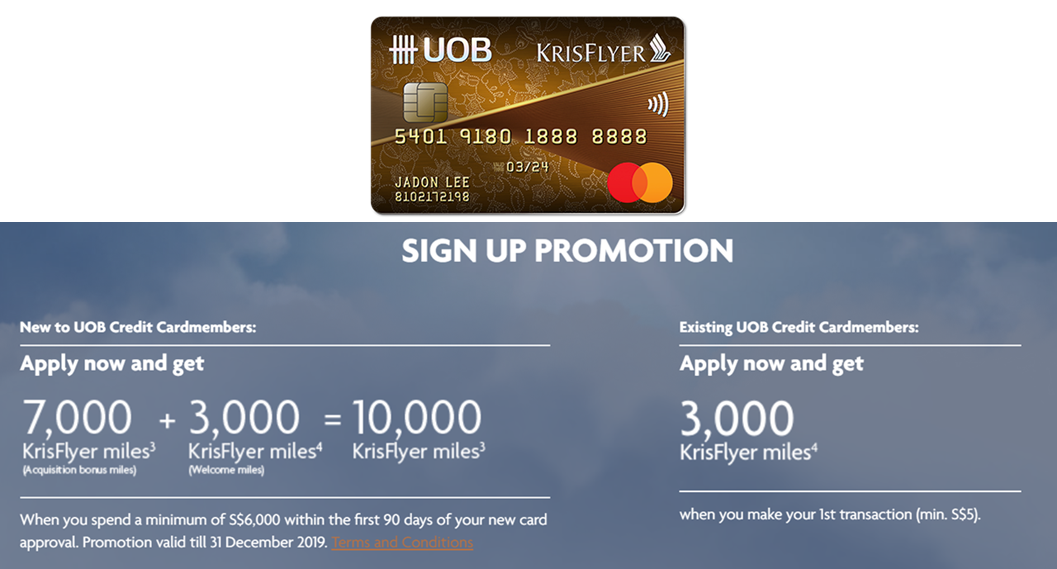

UOB is currently running a 10,000 miles sign up bonus for new-to-bank customers on the KrisFlyer Credit Card, which is unlocked by spending at least S$6,000 in the first 90 days of approval. This same sign up offer is available to SingSaver applicants as well.

Remember that unlike the rest of UOB’s cards, the KrisFlyer Credit Card earns KrisFlyer miles instead of UNI$. These are deposited directly into your KrisFlyer account with no transfer fees.

Conclusion

If you’re new to UOB cards (and don’t have a UOB bank account), then this could be a good way to stack a miles sign up bonus with a cash gift. Look out for the rewards form in your email and remember to submit it promptly.