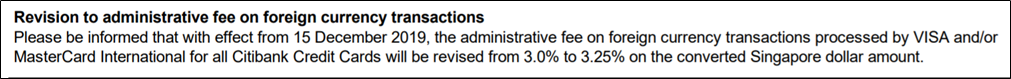

It just keeps getting more and more expensive to use your credit card overseas. After OCBC’s recent decision to hike their foreign currency transaction fee, Citibank has followed suit. From 15 December 2019, the fee on Visa and Mastercard transactions will increase from 3% to 3.25%.

This information isn’t yet available on Citi’s website, but was included in my most recent e-statement.

Citi’s previous fee hike in October 2018 was softened by a 3 month boost in the FCY earn rate on the PremierMiles, Prestige and ULTIMA cards from 2 to 2.4 mpd, but there’s no such carrot this time round.

For what it’s worth, the fee hike does not affect Citi AMEX cards, which retain their 3.3% FCY fee. Kind of cold comfort, considering that Citi has stopped issuing them…

Fee hikes all round

It says quite a bit about how many fee hikes we’ve seen lately that I’ve got this list saved as a template:

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, effectively increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

- On 15 Mar 19, OCBC increased its FCY charge from 2.8% to 3%

- On 4 Sep 19, UOB increased its FCY charge from 2.8% to 3.1%

- On 1 Nov 19, DBS will increase its FCY charge from 3% to 3.25%

- On 3 Dec 19, OCBC will increase its FCY charge from 3% to 3.25%

SCB retains the unenviable “market leader” position when it comes to FCY fees at 3.5%, but from December 2019, OCBC, DBS, Citibank and selected UOB cards will share joint second at 3.25%.

| Bank | Visa/MC | AMEX |

|---|---|---|

| DBS | 3.25% | 3.0% |

| UOB | 3.25% | 3.25% |

| OCBC | 3.25% | N/A |

| Citibank | 3.25% | 3.3% |

| HSBC | 2.8% | N/A |

| SCB | 3.5% | N/A |

| Maybank | 2.75% | N/A |

| CIMB | 3.0% | N/A |

| BOC | 3.0% | N/A |

| AMEX | N/A | 2.95% |

The lowest cost cards to use overseas, surprisingly, are American Express. They’ve held their fee steady at 2.5%, although one wonders how long this will remain.

Is it still worth using your Citi cards overseas?

The increased FCY fees are not deal breaking, but they do necessitate a relook at the maths behind using your Citi cards overseas.

| Card | FCY Earn Rate | FCY Fee | CPM |

Citi ULTIMA Citi ULTIMA |

2.0 | ||

Citi Prestige Citi Prestige |

2.0 | ||

Citi PremierMiles Visa Citi PremierMiles Visa |

2.0 | ||

Citi Rewards Visa Citi Rewards Visa |

4.0 (on eligible 10X categories) |

Given the current market landscape, the best overseas spending card remains the OCBC 90N, with an uncapped 4 mpd on all foreign currency spend (3.25% fee) until 29 Feb 2020.

Read about the OCBC 90N Card here

- Capped at S$3,000 for the entire promo period

- Only valid for spending on overseas dining, shopping (including online shopping) and accommodation

- Subject to the “payment processor” caveat- if you shop online at a merchant that processes payments in Singapore, you’ll earn 1.4 mpd notwithstanding the fact the transaction is denominated in foreign currency

Conclusion

These continual FCY fee hikes mean that the CPM costs from using your credit card overseas are steadily creeping up. It can still make sense to do so, but the use case is increasingly marginal (especially after OCBC ends its 4 mpd promo on the OCBC 90N in Feb 2020).

It make more and more sense to top up Youtrip or Revolut with Grabpay MasterCard.

Well, so long as 10x is possible…

as long as they keep burning money, sure. loss making company topping up another loss making company

Loss making companies? Like Mileslife? Well as long as you don’t have a balance with them when they all of a sudden close up shop and go out of business then you should be fine.

What about ICBC when they give you back 3% , so technically you make 0.5%. This means it is more convenient and cheaper to use than going to the money changer. I believe I am correct?

Yes, you get a 0.5% rebate on your spending. But you also earn no points